Introducing The In Marriage Qdro

A solution exists that allows you to access your retirement account while avoiding many of the rules and regulations associated with taking an early distribution. This involves a well known, often utilized legal process to access a retirement account by transferring the funds from one spouse to another. This process is completely legal, highly effective and often makes far more financial sense than paying heavy fees and penalties.

Locate Where Your 401s Are

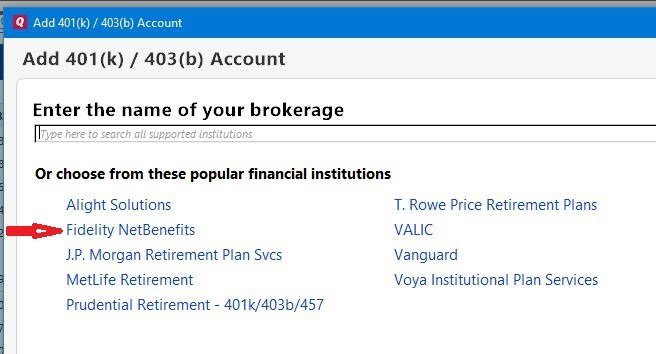

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up is free and only takes a couple of minutes.

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

Other Investment Accounts For Retirement

In addition to a Wells Fargo IRA and employee-sponsored retirement plans that Wells Fargo services, the financial services company also offers other investment options that you may be using to plan for retirement, including mutual funds, stocks and exchange-traded funds. By opening a WellsTrade® online and mobile brokerage account, you’ll not only be able to access your account online, but you’ll also be able to manage your own investment portfolio.

Visit the Wells Fargo online and mobile brokerage webpage and click “Apply Online” to set up your WellsTrade® account. After you set up your account, you’ll be able to plan for and manage your IRA by choosing the investments you want, entering self-directed online trades, transferring funds between your accounts and accessing this account information any time.

You May Like: Can I Roll A Roth Ira Into A 401k

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Check On Your 401 Periodically

As mentioned, it’s essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio won’t happen that quickly. But by scheduling an annual check of your 401 balance, you’ll get a good picture of your 401 portfolio.

Tags

Recommended Reading: What To Do With Your 401k

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a section of the U.S. Internal Revenue Code.

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

How Can I Find My Old 401 Account

Ask previous employers whether theyre maintaining any accounts in your name. If the company no longer exists, contact the plan administrator. If you dont know the name of the plan administrator, search the Department of Labor website for the companys Form 5500 , which will list their contact information. You might also check the states unclaimed property database via the National Association of Unclaimed Property Administrators .

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new brokerage or IRAs, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Read Also: How Much Can You Contribute To 401k Per Year

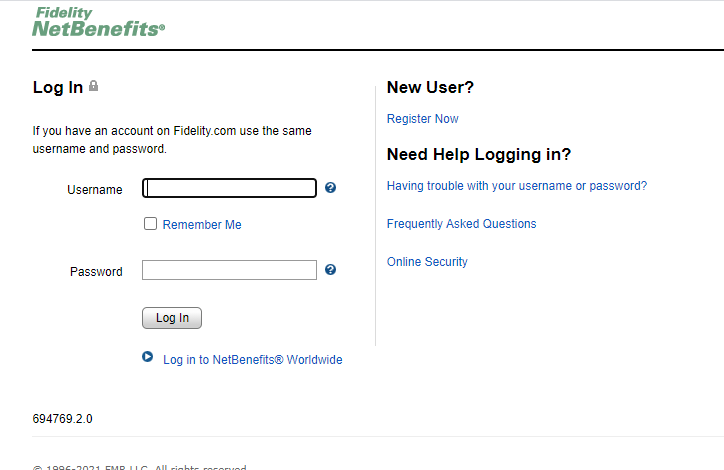

How To Register Log In And Manage Your Username And Password

Click “Log In” at the top of any Principal.com page, enter your username and password and click the Log in button.

If you havent yet registered to access your account information online, its no problem. Simply click Create an account, choose Individuals as your role and click Create an individual account button. Then, simply follow the instructions on the screen to create your personal login credentials.

Dont worry it happens! We can help you recover your username or reset your password online.

If you forgot your username:

- Go to the Forgot username page.

- Choose Individuals as your role and click Continue.

- Enter the email address you use to do business with us, and we’ll send you an email with your username.

If you forgot your password:

- Enter your username.

- We’ll provide you a verification code by text, voice call or an authenticator app. Which one we send it to depends on the option you registered.

- After you’ve correctly entered your code, you’ll be prompted to reset your password.

- You can then use this new password to log in to your account online.

You can also call us at 800-986-3343 for assistance.

Register online by following the steps below or .

Voice call is when we call you to provide a verification code. If you register for voice call, you will be asked to provide a phone number. The number you provide can be a mobile phone or landline phone.

Rules Regulations Fees And Penalties

Various and complex obstacles prevent people from accessing the money tied up in their retirement accounts without heavy penalties. Employer plans make it easy to contribute to a 401 with pre-tax benefits and matching contributions, but when it comes time to actually use your money, there are so many rules, fees and penalties in place that the costs often outweigh the benefits. This can leave some people with no other options than to pay these fees and penalties, find another source of funding, or pass up an opportunity altogether.

Recommended Reading: How Do You Get Money From Your 401k

Contact Wells Fargo By Phone

Wells Fargo offers Individual Retirement Accounts , and it also services employee-sponsored 401 retirement plans.

Video of the Day

Access your existing Wells Fargo IRA by calling a representative at 1-800-237-8472 between 8:00 a.m. and 10:00 p.m. Eastern Time or between 8:00 a.m. and 5:00 p.m. Eastern Time on Saturday.

Access your existing Wells Fargo employee-sponsored retirement account, such as a 401 or 403 plan, or find out how to make a Wells Fargo 401 withdrawal by calling 1-800-728-3123 between 7:00 a.m. and 11:00 p.m. Eastern Time on Monday through Friday.

Standard Retirement Is Part Of Early Retirement

Before we dive into the various withdrawal methods though, its worth stating something obvious that people seem to miss.

Normal retirement is part of early retirement.

Heres a highly-detailed diagram to help explain this even further:

People have said to me that they arent contributing to their 401s because they plan on retiring early. Thats insane! Even if you plan to retire early, you still need money to live on in your 60s, 70s, and beyond so why not pay for those years with tax-deferred money?

Everyone should utilize retirement accounts for standard-retirement-age spending but for people who think theyll have more in their retirement accounts than theyd ever be able to use after they turn 60 and want to start accessing that money during early retirement, here are your options

Recommended Reading: How To Cash Out Your 401k Fidelity

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is free and only takes a few minutes.

I Have Money In A Qrp Where I Used To Work What Are My Distribution Options

There are typically four options available to you:

- Roll your money over to an IRA, where it can continue its tax-advantaged status and growth potential for retirement. In addition, an IRA often gives you access to more investment options than are typically available in a QRP.

- Leave your assets in your former employer’s QRP, if the plan allows, where it can continue its tax-advantaged status and growth potential for retirement. You will continue to be subject to the QRPs rules regarding investment choices, distribution options, and loan availability. If you choose to leave your savings with your former employer, remember to periodically review your investments and carefully track associated account documents and information.

- Move your money to your current/new employer’s QRP, if the plan allows, where it can continue its tax-advantaged status and growth potential for retirement. This may be appropriate if you want to keep your retirement savings in one account, and if youre satisfied with the investment choices offered by that QRP.

- Take a lump-sum or cash-out of your QRP you will generally owe ordinary income taxes and possibly an IRS 10% additional tax. You should carefully consider all of the financial consequences before cashing out your QRP savings. The impact will vary depending on your age and tax situation. If you absolutely must access the money, you may want to consider withdrawing only what you will need until you can find other sources of cash.

Read Also: Can You Merge 401k Accounts

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

What Is A Rollover

A direct rollover occurs when your qualified employer sponsored retirement plan , such as 401, 403, or governmental 457 distribution is sent directly to your IRA provider or another QRP. There are no taxes or IRS withholdings, which helps preserve your retirement savings and your assets retain their tax-advantaged growth potential.

An indirect rollover is one where you receive a check made payable in your name from either a former employers QRP or a current employers QRP and you have 60 days to roll over those assets by having them deposited into an IRA or a QRP, if the plan allows. The distribution must be eligible to be rolled over. Failure to complete a rollover during that 60-day time frame will trigger taxes, and depending on your age, an IRS 10% additional tax for early or pre-59-1/2 distributions. Note: Governmental 457 plans are not subject to the 10% additional tax. This will also end any tax-advantaged compounding on those funds.

A direct transfer occurs when your IRA provider sends your IRA assets to another IRA held with that provider or to another IRA custodian. There are no taxes or IRS reporting for this method. This generally involves completing a transfer form at the receiving institution. You can do an unlimited number of direct trustee-to-trustee transfers per year.

Please keep in mind that rolling over your QRP to an IRA is just one option. Each of the following options are different and may have distinct advantages and disadvantages.

Read Also: How To Set Up 401k In Quickbooks

Investment Choice And Fee Transparency

With our open architecture platform, you can choose from thousands of investment options with no proprietary requirements. Fee transparency means you know exactly what youre paying for, and our return of mutual fund revenue share policy gives revenue share payments from mutual funds back to participants.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Read Also: Can I Roll A 401k Into A Roth Ira

When You Retire You Have To Decide What To Do With Your 401 Money Generally Speaking You Will Have Some If Not All Of The Following Five Choices: Leave Your Money Parked In The Plan Take A Lump

Keep in mind, not all employers allow retired workers to remain participants in their 401 plan, but if yours does, here’s a quick look at the pros and cons of the various distribution options:

Lump-sum distribution

If you need a wad of cash right away, this option will serve that purpose. There are two key downsides: you forfeit the benefits of tax-deferred compounding by cashing out all at once and you’ll have to pay income taxes on your distribution for the tax year in which you take it, which can be a big bite out of your nest egg all at once.

Leave the money as is

Financial advisers often recommend retirees tap taxable accounts first in order to keep as much money growing tax-deferred as possible.

So if you’re retiring and have money outside of your 401 that you plan to live on, you may leave your account untouched until you’re 70-1/2. That’s when Uncle Sam requires all retirees to begin taking mandatory annual distributions from their 401s and traditional IRAs.

Of course, if your plan’s investment choices are very limited or have performed poorly relative to their peers, you might be better off rolling the money into an IRA.

Rolling money into an IRA

This is the option often recommended by financial advisers since an IRA offers greater investment choice and control, and is especially recommended if your plan has few investment options and not very good ones at that.

There are two advantages your 401 has over an IRA.

Periodic distributions

Annuities

Determine Your Need For Access

If your need for your 401 money is immediate and absolute, you can simply withdraw the assets from the account, and within a few days the money will be wired to your bank account or sent to you in a check. Taking a distribution in this way will subject your entire withdrawal to taxation at ordinary income rates, and if you are under the age of 59 1/2, you will owe a 10 percent early withdrawal penalty as well.

Video of the Day

Also Check: Can I Take 401k Money To Buy A House

How Do I Access My Wells Fargo Retirement Account

Wells Fargo & Company is a self-described community-based financial services company with assets totaling almost $2 trillion. Among the products that Wells Fargo offers its customers, retirement accounts provide a savings vehicle outside other types of savings accounts and workplace retirement plans. Customers can remotely access their Wells Fargo retirement account without making a bank visit.

Tip

In addition to visiting an account representative at your local Wells Fargo branch, you can access your Wells Fargo retirement account by reaching a Wells Fargo representative over the phone, creating an online account or using Wells Fargos mobile app for your smartphone.