Pros And Cons Of An Opt

Many workers in the U.S. do not sock away nearly enough for retirement, and some save nothing. Knowing this, some companies enact opt-out plans in an effort to boost the number of employees who save.

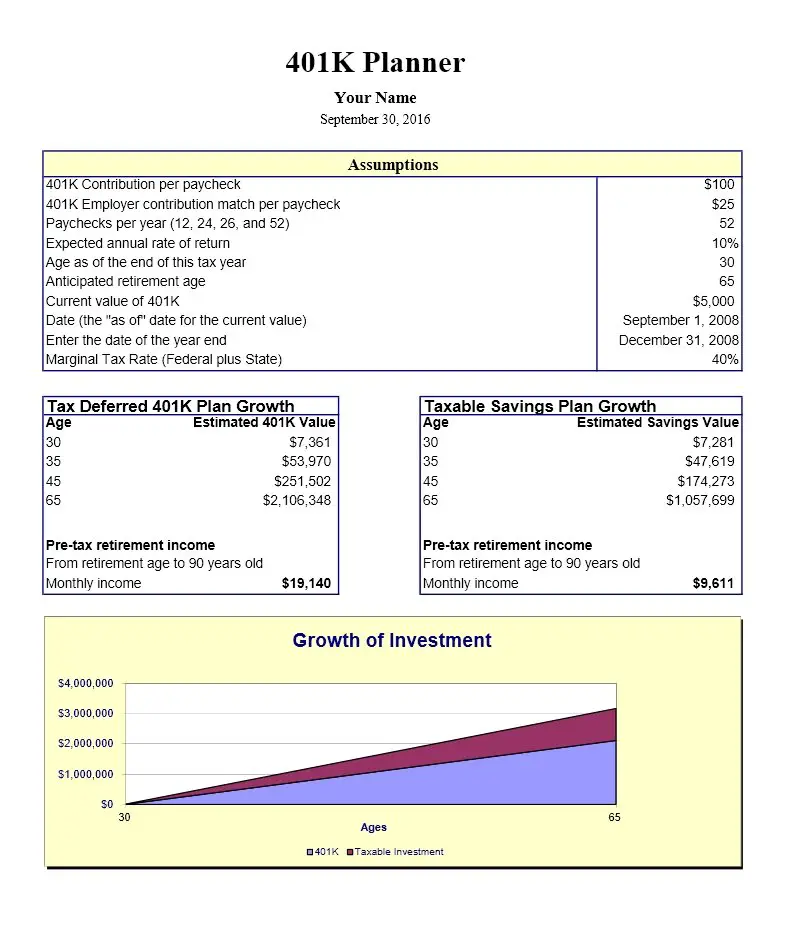

The amount deducted in an opt-out plan, typically about 3%, is a good start but too low to build a significant retirement account.

Opt-out plans tend to raise participation rates. However, they are set at contribution levels that are too low to meaningfully help the employees in retirement. Employees who don’t proactively change their contribution levels may under-invest over the long term. Without a periodic reminder that a 3% contribution, for example, is just a starting point, many may not save enough in the long run.

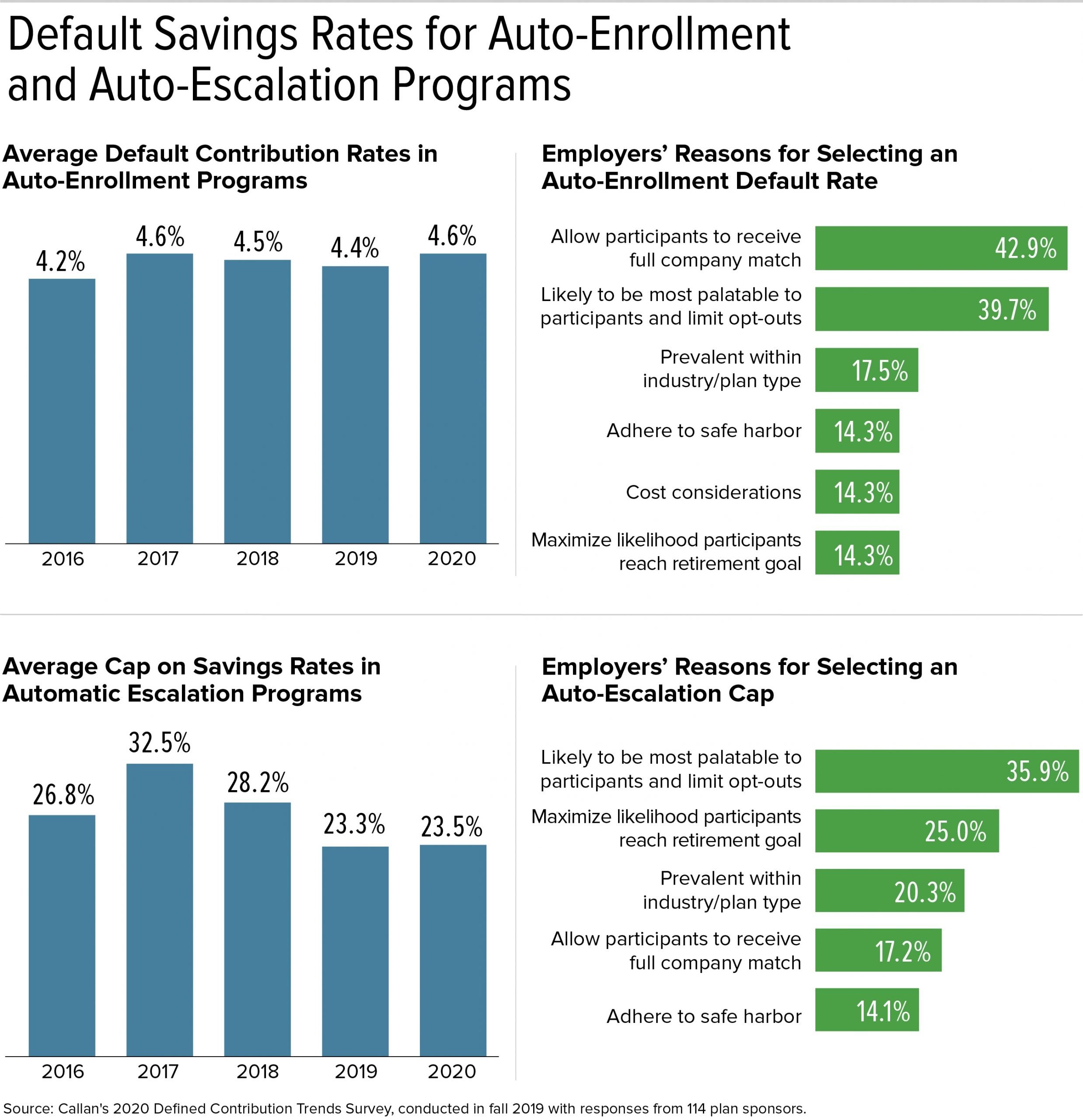

For this reason, some argue that opt-out plans may encourage wider participation in retirement savings plans, but they tend to lower their total retirement contributions. To counter this possibility, some employers raise the employee contribution rate by 1% each year, with 10% being the usual maximum.

There are other ways employers can encourage retirement contributions. Raising the company match is one of them. Most employees who have retirement savings plans know that failing to save enough to take advantage of the full company match is just “leaving money on the table.”

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Where Fidelity Go Shines

Low cost: Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999.

Fidelity integration: Customers who already have an IRA or taxable account with Fidelity can easily take advantage of the company’s robo offering.

Human portfolio oversight: The day-to-day investment and trading decisions for portfolios are handled by a team of humans from Strategic Advisors, a registered investment advisor and Fidelity company.

You May Like: How To Increase 401k Contribution Fidelity

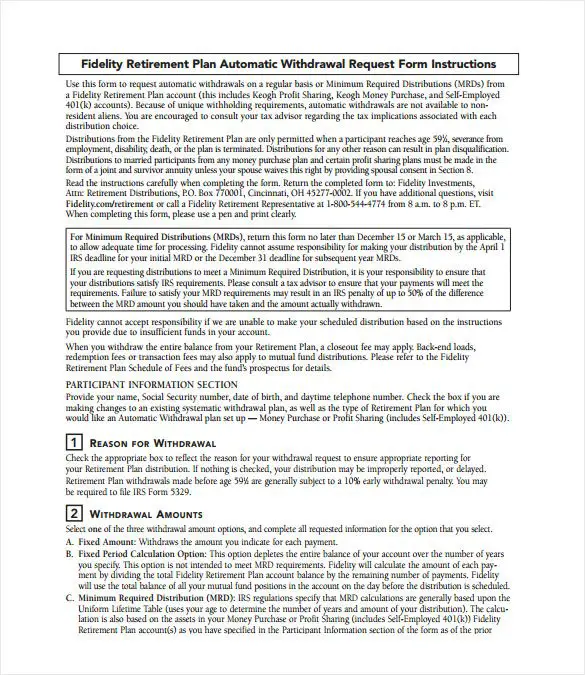

Contact Fidelity And Close Your Account

There are a few different ways to close your account. The most efficient way is to call Fidelity directly at 1-800-343-3548. You can speak to a representative that will guide you through the process of closing your account.

You can also log into your account online and transfer funds out of your account. Some people think just moving the funds out of the account is sufficient. However, you need to fully close the account. Leaving it open, even with a zero balance, leaves you at risk for fraudulent activity by an unauthorized user. You can send a message through the online chat to initiate the closing process.

Finally, you can visit a Fidelity branch in person. If you go that route, consider calling ahead to set up an appointment. That can make the process go much more quickly.

How To Roll Over Your Fidelity 401k

Rolling over your Fidelity 401k is simpler than you might think. You and Your 401K

Leaving a job or getting laid off usually prompts a period fraught with tough choices and big changes. In the midst of everything else, managing your old 401k might be the last task you want to deal with.

The good news is, if your 401k is with Fidelity, the process for completing your rollover is actually simple and quite painless. You can convert your employer-sponsored 401k to an IRA or even move it into the 401k account of your new employer rather seamlessly if you know the correct steps to take.

Heres a quick look at how to roll over your Fidelity 401k.

Recommended Reading: How Does 401k Work When You Quit

How To Permanently Close A Fidelity Account Online: Step

Ready to close your Fidelity account? You may find that Fidelity no longer meets your needs and its time to close your account. Alternatively, you may find yourself needing to close a Fidelity account on behalf of a loved one who has passed away. Here, well break down the steps you should take to make this happen.

An Astounding 90% Of American Workers With 401k Plans Said That Payroll Deduction Helps Them Save

Stats show that workers are satisfied with 401k plans and their features as they make it easier for them to save money for retirement. Whats more, 90% said that it helps them think about the future rather than their needs at the moment. Besides, 82% believe that saving money with every paycheck makes them less anxious about investment performance.

Recommended Reading: How To Recover 401k From Old Job

Is It Worth It To Take A 401k Withdrawal

Sometimes you just don’t have a better option. If withdrawing from the 401 plan is the only way to pay your bills without incurring expensive credit card debt, go for it. There is no point in leaving your retirement assets alone if it jeopardizes your current financial security and your ability to save more for your future retirement.

When To Cash Out Your 401k To Pay Off Debt

The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans. Withdrawing the 401k plan early can cost money. The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans.

Also Check: What Age Can You Take Out 401k

How To Maximize Your 401 Match

U.S. News & World Report – 02/11/2020

Many companies offer a 401 match to employees who save for retirement, but it’s not always easy to qualify for the match and take it with you when you leave the job. There might be waiting periods before you are eligible for a 401 match and vesting schedules that prevent you from keeping the match if you don’t stay at that job for a specific period of time.

How Does 401 Matching Work?

Some companies contribute to a 401 plan on behalf of employees regardless of whether the worker saves in the plan, while other firms offer to make a contribution to the 401 plan only if the employee also saves some of his or her own money in the plan. The exact amount of a 401 match varies by employer, but it is often 50 cents or $1 for each dollar the employee contributes. There is also often a cap on the amount the employer will match, such as 6% of pay. A 401 match does not count against the employee’s 401 contribution limit for tax deduction purposes, but it is subject to a different IRS annual limit.

Here’s how to take advantage of 401 matching contributions:

– Find a job with a good 401 match.

– Set up automatic 401 withholding.

– Watch out for 401 waiting periods.

– Follow the 401 match rules.

– Don’t stick with the 401 default contribution.

– Pay attention to the 401 vesting schedule.

Find a Job With a Good 401 Match

Set Up Automatic 401 Withholding

Watch Out for 401 Waiting Periods

Follow the 401 Match Rules

919308.1.0

Your 401 Plan If Your Company Was Acquired

If your company was acquired by Adobe, youll have approximately 1224 months to access your old 401 account and allocate investments, but you wont be able to roll over assets or request an account distribution until a plan audit with a favorable determination has been completed by the IRS, which typically takes 1218 months.

Following the plan audit and receipt of a favorable determination from the IRS, you can do one of the following:

- Roll over your account assets into Adobes 401 plan at Vanguard.

- Roll over your account assets to an individual retirement account .

- Request an account distribution, which may be subject to taxes and early-withdrawal penalties.

If your employment ends, you can immediately initiate a rollover or account distribution by contacting the plans provider.

Be sure your contact information is up to date so you receive notifications about your account and actions you have to take. See below for address-update directions for your plan.

Heres the status of the 401 plans for recently acquired companies.

Also Check: How Do I Know If I Have Money In 401k

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

Automatic Enrollment Or Making Changes

Enrollment is Automatic for All Employees

Participation in the Supplemental Retirement and Savings Plan is automatic for all employees. You will automatically be enrolled to contribute 3% of your eligible compensation, as defined under the BU Retirement Plan, on a tax-deferred basis and your contribution will be invested in a Vanguard Target Date Fund closest to the year in which you will turn age 65. Your first contribution to the plan will commence in the month following your hire date.

You may change or stop your contribution at any time. You may also change the investment allocation of your contributions at any time.

Automatic Enrollment and BU Matching Contribution After Two Years of Service

Once you have completed two years of service with at least a nine-month assignment at 50% or more of a full-time schedule, you will be eligible to receive the University matching contributions to the Boston University Retirement Plan.

In addition, you will automatically be enrolled in the Supplemental Retirement and Savings Plan to contribute 3% of your eligible compensation as defined under the BU Retirement Plan on a tax-deferred basis if you are not already doing so when you complete two years of service. BU matches your contribution dollar-for-dollar up to 3% of your eligible compensation as defined under the BU Retirement Plan.

You may make the following changes at any time:

Don’t Miss: Where To Move Your 401k Money

K Stats Show That 13% Of Plan Participants Have Made An Early Withdrawal

As many as 23% of workers participating in a plan have taken a loan or opted for an early withdrawal from their account. Large company employees are more likely to take out a loan or go for an early withdrawal . In comparison, 22% of small non-micro company workers and 17% of micro company workers consider the options above. Early withdrawals, as well as loans from retirement plans, can considerably reduce your retirement nest egg.

Planning & Guidance Center

Fidelity offers the Planning & Guidance Center through Fidelity NetBenefits. The Planning & Guidance Center can help you create a retirement plan or investment strategy and monitor your progress. Watch a short video which includes information on the following:

- Planning & Guidance Center Overview

- Creating a Plan

- Retirement Analysis

If you need assistance or have questions about the Planning & Guidance Center, you can speak with a Fidelity Guidance Consultant at 1-800-420-2363.

Also Check: Who Has The Best 401k Match

Interestingly 441000 Ira Or 401k Accounts Managed By Fidelity Had A Balance Of $1 Million In 2019

It may seem like an impressive number and the highest 401k balance one can reach. However, the reality is that only 1.6% of all the accounts that Fidelity manages have a million-dollar balance. There is good news, though. A third of participants upped the amount they were saving by 3% an encouraging stat for all future retirees.

According To 401k Statistics 58% Of 401k Participants See Themselves As Savers

Interestingly, the remaining 42% of 401k plan participants think of themselves as investors. Whats more, 72% believe its more important to save now so you could have a comfortable retirement. These attitudes show a changing dynamic towards savings. Hopefully, it will prompt more Americans to choose a retirement plan as soon as possible.

Read Also: When Can You Rollover A 401k Into An Ira

Report The Rollover On Your Taxes

In a direct rollover, you shouldnt owe any additional taxes, but you need to report the transaction on your taxes. If you roll over a 401k to an IRA, you should expect a 1099-R form from your 401k plan provider. This is the form youll use to report a direct rollover to the IRS. Fidelity will also send you a 5498 form if your rollover was a direct one. Simply add that information to your tax return at the end of the year.

More on 401k Investments:

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Also Check: Can You Use Your 401k To Pay Off Debt

What Are The Pros And Cons Of Cashing Out A 401k

- Access to money. The biggest benefit of retiring from your 401 is having money. Everyone would like to have more money in their pocket.

- taxes. Regardless of how you use your 401 withdrawal, you will have to pay withdrawal tax.

- To punish. Even if you qualify to be fired for difficult working conditions before you turn 59 1/2, the IRS will penalize you for doing so.

Automatic Enrollment And Aip

As an eligible associate, youâre automatically enrolled in the 401 on the first of the month coincident with or following 60 days of employment at a contribution rate of 3% of eligible pay. As part of automatic enrollment, youâre also enrolled in the automatic annual increase program , which increases your contribution by 1% each year until you reach 6%.

- If you want to change the automatic contribution elections before they begin, visit NetBenefits.com or call Fidelity at 1-800-635-4015 before 60 days of employment and make your own choices.

- If you donât actively enroll and choose investment funds for your account, Syscoâs contributions will be invested in the Vanguard Target Retirement Fund thatâs closest to your projected retirement date .

If you wish to contribute to the Plan before you are automatically enrolled or to opt out of automatic enrollment, log in to NetBenefits.com or call Fidelity at 1-800-635-4015. Note that youâll need to sign up for AIP if you choose to actively enroll. To do so, log in to NetBenefits.com and click Contribution Amount.

You May Like: What Age Can I Withdraw From 401k

How Long Does It Take To Get Money Out Of My 401k

May 3, 2011 It usually takes a week or two to get money out of your 401, although it can take much longer. The countdown begins when you request payment and ends when you actually receive the money in the form of a check or wire transfer.

Principal 401k phone number What is your 401k plan based on your retirement count?Your 401 is qualified retirement plan Although your donation has been reported in field 12 code D in format W2. You don’t need to report them again in TurboTax. If you’re going to bring up another issue, you’ll only answer “yes” to this question, such as BT IRA or Roth IRA. June 4, 2019 at 11:51 a

What Is An Opt

An opt-out plan is an employer-sponsored retirement savings program that automatically enrolls all employees into its 401 or SIMPLE IRA. Companies that use the opt-out provision enroll all eligible employees into a default allocation at a set contribution rate, usually around 3% of gross wages.

Employees can change their contribution percentages or opt-out of the plan altogether. They also may change the investments their money goes into if the company offers choices.

Read Also: How Do You Get Money From 401k