Federal Insurance For Private Pensions

If your company runs into financial problems, you’re likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

Rolling Over Into An Ira

Well handle the entire process for you online, for free!

- Well help you choose an IRA provider if you dont already have one

- Customer support available if you have questions along the way

- We get paid by the IRA provider if you open an account so our service comes at no cost to you!

Weve laid out a step-by-step guide to help you roll over your old ADP 401 in five key steps:

Do I Have A 401k I Don’t Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

Don’t Miss: How Much Should I Have In My 401k At 60

What If My Check Gets Misplaced Or Lost In The Mail

This unfortunately does happen every once in a while, but dont worry your money hasnt disappeared. If your check doesnt arrive then youll have to call your 401 provider again and ask them to issue a new one. Theyll place a stop on the first one, and nobody will be able to cash the first check since its generally made out to you or your IRA provider and will always stipulate that its for the benefit of or FBO, your name.

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Also Check: How Does Retirement Work With 401k

Heres How The Company Match Works:

Matching contributions are deposited into your savings plan annually in January . You are eligible to receive the matching contribution if you are an active employee on December 31 of the calendar year.

Meet the match!

Are you making your money work as hard as you do? Try to contribute at least 6% to take full advantage of the match otherwise, youre leaving free money on the table.

Leave It With Your Former Employer

If you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. If it is under $1,000, the company can force out the money by issuing you a check, says Bonnie Yam, CFA, CFP, CLU, ChFC, RICP, EA, CVA, CEPA, Pension Maxima Investment Advisory Inc., White Plains, New York. If it is between $1,000 and $5,000, the company must help you set up an IRA to host the money if they are forcing you out.

If you have a substantial amount saved and like your plan portfolio, leaving your 401 with a previous employer may be a good idea. If you are likely to forget about the account or are not particularly impressed with the plans investment options or fees, consider some of your other options.

When you leave your job and you have a 401 plan which is administered by your employer, you have the default option of doing nothing and continuing to manage the money as you had been doing previously, says Steven Jon Kaplan, CEO, True Contrarian Investments LLC, Kearny, New Jersey. However, this is usually not a good idea, because these plans have very limited choices as compared with the IRA offerings available with most brokers.

Specifying a direct rollover is important. That means the money goes straight from financial institution to financial institution and doesn’t count as a taxable event.

Don’t Miss: Where To Move Your 401k Money

Roll It Over Into An Ira

If you’re not moving to a new employer, or your new employer doesn’t offer a retirement plan, you still have a good option. You can roll your old 401 into an IRA.

You’ll be opening the account on your own, through the financial institution of your choice. The possibilities are pretty much limitless. That is, you’re no longer restricted to the options made available by an employer.

The biggest advantage of rolling a 401 into an IRA is the freedom to invest how you want, where you want, and in what you want, says John J. Riley, AIF, founder and chief investment strategist for Cornerstone Investment Services LLC, Providence, Rhode Island. There are few limits on an IRA rollover.

One item you might want to consider is that in some states, such as California, if you are in the middle of a lawsuit or think there is the potential for a future claim against you, you may want to leave your money in a 401 instead of rolling it into an IRA, says financial advisor Jarrett B. Topel, CFP, Topel & DiStasi Wealth Management LLC, Berkeley, California. There is more creditor protection in California with 401s than there is with IRAs. In other words, it is harder for creditors/plaintiffs to get at the money in your 401 than it is to get at the money in your IRA.

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

You May Like: How Do I Start My Own 401k

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corp Report, T. Rowe Price – Get T. Rowe Price Group Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

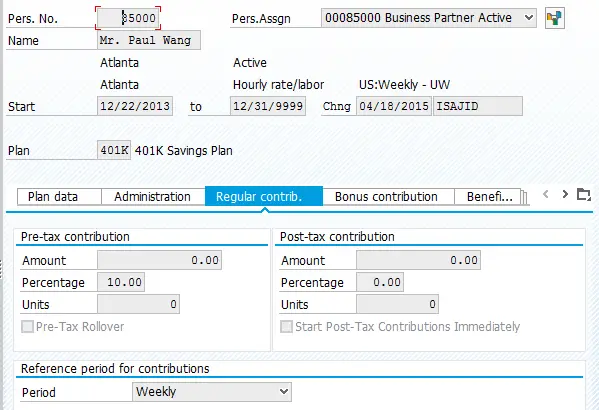

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

Read Also: Can You Roll A Traditional 401k Into A Roth Ira

How To Check Your 401

First things first, how do you even check your 401 account online? Start by going to the website of your 401 provider. If youre not sure who your 401 provider is, go onto your employer intranet and it should be listed under a HR resources section. Once youre on their website, if you get stuck hit forgot username. If youve never set up an online profile this process will alert you to that pretty quickly. Itll take a couple of steps to get your username and password retrieved / set up. Once you have this bookmark the page and save your username / password either through a password manager or somewhere you can reference later.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

You May Like: How To Transfer 401k Accounts

What Are The Consequences Of Cashing Out A 401

When cashing out a 401, be prepared for the penalties and taxes. Penalties are usually easy to estimate when they apply, but potential taxes can be more elusive.

One assumed benefit implicit in any tax-deferred plan is that you will withdraw the money in a lower tax bracket than you deferred the tax when you made the contributions. This is not always the case, but taking an early withdrawal in a year when you have a high level of income ensures that you will never see this potential benefit on the amount withdrawn.

If you have existing income for the year, a big withdrawal might put you in a higher tax bracket or at least ensure youre paying taxes on most of the withdrawal at your current tax rate without the benefit of the lower rates in our graduated tax system. Lower tax rates may apply to at least a part of the distribution if you were to take a similar withdrawal in a year where you do not have as much other income.

Also, if you have a true emergency and pull money from a 401 to cover that emergency, then what about the taxes and penalties which are due next April 15th? Could your initial withdrawal start a chain reaction that may force taking another withdrawal to cover taxes?

Make sure you have a way to pay the taxes on 401 withdrawals.

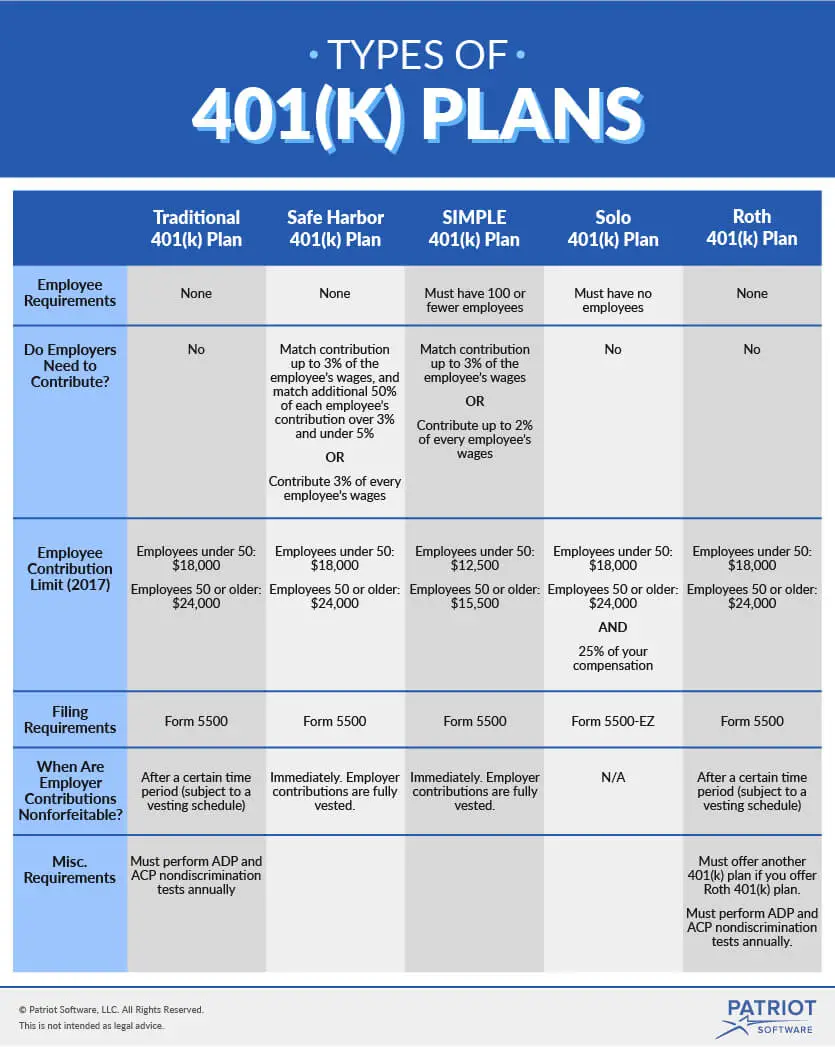

Cannot: Exceed Annual Contribution Limits

Regardless of the type of 401 plan that your company offers, youll have to abide by the annual IRS contribution limits. For 2021, the limit on employee elective deferrals is $19,500, rising to $20,500 in 2022. If youre 50 or older, you can contribute an additional $6,500 in both 2021 and 2022. For 2021, the total amount that can be contributed to your account, including your own contributions, your employers contributions and any other additions, is the lesser of $58,000 or 100% of your earned compensation.

Recommended Reading: How To Set Up 401k In Quickbooks

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Recommended Reading: How Do You Roll A 401k Into An Ira

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

Youve Got Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into a new account with your new employer, or roll it into an individual retirement account , but you must first see when you are eligible to participate in the new plan. You can also take some or all of the money out, but there are serious tax consequences to that.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Recommended Reading: How To Transfer 401k Without Penalty