You Get More Investment Options

In a 401 plan, your mutual fund investment options can be limited, points out Dominique Henderson, CFP, founder of DJH Capital Management.

Often you have between six and 24 fund choices in a 401, Henderson says. With an IRA, you can choose individual stocks as well as fundsand even use alternative investments. Alternative investments can include everything from real estate to bitcoin.

If you move your retirement funds into an IRA, you get a very broad menu of investment choices and more control over how your money is invested.

- Roll over a traditional 401 into a traditional IRA, tax-free.

- Roll over a Roth 401 into a Roth IRA, tax-free.

- Roll over a traditional 401 into a Roth IRAthis would be considered a Roth conversion, so youd owe taxes. Note: A Roth conversion that happens at the same time as your rollover may not be eligible for all plans. We can usually complete the Roth conversion once your pre-tax assets arrive into your Vanguard IRA account, though.

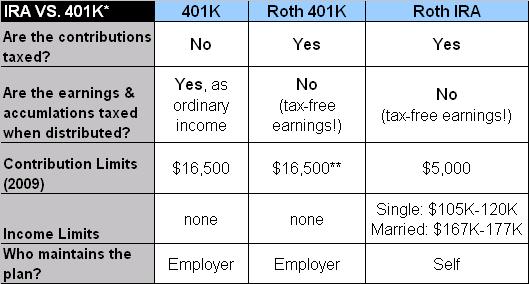

The Differences Between An Ira And A 401

401s are employer-sponsored retirement plans that are part of an employee’s benefits package. Many employers will match your 401 contributions up to a certain percentage or dollar amount. In most cases, your 401 is held at an investment firm of your employer’s choice and may have certain investment options.

IRAs

Based on your situation, you can determine whether to continue adding money to your 401 and/or open an IRA. You can open an IRA at most banks and investment firms. These accounts are not tied to your employer and are transferable between institutions. Though there are some limitations, most people can fund an IRA.

IRAs may also allow you more flexibility in your investment choices, since you’re able to choose the firm you invest with as well as the types of investments that make sense for you.

Can An 18 Year Old Open A Roth Ira

An adult has to open a Roth IRA escrow account for a minor. In most states he is 18 years old, but he is 19 or 21 in others. Custodial Roth IRAs are basically the same as standard Roth IRAs, but the minimum investment amount may be less. Many, but not all, brokers offer Roth IRA escrow accounts.

Is there an age limit to open a Roth IRA?

There are no age restrictions. Children of any age can contribute to a Roth IRA as long as they have an income. A parent or other adult will need to open the custody Roth IRA for the child. Not all online brokerages or banks offer escrow IRAs, but Fidelity and Charles Schwab do.

Can I open a Roth IRA for my adult child?

Roth IRAs make great gifts for kids and teens because they can make the most of time and makeup. You can give a child a Roth by opening an account in their name and helping to fund it. You can also give someone a Roth IRA by designating them as your account beneficiary.

You May Like: How Do I Look At My 401k

Benefits Of Having Both A 401 And An Ira

Instead of investing in only an IRA or your companys retirement plan, consider how you can blend the two into a powerful investment strategy. One reason this makes sense is that you can invest more for your retirement, with the additional savings and potential growth providing even more resources to fund your retirement dreams.

Since employers often match 401 contributions up to a certain percentage , this supplement boosts your overall savings. The employer match is essentially free money that you could get simply by making the minimum contribution to your plan. Every company is different, so check with your employer to determine their policy on matching 401 contributions.

Now imagine adding an IRA to the picture. One of the best things about an IRA is the flexibility you have when investing. With a 401, you have limited options when it comes to investment funds. With an IRA, youre able to decide what youd like to invest in, whether it be stocks, bonds, mutual funds, ETFs, or other options.

By investing in both a 401 and IRA, you are taking advantage of employer-matched contributions and diversifying your retirement portfolio which can help manage risk and potentially improve the overall performance of your investments in aggregate.

That said, if you choose to invest in both types of accounts, its important to make sure your investment choices dont overlap.

Can I Contribute To A 401 An Ira A Roth Ira And A Roth 401

You can contribute to a 401, an IRA, a Roth IRA, and a Roth 401 all at the same time. In fact, diversifying your accounts can help boost your savings even more.

When starting to save for retirement, the vast array of retirement account options can be dizzying. The most common retirement accounts to contribute to are a 401, an IRA, a Roth IRA, and a Roth 401. But can you invest in all four?

Yesâin fact diversifying your retirement savings is a good idea. Contributing to a 401, an IRA, a Roth IRA, and a Roth 401, allows you to enjoy the benefits of each.

When deciding which one to contribute to, itâs essential to understand how each one works. Each account has its pros and cons, and knowing the features of each can help you decide which one is best for your retirement goals.

Let’s go over how you’re able to contribute to multiple retirements and whether it’s worthwhile.

Recommended Reading: Where To Check 401k Balance

Understand The Rules For Contributing To A 401k And A Roth Ira

If your employer offers a 401 plan, there may still be room in your retirement savings for a Roth IRA. Yes, you can contribute to both a 401 and a Roth IRA, but there are certain limitations you’ll have to consider.

This article will go over how to determine your eligibility for a Roth IRA. You’ll also learn how much you can contribute to that Roth IRA, how to work around the eligibility restrictions, the flexibility of saving in a Roth IRA versus other individual retirement accounts, and the benefits of saving in both a 401 and a Roth IRA.

Benefits And Drawbacks Of A 401

The prospect of employer matches and large contribution limits can give the 401 an edge, but it does have its limitations. For instance, companies typically place stricter restrictions around your funds. No law states they must allow hardship withdrawals, for example.

And some plans can involve hefty administration fees and fund expenses that can add up, taking a chunk out of your retirement savings. Thats why you should learn everything you need to know about 401 fees. Generally speaking, though, the larger the company, the lower the fees.

Recommended Reading: Who Does Walmart Use For 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

This Is A Great Question The Answer Is Yes You Can Have Both Should You Have Both It Depends

-

Yes, you can contribute to both a 401 and an IRA at the same time.

-

If youre under 50, you can contribute $19,500 to a 401 for 2021. Those age 50+ can contribute an additional $6,500 for a total of $26,000.

-

On top of that, those under 50 can contribute an additional $6,000 to an IRA. Those age 50+ can contribute $7,000.

Everyone knows that its important to save for retirement. But not everyone knows how. This is because there are many different ways you can save for retirementeither through your employer or on your ownand the different options may make retirement planning feel like solving a Rubiks cube to most.

Our customers have access to a personalized retirement plan, which offers recommendations on how they should save for retirement. Depending on your plan and personal situation, our advice can sometimes be to contribute to both a 401 through work while also contributing to an IRA on your own.

Generally, you can contribute to both a 401 and an IRA at the same time.

Also Check: What Is My Fidelity 401k Account Number

You May Be Able To Contribute To Both If

- Single, head of a household or married and filing separately and making between $107,001-$122,000

Then you can contribute to both a 401k and a Roth IRA, but you cant contribute the full $5,000.

So, there you have it.

Whether or not you can supplement a 401k plan with a Roth IRA depends on your filing status and how much taxable income you make over the course of a year.

If you want to learn about other aspects of investing, then go ahead and explore other sections of the site to find what you need.

Related 401k Information You May Like

Limitations On Having Both An Ira And 401

As mentioned, while you are always eligible to contribute to both retirement accounts, if your income is too high, you may not be eligible for the tax benefits of both. To work through this yourself you need to answer two questions:

If you answered no to the first question, then youre set. However, if you or your partner participate in a work-sponsored retirement plan such as a 401, you will be ineligible to deduct your IRA contributions because your income exceeds whats known as the phase-out limit.

If you are filing as single or head of household, the phase-out limit is between $64,000 and $74,000. If your income is less than $64,000, you are eligible for full tax deduction of your contribution to an IRA. If its over $74,000, you are not eligible, and if you are in between you are eligible for a partial deduction.

If you are filing jointly, the limit is $103,000 to $123,000. The same rules apply .

Read Also: Is Spouse Entitled To 401k In Divorce In Ny

Can I Contribute To A Traditional Or Roth Ira If I’m Covered By A Retirement Plan At Work

Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan . See the discussion of IRA Contribution Limits. If you or your spouse is covered by an employer-sponsored retirement plan and your income exceeds certain levels, you may not be able to deduct your entire contribution. See the discussion of IRA deduction limits.

How Much Will An Ira Reduce My Taxes

Contribute to an IRA. You can defer the payment of income tax up to $ 6,000 deposited in an individual retirement account. A worker in the 24% tax bracket who maximizes this account will reduce their federal income tax by $ 1,440.

Can IRA contributions lower your tax bracket? Contribute to an IRA. You can defer the payment of income tax up to $ 6,000 deposited in an individual retirement account. A worker in the 24% tax bracket who maximizes this account will reduce their federal income tax by $ 1,440. Income tax does not apply until the money is withdrawn from the account.

Read Also: How To Close Vanguard 401k Account

Can Husband And Wife Have Separate Ira

IRAs can only be opened and owned by individuals, so a married couple cannot jointly own an IRA. However, each spouse can have a separate IRA or even multiple traditional and Roth IRAs.

Should Husband and Wife Have Separate IRA? There is no such thing as jointly owned IRA. Since there are annual contribution limits imposed for both traditional and Roth IRAs, having two separate IRAs can save you more money towards retirement.

Can I Contribute To A 401k And A Roth Ira

Its a question I get all the time Can I Contribute to a 401k and a Roth IRA?

This page will answer that pesky question for you once and for all. But before that, a quick refresher on the difference between a 401k and an IRA:

- 401k This is an employer sponsored plan in which a certain amount of money is taken out of your check every time you get paid and put into an account that the company has set up. From there, you invest your money in things like stocks, bonds, and money market funds. People like 401k plans because a lot of companies will MATCH your contributions to some extent.

- Roth IRA This is an individual retirement account where youre taxed on the front-end rather than on the back-end when youre ready to start taking distributions. Think of it like this in a Roth IRA, you clear up your tax obligations while youre young. In a traditional IRA, you pay the tax when youre old.

Now, to answer the question of Can I Contribute to a 401k and a Roth IRA? the simplest answer is Maybe. Maybe not.

You may want to maximize your retirement savings by having as many different types of retirement accounts as you can. Thats logical and admirable, but you have to figure out whether or not youre eligible for a Roth IRA in the first place.

Recommended Reading: How Much Can I Take From 401k For Home Purchase

Yes But The Tax Breaks You Receive May Be Limited By Your Income

The quick answer is yes, you can have both a 401 and an individual retirement account at the same time. Actually, it is quite common to have both types of accounts. These plans share similarities in that they offer the opportunity for tax-deferred savings . However, depending on your individual situation, you may or may not be eligible for tax-advantaged contributions to both of them in any given tax year.

If you have a retirement plan at work, your tax deduction for a traditional IRA may be limitedor you may not be eligible for a deductiondepending on your modified adjusted gross income .

You can, however, still make nondeductible contributions. And if your income exceeds certain thresholds, you may not be eligible to contribute to a Roth IRA at all.

Pros Of Having Both Plans

It makes sense to contribute to both these accounts if you qualify, you can afford it, and you want to invest more than the 401 or Roth IRA limits. Both accounts offer unique incentives when they’re combined, allowing you to make the most of your savings.

You can deduct the contribution from your taxable income, because 401 plans are tax-deferred accounts that you pay into with pre-tax dollars. This lowers your tax liability in the present. But both your contributions and their earnings are subject to taxes when you take the money out. The withdrawal will also be subject to an early-withdrawal penalty of 10% if you take it before age 59 1/2, with certain exceptions.

You don’t have to pay any taxes on either the contributions or the earnings with a Roth IRA when you take the money out, as long as you’ve held the account for five years. Again, you must wait until age 59 1/2 to take the earnings. Your original contributions can also be withdrawn tax-free at any time before you reach retirement.

This tax arrangement lets you save for other goals, such as buying a house or paying for a child’s college education. Some people even use Roth IRAs as emergency savings accounts.

Invest at least the minimum amount in your 401 to qualify for your employer’s matching program, if one is offered.

Also Check: Can You Have A Solo 401k And An Employer 401k

Contribution Limits For Roth Iras

For most households, the Roth IRA contribution limits in 2020 and 2021 will be the smaller of $6,000 or your taxable income. If you’re age 50 or older, you can make an additional $1,000 catch-up contribution.

Some may see a reduced contribution limit based on their modified AGI. If you make within $10,000 or $15,000 of the maximum modified AGI, you’ll have to do a little math.

- Take the maximum limit for your filing status and subtract your modified AGI.

- If you’re married filing jointly or separately and you lived with your spouse, take that number and divide by $10,000.

- Otherwise divide by $15,000.

- Multiply the resulting percentage by $6,000 . That’s your contribution limit for a Roth IRA.

For example, if you’re a married couple and you have a combined AGI of $200,000 in 2020, you’d:

- Subtract that amount from $206,000, the maximum AGI allowed to make any contribution. The result is $6,000.

- That number divided by $10,000 is 60%.

- 60% multiplied by $6,000 is $3,600. That’s the maximum amount you and your partner can each contribute to your Roth IRAs.

Importantly, the $6,000 contribution limit applies to all IRAs. The income limits for the Roth IRA apply only to Roth IRA contributions, so you could still contribute to a traditional IRA up to the $6,000 limit. Those contributions won’t be tax deductible, though, if your Roth contributions are limited by your income and you have a 401 at work.