How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

Defining Ownership For Purposes Of The Still

Of course, even if we know whose ownership percentages must be aggregated together when considering whether an employee is a “5-percent owner”, we still need to know what, precisely, defines ownership for any of those persons and/or entities to begin with! And unfortunately, the term ownership is somewhat fungible and can mean different things in different situations. Thankfully, IRC Section 416 does not leave us guessing.

Under IRC Section 416, if the entity in question is a corporation, then a 5-percent owner is deemed to be anyone who owns either 5% of the outstanding stock of the corporation, or who possesses enough stock to give them more than 5% of the total combined voting power of the corporation.

On the other hand, if the entity in question is a partnership, or other business that is not a corporation, then ownership is determined based on ownership of profit, as well as ownership of capital of the business. Thus, if a partner in a partnership is entitled to more than 5% of the partnerships profit, or more than 5% of the partnerships capital , they are considered a 5-percent owner for purposes of the still-working exception.

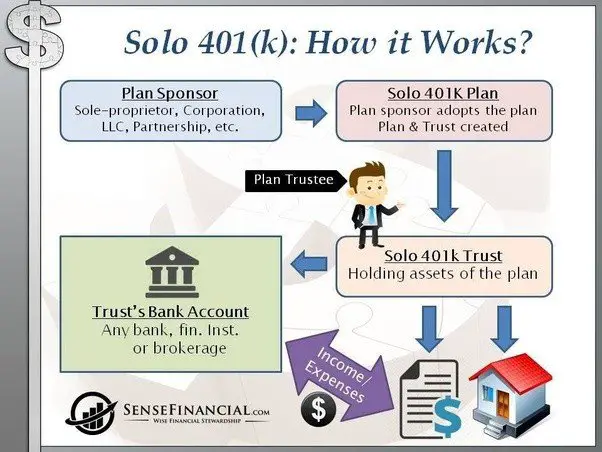

Establish Solo 401k Plan And Trust

If you were facing a legal trial against a customer or service provider, would you fight the trial yourself or look for a qualified lawyer with your best interest at heart? Unless youve a strong understanding of the law, the latter would be your choice. The same principle holds while opening a self-directed Solo k plan. Considering a somewhat sophisticated nature of the plan, its best to work with a retirement planning expert.

Being the owner of the business, youll adopt the Solo 401k plan, and as per the IRS requirement, a Solo 401k trust will be incorporated to hold the assets of the plan. As the plan owner, you can either appoint yourself as the discretionary trustee of the Solo 401k trust or hire a directed trustee to take decisions on your part. A majority of people choose the earlier option, hence utilizing the discretionary investment authority offered in the plan.

Read Also: How To Withdraw Money From My Fidelity 401k

How Does The Solo 401 Work For You

The Solo 401 plans work best for self-employed individuals, small business owners with no full-time employees, freelancers and sole proprietors. It is a type of qualified retirement plan that offers the same benefits as a traditional 401, but designed specifically for one individual.

At IRA Financial, we simplify how you establish your self-directed retirement plan. We provide the following for one low price.

Employee Pro: Larger Contribution Potential

Some employees might appreciate that their employer 401 contribution is tied to profits, as the compensation might feel like a more direct reflection of the hard work they and others put into the company. When the company succeeds, they feel the love in their contribution amounts.

Additionally, depending on the type of distribution strategy the employer utilizes, certain employees may find a profit-sharing 401 plan to be more lucrative than a traditional 401 plan. For example, an executive in a company that follows the New Compatibility approach might be pleased with the larger percentage of profits shared, versus more junior staffers.

You May Like: Can I Borrow From My 401k Without Penalty

Try Out A Simple Ira If You Have Employees

SIMPLE stands for Savings Incentive Match Plan for Employees and it allows employees and employers to contribute to traditional IRAs for employees. Its available to any small business with 100 or fewer employees.

You, as the employer, are required to pony up a matching contribution up to three percent of compensation or two percent of non-elective contribution for each eligible employee.

Employees can choose whether or not theyd like to participate, and the employee always has 100 percent ownership of all SIMPLE IRA money. They may defer up to $12,500 and employees over age 50 can make a catch-up contribution of up to $3,000.

Employer Pension Plan Basics

An employer pension plan is a registered plan that provides you with a source of income during your retirement. Under these plans, you and your employer regularly contribute money to the plan. When you retire, youll receive an income from the plan.

There are two main types of employer pension plans:

- defined contribution plans

- defined benefit plans

Speak to a human resources adviser or pension plan manager to find out how your employer-sponsored pension plan works.

If you switched jobs during your career, you may have two or more pensions from different employers. You may be able to transfer your old pension to your new plan. Talk to a financial planner or representative at your financial institution or your human resources representative to understand what choices you have.

You May Like: How Do I Transfer My 401k To A Roth Ira

How Much To Invest

Finally, the rule of thumb from most financial advisers is to save at least 10 percent or more of your income-but if that seems impossible, remember that every little bit helps.

Also, a MUST: Make your contributions automatic. Have money sent directly from your checking account to your IRA every month, so you dont have to think about it at all. If at all possible, aim to max out your plan.

You cant make a wrong decision, and I think Nike says it best: JUST DO IT.

- Total3

You Can Fund A Traditional Ira

A traditional IRA, or individual retirement account, allows you to contribute pre-tax dollars . You pay taxes when you withdraw the money once you retire, meaning that its tax-deferred.

If you earn taxable income and are under age 70 ½, you can contribute. Easy-peasy. Plus, since you have no 401k or retirement plan at work, you can put money in and deduct the entire amount from your taxes.

You May Like: What To Do With 401k When You Retire

Difference Between 401k Plan And Pension Plan

- Pension plans are being funded by the employers, and they ensure regular income to members. Also, the investments in the fund are handled by the investment managers.

- On the other hand, these are funded by the employees. The amounts in the fund depend on deposits made the income arising from the investment therein. Also, the investments are managed by the employees themselves.

What Is The Maximum 401k Contribution For 2021

That depends on your employer’s plan. The maximum the IRS allows for 2021 stayed the same as 2020. Currently, the cap sits at $19,500 but your employer may cap the amount below that. For people over 50 the maximum increases to help them “catch up” before their retirement. They can contribute an additional $6,500 a year.

You May Like: How To See How Much Is In My 401k

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows an employee to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in a range of vehicles like stocks, bonds, mutual funds, and cash. Oh, and if you’re curious where the name 401k comes from? It comes directly from the section of the tax code that established this type of plan specifically subsection 401k.

A Beginner’s Guide To Understanding 401k Plans

The word 401k is synonymous with retirement, but how many of us actually know all the rules around 401k accounts? We’ll walk you through all the finer details, but we also know you’re busy, so we’ve also whipped up this handy table of contents for you, too. Feel free to self-serve some of the most frequently asked questions about 401k plans, or binge it all, top to bottom.

Now, onto the good stuff:

Recommended Reading: Can You Buy A House With 401k

Solo 401 Contribution Limits For 2021

| Type Of Contribution | |

|---|---|

| Employer | 25% of gross income% |

| Total | $58,000 # |

*This limit applies across all 401 plans to which you have access. If you make less than $19,500 in self-employed income, your contribution limit is 100% of what you earn.

^This requires a calculation, which you can outsource to a tax specialist. If you want to do it on your own, youll need to use the rate table worksheet in Chapter 6 of IRS Publication 560. You can also make the calculation via another IRS document called Calculating Your Own Retirement Plan Contribution.

%You can use a maximum of $290,000 in compensation for these purposes. Anything you make beyond $290,000 isnt eligible for additional employer contributions.

#Employer contribution limits arent comprehensive like employee limits.You can get up to $58,000 in total from multiple employers.

Disadvantages Of A Solo 401

Here are some of the drawbacks of a solo 401 plan:

- No employees allowed. If you have an employee who has worked for your company for at least one year , youre no longer eligible to maintain a solo 401 plan unless that employee is your spouse.

- Can create significant administrative work. A solo 401 plan isnt as time-consuming as a full-scale corporate 401. But it can be a significant resource drain. This is especially true if you select the do-it-yourself option and open an account on your own, outside of a brokerage firm.

- Need decent income before it becomes worthwhile. If youre not planning to set aside more than $6,000 per year into a retirement account perhaps a decent amount more than $6,000 opening a solo 401 probably isnt worth the effort.

- Some of the nuances and rules are especially dense. Personally, I find that solo 401 plans to be one of the most complex types of retirement accounts.

Also Check: Should I Roll My 401k Into An Annuity

Learn More About The Benefits Of The Solo 401k

- Solo 401k Information, Rules and Frequently Asked Questions about the Solo 401k.

- Solo 401k Eligibility Learn about the eligibility rules and find out who is eligible and who is ineligible to establish a Solo 401k plan.

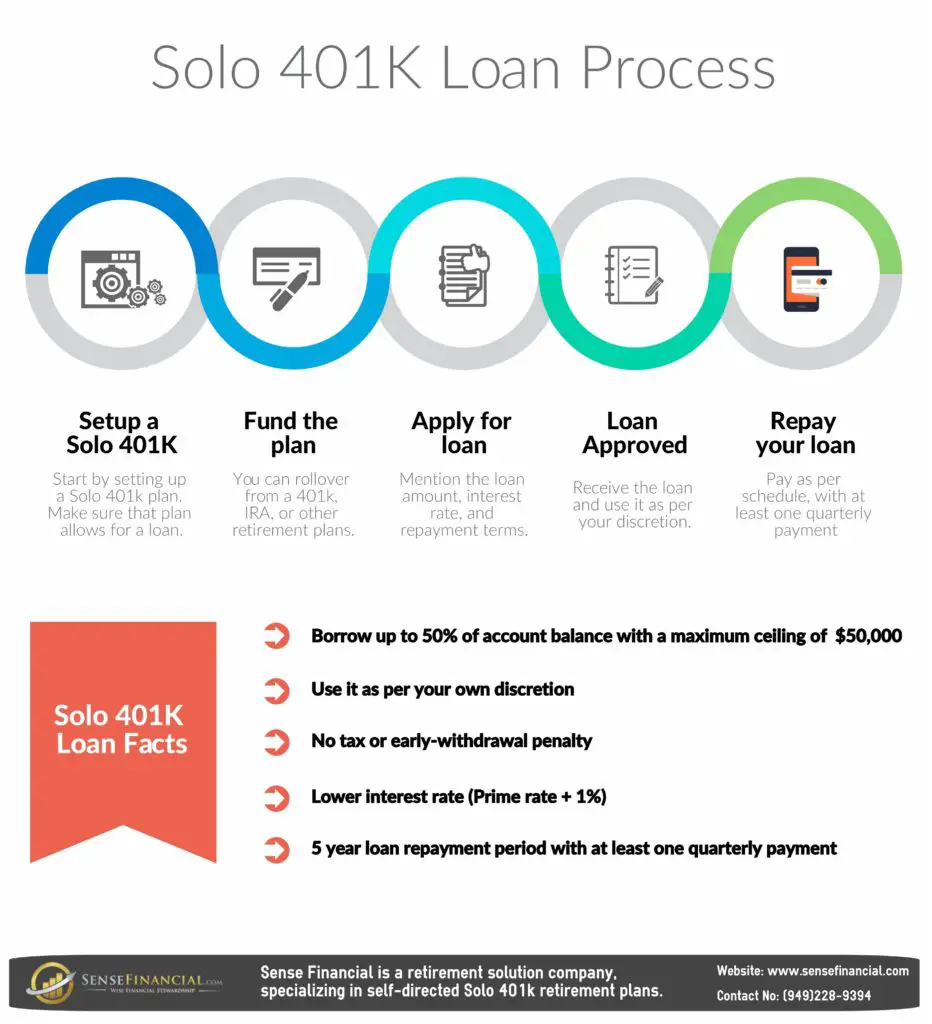

- Solo 401k Loan A 401k loan up 50% of the total value of the 401k up to a maximum loan of $50,000 is permitted with a Solo 401k plan.

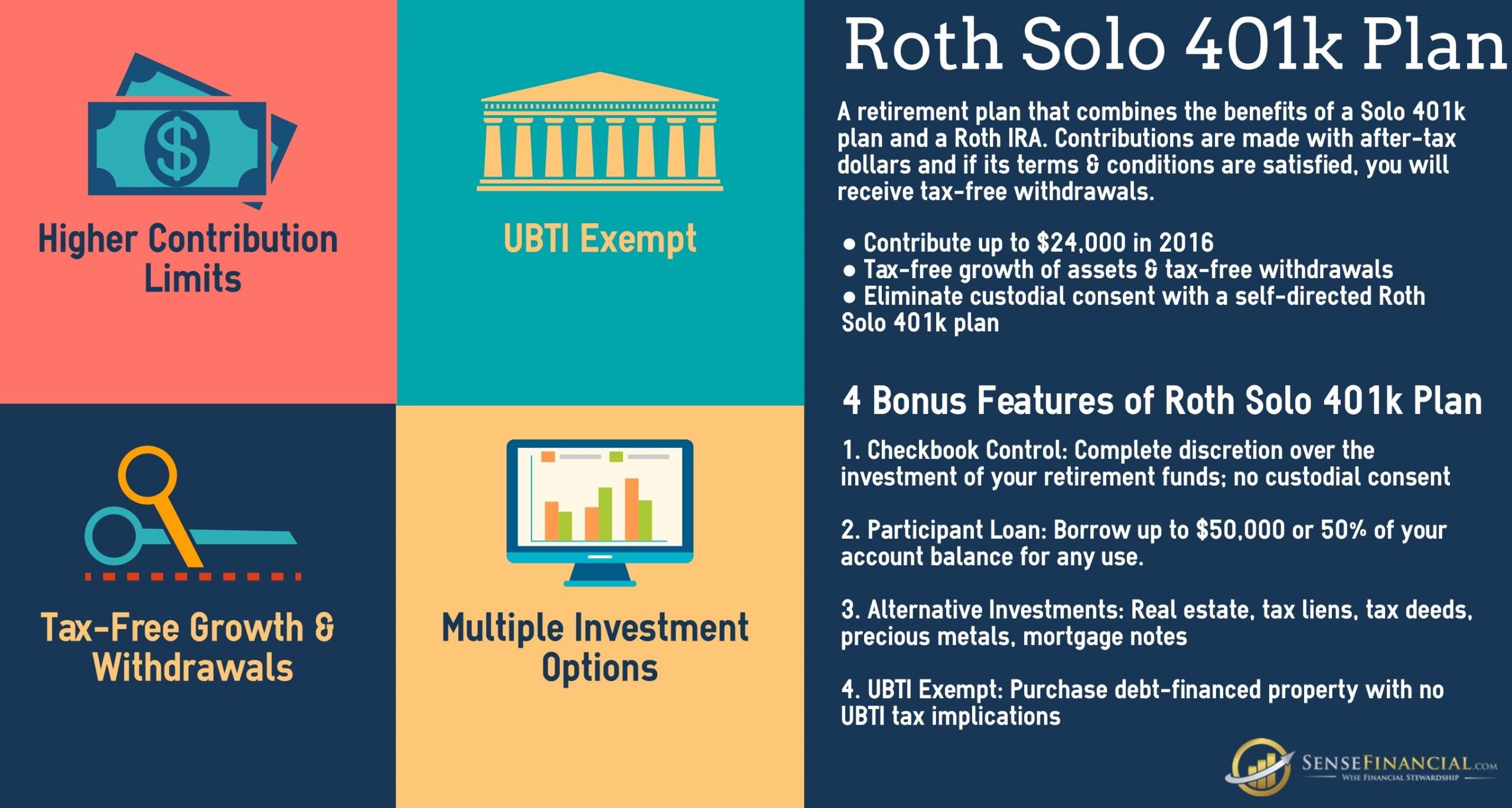

- Solo Roth 401k There is an option to make Roth 401k contributions with the salary deferral portion of the Solo 401k. Contributions into a Roth 401k are not tax deductible, but withdrawals are tax free after age 59 ½.Solo 401k Rollover You can rollover your 401k, 403b, 457, TSP and Defined Benefit Plan from a previous employer. You can also rollover a Traditional IRA, SEP IRA, Rollover IRA, SIMPLE IRA and Keogh plan.

- Solo 401k Providers Learn about the 3 main types of Solo 401k providers and the investment options available with each Solo 401k provider.

- Self Employed Retirement Plan Comparison Compare the Solo 401k, SEP IRA, Defined Benefit Plan and Simple IRA.

Employee Con: Inconsistent Contributions

While employers may consider the flexibility in contributions from year to year a positive, its possible that employees might find that same attribute of profit sharing 401 plans to be a negative. The unpredictability of profit share plans can be disconcerting to some employees who may have come from an employer who had a traditional, consistent match set up.

You May Like: Can I Rollover My 401k To A Roth Ira

What Is A Roth Ira

A Roth IRA is a type of individual retirement account similar to traditional IRAs in many ways, but with some significant differences. One of the main differences is how the tax breaks are different: with a traditional IRA, the money you put in isn’t taxed with a Roth IRA the money you take out isn’t taxed. Roth IRA’s also have no requirements on when the money must be taken t, so they can be a good tool to pass along wealth to your beneficiaries if you find you don’t need the money in retirement.

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Don’t Miss: Can I Sign Up For 401k Anytime

Check Out Something Called My Ra

This cool option is absolutely designed for people who dont have access to a retirement savings plan at work. Your investments are backed by the U.S. Department of the Treasury and there are no fees and no cost to open-and the investment is just $25. There are no required minimum account balances or contributions, and there are tax advantages. In addition, theres no risk of losing money, since theyre FDIC-insured.

Single filers with incomes under $131,000 and married couples filing taxes jointly with incomes under $198,000 can contribute. The maximum contribution is $5,500 per year, or $6,500 if youre 50 or older.

Interestingly, once a myRA account balance reaches $15,000, its rolled into a Roth IRA. Ultimately, the goal of myRA is to give you a return thats higher than inflation and keeps you away from risk. This is a great way to start building your nest egg.

One of the best reasons you may not have a retirement plan at work may be because youre self-employed. Self-employed people have some beautiful options at their disposal, too!

For the self-employed, never fear. Here are some other fantastic options:

What Is A Self

What is it: A qualified retirement plan targeted at owner-only businesses and self-employment professionals that allow comparatively higher contributions and diverse investment options.

Revised contribution limits for 2017: $54,000

- Elective contributions of up to $18,000

- Profit-sharing contributions of up to 20% to 25% of business income

A Solo 401k plan allows catch-up contributions of up to $6,000 for professionals above 50 years of age, pushing their net contributions to a maximum of $60,000 for the financial year 2017.

Recommended Reading: Can You Convert Your 401k To A Roth Ira

Claim Solo 401k Contributions On Your Tax Return For An S

Is your business a corporation? If so, business income and contributions do not pass directly to your personal income tax return. There is a different tax reporting process that requires different tax forms.

Most, but not all, corporations are separate business entities. Therefore, they do not allow earned income to pass directly through to your personal income tax return. An important exception is S-corporations. For an S-corp, business income passes through to owners/shareholders. Youll then report that income to the IRS as taxable. However, S-corporations do have other tax obligations as a corporate entity. This requires the S-corporation to file a tax return separate from the business owners.

The S-corporation files with the IRS using Form 1120-S. List the business portion of the Solo 401k contribution on line 23. Additional supporting IRS forms are generally required for S-corporations. Some of these are Form 5500, or Form 5500-SF.

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Recommended Reading: What Is The Max Percentage For 401k

Group Registered Retirement Savings Plans

A group Registered Retirement Savings Plan is a retirement savings plan sponsored by your employer.

You open an individual RRSP but pay into it through your employer. You contribute through regular deductions from your paycheque. Your employer may also contribute to your RRSP on your behalf.

The details of group RRSPs vary by employer. For more information on your Group RRSP, talk to your human resources or pension plan representative.