Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55, and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal. but only from a current 401 account held by your employer. You can’t loans out on older 401 accounts. You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Leave Your Assets Where They Are

If the plan allows, you can leave the assets in your former employers 401 plan, where they can continue to benefit from any tax-advantaged growth. Find out if you must maintain a minimum balance, and understand the plans fees, investment options, and other provisions, especially if you may need to access these funds at a later time.

Don’t Miss: How To Collect My 401k Money

Withdrawals After Age 59 1/2

Age 59 1/2 is the magic number when it comes to avoiding the penalties associated with early 401 withdrawals. You can take penalty-free withdrawals from 401 assets that have been rolled over into a traditional IRA when you’ve reached this age. You can also take a penalty-free withdrawal if your funds are still in the 401 plan, and you’ve retired.

You can take a withdrawal penalty-free if you’re still working after you reach age 59 1/2, but the rules change a bit. Check with the plan administrator about its specific rules if you’re still working at the company with which you have your 401 assets.

Your plan might offer an “in-service” withdrawal that allows you to access your 401 assets penalty-free, but not all plans offer this option. And remember, the withdrawal will still be subject to income taxes, even if it’s not penalized.

Is It Legal To Cash Out Your 401 Before A Divorce

After a divorce starts, it is generally not permitted to dispose of martial assets such as retirement accounts. Additionally, just because you empty the account doesn’t mean that your spouse won’t just ask for their martial share, so you could still end up having to pay. Finally, while you can choose to cash out your 401 whenever you want, there is a penalty fee of 10% if you are under age 59 ½, and you will owe income tax.

Read Also: Should I Get A 401k

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Don’t Miss: How To Take Out 401k Early

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

What Is A 401 Divorce Cash Out

Many people going through divorce need cash for a down-payment on a new house or to cover living expenses before finding a job. Taking a lump sum payment from your ex’s retirement account as part of the property settlement is one way to get access to cash.

Generally, taking money from a 401 before the age of 59 ½ would have a 10% penalty fee. However, early withdrawals can be made as part of a divorce settlement without this fee by following a set of specific rules, including using a Qualified Domestic Relations Order .

Note: The cash out would still be taxed according to your income tax rate.

Read Also: Can I Transfer My 401k To Another Company

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Also Check: Can I Sign Up For 401k Anytime

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

There are many valid reasons for dipping into your retirement savings early. However, try to avoid the mindset that your retirement money is accessible. Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. So before you take any money out, ask yourself: Do you actually need the money now?

Think of it this way: Rather than putting money away, you are actually paying it forward. If you are relatively early on in your career, your present self may be unattached and flexible. But your future self may be none of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

With all this talk of 10% penalties, and not touching the money until youre retired, we should point out that there is a solution if you feel the need to be able to access your retirement funds before you reach age 59 ½ without penalty.

Contribute to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Keep in mind that there are income limits on contributing to Roth IRAs, and that you will still be taxed if you withdraw the funds early or before the account has aged five years, but some people find the ease of access comforting.

For some folks, however, a Roth-type account is not easily available or accessible to them.

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Also Check: How To Recover 401k From Old Job

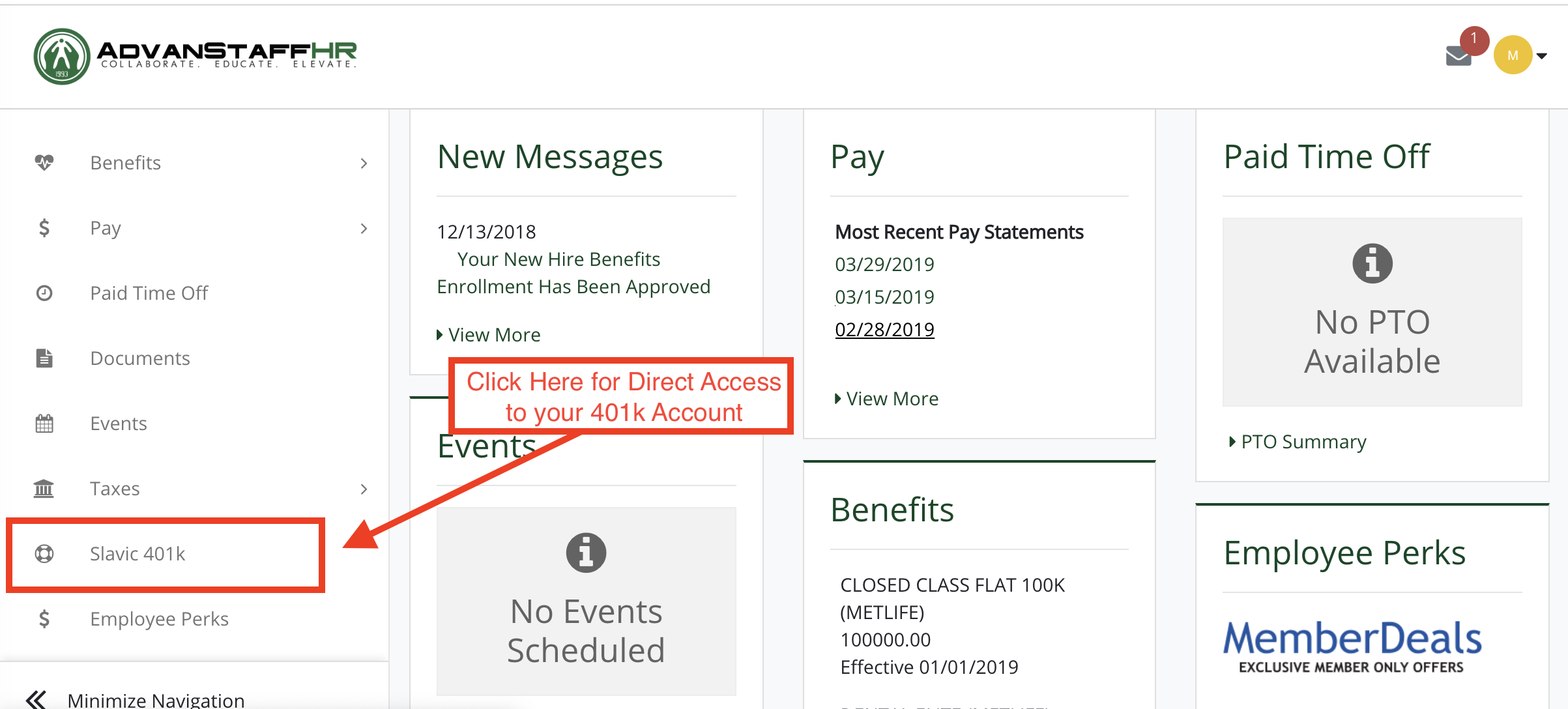

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corp Report, T. Rowe Price – Get T. Rowe Price Group Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

You May Have To Sell Investments At A Bad Time

Pulling cash out of investment accounts after the market has fallen means youre locking in any losses youve incurred. Even if you reinvest these funds down the road, youll have missed reaping any gains those investments would have seen in the interim.

In 2020, the S& P 500 had its largest first-quarter decline in history, finishing down 20%. Stats like this can lead to panic selling, or, coupled with the loosened withdrawal rules, may tempt you to dip into retirement accounts to prevent further losses.

But remember: You havent lost anything until you sell. So if your cash crunch isnt an emergency, you can avoid losses by riding out the storm, and benefit from the rebound whenever it eventually occurs.

Read Also: Can You Withdraw Your 401k If You Quit Your Job

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Living With A Disability

If you become totally and permanently disabled, getting access to your retirement account early becomes easier. In this case, the government allows you to withdraw funds before age 59½ without penalty. Be prepared to prove that youre truly unable to work. Disability payments from either Social Security or an insurance carrier usually suffice, though a doctor’s confirmation of your disability is frequently required.

Keep in mind that if you are permanently disabled, you may need your 401 even more than most investors. Therefore, tapping your account should be a last resort, even if you lose the ability to work.

Recommended Reading: What Age Can You Take Out 401k

Alternatives To Rule Of 55 Withdrawals

The rule of 55, which doesnt apply to traditional or Roth IRAs, isnt the only way to get money from your retirement plan early. For example, you wont pay the penalty if you take distributions early because:

- You become totally and permanently disabled.

- You pass away and your beneficiary or estate is withdrawing money from the plan.

- Youre taking distributions to pay deductible medical expenses that exceed 7.5% of your adjusted gross income.

- Distributions are the result of an IRS levy.

- Youre receiving qualified reservist distributions.

You can also avoid the 10% early withdrawal penalty if early distributions are made as part of a series of substantially equal periodic payments, known as a SEPP plan. You have to be separated from service to qualify for this exception if youre taking money from an employers plan, but youre not subject to the 55 or older requirement. The payment amounts youd receive come from your life expectancy.

Ways To Withdraw Money From Your 401k Without Penalty

When hard times befall you, you may wonder if there is a way withdraw money from your 401k plan. In some cases you can get to the funds for a hardship withdrawal, but if youre under age 59½ you will likely owe the 10% early withdrawal penalty. The term 401k is used throughout this article, but these options apply to all qualified plans, including 403b, 457, etc.. These rules are not for IRA withdrawals see the article at this link for 19 Ways to Withdraw IRA Funds Without Penalty.

Generally its difficult to withdraw money from your 401k, thats part of the value of a 401k plan a sort of forced discipline that requires you to leave your savings alone until retirement or face some significant penalties. Many 401k plans have options available to get your hands on the money , but most have substantial qualifications that are tough to meet.

Your withdrawal of money from the 401k plan will result in taxation of the withdrawal, and if you do not meet one of the exceptions, a penalty as well. See the article Taxes and the 401k Withdrawal for more details about how the taxation works.

In addition to withdrawing money from a 401k plan, many plans offer the option to take a loan from your 401k. This can be a better alternative than the withdrawal. A loan is often the only way you can access the money in a 401k if youre still employed by that company. The article at this link explains the differences between a 401k loan and a 401k withdrawal.

You May Like: How Much Will I Have When I Retire 401k