What Is A Terminal Illness Benefit

A terminal illness benefit allows the policy holder to receive a death benefit before their actual passing.

Generally, claimants will have to meet certain requirements. Most life insurance providers ask for a diagnosis which predicts a life expectancy of twelve months or less. The life insurance coverage will also have to be in effect for at least two years.

However, these requirements can vary between different states. Remember to check with your insurance provider to see if you can meet these conditions.

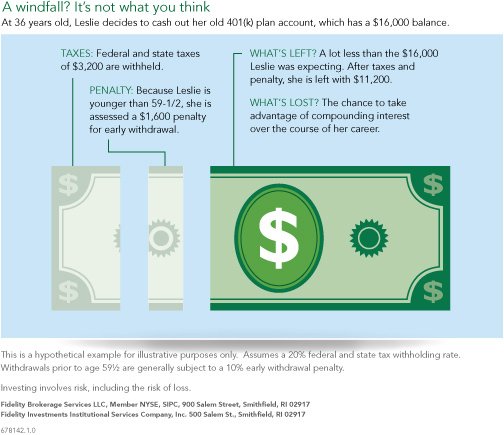

What You Should Know About Withdrawing Retirement Funds Early

Is your retirement money only for retirement? Ideally, yes. But its your money, so the decision of what to do with is ultimately yours. During financially challenging times, its easy to understand the temptation to tap into retirement funds earlier than planned. But heres what you should know before you consider accessing retirement savings early.

Can I Take A Loan From My 401k If I Am Unemployed

Workers 55 and older can access 401 funds without penalty if they are laid off, fired, or quit. Unemployed individuals can receive substantially equal periodic payments from a 401. These payments are distributed over a minimum of five years or until the individual reaches age 59½, whichever is greater.

Don’t Miss: Where To Put My 401k

Youll Still Need To Be Mindful Of Taxes

Youll still owe income tax on your distribution from any tax-deferred retirement account. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

Also worth noting: The income can be claimed all at once in 2020 for tax purposes, or spread evenly over the next three years. In many cases, dividing it evenly over three years may result in a better tax situation, as its less likely to bump you into a higher tax bracket in any single year.

If your income is expected to be lower in 2020 than the subsequent two years, though, it could make sense to claim all of the income on your 2020 tax return. Not only might this minimize the effective tax rate you pay on this income, but youll also have two years to pay back the distribution and ultimately get a refund.

Keep in mind that if you have a Roth IRA, it may still be a better choice for withdrawals than your 401 or IRA. Thats because savers can always withdraw contributions from their Roth IRA penalty- and tax-free.

Why Would I Need A Terminal Illness Benefit

When a loved one suffers from a terminal illness, costs can add up quickly. Often, the money theyve set aside for their life insurance policy would relieve their caregivers of the financial burdens that come with end-of-life care.

Some life insurance policies, however, cant adjust their coverage to provide death benefits prematurely. Thats why life insurance providers can offer a terminal illness benefit, which allows the beneficiaries to receive the death benefit payment earlier.

Many life insurance companies will offer a terminal illness benefit free of charge. With other policies, you may be able to purchase this benefit as an additional rider to your policy.

Don’t Miss: Can I Use My 401k To Start A Business

What Is The Rule Of 55

Your 401 account is likely one of the most valuable assets you have, so it’s essential to know when and how you can access it. These accounts are intended to fund your retirement, and as such you can access them penalty-free when you reach age 59½. In most cases, taking money out of your 401 before then will cost you a pretty penny: Early withdrawals come with a 10% penalty.

There are a few exceptions, however, and one of them could help you if you want or need to retire early. The Rule of 55 is an IRS provision that allows you to withdraw funds from your 401 or 403 without a penalty at age 55 or older. Read on to find out how it works.

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

You May Like: How Much Income Will My 401k Generate

Can I Retire At 55 And Collect Social Security

Social Security retirement benefits can be an important part of your financial puzzle. These benefits are designed to provide monthly income in addition to any income you have from qualified retirement accounts, taxable investment accounts, annuities or other sources.

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to begin drawing Social Security retirement benefits is 62. But theres a catch. Taking Social Security benefits prior to reaching your normal retirement age results in a reduction of your benefit amount.

Your benefits can also be reduced if you start taking them at age 62 but are still working in some capacity. So, say you retire at 55 from your full-time job but you want to do some consulting work on the side. Once you turn 62, you could claim Social Security retirement benefits but your earnings from consulting work could affect how much you collect.

The flip side to Social Security is that you can be rewarded with a larger benefit amount by waiting to claim them. If you wait until age 70 to take Social Security, for example, you can receive a monthly payment thats equal to 132% of your regular benefit amount.

So if youre asking, can I retire at 55? its important to know that you wont have Social Security as a source of income for a few years. And that if you decide to take those benefits as soon as youre able to, theyll be less than what youd get if you waited until full retirement age instead.

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Also Check: How To Find Out If I Have An Old 401k

Should You Borrow From 401

Your 401 may be a good place to tap into when you need short-term liquidity. However, before tapping into your retirement money, you should explore other sources of cash available.

If borrowing from your 401 is the only option you have, you should understand the loan terms, and have a plan on how you will repay the loan. Using a 401 loan for the right short-term reasons can be the most convenient and lowest-cost of cash available.

Plan to make 401 loan payments ahead of schedule or make a lump sum payment to pay off the loan. The sooner you pay off the loan, the quicker you can return your money to generate returns while avoiding derailing your retirement progress.

Tags

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

You May Like: Can I Move Money From 401k To Ira

Unlocking Liras: How To Get Money Out Of Your Pension

If you left a company with a pension before retirement, chances are you had to move the money into a Locked in Retirement Account . Thats because both the federal and provincial governments do not permit you to convert your pension into cash.

LIRAs are designed for accumulation of money that originated from a pension plan. People who leave employers with either Defined Benefit Plans or Defined Contribution Plans can move their pension funds into LIRA where they can self manage their asset .

LIRAs do not allow for lump sum withdrawals and there are no options to create income. If you want income from your LIRA, you will have to either transfer to a Life Income Fund or a Life Annuity. Typically the need for income from happens when your retire.

Forget Your 401 Exists Unless Youre Really Desperate

401 plans were designed specifically to incentivize people to save for life beyond their earning years. To discourage people from squandering their nest eggs, the IRS makes it difficult and expensive to pull their money out early.

Its important to remember that a 401k plan is a retirement savings vehicle, said Matthew Compton, director of retirement services at Brio Benefits, a full-service employee benefits consulting firm based in New York City. The government and the IRS provide tax benefits as a way to encourage individuals to save for retirement. That being said, unexpected events can inevitably occur during a persons life that make it necessary to tap into their retirement nest egg.

But those unexpected events should qualify as an emergency or something close to it if youre even considering raiding your retirement fund.

In general, you want to use withdrawing from your 401k as a last resort, said chartered financial analyst Greg Wilson, who recently retired to run ChaChingQueen and ClothDiaperBasics with his wife Erin. Its like stealing from your future self. But there are instances where you can avoid the 10% early withdrawal tax.

Find: Most Tax-Friendly States To Retire

Recommended Reading: How Can I Invest My 401k

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Taking Money Out Of A Retirement Account May Have Financial Penalties

There are different rules on early withdrawals depending on the type of account. The type of account you want to take money out of will determine the penalties.

401

You maybe able to withdraw funds from your 401 via a loan or hardship withdrawal, but there may be plan limitations on these withdrawals. Note loans must be repaid, and hardship withdrawals are subject to a 10% penalty and income tax. If you have a 401 plan from a previous employer you may be able to access that savings with less restrictions but early withdrawals before age 59 1/2 are subject to the same 10% penalty and income taxes.

Traditional IRA

Traditional IRAs are subject to similar penalties and taxes on distributions as the 401 is, but the exceptions are a little more relaxed. For example, first time home buyers can take out $10,000 from their Traditional IRA without paying the 10% fees. You do still need to pay income tax on this withdrawal though. The same applies for qualified education expenses and health insurance premiums while unemployedyou wont pay the 10% fee, but you will pay income taxes.

Roth IRA

Don’t Miss: How Much Will My 401k Be Worth In 20 Years

How Long Do You Have To Repay A 401 Loan

Generally, you have up to five years to repay a 401 loan, although the term may be longer if youre using the money to buy your principal residence. IRS guidance says that loans should be repaid in substantially equal payments that include principal and interest and that are paid at least quarterly. Your plan may also allow you to repay your loan through payroll deductions.

The CARES Act allows plan sponsors to provide qualified borrowers with up to an additional year to pay off their 401 loans.

The interest rate youll pay on the loan is typically determined by the plan administrator based on the current prime rate, but it and the repayment schedule should be similar to what you might expect to receive from a bank loan. Also, the interest isnt paid to a lender since youre borrowing your own money, the interest you pay is added to your own 401 account.

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59½ is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

You May Like: How To Rollover Fidelity 401k To Vanguard

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55, and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal. but only from a current 401 account held by your employer. You can’t loans out on older 401 accounts. You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Alternatives To Rule Of 55 Withdrawals

The rule of 55, which doesnt apply to traditional or Roth IRAs, isnt the only way to get money from your retirement plan early. For example, you wont pay the penalty if you take distributions early because:

- You become totally and permanently disabled.

- You pass away and your beneficiary or estate is withdrawing money from the plan.

- Youre taking distributions to pay deductible medical expenses that exceed 7.5% of your adjusted gross income.

- Distributions are the result of an IRS levy.

- Youre receiving qualified reservist distributions.

You can also avoid the 10% early withdrawal penalty if early distributions are made as part of a series of substantially equal periodic payments, known as a SEPP plan. You have to be separated from service to qualify for this exception if youre taking money from an employers plan, but youre not subject to the 55 or older requirement. The payment amounts youd receive come from your life expectancy.

Recommended Reading: Why Cant I Take Money Out Of My 401k

Adoption Or Birth Expenses

There is another case where plan holders can make a lump-sum withdrawal from their plans without incurring the 10% penalty. According to Section 113 of the Setting Every Community Up for Retirement Enhancement Actsigned into law in December 2019new parents are allowed to withdraw a maximum of $5,000 from their plans penalty-free to pay for adoption or birth expenses.

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Also Check: Do I Have To Pay Taxes On 401k Rollover