Supplement Your Savings Outside Of A 401

The IRS is so keen on individuals saving for retirement that its willing to allow workers to save in multiple types of tax-favored accounts at once. Combining the powers of a 401 and an IRA can really supersize an individuals tax savings and future financial freedom.

The ability to contribute to a Roth or traditional IRA is not just beneficial for workers stuck with a subpar 401. IRAs offer a lot more flexibility and control for all investors in terms of investment choices , access to portfolio building and investment management tools, and control over account fees.

Can I Get A 401k On My Own

If you are self-employed you can actually start a 401 plan for yourself as a solo participant. In this situation, you would be both the employee and the employer, meaning you can actually put more into the 401 yourself because you are the employer match!

How do I start a 401k?

Consider each of these tips to establish a 401 plan and begin building a nest egg for retirement.

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows an employee to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in a range of vehicles like stocks, bonds, mutual funds, and cash. Oh, and if you’re curious where the name 401k comes from? It comes directly from the section of the tax code that established this type of plan specifically subsection 401k.

Also Check: Can I Use My 401k To Buy Stocks

Take Full Advantage Of The Company Match

The first place to look in your 401 information is your employer match. Employers typically match 3% to 6% of your salary, but that is contingent on your own contribution. Generally, employers match 50% or 100% of your contribution up to the salary limit. Hint: you should always contribute at least up to your employer match, your net worth depends on it.

For example, lets look at someone who earns $50,000 per year and has a 50% match up to 3% of their annual salary. To take full advantage of the employer match, the employee must contribute 6% of their salary, or $3,000 per year, to get the full employer match of $1,500. That $1,500 is like free money from your employer, so this person should be absolutely sure they are saving enough to get that full 3% match.

Combined, that is like contributing 9%, or $4,500 per year, to their 401. That is likely not enough to maintain the same standard of living in retirement, but it is a great start and more than what the average person is doing. Assuming a biweekly pay schedule with 26 annual pay periods, that contribution is only $115 per payday, and that $115 has a tax advantage. Not a bad deal to get $1,500 in free money for retirement.

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

You May Like: How Do You Find Out About Your 401k

What Is A 401 Plan

A 401 plan is a type of IRS-approved retirement plan that allows employees to contribute pretax amounts to individual retirement accounts. Employers also can contribute to employee accounts, often by matching employee contributions, up to a certain percentage.

You can choose from several types of small-business 401 plans and other varieties of retirement plans. Get help from a retirement plan advisor to select the best one for your business.

Don’t Wait Because Of Debt

Forty-four million Americans are in the process of paying off student loans, so if you have debt to pay off, you are not alone. Don’t make the mistake of waiting to start contributing to a 401 plan until after your loans are completely paid off, though. Budget your expenses carefully, try not to spend too much on fancy coffee drinks or craft beer, and paying off loans while saving won’t be nearly as difficult as you might think it will be.

Saving for the future is just as important as paying off debts from the past. You invested in your education now you need to invest in your retirement.

Read Also: What Are The Best 401k Funds To Invest In

Balance Retirement Savings And Paying Down Debt

Most likely, saving for retirement is not your only financial goal. Far from it.

Youll likely need to balance your 401 contributions with paying down debt or saving for other goals like a house or a family.

Thats fine. Just dont use competing goals as an excuse to forgo making 401 contributions. Youll miss out on the prime years to make your 401 a million-dollar nest egg. Even if you have debt, contribute enough to your 401 to get your employer match. Then, as you clear money out of the debt pile, reallocate the funds to the retirement pile through payroll deductions.

How To Save Money: Retirement Accounts

When it comes to a retirement plan, there is no single way that everyone should allocate their savings. Depending on how much you have and what your goals are, you might want to consider different account types or investment vehicles. This is where a financial advisor can really help you. Financial advisors are experts who can help you choose the best investments for your specific situation.

There are a few ways to save that you should consider. If your employer offers a 401, take advantage of it. It will allow you to grow your savings without paying income tax upfront. How much you should contribute to a 401 will depend on your situation. Though if your employer offers a 401 match, its usually a good idea to contribute enough to take full advantage of the match.

If your employer doesnt offer a 401, you can get many of the same benefits with a traditional IRA. Many experts also advise that people diversify their retirement savings with a Roth IRA. Unlike a traditional IRA, a Roth IRA takes after-tax dollars. The plus is that you dont have pay income tax when you withdraw the money in retirement. Both types of IRAs can help you to reach your savings goals but you might benefit more from one or the other. For example, people who are just starting their careers might benefit more from contributing to a Roth IRA.

| Common IRA Contribution Limits |

Don’t Miss: How To Cash Out Nationwide 401k

S For Young Adults To Open And Maintain A 401

In your 20s and even in your 30s, retirement seems like a long time away, but the fact is, someday you may want to stop working as hard as you do and relax and enjoy your life in your 60s, 70s, and beyond. And for young adults who take great care of themselves, living a long and healthy life is not only a possibility but quite likely.

You don’t want to run out of money before you run out of time. Saving for the future should start the day you begin working at a full-time job. A 401, if offered by your employer, is the best way to get started with planning for the future.

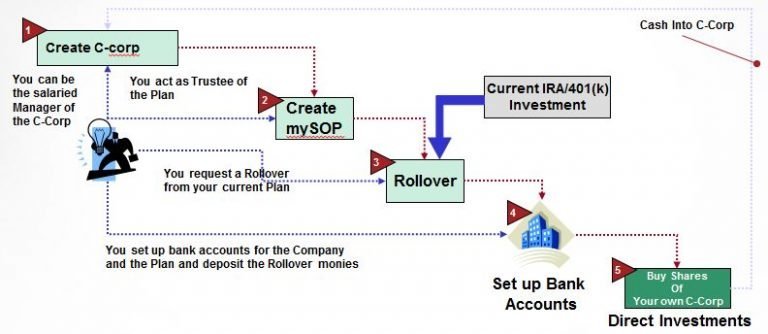

What Are The Steps To Complete A Robs

Removing money from a retirement account requires careful consideration of the costs and a frank assessment of the risksbeyond those inherent in any new business venture. The bottom line is that startups need cash. Tapping your retirement savings is one way to get it.

You May Like: When Leaving A Job What To Do With 401k

Start Preparing For College Expenses With A 529 Plan

Those with young children, take note: Its never too early to think about college. But financial advisors strongly recommend that you still make saving for retirement your first priority.

A secure financial future is vital, says Bruce McClary, spokesman for the National Foundation for Credit Counseling. Its up to you to provide the majority of funding to get you through your golden years. No one else is going to do that.

A 529 plan is a great way for parents to save for education, McClary says. A 529 plan so-called because it is authorized by Section 529 of the federal tax code is a tax-advantaged savings plan for a college education or tuition at any elementary or secondary school.

Make use of 529 college savings plans where theyre available, McClary says. It is a very affordable way to put your kid through college versus independently putting aside money to send them somewhere else.

Families should also find out whether there are work-study programs, grants, loans or scholarships that will help fund their childrens college education.

If you are determined to send your child to Harvard, start saving early. Like any other big-ticket expense, its easier to save a little bit over the long haul than try to play catch-up when your kids are in high school.

Decide How Much To Contribute

One reason experts like 401 plans so much is because 401s make it easy to start investing. “They take the guesswork out of when to invest because money comes out of your paycheck automatically,” says Christine Benz, director of personal finance at Morningstar. “Turns out, that’s a really great way to invest.”

Still, you need to decide how much money to contribute each pay period. Experts typically advise you aim to put away 10% to 15% of your salary for retirement each year, but even if you’re juggling a lot of other expenses, some is better than none. “Put $50 or $100 in there just so you’re used to saving and seeing a statement that has investments in there,” Reyes recommends.

As you earn more money, aim to increase your contributions. There are contribution limits in place: You can make an annual 401 contribution of up to $19,000 as of 2019.

It’s especially important to contribute to a 401 if your employer offers a match. There are a variety of formulas for matching contributions, but the average reached a record high of 4.7% this year, according to data from Fidelity.

That means if you make $50,000 and contribute at least that amount, your company will contribute $2,350 as well.

Recommended Reading: Is There A Limit For 401k Contributions

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

The Impact Of Downturns On Defined Contribution Retirement Accounts

Current retirees arent the only ones subject to market volatility. In fact, the movement away from the traditional pension plan means that many people are working with defined contribution retirement accounts instead. There are both pros and cons to this change. While you are in control of your ultimate retirement destiny, you are also likely to have less definitive retirement income to rely on.

- SEE MORE You Are Probably Making at Least 1 of These 4 Retirement Mistakes

If you have many years before retirement, then you have plenty of options to grow your 401 and protect it against volatility. One of the most important tactics is to continue to make steady contributions to your retirement accounts, regardless of the state of the market. Be careful not to fall prey to emotions and withdraw before age 59½ this will result in a 10% penalty in addition to normal income taxes. Moreover, its important to become increasingly conservative as you approach retirement, as this will ensure there is a decreased loss with a market downturn. While there are no guarantees, an easy way to do this is with target-date funds, which will be rebalanced regularly based on the date. Once the market does take a hit, your retirement accounts will be better equipped for the fallout.

Read Also: What Is The Difference Between A Pension And A 401k

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

The Younger You Are The More You Should Lean Into Stocks

Over the long term, stocks offer the best chance of growing your money at a rate that exceeds the rate of inflation that decreases your purchasing power each year. But you probably dont want to put all of your money into stocks because they go through stretches where they fall in value, sometimes drastically. Thats where bonds come into play: When your stock portfolio hits a rough patch, bonds tend to hold their value and often rise.

The decision you face, then, is determining the right mix of stocks and bonds to help you reach your retirement goalsand keep sleeping at night.

The younger you are, the more you want to own stocks as you have decades until retirement. For someone in their 20s or 30s, its typically recommended to keep 80% or so of your retirement money in stocks. As you age this becomes more conservative to include greater percentages of bonds and bond funds. This way, youre less likely to face enormous losses when you have less time to recover from them.

You May Like: How To Borrow Money From 401k Fidelity

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeeping make the implementation and maintenance of offering a retirement plan more affordable than ever.

Don’t Miss: How To Transfer Roth 401k To Roth Ira