Retirement Plan And Ira Required Minimum Distributions Faqs

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

The Setting Every Community Up for Retirement Enhancement Act of 2019 became law on December 20, 2019. The Secure Act made major changes to the RMD rules. If you reached the age of 70½ in 2019 the prior rule applies, and you must take your first RMD by April 1, 2020. If you reach age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72.

For defined contribution plan participants, or Individual Retirement Account owners, who die after December 31, 2019, , the SECURE Act requires the entire balance of the participant’s account be distributed within ten years. There is an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner. The new 10-year rule applies regardless of whether the participant dies before, on, or after, the required beginning date, now age 72.

Your required minimum distribution is the minimum amount you must withdraw from your account each year. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 72 . Roth IRAs do not require withdrawals until after the death of the owner.

For more information on IRAs, including required withdrawals, see:

Is An Employer Required To Make Plan Contributions For An Employee Who Has Turned 72 And Is Receiving Required Minimum Distributions

Yes, you must continue contributions for an employee, even if they are receiving RMDs. You must also give the employee the option to continue making salary deferrals, if the plan permits them. Otherwise, you will fail to follow the plan’s terms, causing your plan to lose its qualified status. You may correct this failure through the Employee Plans Compliance Resolution System .

Beginning At Age 705 You Must Withdraw Money From Your Retirement Accounts

If you have money in an individual retirement account, once you turn 70.5, the Internal Revenue Service requires that you withdraw money from this account every year, even if you still work.

In effect, just after you turn 70, the IRS requires you to stop saving all your money in your individual retirement account IRA or most other employer-based retirement accounts, such as 401, 403 and 457 plans. You must withdraw it over time. Unfortunately, when you withdraw the money, the government gets to tax it. Remember that any money that you put into these accounts went in tax-free, before taxes. And, any money in an IRA can appreciate without any taxes on the appreciation until you withdraw the money.

Heres more from Just Care:

Read Also: When Can You Take Out 401k Without Penalty

When Must I Start Taking Required Minimum Distributions

Many taxpayers won’t have to take their first RMDs until April 1 of the year after they reach age 72, but the rule wasn’t always this generous.

It was age 70½ before the passage of the Setting Up Every Community for Retirement Enhancement Act in December 2019. Anyone who is covered by the old rules has already begun paying RMDs and must continue to do so. Everyone else can wait until April 1 of the year following the year in which they reach age 72.

If you wait until the last minute for your first RMD, you will effectively have to take two RMDs in the same calendar year. That’s because the deadline for your first RMD is April 1, but all subsequent RMDs are due December 31. Therefore, if you turn 72 in 2021 wait until March 31, 2022 to make your first RMD, you’ll have to take another RMD in December 2022.

Do You Have To Calculate Rmds On Your Own

Luckily, no. Most financial institutions will calculate the figure for you. For all my clients that have reached RMD age, my custodian calculates the RMD amount for my clients and then I contact the client to notify them of the amount.

Another thing to consider is that since it is a taxable distribution, your IRA custodian will most likely require you to sign a form to take out the money . If a form needs to be signed, dont procrastinate and wait till the last minute.

Read Also: When Can You Take 401k Out

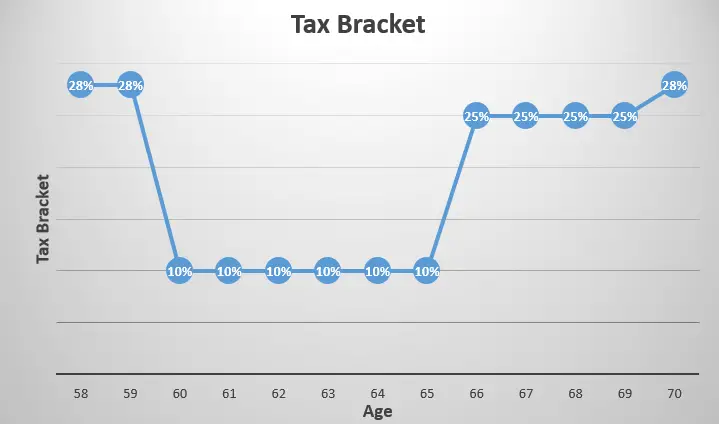

Additional Partial Roth Conversions Can Be Made During The Bonus Rmd Gap Years

Traditionally, so-called Gap Years have been generally understood to represent the years between when an individual retired and when they began receiving Social Security benefits and taking RMDs. For those who could afford to delay IRAs and Social Security until required to do so , Gap Years would end when income from both Social Security and RMDs began to flow in often at around the same time, as Social Security would begin at age 70, and RMDs in the year an individual reached 70 ½.

These Gap Years can be some of the lowest taxable income years of an individuals adult life, and as such, they often make prime years for accelerating income that would otherwise be taxable in a future, higher-income year . More often than not, this income acceleration is best accomplished via partial Roth IRA conversions, both because it is easy to generate the income , and because it also provides further tax benefits in the form of future tax-free distributions of earnings .

The SECURE Acts changes will potentially give an additional year or two where Social Security benefits may begin but before the onset of RMDs stacked on top that can substantially increase income , in essence creating one or two Semi-Gap Years where it may still be appealing to do a partial Roth conversion on top of Social Security benefits to fill the void of not-yet-required-to-be-taken RMDs.

Planning With The New Rmd Starting Age

While any delay in the forced distribution of funds from IRAs and other retirement accounts will, no doubt, be welcome news for many individuals – particularly the clients of financial advisors who tend to have sizable retirement account balances the reality is that the majority of retirement owners will see little to no benefit from this change.

As its important to remember that an RMD is a required minimum distribution, it doesnt prevent people from taking more than the required amount, or from taking distributions from their retirement accounts before they are mandated to do so. Which in practice is what many people do, simply because they need the money .

To that end, earlier this year, as part of Proposed Regulations to update the Life Expectancy Tables that individuals use to calculate RMDs, the IRS indicated that according to its own numbers, only about 20% of people take just the required minimum amount. And if someone is already taking more than the minimum, theyll likely continue to do so regardless of whether the RMD age is age 70 ½ or age 72. Its unlikely that theyll suddenly find enough other money to be able to delay taking distributions.

For such individuals, pushing back the RMD starting age from 70 ½, all the way to 72 may seem like only a minor change, but whenever Congress cracks open a planning window, its best to make the most of it, no matter how small that crack may be.

Read Also: How To Roll 401k Into New Job

Tax On A 401k Withdrawal After 65 Varies

Whatever you take out of your 401k account is taxable income, just as a regular paycheck would be when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on withdrawals. On your Form 1040, you combine your 401k withdrawal income with all your other taxable income. Your tax depends on how much you withdraw and how much other income you have. If you have a $200,000 account, you could legally withdraw it all the year you turn 70. The amount of a 401k or IRA distribution tax will depend on your marginal tax rate for the tax year, as set forth below the tax rate on a 401k at age 65 or any other age above 59 1/2 is the same as your regular income tax rate.

How To Calculate Required Minimum Distribution For An Ira

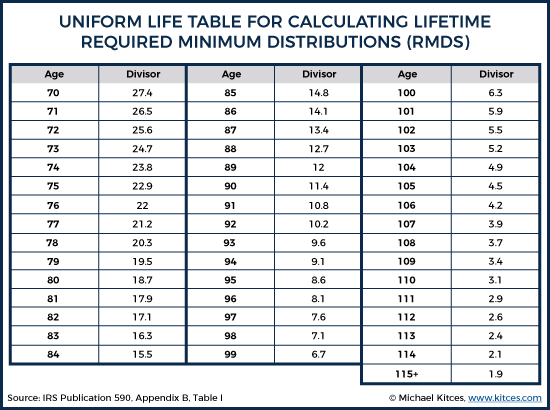

To calculate your required minimum distribution, simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. 31st each year. Every age beginning at 72 has a corresponding distribution period, so you must calculate your RMD every year.

For example, Joe Retiree, who is age 80, a widower and whose IRA was worth $100,000 at the end of last year, would use the Uniform Lifetime Table. It indicates a distribution period of 18.7 years for an 80-year-old. Therefore, Joe must take out at least $5,348 this year .

The distribution period also decreases each year, so your RMDs will increase accordingly. The distribution table tries to match the life expectancy of someone with their remaining IRA assets. So as life expectancy declines, the percentage of your assets that must be withdrawn increases.

If you need further help calculating your RMD, you can also use Bankrates required minimum distribution calculator.

RMDs allow the government to tax money thats been protected in a retirement account, potentially for decades. After such a long period of compounding, the government wants to be sure that it eventually gets its cut in a clear timeframe. However, RMDs do not apply to Roth IRAs, because contributions are made with income that has already been taxed.

You May Like: How To Avoid Taxes On 401k

How To Calculate Required Minimum Distribution

Required minimum distributions are withdrawals you have to make from most retirement plans when you reach the age of 72 . The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. If you have more than one retirement account, you can take a distribution from each account or you can total your RMD amounts and take the distribution from one or more of the accounts. RMDs for a given year must be taken by December 31 of that year, though you get more time the first year you are required to take an RMD. If youre not sure whether to return the RMD or you need help with other retirement decisions, a financial advisor could help you figure out the best choices for your needs and goals.

Calculating The Required Minimum Distribution

The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRSs Uniform Lifetime Table. A separate table is used if the sole beneficiary is the owners spouse who is ten or more years younger than the owner. In this regard, the following materials will be useful to you in determining required distribution amounts and payout periods:

- worksheets to calculate the required amount

- tables to calculate the RMD during the participant or IRA owners life:

- Uniform Lifetime Table -for all unmarried IRA owners calculating their own withdrawals, married owners whose spouses arent more than 10 years younger, and married owners whose spouses arent the sole beneficiaries of their IRAs

- Table I is used for beneficiaries who are not the spouse of the IRA owner

- Table II is used for owners whose spouses are more than 10 years younger and are the IRAs sole beneficiaries

Inherited IRAs – if your IRA or retirement plan account was inherited from the original owner, see “required minimum distributions after the account owner dies,” below.

Also Check: How To Make More Money With My 401k

What Is A Required Minimum Distribution And Why Should I Care About It

An RMD is the smallest amount you must withdraw from your tax-deferred retirement accounts every year after a certain age. At some point in your life, you may have put money into tax-deferred retirement accounts, such as Individual Retirement Accounts and 401 workplace retirement accounts. The key words here are tax-deferred. You postponed taxes on your contributions and earnings you didnt eliminate them. Eventually, you must pay tax on your contributions and earnings. RMDs make sure that you do that.

What If I Withdraw Too Little Or Dont Take An Rmd

If you dont make a proper RMD by the appropriate deadline, Uncle Sam will tax you 50% of the difference between the amount you withdrew that year and the amount you were supposed to take out that year.

However, you dont have to take your RMD in one lump sum. You can take it in increments throughout the year. Just make sure you withdraw the total RMD amount for the year by December 31. In some cases, however, you can delay RMDs.

Read Also: Where Can I Find My 401k Balance

A Word About Roth Iras

Roth IRAs do not require RMD withdrawals until after the death of the owner. If you have a Roth account in an employer-sponsored plan, the IRS recommends that you contact your plan sponsor or plan administrator regarding RMD information.

7. What happens if a retirement plan account owner or IRA owner dies before RMDs have begun?

8. Do I have to take an RMD if I own an annuity?

The answer depends on the type of annuity you own. If you own a variable annuity, and it is held in an IRA, the answer is yes. This is referred to as a “qualified annuity” by the IRS, meaning that it likely was funded with pre-tax money that requires you to pay taxes on your withdrawals, as well as take RMDs. Non-qualified annuity contracts offer tax-deferred growth of after-tax funds they are taxed when annuitized, but as a general rule are not subject to RMDs. , see the IRSs Form 1098-Q info page.)

9. What reporting obligations does my brokerage firm have with respect to RMDs?

10. What if a mistake is made?

All is not lost if you or someone you entrust to do your RMD calculations makes a mistake. In one of its FAQs, the IRS states that penalties “may be waived if the account owner establishes that the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall.” In order to qualify for this relief, you must file Form 5329 and attach a letter of explanation.

Required Minimum Distribution Rules For Non

Under IRC Section 401, when a retirement account owner dies prior to their RMD Required Beginning Date and has named a Non-Designated Beneficiary , that Non-Designated Beneficiary is required to distribute all the assets in the inherited retirement account within 5 years. Conversely, IRC Section 401 provides that when the owner dies on or after their Required Beginning Date with a Non-Designated Beneficiary, annual minimum distributions are calculated using the decedents remaining single life expectancy .

The SECURE Act made no direct change to these rules . However, as a result of the change in the age at which RMDs begin, an IRA owners Required Beginning Date is now pushed back to April 1, of the year following the year that they turn 72 . Thus, for Non-Designated Beneficiaries, the 5-Year Rule will still apply if death occurs at an even later age, requiring full distribution of the inherited account within 5 years of the retirement account owners death if they die prior to April 1st of the year after they reach age 72.

Also Check: Should I Keep My 401k Or Rollover To Ira

I Failed To Take Out Rmds In Prior Tax Years Is There A Penalty

Yes. There is no statute of limitations on how far back the IRS can look for RMD mistakes. If you have discovered mistakes in prior years withdrawal amounts, correct those figures immediately.

If you can provide evidence that you made a reasonable mistake when calculating distributions for prior years, the IRS does have the ability to waive penalty fees. The most common reasons considered for waiving fees include serious illness or dementia.

Ira 705 Irs Withdrawal Rules

An IRA can be a useful retirement planning tool.

When you own a traditional IRA you benefit from a number of tax advantages. Your contributions may qualify for a tax deduction , and investment earnings in the plan accumulate tax free. You only pay tax when you begin taking withdrawals.

One major restriction is that you are forced to take distributions once you reach age 70.5. Failure to do so can result in a hefty 50 percent penalty from the IRS.

Also Check: How Do I Rollover My 401k To My New Job

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2 if you’re still working, but you may not have the same access to the funds at the company for which you currently work if you’ve changed jobs.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Uniform Lifetime Table To Calculate 401k Minimum Required Distributions

To Calculate the MRD, example:

If Retiree turns 77 during this year, the MRD is calculated as:

MRD = Market Value of Retirement Savings / DivisorMRD = $250,000 / 21.2

| Age of 401k Retirement Savings Account Owner | Divisor |

Welcome to Research401k.com A Complete Resource On Important 401k Retirement Plan Topics such as Rollovers, Roth IRA Accounts, Contribution Limits, Hardship Withdrawals, Self-Employed 401k and more!

You May Like: Do I Have To Pay Taxes On 401k Rollover