Highly Compensated Employee 401k Contribution Limits

Highly compensated employees face different limits than non-highly compensated employees.

Who is a highly compensated employee and how does it affect your 401k contribution limits? Its important to know the IRS rules for 401k contribution limits. Heres the scoop: If you own more than 5% of the interest in a business or receive compensation above a certain amount , youre considered a highly compensated employee for 401k retirement plan purposes.

You will have to follow more stringent contribution limits. You can take a look at the IRS tests to ensure that you participate in your company plan with the right amount of money.

Irs Lifts 401 Contribution Limits For 2020

The IRS has nudged up the basic employee contribution limit for 2020 to 401 accounts to $19,500. And it boosted the catch-up contribution for the first time in five years.

If you are 50 or older, you can kick in as much as an additional $6,500.

The combined limit would be $26,000.

The limits apply to regular 401 accounts and to Roth-style accounts, if your plan permits them.

Donât Miss: Can You Use Your 401k To Buy Real Estate

Ira Eligibility And Contribution Limits

The contribution limits for both traditional and Roth IRAs are $6,000 per year, plus a $1,000 catch-up contribution for those 50 and older, for both tax years 2020 and 2021. You can split your contributions between the two types, but your total contribution is still limited to $6,000 or $7,000. Traditional and Roth IRAs also have some different rules regarding your contributions

Read Also: How To Find Out If You Have An Old 401k

If Youre 50 Or Older You

5 rows Oct 29 2020 If youre under 50 you can put in up to 6000 in 2021. 10 rows Nov 22 2020 2021 Salary Deferral 401 k Contribution Limits. The 401 k catch-up contribution limit is.

The annual contribution limit is 19500 for tax year 2020 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Oct 26 2020 For 2021 employees who are saving for retirement through 401 ks 403 bs most 457 plans and the federal governments Thrift Savings Plan can contribute up to 19500 to those plans during the. Jul 21 2009 Your employers maximum 401K contribution limit is entirely up to them but the max on total contributions employee plus employer to your 401K is 58000 in 2021 or 100 of your salary whichever is less.

If age 50 it goes up to 64500 in 2021 with the catch-up contribution. Individual plan participants can contribute. Anyone age 50.

In addition the same goes for most of the retirement plans that are similar to a 401 k. 7 rows Employees can contribute up to 19500 to their 401k plan for 2020 and 2021. The 401 k catch-up contribution limit is.

Retirement planners say only do this if necessary. What kind of investments are in a. Youd have to save 1625 each month to be able to reach the maximum contribution amount.

The 401 k contribution limit is unchanged at 19500. The 401 k contribution limit is unchanged at 19500. Jan 10 2021 To ensure youre getting the best value from your 401k in 2021 there are three steps to take as early as possible.

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.

Also Check: How To Take Money Out Of 401k Without Penalty

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Read Also: How Can I Use 401k To Buy A House

How Does A 401 Work

Eligibility to participate in your company 401 usually involves a minimum employment period. Many employers allow you to participate in the 401 within a month or two of your hire date.

The amount you deposit into your 401 with each paycheck is calculated from your contribution rate. Your contribution rate is the percentage of your salary you will contribute. Say you make $45,000 annually, or $3,750 gross monthly. A 10% contribution rate would mean you contribute $375 from your monthly paycheck towards this retirement plan.

Don’t panic if that seems like too much money to carve out of your income. Thanks to the 401’s tax advantages, a $375 paycheck deferral will cost you something less than $375. The contributions from your paycheck are tax-deductible. Known as paycheck deferrals, these amounts are taken from your pay before income taxes are applied. That lowers your taxable income, which, in turn, reduces your income taxes.

Some 401 plans offer matching contributions, also known as an employer match. These are deposits to your 401 account that are funded by your employer — basically free money. Matching contributions follow a formula that your employer defines. A common structure is for the employer to deposit $0.50 for every $1 you contribute, up to 6% of your salary.

When Can I Contribute To A Roth Ira For 2021

You can make IRA contributions for a specified year anytime between January 1 and the following years tax filing deadline . The IRS has extended the 2020 tax filing and IRA contribution deadline to Monday, May 17, 2021.

What is the last day to contribute to an IRA for 2021?

As a general rule, you have until tax day to make IRA contributions for the year in advance. In 2021, that means you can contribute to your 2020 tax year limit of $ 6,000 until May 17th. And from January 1, 2021, you can also contribute to your 2021 tax year limit until tax day in 2022.

Can I open an IRA in 2021 and contribute for last year?

Make Sure You Choose The Right Tax Year. If you open an IRA before the tax deadline, you can make contributions for the previous or current year. For 2021, the maximum IRA contribution is $ 6,000. People age 50 and older can make an additional $ 1,000 in holding contributions, totaling $ 7,000.

How much can I put in a Roth IRA 2021?

More On Retirement Plans Note: For other retirement plan contribution limits, see the Topic Retirement â Contribution Limits. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot be more than: $ 6,000 , or.

Don’t Miss: What Is The Difference Between A Pension And A 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before April 15, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

About the author:Arielle OâShea is a NerdWallet authority on retirement and investing, with appearances on the âTodayâ Show, âNBC Nightly Newsâ and other national media. Read more

Recommended Reading: Can Business Owners Have A 401k

You May Like: How To Find Previous Employer’s 401k

Retirement Savings Contributions Credits

Finally, workers who are not full-time students and not dependents might qualify for the Retirement Savings Contributions Credit. This tax credit allows you to deduct an additional portion of your 401 contribution if your income falls below certain thresholds. This program can provide an additional tax deduction of 10% to 50% of your total contribution up to a total of $1,000 .

Workers Saving For Retirement Have A Reason To Rejoice Over The 401 Contribution Limits For 2022

Saving for retirement, at times, can seem like a daunting task. But utilizing a 401 account, if your employer offers one, is one of the best and most tax-friendly ways to build a nest egg. You should start saving in a 401 account as soon as you, though the IRS limits how much you can contribute each year.

Also Check: How To Use Your 401k Money

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Recommended Reading: Should I Convert My 401k To A Roth Ira

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

Contribution Limits For Highly Compensated Employees

Some 401 plans have extra contribution limits on employees who are highly compensated. plan and you are a high earner, these limits may not apply to you.)

Highly compensated employees can contribute no more than 2% more of their salary to their 401 than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary. In addition to the federal limit, your company may have specific caps established to remain compliant.

The IRS determines you are a HCE if:

Either you owned 5% or more of a company last year and are participating in its 401 plan this year.

Or you earned $130,000 or more in 2020 from a company with a 401 plan youre participating in this year.

Unlike most other 401 limit guidelines, HCE classifications are based on your status from the previous year. For the 2022 plan year, the employee compensation threshold is $135,000.

If HCE contribution rates exceed non-HCE contribution rates by more than 2%, companies workplace retirement plans may lose their tax-advantaged status. As a HCE, you may be prevented from contributing to your 401 to the employee contribution max due to low 401 participation rates. You should still be able to make catch-up contributions on top of your HCE cap if you are eligible, though.

Also Check: How To Save Without 401k

How Much Will You Need In Retirement

The sum youll need to retire is a highly personal question but needs careful consideration.

I believe retirement is a financial number versus a retirement age. Assess how much you need in your retirement account to live at least 20 years in retirement without having to go back to work to pay your bills, says Shaquana Watson-Harkness, personal finance coach and founder of Dollars Makes Cents, an online debt management and investing training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and creator of Wealth Para Todos, told us how she calculates her financial independence number using Trinity Studys 4% rule. According to the 4% rule, you can estimate how much money youll need to live on during retirement using this quick calculation:

Annual Expenses x 25 = Nest Egg .

For example, if your annual expenses are $40,000, multiply that by 25 for a total of $1M the amount youd need to retire, based on the 4% rule above.

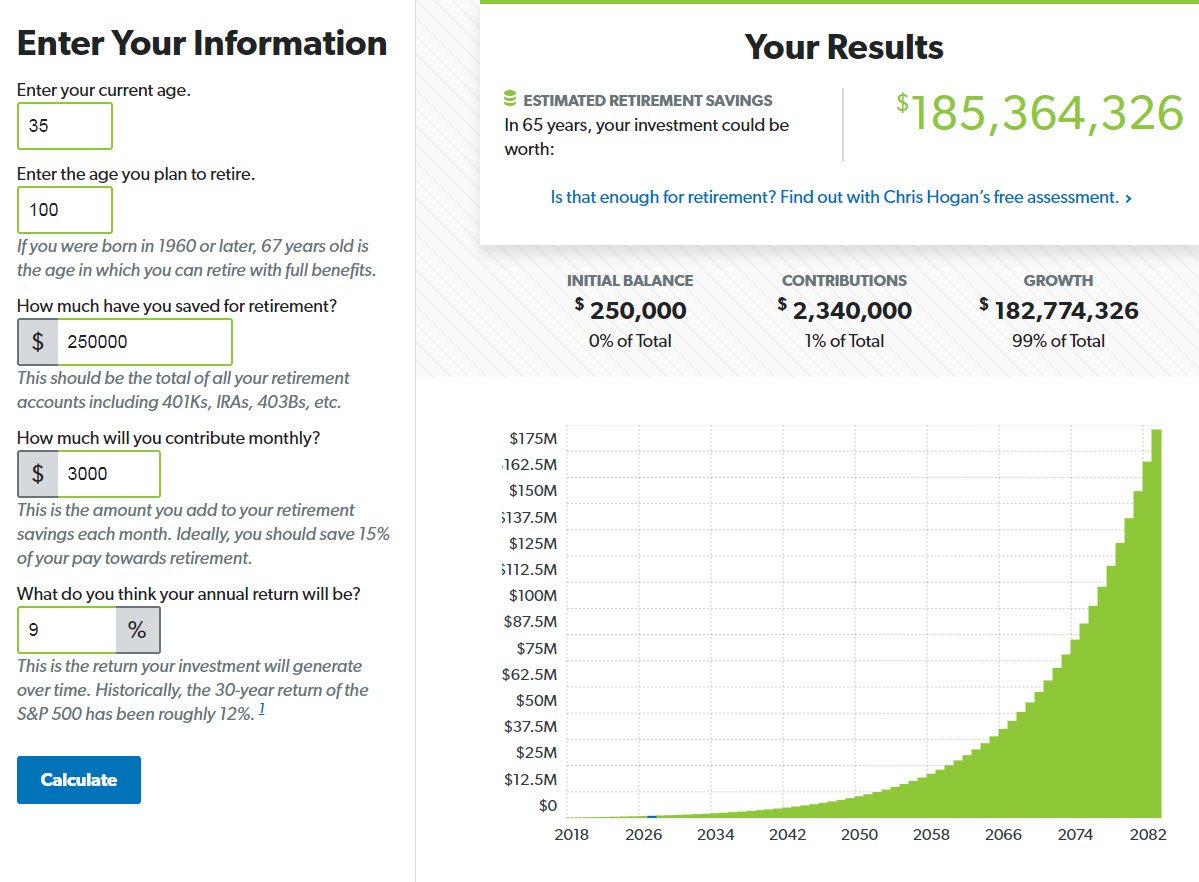

If youre already freezing up thinking about million-dollar sums, remember youre not solely responsible for saving up this much on your own. The market, through compound interest, will do most of the heavy lifting for you, especially if you invest early and let your portfolio grow for decades.

Thats why starting early is so important.

How Much Tax Do You Pay On 401 Distributions

A withdrawal you make from a 401 after you retire is officially known as a distribution. While youve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw. If you withdraw $10,000 from your 401 over the course of the year, you will only pay income taxes on that $10,000. Its possible to withdraw your entire account in one lump sum, though this will likely push you into a higher tax bracket for the year, so its smart to take distributions more gradually.

The good news is that you will only have to pay income tax. Those FICA taxes only apply during your working years. You will have already paid those when you contributed to a 401 so you dont have to pay them when you withdraw money later.

State and local governments may also tax 401 distributions. As with the federal government, your distributions are regular income. The tax you pay depends on the income tax rates in your state. If you live in one of the states with no income tax, then you wont need to pay any income tax on your distributions. So depending on where you live, you may never have to pay state income taxes on your 401 money.

Also Check: How To Get My 401k Early

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.