What Is A 401k Plan Loan

A 401k plan loan is one of a few ways you can borrow money from your 401k early without incurring a penalty.

While 401k plan loans will vary depending on which plan your company offers, a few rules are constant:

- The maximum amount you can take from your 401k is 50% of the vested account amount.

- You may borrow no more than $50,000.

- If 50% of your vested account amount is less than $50,000, you can withdraw up to $10,000.

- You must repay the loan within five years.

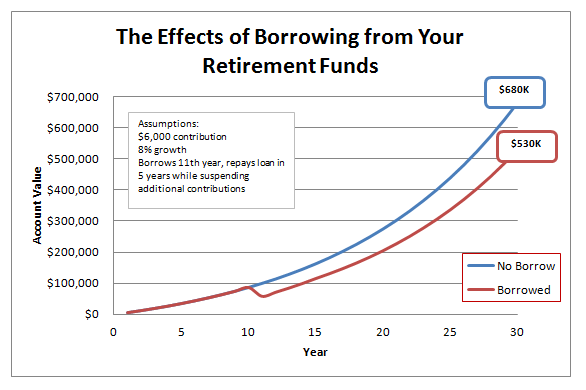

Youre borrowing the money from your future self when you take a 401k loan and your future self is going to want that money back with interest.

Thats because when you take the money out, its no longer compounding and accruing interest. This means you will lose the gains on any amount you borrow. The interest rate is there to compensate for the loss in gains.

Now lets take a look at how to borrow from your 401k.

Make A 401 Withdrawal

Your second option would be to make a direct withdrawal from your 401 account. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

Are There Any Restrictions On How A Solo 401k Loan Is Used By A Participant

No. In fact, as long as the employer does not place any restrictions on use of the loan that would benefit itself, a fiduciary, or other party in interest, there is no reason why a participant cannot independently make the decision to use loan proceeds in a way that would benefit the employer or other restricted party. See

Read Also: How To Get Money Out Of 401k Without Penalty

Not All 401 Plans Will Allow You To Borrow

Not all 401 plans allow you to borrow against your retirement account. If your employer doesn’t permit it, you won’t have this option available to you.

Further, while the CARES Act allows employers to enable larger loans, it doesn’t require them to do so. Even some 401 administrators that generally permit borrowing may not double the loan limits.

You’ll need to check with your plan administrator to see if you’re allowed to borrow at all and, if so, how much you can borrow.

How Much Can You Withdraw From 401k For Home

In most cases, you can borrow the lesser of up to 50% of your vested balance or $50,000. This means that if you have $200,000 vested in your 401k, you can only borrow up to $50,000. If you have $60,000 vested, you can borrow up to $30,000.

Your vested balance is the amount of money you’d be able to keep if you left your current employer. Any money you’ve personally contributed is automatically vested. The money your employer contributes is usually only vested once you’ve stayed with the company for a certain amount of time.

Also Check: What Is The Minimum Withdrawal From 401k At Age 70.5

Quick Answer: How Much Money Can I Borrow From My 401k

401 loans: With a 401 loan, you borrow money from your retirement savings account. Depending on what your employers plan allows, you could take out as much as 50% of your savings, up to a maximum of $50,000, within a 12-month period.30-Dec-2020

- If permitted by your specific 401 plan, you can borrow up to the greater of $10,000 or 50 percent of your vested balance, or $50,000, whichever is less. The amount you can borrow from your 401 depends on the vested balance, which is the balance that wont be forfeited due to separation from your job.

What Happens If A Plan Loan Is Not Repaid According To Its Terms

A loan that is in default is generally treated as a taxable distribution from the plan of the entire outstanding balance of the loan . The plans terms will generally specify how the plan handles a default. A plan may provide that a loan does not become a deemed distribution until the end of the calendar quarter following the quarter in which the repayment was missed. For example, if the quarterly payments were due March 31, June 30, September 30 and December 31, and the participant made the March payment but missed the June payment, the loan would be in default as of the end of June, and the loan would be treated as a distribution at the end of September. -1, Q& A-10)

If your 401 plan or 403 plan has made loans that havent complied with plan terms about loans, find out how you can correct this mistake.

Read Also: How Much Can You Contribute To 401k

The Details Of The 401k Loan

Before you take out a 401K loan, you should know how it works. Of course, you should check with your plan sponsor as each plan operates differently, but the following guidelines are fairly standard:

- You will likely pay interest of at least 2 points over the current prime rate. This will help make up for the interest you lose by taking your funds out of your 401K early.

- You will only have a specific period to pay the funds back. Many plans require you to make quarterly payments for five years. Youll need to know the specifics from your plan sponsor so that you can make sure you can afford the payments.

- If you leave your company, the loan may become due and payable immediately or at least within 2 to 3 months. If you dont pay it back, the plan sponsor can consider it a hardship withdrawal, which will end up costing you taxes and interest.

- You cannot make contributions to your 401K while you have an outstanding loan. This means that your 401Ks potential decreases because you cant contribute to it.

When To Borrow From Your 401

Only borrow from your 401 when no other reasonable loan rates are available and only if the situation is dire.

Vacations are ruled out. So are 50-inch 4K TVs, shopping sprees and any form of consumerism that might be considered excessive. There are, however, emergencies or dead-end scenarios when a 401 loan may be your best or only option.

If youre suffering a medical setback and need cash fast, your 401 may be a good place to look. You may even qualify for a hardship withdrawal. In this case you wont have to pay the loan back, but youll still have to pay income taxes, plus the 10% early withdrawal fee.

The qualifications for hardship withdrawal differ from plan to plan. Check with your employer to see what yours may cover.

If youre looking at your 401 as a way out of debt, youre looking in the wrong direction. Debt is often the result of undisciplined spending or an unforeseen emergency like job loss or medical setback. Its rarely a one-time purchase that sends the consumer into financial despair.

Don’t Miss: What Are The Different 401k Plans

How Do I Repay My 401k Loan

If you have a 401 loan, you are required to make timely loan payments to your 401 account. Here is how to repay your 401 loan on time.

If your employer allows 401 loans, you can tap into your accumulated savings to borrow up to $50,000. As long as you have a sufficient balance, you can be allowed to borrow from your 401 and pay back the loan over time. While most employers require automatic loan payments through payroll deductions, some plans may rest this responsibility on employees, and you have to figure out how to pay the loan on time.

Most 401 plans require employees to make automatic loan payments from their paycheck through payroll deductions. If you opt out of automatic loan payments, you should create a structured plan on how you are going to pay the loan. You can also make extra payments or a lump sum payment to pay the 401 loan early. If you have an unpaid loan in the former employerâs plan, you can take a new 401 loan with the new employer to pay the old 401 loan.

Dip Into Your Emergency Fund

An emergency fund is money tucked away for surprise and pressing expenses .

A good rule of thumb is having enough money for three to six months of living expenses in the fund to hedge against financial emergencies.

Whats a financial emergency? Two things:

If you dont have an emergency fund, thats okay. Move onto either of the next two methods for an alternative. If you want to learn how to create one, head over to our article on how to build your own emergency fund and get started today.

Read Also: Can You Roll A 401k Into A Self Directed Ira

Must My Solo 401k Plan Loan Interest Rate Be Reviewed Each Time A New Solo 401k Loan Is Made

Yes. The DOL regulations require that the reasonable rate of interest standard must be reviewed at each time a loan is originated, renewed, renegotiated, or modified. See

As such, a Solo 401k plan sponsor cannot simply choose a loan rate at the time the plan is setup and use that rate continuously. Loan rates must be reviewed and updated as often as needed to confirm that they remain uniform with commercial lending practices.

Pay Off The Loan Before Leaving Your Job

If you plan to leave the company, and you have an active 401 loan, you should work out a plan to pay the loan balance before you leave. You can increase the loan payments or offer to clear the loan with a lump sum payment before you leave. Usually, leaving a job with an unpaid loan means you will have to pay back the full loan amount within a shorter period, usually before the tax due date for federal tax returns. If you donât pay the balance in full before the tax deadline, the unpaid loan could be considered a taxable distribution, and you could pay taxes and penalties on the distribution amount.

Tags

Also Check: What Is A Simple 401k

Maximum Solo 401k Loan Amount

Generally, the maximum amount that an employee may borrow at any time is one-half the present value of his vested account balance, not to exceed $50,000. The maximum amount, however, is calculated differently if an individual has more than one outstanding loan from the plan.

Example: Mark would like to take a loan from his Solo 401k plan. Mark has a vested balance of $50,000, the maximum amount that he can borrow from the account is $25,000.

50% x $50,000 = $25,000

If Mark had a vested balance greater than $100,000, he could only borrow $50,000

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Recommended Reading: How Should I Invest My 401k

Loan Vs 401 Withdrawal

You should utilize a 401 loan if you intend to pay the money back to your retirement account. However, if you’re just looking to take money out for an expense, this would be considered a withdrawal.

Withdrawing money early from your 401 is often not recommended since you’ll be subject to fees and taxes if you’re not at least age 59 ½.

Let’s look at an example of how a 401 loan would work: Let’s say you needed $25,000 immediately to pay off high-interest debt and you have a vested 401 balance of $60,000. If you took out a 401 loan, you could receive a maximum of $30,000 .

But in this case, you could borrow $25,000 from your plan , which would leave you with a 401 balance of $35,000 in your plan, and no taxes or penalties would be due related to your loan. Assuming the loan has a five-year term, a 5% interest rate, and you pay back your loan through bi-weekly payroll deductions, you’ll make a payment every pay period of $235.89 . That means you’d end up repaying $28,306.85 in total .

After five years, your loan will be fully paid off and your 401 account will now include all the loan and interest payments you made .

“Some plans have hardship withdrawals, which provide funds in very specific emergency cases, but you must have an immediate and heavy financial need,” says Riesenberg.

Riesenberg also adds that if you are allowed a hardship withdrawal from your 401 account, you’re not required to pay the 10% early withdrawal penalty.

Who Should Withdraw From Their 401 Early

Just because you qualify for a hardship-related withdrawal doesnt mean you should take one without weighing all your other options.

The experts we spoke with were all in agreement that withdrawing from your 401 shouldnt be your first move. However, they also indicated that if youre truly in need, then you should take advantage of the CARES Acts allowances.

It should be a last resort option. People shouldnt get carried away and start using their 401 assets just because they can, Pfau says.

You May Like: Can I Borrow From My 401k To Refinance My House

Loan Repayment After Termination

The IRS doesnt care if you quit your job, were laid off or were fired. The same rules apply in all cases you either come up with the money to pay back the loan by October of the year following your departure from work or face an early withdrawal tax hit. The one exception are people older than 59 ½ and are no longer subject to early withdrawal rules.

Solo 401k Loan Repayment Period

Loans must generally be repaid in full within five years from the date of loan origination ). An exception to the five-year payback rule exists for loans used to purchase a principal residence of the participant. If a participant wants a repayment period longer than five years, plan administrators should obtain a sworn statement from the participant certifying that the loan is to be used to purchase the participants principal place of residence .

Recommended Reading: Do I Have To Pay Taxes On 401k Rollover

Make A Lump Sum Payment

If you receive a windfall or a large payment, you can use part of the money to settle the loan in one lump sum payment. You will need to calculate how much loan is unpaid, including any interest payments, and settle any outstanding obligations. You wonât owe any prepayment penalties for paying off the loan early.

The Drawbacks Of Taking Out A 401 Loan

On a normal day in a normal market, borrowing from your future self wouldnt be a good idea. Heres why:

- You never get that money back. Even when you repay your loan, the money that wouldve been there the entire time doesnt get a chance to earn and grow. Youre losing out on earnings by taking money out early.

- You might need to pay it off sooner. If you leave your job , youll need to repay your loan by the upcoming tax deadline. So if you took out a 401 loan right now and lost your job next month, youd be on the hook for paying it by the .

- Repayment is with after-tax dollars. That means when you withdraw the money again later down the road, itll be taxed again.

- You could get taxed anyway. If something comes up and you cant pay your loan back, its considered an early distribution and youll face the 10% penalty.

Also Check: Can I Invest In 401k And Ira

Repaying A Retirement Plan Loan

Generally, qualified-plan loans must be repaid within five years. An exception is made if the loan is used towards the purchase of a primary residence. It is important to note that your employer may demand full repayment should your employment be terminated or you choose to leave.

The Tax Cuts and Jobs Act of 2017extended the deadline to repay a loan when you leave a job.Previously,if your employment ended before you repaid the loan, there was generally a 60-day window to pay the outstanding balance. Staring in 2018, the tax overhaul extended that time frame until the due date of your federal income tax return, including filing extensions.

If you are unable to repay the amount at this point, and the loan is in good standing, the amount may be treated as a taxable distribution. The amount would be reported to you and the IRS on Form 1099-R. This amount is rollover eligible, so if you are able to come up with the amount within 60 days, you may make a rollover contribution to an eligible retirement plan, thereby avoiding the income tax. Note that if you are younger than 59½, you will likely also owe an early withdrawal penalty, unless you meet certain exceptions.