Handling A Previous 401k

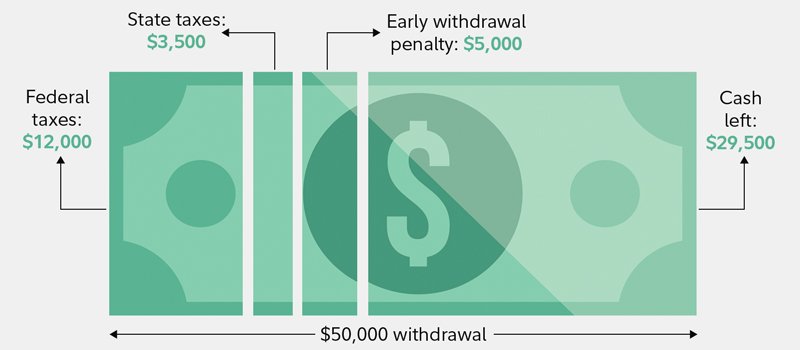

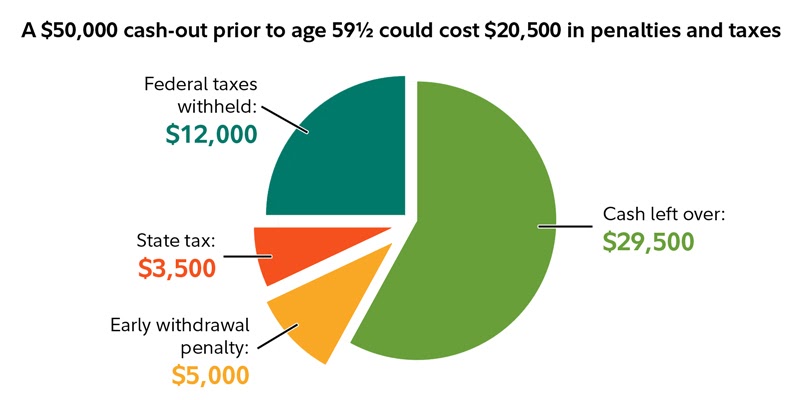

You usually have a few options when it comes to handling a 401k from a former employer. These include leaving the 401k where it is, rolling it into a taxable or nontaxable Individual Retirement Account or transferring it to a 401k with your current employer and cashing it out. Of all your options, cashing out will cost you the most now and in the future. You will have to pay income taxes on the withdrawal along with a 10 percent early withdrawal penalty. You’ll also lose the tax benefits offered by the 401k as a qualified retirement plan.

Have You Been Diligently Saving Money In Your 401 What Should You Do With It When You Switch Jobs There Are Four Main Options To Consider And One Of Them Should Be Used Only When Absolutely Necessary

So, you have been laid off or left your previous employer. This transitional period may be full of decisions, such as balancing unemployment insurance, health care insurance, and other important life decisions. Of course, retirement planning is still important, but what are your options with your old 401?

Dont Miss: Can You Pull From 401k To Buy A House

How Much Will I Get If I Cash Out My 401k

If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

You May Like: How To Cash Out Your 401k Fidelity

What Is An Opt

An opt-out plan is an employer-sponsored retirement savings program that automatically enrolls all employees into its 401 or SIMPLE IRA. Companies that use the opt-out provision enroll all eligible employees into a default allocation at a set contribution rate, usually around 3% of gross wages.

Employees can change their contribution percentages or opt-out of the plan altogether. They also may change the investments their money goes into if the company offers choices.

What You Need To Think About First

Taking money out of a pension is a major decision. So, before you request your withdrawal, there are a number of areas that you need to think about carefully. If you are unsure what the right choice is for you, or what the relevant tax implications might be, we recommend that you speak to an independent financial adviser.

It may help if you take a look at our tools and calculators, and ask yourself the following questions:

Also Check: Can I Roll A Roth Ira Into A 401k

What Should I Do With My 401k After I Left My Job Quora

What Should I Do With My 401k After Losing My Job

Answer : there are a few options, depending on your specific situation: first off, before you request any distributions, check with your hr or benefits coordinator to make sure your account is fully funded. After you leave your job, there are several options for your 401. you may be able to leave your account where it is. alternatively, you may roll over the money from the old 401 into a new. After you leave your job, there are several options for your 401. you may be able to leave your account where it is. alternatively, you may roll over the money from the old 401 into a new. option 1: keep your 401 with your old employer. many are surprised to learn that in certain circumstances, you can leave your 401 with your old. 1. keep your 401 with your former employer. most companiesbut not allallow you to keep your retirement savings in their plans after you leave. some benefits: your money has the chance to continue to grow tax deferred. you can take penalty free withdrawals if you leave your job at age 55 or older. Option 1: keep your 401 with your old employer. many are surprised to learn that in certain circumstances, you can leave your 401 with your old companys retirement plan. however, if you have less than $5,000 in retirement savings, your company may force you out by issuing you a check.

Should I Max Out My 401k Quora

If I Get A Job In California That Pays 150k How Much

How Long Does It Take To Get Money Out Of My 401k

May 3, 2011 It usually takes a week or two to get money out of your 401, although it can take much longer. The countdown begins when you request payment and ends when you actually receive the money in the form of a check or wire transfer.

Principal 401k phone number What is your 401k plan based on your retirement count?Your 401 is qualified retirement plan Although your donation has been reported in field 12 code D in format W2. You dont need to report them again in TurboTax. If youre going to bring up another issue, youll only answer yes to this question, such as BT IRA or Roth IRA. June 4, 2019 at 11:51 a

Recommended Reading: How To Know If You Have A 401k

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

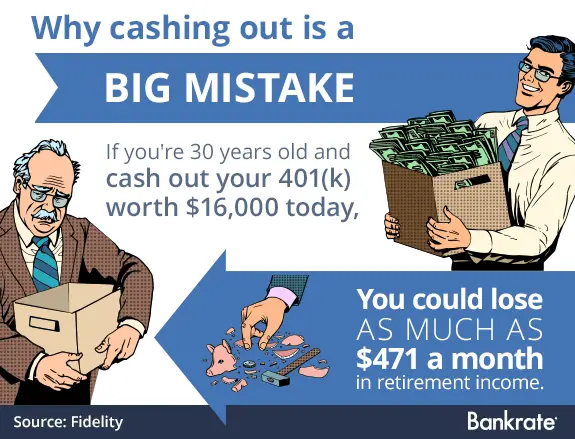

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash out at age 24 leads to a $23,000 difference , in your projected account balance at age 67, so even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

You May Like: What Is A 401k Vs Ira

An Astounding 90% Of American Workers With 401k Plans Said That Payroll Deduction Helps Them Save

Stats show that workers are satisfied with 401k plans and their features as they make it easier for them to save money for retirement. Whats more, 90% said that it helps them think about the future rather than their needs at the moment. Besides, 82% believe that saving money with every paycheck makes them less anxious about investment performance.

Recommended Reading: How To Recover 401k From Old Job

How To Cash Out A 401 From A Former Employer

Cashing out a 401k from a former employer is not a difficult task. In most cases, you contact the plan administrator for the appropriate paper work, fill it out, send it to the financial institution that manages the 401k, and wait for the check to come in the mail or for the electronic transfer.

Tips

-

In order to cash out a 401 from a former employer, you will likely have to contact the plan administrator at your former place of employment and request access to the paperwork needed to withdraw your funds.

You May Like: Can You Roll A Traditional 401k Into A Roth Ira

You May Like: Should I Open A 401k

Make Sure That Youre Eligible

The general rule of thumb is that you established your 401 as a full-time employee from a previous employer, or you are more than 59.5 years old. Other eligibility requirements can vary, depending on the type of retirement plan you have, such as a Roth IRA, 403, 457 and Thrift Savings Plan .

Please note, the rules dictating eligibility to move a 401 to an IRA arent always crystal clear and can vary from person to person. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation.

We have a team of IRA Specialists, who are well-versed in the rules of 401-to-Bitcoin IRA rollovers. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. However, please note that there is no obligation for you to take any action after your consultation.

Here are the three steps to take to convert your 401 savings into bitcoin:

You May Like: How Do I Cash Out My 401k After Being Fired

What Is A 401 K

If you’re a member of the US workforce, you probably have a rough idea of what a 401 k account is. Many employers offers a 401 k. A 401 k is an account that part of your pay/income goes towards. A financial institution uses this money to invest. Once the investment is profitable, you get a share of the returns.

An 401 k account is subject to different taxes than a regular savings account. You can keep the money in such an account for years without paying taxes on it. The amount of time that the funds sit in your account isn’t important, though. It’s actually expected that the funds stay in your 401 k account until you reach retirement age.

Don’t Miss: Is 401k The Best Way To Save For Retirement

Traditional Rollover Sep And Simple Iras

If you are considering a withdrawal from one of these types of IRAs before age 59½, it will be considered an early distribution by the IRS.

In many cases, youll have to pay federal and state taxes. There may also be a 10% penalty unless you are using the money for exceptions such as a first-time home purchase, birth or adoption expense , qualified education expense, death or disability, health insurance , and some medical expenses. A 25% penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA.

If any of these situations apply to you, then you may need to fill out specific IRS forms. Always consult your tax advisor about your specific situation.

Because You Asked: How Long Does It Take To Cash Out 401k After Leaving Job

Not every job works out the way you might have hoped. Whatever your reason is for looking for a new employer, you’re probably wondering about cashing out your 401 k from your old job if you’re quitting before you reach retirement age. Depending on your individual retirement account, this may involve penalties.

This article discusses how long it might take for you to cash out your 401 k once you’ve left your job. It also goes over your possibilities for doing so and the different types of 401 k account you can have. If you don’t want to cash out the old account, you can generally transfer the money to a new 401 k plan or IRA account. It would help if you decided this based on any potential penalties and your investment options.

Read Also: How To Cash Out Nationwide 401k

How Long Does A Payout Take

The amount of time it can take for your 401 k payout to come to you varies depending on the type of retirement plan you have. If your situation is uncomplicated, you can expect to receive the check within days. However, a more complex case might mean it takes up to 60 days if you request to receive the money via check.

How To Withdraw From A Fidelity 401k

The Fidelity suite of products offer a wide range of services that help individuals do everything from saving for retirement to investing extra money to trade on the stock market. Fidelity manages employer-sponsored 401 plans and offers its own self-employed and small business 401 plans. Customers with a Fidelity 401 can withdraw money from the account, but they should be aware of the tax implications of early withdrawal.

Don’t Miss: What To Do With 401k When You Retire

If Im Eligible Should I Take A Distribution From My 401 Or Ira

Even with the new rules in place, its still advisable to exhaust most other resources, such as emergency funds or other easily accessible forms of savings, before tapping into your retirement accounts.

But if you are considering taking a distribution from your IRA or 401, think through the following first.

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Recommended Reading: How Do I Sign Up For 401k

Set Up Your New Account

According to the IRS, most pre-retirement payments that you receive from a retirement plan can be rolled over to another retirement plan within 60 days. If you dont roll over your payment, it will be taxable, so its best to have the new account set up and in place well before you close out your old one.

Be sure to take advantage of the resources offered by your new account manager. They should be happy to have your business and should offer up plenty of assistance and maybe even some perks to entice you to use their services.

Of course, if youve been happy with Fidelity, you can consider using them for your new account as well by opening a Fidelity rollover IRA.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If youve explored all the alternatives and decided that taking money from your retirement savings is the best option, youll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Recommended Reading: What Is The Difference Between 401k And 403b

Also Check: Can A Qualified Charitable Distribution Be Made From A 401k

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: How To Open A 401k Plan

Where Fidelity Go Shines

Low cost: Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999.

Fidelity integration: Customers who already have an IRA or taxable account with Fidelity can easily take advantage of the companys robo offering.

Human portfolio oversight: The day-to-day investment and trading decisions for portfolios are handled by a team of humans from Strategic Advisors, a registered investment advisor and Fidelity company.

You May Like: How To Increase 401k Contribution Fidelity

Automatic Enrollment Or Making Changes

Enrollment is Automatic for All Employees

Participation in the Supplemental Retirement and Savings Plan is automatic for all employees. You will automatically be enrolled to contribute 3% of your eligible compensation, as defined under the BU Retirement Plan, on a tax-deferred basis and your contribution will be invested in a Vanguard Target Date Fund closest to the year in which you will turn age 65. Your first contribution to the plan will commence in the month following your hire date.

You may change or stop your contribution at any time. You may also change the investment allocation of your contributions at any time.

Automatic Enrollment and BU Matching Contribution After Two Years of Service

Once you have completed two years of service with at least a nine-month assignment at 50% or more of a full-time schedule, you will be eligible to receive the University matching contributions to the Boston University Retirement Plan.

In addition, you will automatically be enrolled in the Supplemental Retirement and Savings Plan to contribute 3% of your eligible compensation as defined under the BU Retirement Plan on a tax-deferred basis if you are not already doing so when you complete two years of service. BU matches your contribution dollar-for-dollar up to 3% of your eligible compensation as defined under the BU Retirement Plan.

You may make the following changes at any time:

Read Also: How Much Do You Need In 401k To Retire