Is It Better To Do Pre

Posted by Greg Phelps, CFP®, CLU®, AIF®, AAMS® | Nov 6, 2020 | 0

Your 401 at work is one of the best waysif not THE SINGLE best wayto save for retirement! The 401 makes it easy, quick, relatively painless, and forces you to dollar cost average into your investments over time. Your 401 may also provide employer matching contributions and lower costs than youd be able to get on your own due to economies of scale!

But, for all of their glory, the 401 can be difficult to navigate. There are rules and potential penalties. There are limits and restrictions on investments. Most importantly, most 401 plans today have the Roth or pre-tax option, making things even MORE confusing!

This short video explains the differences between the Roth 401 and the pre-tax 401 and will guide you towards which one is best for you and your retirement planning needs.

Hi there. My name is Greg Phelps and Im the president of Redrock Wealth Management here in Las Vegas. Im also your host to the RetireWire Blog and Podcast and webinars series, and a lot of other fun stuff that I put up at RetireWire specifically for retirement education.

Todays webinar video is going to tackle a question that I got from a 401 client. In the age of COVID since we cant see each other face-to-face quite as much and have the big group gatherings, we decided that doing a video and putting that out there on RetireWire would be very helpful as an education piece for the participants.

Table of Content

Is Your Income Likely To Increase

Seriously consider your future earnings potential when making the Roth vs. traditional 401 decision. If you are at or near your peak earning years right now, you may want to stick with pre-tax 401 contributions. But if you anticipate your income increasing, you will likely see your income tax bracket increase. That could bump you into a higher tax bracket and would, therefore, make the Roth option more appealing.

Is It Better To Contribute To A Traditional 401k Or Roth 401k

Contents

Thats because, typically, theyre currently in the low-income tax bracket, and the upfront tax deduction from a traditional retirement account is now less valuable than a tax-free Roth withdrawal down the road. Lately, however, financial advisors have been directing their older clients to Roth accounts as well.

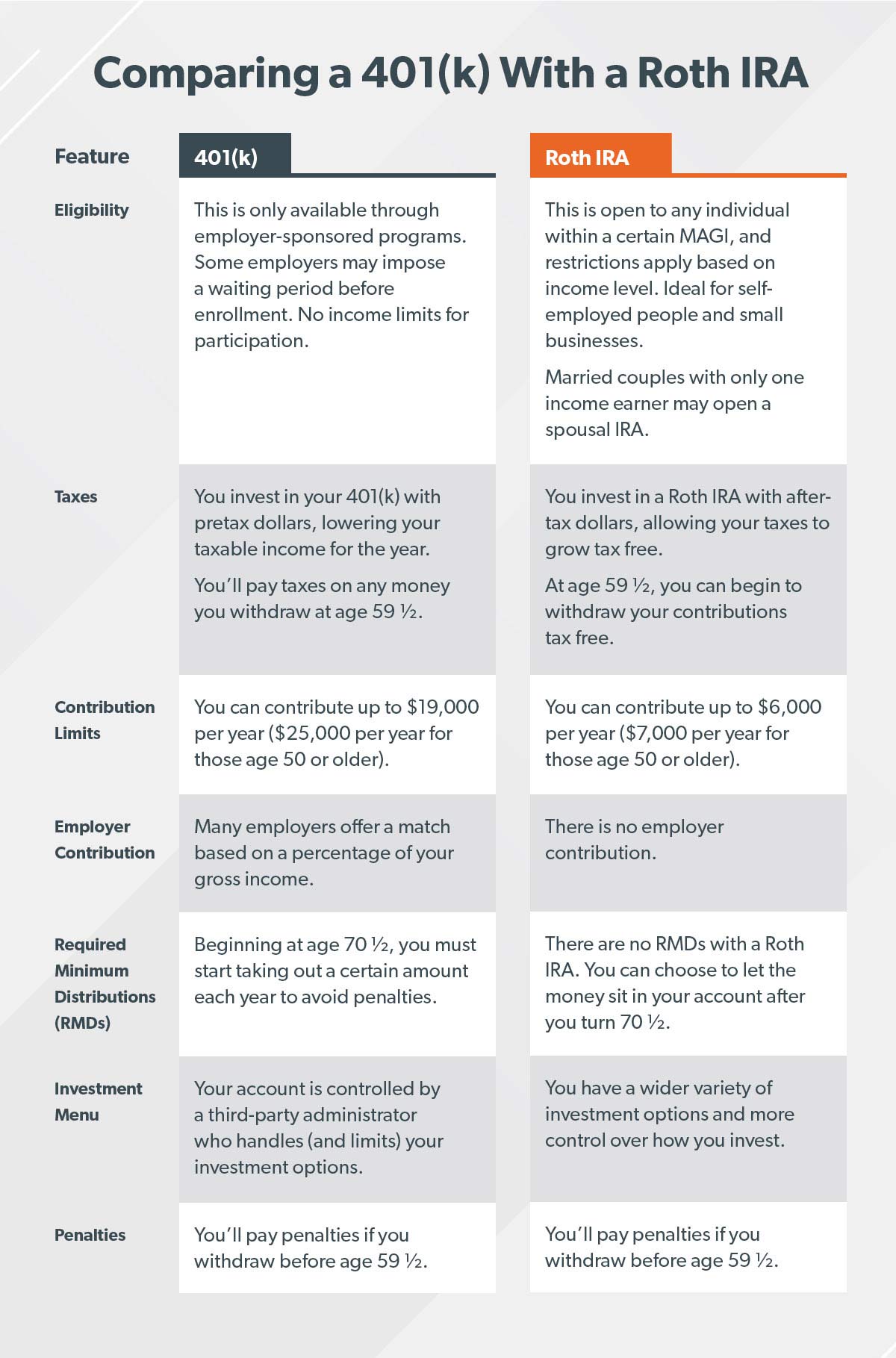

Is it better to contribute to a 401k or a Roth? A Roth 401 tends to be better for those with higher incomes, have higher contribution limits, and allow for employer matching funds. Roth IRAs allow your investment to grow longer, tend to offer more investment options, and allow for easier early withdrawals.

Read Also: Should I Move My 401k When I Change Jobs

Does Roth Count Toward 401k Limit

Rollover does not count towards limits. If you have money in other eligible retirement accounts, such as a traditional IRA, 401, 403, or even another Roth IRA, you can transfer money into the Roth IRA. These renewals do not count as a premium and therefore do not reduce the amount that you can pay annually.

Is Roth Better Than Traditional

Roth IRAs are not always better than traditional ones. The most important factor is whether you pay a higher or lower marginal tax rate when you withdraw money than when you deposit it.

Last day to contribute to roth ira 2020Can I contribute to my Roth IRA? You can also deposit money into the Roth IRA if you want. These accounts are generally better if you think you’re currently in a lower tax bracket than if you were retired. But you now pay taxes on these contributions in exchange for subsequent tax-free distribution, so Roth IRA contributions won’t help you save money this year.Who can contribute

Recommended Reading: How To Check My Walmart 401k

Will You Work During Your Retirement

You might not see any big changes in your income tax bracket if you plan on working into traditional retirement years. The result might be that you remain in the same tax bracket. Usually, if your tax bracket is the same at retirement, you will see equal benefits with a Roth 401, compared to a traditional 401. But consider keeping some money in a Roth account to avoid seeing your income taxes creep into a higher marginal tax bracket.

Similarly, most retirees in the U.S. end up with an income-replacement rate during retirement that is lower than their income while working. But if you think your income will be higher in retirement, the Roth 401 could make more sense because you won’t owe taxes on qualified Roth 401 distributions.

How Do Roth 401 And Pre

How do these tax implications affect you? Lets look at a working life here.

What I did is I took just a sample scenario where, lets just say, youre 40 years old, and now you decide youre going to start saving for retirement. Thats great. And then you retire over here, right about age 62. Its just not on the chart there.

So you retire at age 62. And then you end up dying over here at age 84. This is a very common scenario that a lot of people have experienced throughout their life.

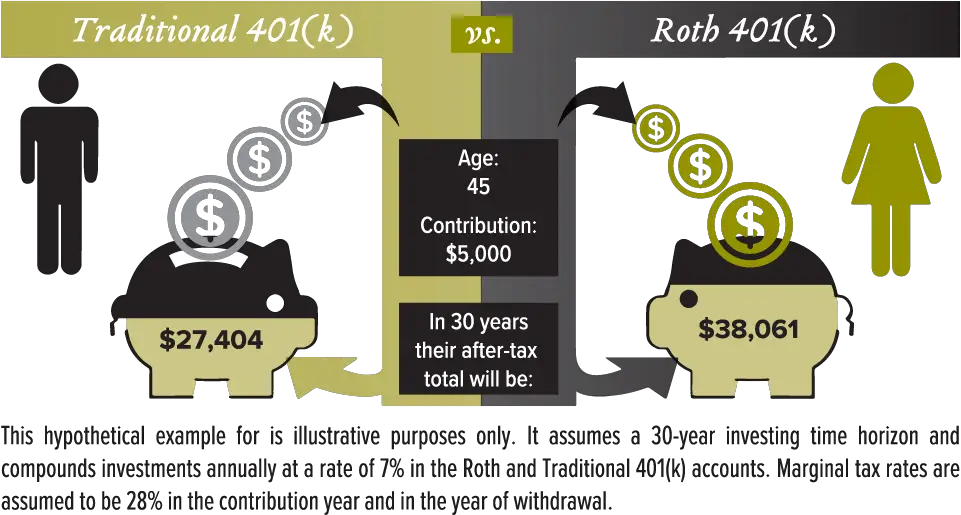

So, as you can see here, weve got a chart here with the pink, which is effectively your Roth contribution. And what youll notice there is, again, you have less money because you paid your taxes upfront. Less money in your account. So it may feel worse when in actuality its really not.

And then you can see right here, the red chart is your traditional or your pre-tax 401 contribution because you basically did not pay those taxes upfront. Youve got more money than youre using that you would have paid in taxes to grow for you. You can see here, you have more money when you retire at age 62 versus here with the Roth. Thats not necessarily a bad thing though.

Lets go ahead and follow through with the mathematical concepts here. If your salary is $4,000 a month, all things being equal, youre saving 10%. Your pre-tax savings is going to be $400, just like we just talked about. Your taxable income is now $3,600 because you saved that $400 into your pre-tax 401 at a tax rate of 20%.

You May Like: How To Protect Your 401k In A Divorce

Is Roth After Tax

Rotten election postponement and after-tax deductions are initially comparable in terms of tax regime and in the years prior to retirement. The main difference concerns the tax treatment of withdrawals. At retirement, loan payments from Roth funds are tax-free Income tax is paid on the after-tax deductions.

Its Not Only About Taxes

Taxes are important, and they’re the primary factor in this debate. But there are other points to consider:

-

Whether youre eligible for a Roth IRA.Roth IRAs have income limits Roth 401s do not. If you earn too much to be eligible for the Roth IRA, the Roth 401 is a chance to get access to the Roths tax-free investment growth.

-

Certain income thresholds in retirement. Taking some of your retirement income from a Roth can lower your gross income in the eyes of the IRS, which may in turn lower your retirement expenses. A lower income in retirement may reduce the taxes you pay on your Social Security benefits and the cost of your Medicare premiums that are tied to income.

-

Access to your retirement money. Unfortunately, the Roth 401 doesnt have the flexibility of a Roth IRA you can’t remove contributions at any time. In fact, in some ways its less flexible than a traditional 401, due to that five-year rule: Even if you hit age 59½, your distribution wont be qualified unless youve also held the account at least five years. Thats something to keep in mind if youre getting a late start.

-

Required minimum distributions in retirement. Both accounts require account owners to begin taking distributions at age 72, but money in a Roth 401 can easily be rolled into a Roth IRA, which will then allow you to avoid those distributions and even pass that money on to heirs.

Read Also: How To Calculate Rate Of Return On 401k

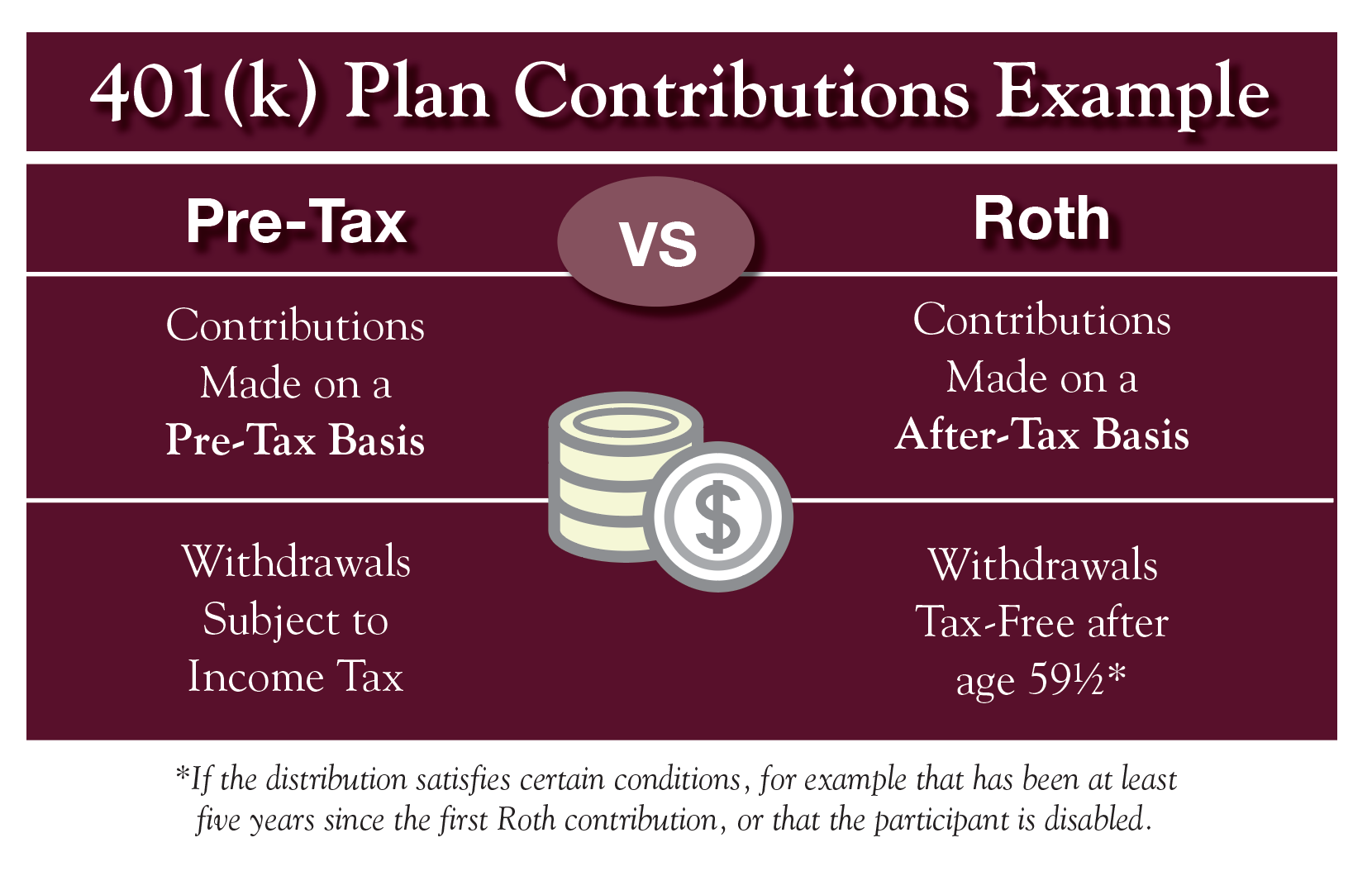

Traditional And Roth 401s

When you participate in a traditional 401 plan, the taxable salary that your employer reports to the IRS is reduced by the amount that you defer to your account. This means income taxes on that money are postponed until you withdraw from your account, usually after you retire.

An increasing number of employers are offering employees a relatively new 401 choicea Roth 401. If you participate in a Roth 401, the amount you defer doesn’t reduce your taxable income or your current income taxes. But when you withdraw after you retire, the amounts you take out are tax-free, provided you’re at least 59½ and your account has been open at least five years.

Both the traditional 401 and Roth 401 offer tax advantages when you defer a portion of your salary into an account in your employers retirement savings plan. Both feature tax-deferred compounding of contributions that are made to the account. Both have no income limits and require minimum distributions after you turn 72 in most cases, and both can be rolled over to an IRA when you retire or leave your job for any reason.

Here is a chart showing the different tax structures for the two 401 options:

Whats more, if your modified adjusted gross income is too large to allow you to qualify for a Roth IRA, a Roth 401 is one way to have access to tax-free withdrawals. There are no income restrictions limiting who can participate. The only requirement is being eligible to participate in your employers plan.

Roth 401 Retirement Savings Tips

Advice for maximizing your Roth 401 account:

- Max out your contributions. For each year that you’re able, aim to hit the $20,500 limit.

- Once you turn 50, add another $6,500 to that limit annually while you continue to work.

- If your employer offers to match your contributions up to a certain amount, be sure to invest at least that much in your Roth 401 each month. It’s free money, after all.

Don’t Miss: Can Business Owners Have A 401k

First Question: When Do You Want To Pay Taxes Now Or Later

Income taxes are a thing. And the money you withdraw from your 401 when you retire is, technically, income. But by choosing between a traditional and a Roth, you do get to decide if you want to pay those taxes later or now .

You might be able to save money in the long term if you pay those taxes now. It all comes down to tax brackets because youre probably not going to be in the same one forever.

Maybe you plan to live off less money during retirement than youre making today. That would mean your tax bracket could be lower in retirement which means youd probably save money by waiting to pay your taxes until then.

Or you might expect your income to go up a lot between now and retirement. In that case, your tax bracket could be higher once you retire which means youd probably save money by paying taxes now.

With a traditional 401, you pay taxes later. With a Roth 401, you pay taxes now. So if you think youll move down in tax brackets when you retire, you might choose a traditional, and if you think youll move up in tax brackets when you retire, you might choose a Roth. Or, if youre like, heck if I know, you might plan for either reality by using both.

Roth 401k Vs After Tax 401k Comparison

The second major difference between the Roth IRA and the 401 is the tax regime. Roth contributions are paid after taxes and regular 401 assessments are made before taxes. This means you will pay income tax today if you invest in a Roth IRA and receive a tax deduction for the current year if you contribute 401.

Also Check: What’s My 401k Balance

Tax Bracket Now Vs Later

If you’re in a higher tax bracket now than you expect to be in retirement, then it generally doesn’t make sense to make Roth 401 contributions over pre-tax additions.

For example, if your household taxable income is $500,000, you’re in the 35% marginal tax bracket.¹ If you retire in 2022 and have taxable income of $340,000 from pre-tax retirement accounts, you’re at the top of the 24% marginal tax bracket for married couples. So the question is: should you pay tax now or later? With only basic math, the tax on ordinary income is 31% more while working vs the year after.

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: Can I Roll My 401k Into A Roth Ira

Should High Earners Use Roth 401k Or Traditional

Roth has also been recommended as a way to diversify the tax treatment of retirement income sources and to provide retirees with tax flexibility. Even if you end up in a lower income tax bracket when you retire, withdrawals from your traditional retirement account could potentially put you into a higher tax bracket.

Should I do all Roth or traditional 401k?

If you expect to be in a lower tax bracket in retirement, a traditional 401 may make more sense than a Roth account. But if youre in a lower tax bracket now and believe youll be in a higher tax bracket when you retire, a Roth 401 may be a better choice.

Does it make sense to have a Roth and traditional 401k?

If youve funded a traditional 401, it makes sense to add a Roth plan to the mix. Its actually worth it not to keep all your eggs in one retirement basket, even if it makes the most financial sense right now. Thats because having both plans will give you flexibility later.

Is a Roth 401k good for high earners?

Choosing an Account for the High-Income With the potential for large compound growth, along with the benefits of this non-taxable money, the Roth 401k can be a great choice for high-income earners.

Is The Roth 401 A Good Deal

One thing to keep in mind when using the Roth 401: Only your contributions are not taxable. If your company offers a match, you must pay your retirement income tax on the match page of your account. That said, the Roth 401 is an incredible deal. You can literally save hundreds of thousands of dollars in retirement.

Don’t Miss: How Much Can One Contribute To 401k

Traditional And Roth 401 Plans

Individuals who want to save for retirement may have the option to invest in a 401 or Roth 401 plan. Both plans are named for the section of the U.S. income tax code that created them. Both plans offer tax advantages, either now or in the future.

With a traditional 401, you defer income taxes on contributions and earnings. With a Roth 401, your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement.

How Much Can You Contribute To Both A Roth 401 And Roth Ira

However, the same limit does not apply to contributions to Roth IRAs, which have a separate annual limit of $5,500 with additional compensation payments of $1,000. So if you have a Roth 401 plan and a Roth IRA, your total annual premium on all accounts is $24,000, or $31,000 if you’re 50 or older.

Defined benefit vs defined contribution

Don’t Miss: Can You Roll Over 401k From One Company To Another

Does Roth Count Toward 401k Limit 2018

Switching from another qualifying retirement account will not count against your current IRA contribution limits. Roth IRA Contribution Limits As of 2018, the maximum amount you can contribute to your Roth IRA each year is $5,500 if you are under 50, or $6,500 if you are 50 or older.

Should You Choose A Traditional Or A Roth Ira

One of the reasons for choosing a Roth IRA over a traditional IRA is if you’d rather save tax later than now. However, if you want to lower your taxable income, a traditional IRA is the way to go. The Roth IRA has income limits, according to Fidelity, which means it may not be the best option for everyone.

Read Also: How To Recover 401k From Old Job

Depends On Your Income

It might make sense to start off with a Roth 401 when youre in the lower tax brackets.

But what if you later move into a middle tax bracket? If you believe your income will remain roughly the same in retirement, split contributions offer a diversified tax strategy.

Then again, maybe youre in one of the highest tax brackets.

Do you expect your income to decrease as you become older?

If youre currently in a Roth, you might explore switching entirely to a traditional 401. This way, you can defer taxes until youre in a lower tax bracket.