How Much Should I Have In My 401 By Age 60

Retirement is a big milestone but getting there doesnât happen overnight. Financially preparing yourself to leave the workforce requires some forward thinking. If youâre asking yourself, âHow much should I have in my 401 by age 60?â youâre not alone.

A general rule is to have six to eight times your salary saved by that point, though more conservative estimates may skew higher. The truth is that your retirement savings plan hinges on your individual goals and financial situation, not some magic number. Here are a few ways to measure whether youâre on the right track.

Your 401 Savings And Where You Want To Retire

Where you plan on spending your retirement will have a major impact on how much money youll need to save in your 401. A number of different factors fall under this bucket, each with its own impact on your savings needs.

Cost of living is the most basic factor here. For example, retiring in Hawaii may seem like a tropical dream, but the cost of living in Hawaii is exceptionally high. If hitting the beach to surf in Oahu everyday is something you really want, youll have to make sure you have enough money in your 401 to cover the cost of living.

Big cities like New York and Los Angeles also have predictably high costs of living. However, more remote places like Montana and New Hampshire have much lower costs of living though, so youd need less in your coffers if you opt to settle in places like that.

Another location-based retirement savings factor to keep in mind is taxes. Each state has its own tax codes, and some dont have any income tax at all. Make sure you understand the tax policies of the state where you plan to retire so you have a sense of how much taxes will eat into your 401 savings over time.

For example, Texas does not charge any income taxes. That means when you withdraw funds from your 401 as a resident of Texas, you wont have any state taxes taken out. On the flip side, though, Texas has exceptionally high property taxes. So if you plan on buying a sprawling ranch in the Lone Star State, you property tax bill could be quite high.

Set Your Retirement Goals

How much you need to save depends on how you want to spend your retirement. Think about:

- your travel plans

- your age when you retire

- if you’ll work after you retire

- if you’ll have children or grandchildren to support

- where you want to live

- whether youll have debt to pay, such as a mortgage or a loan

You May Like: Is A 401k Worth It Anymore

I Wish I Hadnt Worked So Hard

This came from every male patient that I nursed. They missed their childrens youth and their partners companionship. Women also spoke of this regret, but as most were from an older generation, many of the female patients had not been breadwinners. All of the men I nursed deeply regretted spending so much of their lives on the treadmill of a work existence.

I Wish Id Had The Courage To Live A Life True To Myself Not The Life Others Expected Of Me

This was the most common regret of all. When people realise that their life is almost over and look back clearly on it, it is easy to see how many dreams have gone unfulfilled. Most people had not honoured even a half of their dreams and had to die knowing that it was due to choices they had made, or not made. Health brings a freedom very few realise, until they no longer have it.

Recommended Reading: How Old Do You Have To Be To Get 401k

One: Track Your Expenses

The best place to start is with your current expenses. They already include many of the expenditures youll pay for in retirement. Well delete the costs that wont apply later.

If you already track your expenses then most of the work is done.

If not, tot up your current spending using a budget planner. This tool helps you remember all the expenses youd prefer to forget dentists bills and the like.

Do this step as accurately as you can. Excavate your credit card and bank statements to fill in the budget planner.

Its good practice to record your monthly expenses for a year at least.

If youre happy with a lower resolution snapshot thats fine. Its better for your numbers to be mostly right than to skip this stage entirely.

Income And Percent Of Income To Save

Deciding what percentage of your annual income to save for retirement is one of the big decisions you need to make when planning. If youre just starting out on your retirement planning journey, saving any amount is a great way to begin. Just keep in mind that youll need to keep increasing your contributions as you grow older.

So how much is enough? Financial services giant Fidelity suggests you should be saving at least 15% of your pre-tax salary for retirement. Many financial advisors recommend a similar rate for retirement planning purposes.

But even then, the 15% rule of thumb assumes that you begin saving early. It also assumes youd be comfortable replacing 55% to 80% of your pre-retirement income. If you start later or expect youll need to replace more than those percentages, you may want to contribute a greater percentage of your income.

Also Check: How Much Can You Invest In 401k

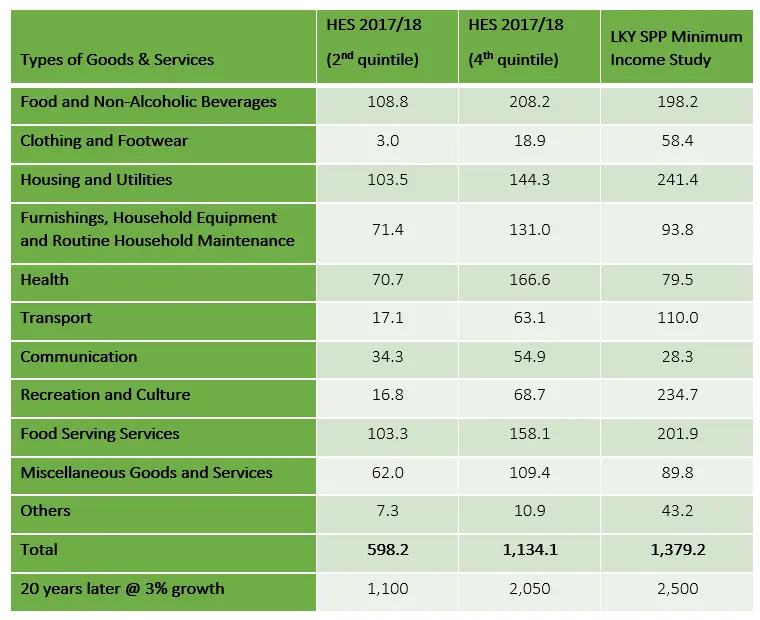

Impact Of Inflation On The Cost Of Goods And Services

When saving for retirement, keep in mind that goods and services will cost more in the future. You can predict how much more goods and services may cost by looking at rates of inflation in past years.

Figure 1: How much a $100 item increases in cost over time because of inflation

| Year | |

|---|---|

| 2016 | $129.92 |

Bank of Canada Inflation Calculator. The average rate of inflation in Canada between the year 2000 and 2014 was 2.00%.

How To Get Retirement Ready

Open a retirement account. If you have access to a GRSP, you should at the very least contribute the amount of money your employer is willing to match. You should also open a RRSP if you don’t already have one. A RRSP is one of the most popular ways to save for retirement in Canada and it comes with nice tax benefits. Learn more about RRSPs and GRSPs.

Avoid paying high fees. Fees are like savings termites they’ll chew right through your savings. When you invest with Wealthsimple, we charge a 0.5% management fees when you invest up to $100,000 and 0.4% when you deposit more than $100,000. That’s significantly less than the 2% fees paid by traditional mutual fund investors in Canada.

Make smart moves. Begin saving for retirement as early as you can and take advantage of the power of compounding. Create a budget that includes retirement savings, learn how investing works, discover smart retirement strategies and understand what it takes to retire early.

Also Check: How To Access My Fidelity 401k Account

What Is A Good 401k Balance At Age 60

The goal is to live a good retirement life and not have to worry about money. The above-average age 60 must have at least $ 800,000 in their 401k if they have been saved and invested diligently. However, the average age of 60 is closer to $ 170,000 in its 401k.

What is the average 401K balance for a 61 year old?

Those with retirement funds dont have enough money in them: According to our research, people ages 56 to 61 have an average of $ 163,577, and those ages 65 to 74 have even less savings.

What is a good savings goal for retirement at age 60?

Mid-50s to mid-60s Experts recommend that you have eight times the annual earnings saved by the age of 60, and 10 times that amount by 67.

How To Turn It Around

That most Americans dont have nearly enough savings to sustain them through retirement is sad but true.

How do you avoid that fate? First, become a student of the retirement savings process. Learn how Social Security and Medicare work, and what you might expect from them in terms of savings and benefits.

Then, figure out how much you think you’ll need to live comfortably after your 9-to-5 days are over. Based on that, arrive at a savings goal and develop a plan to get to the sum you need by the time you need it.

Start as early as possible. Retirement may seem a long way away, but when it comes to saving for it, the days dwindle down to a precious few, and any delay costs more in the long run.

Also Check: How Much In 401k To Retire

Why Did Joseph Valtellini Retire

Joseph Valtellini hasnt fought for GLORY since winning the welterweight title at GLORY: Last Man Standing back in June of 2014. Just when his career was hitting an all-time high, Valtellini, 30, was diagnosed with post-concussion syndrome and was forced to abdicate his welterweight title in June of 2015.

Retirement Income Calculation Rules Of Thumb

When it comes to income required in retirement in Canada, there are several rules of thumb or schools of thought out there. If you are looking for a definite answer to put your mind at rest, you may be disappointed.

In fact, the one thing everyone readily agrees to is that when it comes to retirement income, it is not black and white and there is no 100% consensus.

Popular rules of thumb include:

Read Also: How Can I Use 401k To Buy A House

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

How To Boost Your 401 Retirement Savings

401s come with contribution limits. For 2021, you can contribute up to $19,500. If you feel behind and want to put more muscle behind your savings efforts, the IRS allows folks who are 50 or older to kick in an additional $6,500. If itâs offered by an employer, you may be able to make after-tax contributions to help with savings. Beyond your 401, you can leverage other retirement savings vehicles outside of what your workplace offers, such as a traditional or Roth IRA, to bolster your nest egg.

There are several factors to consider here: Longevity, medical costs, your lifestyle, taxes and more. This can be rather complex for many people, but a financial advisor has the tools and expertise to build realistic financial projections to help you match your goals with your savings so you can live life with less stress. This may include delaying Social Security or exploring other financial tools, such as whole life insurance, to provide flexibility in retirement.

This publication is not intended as legal or tax advice. Consult with a tax professional for tax advice that is specific to your situation.

The primary purpose of permanent life insurance is to provide a death benefit. Using permanent life insurance accumulated value to supplement retirement income will reduce the death benefit and may affect other aspects of the policy.

Recommended Reading

Also Check: Can I Borrow Against My Fidelity 401k

Calculating How Much Money Youll Need At Retirement

By David Aston on January 15, 2020

Use these simple formulas to set your own savings goal, starting with how much youll want to spend each month once your mortgage and other large debts are behind you.

Youve probably heard lots of big numbers bandied around about how much you need to save in order to retire. Since the numbers that get discussed are often so different, how do you know what figure to use?

The smart thing to do is get a handle on figuring it out for yourself, based on your individual situation and preferences. In what follows, we show you the basics of how to set your own savings goal. Basic high-level calculations are shown in the accompanying table with an example. The key elements that determine the size of nest egg youll need are:

- retirement spending

- government benefits and employer pension payouts

- and the rate at which you draw from your nest egg.

The example in the table below uses very basic middle-class-level spending to demonstrate how the calculations work. It shows how a frugal but still potentially fulfilling retirement is possible if you end up with limited savings. Of course, most Canadians will aspire to a more expansive lifestyle with higher spending, which, in turn, will require greater savings.

Watch: How much money should you be saving for retirement

How Much To Withdraw From 401k After Retirement

How much to withdraw from 401k after retirement? The traditional withdrawal approach uses something called the 4% rule. This rule says that you can withdraw about 4% of your principal each year, so you could withdraw about $400 for every $10,000 youve invested.

How much do you have to take out of your 401k after retirement? The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent years withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years.

How much do you have to withdraw from your 401k at age 72? Uniform lifetime table

Can I withdraw all money from 401k after retirement? Special Considerations for Withdrawals. The greatest benefit of taking a lump-sum distribution from your 401 planeither at retirement or upon leaving an employeris the ability to access all of your retirement savings at once. The money is not restricted, which means you can use it as you see fit.

Also Check: How Does Company Match Work For 401k

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

I Wish I Had Stayed In Touch With My Friends

Often they would not truly realise the full benefits of old friends until their dying weeks and it was not always possible to track them down. Many had become so caught up in their own lives that they had let golden friendships slip by over the years. There were many deep regrets about not giving friendships the time and effort that they deserved. Everyone misses their friends when they are dying.

Recommended Reading: How To Pull Out 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Read Also: Should I Convert My 401k To A Roth Ira

How Much Should A Person Save For Retirement Each Month

Retirement You should consider saving 10 15% of your income for retirement.

How much money should I save for retirement every month?

You should consider saving 10 15% of your income for retirement.

How much does the average person save for retirement?

According to a study by the Transamerica Retirement Research Institute, the average retirement age in the United States is: Americans in their 20s: $ 16,000. 30-year-old Americans: $ 45,000. 40-year-old Americans: $ 63,000.