What Is The Maximum 401k Contribution For 2021

That depends on your employer’s plan. The maximum the IRS allows for 2021 stayed the same as 2020. Currently, the cap sits at $19,500 but your employer may cap the amount below that. For people over 50 the maximum increases to help them “catch up” before their retirement. They can contribute an additional $6,500 a year.

What Is The Maximum Amount You Can Contribute To 401 Plans

When determining how much money you should contribute to an employee’s retirement account, you should also consider the annual contribution limits that the IRS sets for both yourself and your employee. For 2020, the limit on elective salary deferrals retirement plan contributions an employee voluntarily makes is $19,500 for a traditional 401 plan. For a SIMPLE 401 plan, this limit is lowered to $13,500. Employees age 50 and older can contribute an additional $6,500 in elective salary deferrals to a traditional 401 plan or $3,000 to a SIMPLE 401 plan.

The total contribution limit a person can make to an employer-sponsored retirement account during a year is the sum of elective salary deferrals, employer contributions and allocations of forfeitures. For 2020, the total contribution limit is $57,000, or for an employee with an annual income below $57,000, the limit is whatever their income is. Notably, if an employee has a retirement account with your company and a separate 401 they contribute to through side income they generate as an independent contractor, that separate account is unaffected by the limits on your employer-sponsored account.

How To Take Full Advantage Of A 401 Match And Build Retirement Savings:

Your minimum goal as a 401 plan participant should be to make sure you dont leave any employer dollars on the table. Find out what the maximum employer match on your plan is, and make sure you contribute enough to qualify for that match.

Beyond that, though, there would most likely still be tax advantages and retirement saving benefits to be had by contributing more than you need to qualify for the full employer match. According to Vanguard, 47% of employees do this, making contributions that go beyond what is necessary to qualify for the full employer match available.

In most cases, you can contribute up to $19,500 to a 401 plan for 2020 . Chances are this is well above what you need to contribute to maximize your employer match, but your goal should be to come as close to this limit as possible. Doing so will enhance your tax savings and build your retirement nest egg more quickly and your employer match should help as well.

Finally, remember that your 401 plan is not your only option for retirement savings.

If you reach the IRS maximum for 401 contributions, there are still other ways from health savings accounts to after-tax savings that you can build a bigger nest egg.

Glossary:

You May Like: Can I Roll My Pension Into My 401k

Employer Contributions To 401 Plans How Do They Work

In general, 401 plans depend primarily on money put into them by the workers themselves. You can choose to defer a portion of your wages to the plan, up to certain limits.

In return, you receive an immediate tax deduction plus tax-free investment growth, though you will ultimately have to pay taxes on the money when you withdraw it from the plan in retirement.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Recommended Reading: How Can I Find All Of My 401k Accounts

How Does A 401k Benefit An Employer

Recruit and Retain. In todays workforce, its becoming the norm to expect certain benefits such as retirement and healthcare. From an employers perspective, offering a 401k can give you that extra edge to stand out amongst your competitors. Attractive benefits are now a must.

Incentivize Performance. Employers also have the ability to use retirement perks as incentives. Many organizations tie their contributions to specific goals, and when employees meet these benchmarks they are rewarded by increases in their 401k contribution. Depending on how you choose to structure your benefits program, they can be used to incentivize performance, which ultimately helps the company succeed.

Tax Perks. 401k plans also help the employer come tax season. Matched contributions and administrative work associated with the benefits plan are tax-deductible. Lower your tax burden with a company-wide 401k program.

These three perks are highly beneficial from a production and financial standpoint. Not to mention, a retirement program lets your staff know that you value their financial future. Showing you care can do wonders for company culture.

K Contribution Limits 2022

- The contribution maximum for workers 401 plans has been raised to $20,500, from $19,500 before.

- Single taxpayers now have a tax bracket of $68,000 to $78,000, up from $66,000 to $76,000 before.

- The threshold for married couples filing jointly has been raised from $105,000 to $125,000 to $109,000 to $129,000, an increase from $105,000 to $125,000.

- The maximum contribution amount for an IRA donor has been raised from $198,000 to $208,000, a $204,000 to $214,000 increase.

- Separate returns filed by a married person are not subject to an annual cost of living adjustment and stay between $0 and $10,000.

- The catch-up deposits for savers over the age of 50 will remain at $6,500.

You can find further information about 401k Contribution Limits 2022 on the IRS website, which you may access here: https://www.irs.gov/newsroom/irs-announces-401k-limit-increases-to-20500

Recommended Reading: How Much Can You Contribute To 401k

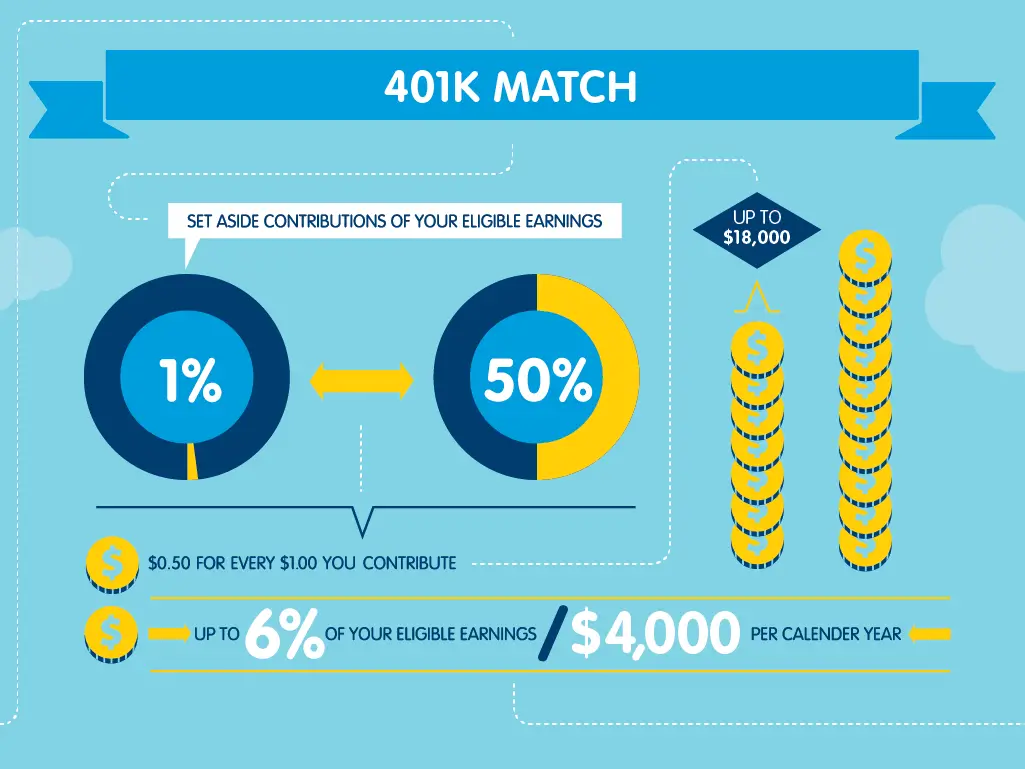

How Does 401k Matching Work

Does your new employer offer 401 matching? Find out how 401 matching works, and everything you need to know about this âfree moneyâ.

If you recently changed jobs or started a new job, your employer will set up a 401 retirement account for you. A 401 account allows employees to make tax-deferred contributions through elective deferrals. An employer may also offer 401 matching as part of the companyâs compensation plan to retain top employees in the company.

An employer with 401 matching makes contributions to the employeeâs 401 account, based on the amount contributed by the employee to the plan. The employer can offer either partial or full matching of your contributions, depending on the companyâs policy. The employee can get full ownership of the matched contributions either immediately or after a certain period, depending on the companyâs vesting schedule.

Why Should You Offer A 401 Employer Match

Offering a 401 employer match as part of your employee retirement plan has three primary benefits for your company:

- Better recruiting. Not all companies offer a 401 employer match, so doing so can help your business stand out to top job candidates. Offering better benefits correlates with hiring better candidates.

- Stronger employee morale and retention. Just as offering 401 contribution matching can draw better recruits to your business, this benefit can also improve employee morale and retention at your company.

- Employer tax benefits. There are tax savings that businesses can take advantage of by offering 401 employer matching. Tax laws allow employers to claim their matching contributions as tax deductions.

Key takeaway: Offering a 401 employer match program can attract stronger new hires, reduce taxable business income, and boost employee morale and retention.

Also Check: Can I Roll My Roth 401k Into A Roth Ira

When Your Company Is In Poor Financial Shape

If your company is not healthy, Stuller recommends looking to shore up your own personal financial and career situation before worrying about retirement, a move that others echo.

One of the first options is getting your emergency fund in order while you can. Experts recommend having at least six months of expenses on hand, but in tougher times having more is not going to hurt you. You can always return to contributing to your retirement accounts later.

If you are already struggling to make ends meet or are uncertain about the security of your job, put more cash into a liquid savings account instead, says Laura Hearn, CFP, a wealth advisor at RMB Capital in Chicago. Why? If you increase the savings to your 401 and find yourself crunched for cash, tapping into your 401 savings can be costly.

Hearn notes that 401 withdrawals will incur a 10 percent bonus penalty on top of any taxes already due on distributions, if youre under age 59 1/2.

If you cant make up for the lost match this year due to uncertainty of cash flow, dont fret, says Hearn. One year of not having a company match savings is unlikely to derail your long-term financial plan.

From here you can then think about the next best move, both financially and career-wise.

Annual Limits For An Employers 401 Match

The 2020 and 2021 annual limit on employee elective deferralsthe maximum you can contribute to your 401 from your own salaryis $19,500. The 2020 annual limit for all 401 contributions, including an employers 401 match and your elective deferrals, is 100% of your annual compensation or $57,000, whichever is less. In 2021, this total rises to the lower of $58,000 or 100% of your compensation.

Considering that surveys suggest many Americans dont have enough money saved for retirement, meeting or exceeding the amount needed to gain your employers full 401 matching contribution should be a key plank in your retirement savings strategy.

Taking into account the power of compounding and a 6% annual rate of return, contributing enough to receive the full employer match could possibly be the difference between retiring at 60 versus 65, said Young.

Use Fidelitys 401 match calculator to find out how matching contributions can impact your retirement savings.

Don’t Miss: Why Rollover Old 401k To Ira

Other Alternatives To Consider

Sometimes in personal finance there may not always be a trade-off for a decision. That might be the case now with low mortgage rates. If your financial situation is strong and maybe even if it isnt you may be able to take advantage of historically low mortgage rates to refinance.

Perhaps the best way to take advantage of these record-low interest rates is not within a 401, says Tim Shaler, economist in residence at iTrustCapital in Encino, California. As soon as the Fed and Treasury actions in the mortgage market normalizes originators ability to help borrowers, everyone who can save money should refi their mortgage on their homes.

The savings there could total hundreds of dollars a month alone, depending on the size of your loan. Any money could then be rolled into savings, either to bolster your emergency fund or allowing you to add more into your 401. In effect, you can create your own match via savings.

Id also encourage consumers to look for every dime of benefits at work you may be ignoring, like health savings accounts , says Krueger. These are triple tax-advantaged accounts that can be used for qualifying medical costs in retirement and you dont lose the funds like flexible spending accounts .

What Is A Good 401k Match

401k matching policies amongst different employers can be very inconsistent.

According to the BLS, only 56% of employers even offer 401 plans, and among those 49% match 0%, 41% will offer a match equivalent to 0-6% of the employees salary, and 10% will offer a match of 6% or more.

So if you have a employer that matches 6% or more of your 401 contribution, that is extremely good! You should make sure to take advantage of this opportunity to pad your retirement savings.

Don’t Miss: Can You Roll A 401k Into A Self Directed Ira

Taxes And Employer 401 Matching Contributions

You dont have to pay any income taxes on employer 401 matching contributions until you start making withdrawals.

Gross income includes wages, salaries, bonuses, tips, sick pay and vacation pay. Your own 401 contributions are pre-tax, but still count as part of your gross pay. However, your employers matching contributions do not count as income, said Joshua Zimmelman, president of Westwood Tax & Consulting.

Your employers matching contribution grows tax-deferred in a traditional 401, boosting your compounding returns over the years. You dont have to pay any taxes on the employer match until you start making withdrawals, said Zimmelman. Traditional 401 withdrawals are taxed as ordinary income at whatever tax bracket youre in when you make those withdrawals..

What Is 401 Matching

401 matching is when your employer makes contributions to your 401 on your behalf. It is called matching because the contributions your employer makes are based on employee contributions i.e. the contributions you make.

For example, you employer can offer a 100% match on up to 5% of your income. That means, for every dollar you contribute to your 401, up to 5% of your paycheck, your employer will also contribute one dollar.

100% Match on 4% of income at $50,000 salary.

| Your contribution | |

| $5,000 | $2,000 |

Once you contribute up to the matching limit, which in this example is 5% of your income, your employer stops contributing, but you can continue to contribute. That means that you want to contribute up to the matching limit if at all possible, to get the most value out of the match.

Employer matching plans can get complicated depending on your employer. Some employers offer graduated matching tiers, such as 100% match on the first 4% of income and a 50% match on the next 4%, giving you a 6% contribution if you make an 8% contribution.

100% Match on 3% and a 50% match on the next 3% of income at $50,000 salary.

| Your contribution |

| $2,250 |

Read the specifics of your plan to learn exactly how much your employer will contribute and how much you need to contribute to max out the benefit.

Also Check: What Percent Should You Put In 401k

Are There Rules For 401 Matches

Employees can make pre-tax contributions to a 401 plan up to the $19,500 maximum for 2020 and 2021 . Employer contributions may lead to a total contribution in excess of $19,500* that is, theyre outside the annual contribution limit applied to employees.

An employer is typically the one to set rules around their maximum contributions. Its largely driven by the matching formula and rules that the employer lays out.

One more caveat to know here: If the employee is also the employer, e.g., if they are self-employed, then an employee can contribute up to $57,000 for 2020 *, or 100% of their compensation, whichever is less.

*$19,500 if theyre under age 50 $26,000 is the annual contribution limit for employees if the employee is age 50 or older. $57,000 is the total if youre under age 50. If youre age 50 or older, the $6,500 catch-up contribution can be added on top.

Do I Qualify For My Employers 401 Matching Program

If you started a new job, you should find out if your new employer has a 401 matching program and the eligibility requirements for new employees. Employee eligibility is at the employerâs discretion, and most employers may require the employee to have worked for the company for a specific period to get the benefit. Some companies may also offer 401 matching to the top executives as part of the employee compensation plan to retain top talents.

If you were recently enrolled in the employer’s matching program, but don’t know how it works, you should talk to the human resource manager or 401 plan administrator to get more information on the matching program. You should ask about the type of matching offered, whether it is a partial or full match, and the matching limits. You should contribute the highest amount that allows you to collect the full employer’s match, without stretching your finances beyond what you can afford.

Read Also: Should I Transfer 401k To New Employer

Can I Contribute More Than What My Company Will Match Should I

You can contribute a higher percentage of your salary than what your employer will match, as long as you dont exceed 401 contribution limits.

Whether you should contribute more to your employers 401 plan after youve received the full match depends on your individual situation.

Dont guess what youll need for retirement. Get clarity about how much you ultimately want to save before making decisions on how much to contribute to your 401. Goal Investor can help you run the numbers.

You could also invest in an individual IRA or Roth IRA once youve earned the full matching contributions to your workplace retirement plan, for instance. Often, IRAs have more flexibility in investment choices and receive unique tax treatments.

How 401 Matching Contributions Work

The 401 plan is one of the most popular retirement savings programs in the U.S., and the company match is one of the easiest ways for workers to quickly accumulate extra retirement funds. Workers contribute directly from their paychecks, and the company contributes additional funds, often as much as 3 to 5 percent of the workers salary each year, depending on the plan.

Some employers require that matching contributions vest over time, usually three to four years. Often each year a portion of the employer match vests, giving you legal ownership of it. So you may not have a full claim on the matching contribution until a few years have passed.

A 2019 study by Natixis Investment Managers of 700 workers with defined contribution plans such as a 401 found that the top reason for participating was the company match. And 57 percent said that a larger match would incentivize them to save more.

Don’t Miss: How To Get My 401k Money From Walmart