The Takeaway: Solo 401 Vs Sep Ira

If youre deciding between a solo 401 and a SEP IRA, and you have employees, the choice is easy: SEP IRA. You cant open a solo 401 plan if you have an employee other than your spouse.

But if youre self-employed with no employees, the choice depends on how much you plan to save. If you cant put away more than $6,000, you should go with the SEP IRA until you can afford to save more. If you dont want to defer taxes, you may want to open a solo Roth 401 or a Roth IRA, depending on how much you can save.

Vs Simple Ira: Which Is Right For Your Business

401 or SIMPLE IRA?

Whether youre just looking to confirm a choice or havent even begun to make one, you know this is an important decision. The kind of plan you pick could have an enormous impact on the finances of everyone involved in your business.

But retirement plans are complex. With all the nuances and complicated jargon, it can be really tough to know which plan is best for your small business.

So with this guide, were going to take a different approach.

Rather than hitting you with vague pros & cons or a massive, jargon-filled table, well instead drill into the 4 key ways 401s and SIMPLE IRAs differ.

Well use real world numbers, as well as the expertise weve gathered servicing over 5,000 small business retirement plans, to provide you with an easy-to-understand comparison between the two plans.

Ready to get started? Lets drill right in.

Ira Vs : Which Is Better For You

Disclaimer: This post may contain affiliate links. Please read my disclosure for more information.

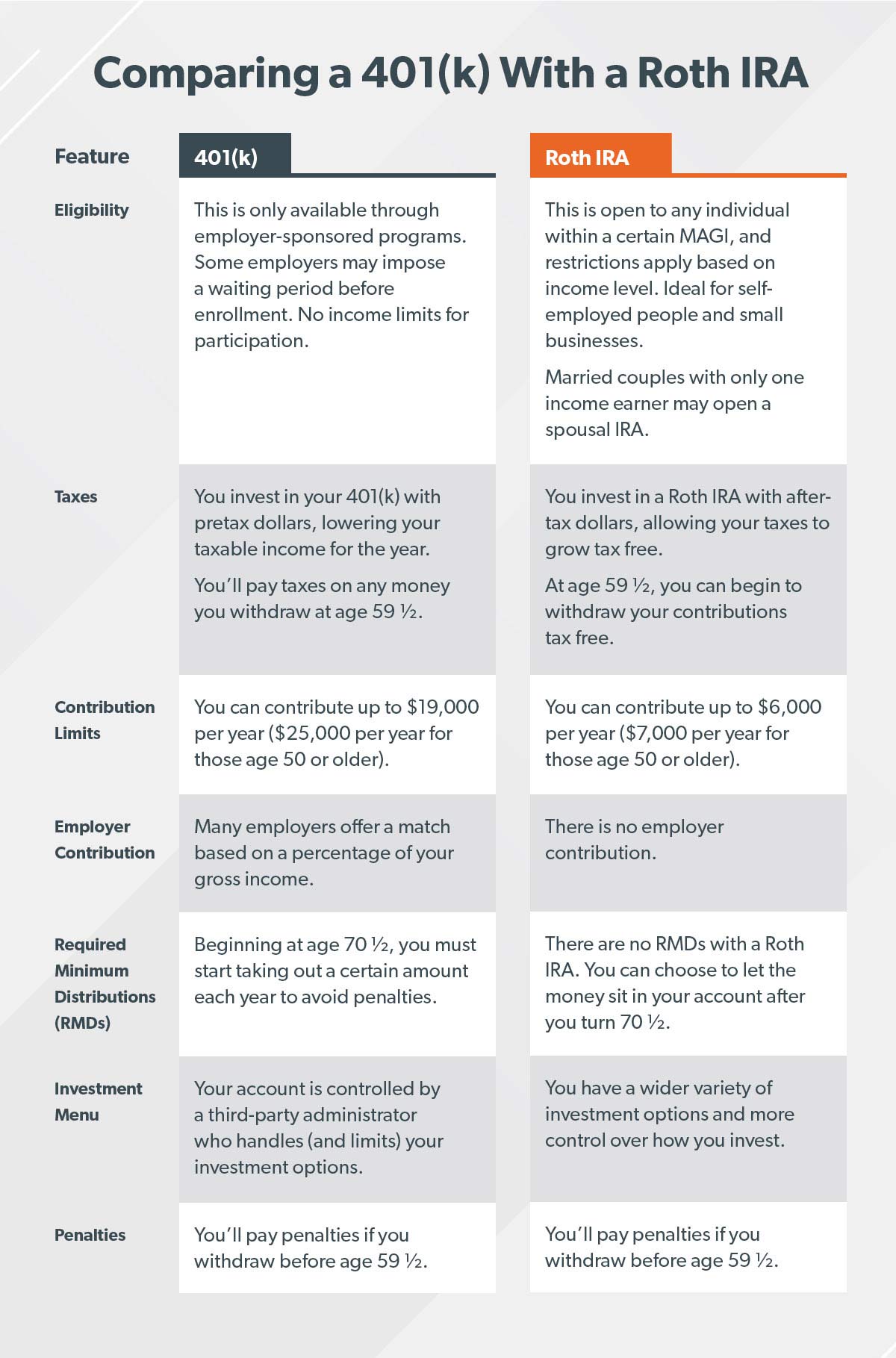

IRA vs. 401 whats the difference, and which is better for you? IRAs and 401s are two different retirement plans that allow individuals to invest and save for retirement. Saving in either is a great way to set money aside for retirement because they both have valuable tax benefits and offer potential investment gains.

The simplest way to differentiate these two retirement plans is to understand that a 401 is available to you through your employer, and an IRA is something you set up for yourself.

Both of these plans grow tax-free, which means theres no tax on the interest and earning over the years, and that makes them a great way to set money aside for your golden years.

Ready to learn more? Lets get started!

Don’t Miss: How To Select 401k Investments

S Are Great But They Can’t Match These Other Accounts In Terms Of Flexibility

A 401 is the go-to retirement account for most workers who have access to one, but it’s not the best choice in every situation. There are other places you can stash your savings that offer greater flexibility and control over your investments. Here are three you should consider adding to your retirement plan.

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Read Also: How Much In 401k To Retire

When An Ira Is Better

An IRA could be better than a 401 if you’re looking for more flexibility in your retirement planning.

“Unlike a 401, with an IRA the investment world is at your fingertips,” says Taylor J Kovar, Certified Financial Planner and CEO of Kovar Wealth Management. “Stocks, bonds, mutual funds, and real estate are all available while with a 401, you are limited to just the funds the plan allows you to invest in.”

Another reason why an IRA could be a better option is if you currently have low tax rates but anticipate higher tax rates during retirement. By contributing to a Roth IRA, you’ll pay your taxes upfront so your growth and withdrawals during retirement are tax-free.

Not all employers offer a 401 plan, so an IRA is one of the best alternatives to help you save for retirement on your own.

| Pros | |

|

|

Tip : Tax Rateshigher Now Or Later

Retirement accounts like 401s, 403s, and IRAs have a lot in common. They all offer tax benefits for your retirement savingslike the potential for tax-deferred or tax-free growth. The key difference between a traditional and a Roth account is taxes. With a traditional account, your contributions are generally pretax. They generally reduce your taxable income and, in turn, lower your tax bill in the year you make them. On the other hand, you’ll typically pay income taxes on any money you withdraw from your traditional 401, 403, or IRA in retirement.

A Roth account is the opposite. Contributions are made with money that has already been taxed , and you generally don’t have to pay taxes when you withdraw the money in retirement.1

This means you need to choose between paying taxes now or in retirement. You may want to get the tax benefit when you think your marginal tax rates are going to be the highest. In general:

Don’t Miss: Is 401k The Best Way To Save For Retirement

Insane Reasons A Roth Ira Is Better Than A 401k

Did you know that saving for retirement in a Roth IRA might be better than a 401k?

There are hardly any instances where I would not recommend the benefits of a Roth IRA in addition to a 401k, especially for young people saving for retirement in their twenties and thirties.

Dont get me wrong, I love 401ks too!

They allow you to save money on taxes now and give your employer a chance to save toward your retirement as well.

But if youre already contributing enough money to get your full employer 401k match, it might make sense to invest additional money into a Roth IRA instead of putting more money into your 401k.

A Roth IRA is also a great choice for those who might not have a 401k match, or a 401k at all through their employer!

There are a handful of reasons why a Roth IRA is better than a 401k, and Ill highlight some of these unique benefits in this article!

If youre confused on whether or not you should open a Roth IRA in addition to your 401k, these reasons will shed some light on how powerful Roth IRAs are, and convince you to open one if you havent yet!

In This Post, We’ll Talk About…

Plans May Offer An Employer Match

While they might be harder to obtain, 401 plans make up for it with the potential for free money. That is, many employers will match your contributions up to some level.

401s sometimes will have a match depending on the employers generosity and financial position, says Michael Lackwood, founding principal of New York City-based Spring Delta Asset Management. If your employer does offer a match, it makes most sense to contribute to the 401 at least up to the maximum percentage match.

For example, if you contribute 4 percent of your salary, your employer may offer 2, 3 or 4 percent, as an inducement to help you save. Thats free money and an immediate return on your investment.

In contrast, youre on your own with an IRA, and your funds will consist only of what you contribute and any earnings on those contributions.

Also Check: What To Do With 401k When You Retire

A Roth Ira Gives You More Control Over Your Account

Have you ever logged in to your 401ks website and looked at the choices you have to invest in?

You probably only have a dozen or so to choose from, and even fewer good options. Most 401ks have relatively high management fees as well.

Opening a separate Roth IRA gives you a smorgasboard of fund options.

You have the choice to select from thousands of diversified, low-cost index funds instead of whatever BS high-fee funds are available in your 401k.

You can pick the best ones out of a much longer list than whats available in your 401k.

Better funds = better performance = more money in retirement!

Roth Ira Vs : Which Is Best For You

The fastest way to determine whether a Roth IRA or 401 is better for you is to look at whether or not your employer matches. If your employer is willing to match your contributions up to a certain amount, it can be a great option to open a 401. Any matching contributions will bolster your retirement savings and allow you to grow those funds. If your workplace does not offer to match, a Roth IRA may provide the freedom to choose from a wider range of investment types. This freedom could allow you to grow your funds at a potentially faster rate. However, always check in with your financial situation and mind due diligence before choosing the right account to start with.

Recommended Reading: When Can You Take Out 401k Without Penalty

More Flexible Withdrawal Options

Having a sizable nest egg is one thing. Being able to get at your cash quickly and easily is another. On that score, IRAs have the edge. “IRAs offer more flexible options,” says Sclafani.

The most common distribution option at a 401 plan, for example, is a lump sum, which creates an all-or-nothing choice for the account holder. Having to yank out all your money means it can’t keep growing in the account along with the market. IRAs, however, allow withdrawals at any time and in amounts the account holder chooses.

“401 participants are worried they won’t be able to access their savings, whereas IRAs don’t have those limitations,” says Sclafani, adding that the 401 distribution limits are “at odds with the concept of re-creating a regular paycheck” in retirement.

Both IRA and 401 participants can take money from their plans after age 59 1/2 without tax penalties from the Internal Revenue Service.

Who Should Use A Roth Ira Roth 401

So, experts concur that if you’re a young worker in the early part of your career, you’re almost certainly better of with a Roth IRA or Roth 401.

How young? How many years until retirement?

Most future retirees should use Roths because tax rates are bound to climb, says Ed Slott, founder of IRAHelp.com.

“That said, If I had to put an age on it, I would say anyone under age 50 should be going all Roth,” Slott added. “The younger you are the more years away from retirement the more likely it is that your tax rates will be raised when you begin withdrawing in your retirement years.”

Recommended Reading: How Often Can I Rollover 401k To Ira

You Can Take A Loan On A 401

Generally if you take out cash from an IRA or a 401, youll likely be charged taxes and penalties. But the 401 may allow you to take out a loan, depending on how your employers plan is structured.

Another clear advantage is that you can take loans from a 401 and continue to contribute to your 401, says Lackwood.

Like a normal loan, youll have to pay interest, and youll have a repayment period, not more than five years. But the rules differ from plan to plan, says Lackwood, so youll have to check on your specific 401 rules to see what youll need to do.

You can also take cash from a 401 for a hardship withdrawal, and you can do so from an IRA, too. But the terms in each case are strict.

401s allow for emergency withdrawals, but most plans offered through employers are very rigid and dont have much flexibility, says David Wilson, CFP and founder of Planning to Wealth.

But taking a non-retirement withdrawal can drastically set back your retirement plans.

What Is Roth Ira

A Roth IRA is a retirement account that allows you to make contributions from post-tax earnings, meaning that qualified contributions are NOT eligible to be deducted from your taxable income. The biggest benefit of a Roth IRA is that earnings can be withdrawn tax-free once you turn 59 ½ years old or for other qualified expenses.

You May Like: How Do You Move Your 401k When You Change Jobs

You Can Leave More Money Behind To Your Heirs

Because Roth IRAs dont come with RMDs, they allow you to leave a substantial amount of wealth to your heirs. If thats something you want to do, then it pays to favor a Roth IRA over any other retirement plan.

5 Winning Stocks Under $49We hear it over and over from investors, I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. Id be sitting on a gold mine! And its true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of 5 Growth Stocks Under $49 for FREE for a limited time only.

Microsoft and partners may be compensated if you purchase something through recommended links in this article.

Roth Ira Vs Traditional Ira

The short answer is that you should use the one that leaves you more money after you’ve paid taxes.

That generally boils down to one factor: if you expect your tax rate to rise when you start to take withdrawals which, odds are, is in retirement then a Roth IRA is typically better for you.

Here’s another way of looking at that: Generally, the younger you are now, the more likely it is that your tax rate will be higher in retirement, years or decades in the future.

Also Check: Should I Invest In 401k

Compare 401 Vs Ira Retirement Plans

Both 401 and IRA plans allow investments to grow tax-deferred. Where 401 and IRA plans mainly differ is in contribution limits, fees, tax breaks and investment options.

Contribution limits in a 401 plan are higher than in a traditional IRA or Roth IRA account. The range of investment options is generally limited in a 401 employer-sponsored plan compared to a self-managed IRA. Roth IRA contributions are not deductible and qualified distributions are not taxed. Contributions to a traditional IRA or 401 are tax-deductible but qualified distributions are taxed as ordinary income in retirement years.

The breakdown of how traditional IRA and Roth IRA plans compare to each other and to 401 plans is shown below. If you decide upon an IRA, compare among the best IRA providers.

S Let Employers Contribute More To Key Employees

When accounting for both the employee deferrals and the employer contribution, the maximum the IRS allows to be put into a defined contribution retirement plan is $58,000 a year . Reaching that limit, however, is only possible with a 401.

401 plans allow employers to make profit sharing contributions. Depending on the formula used, these contributions can allow business owners to funnel large sums of money to themselves, or to make generous contributions to key employees.

If youre a real high roller, 401s can also be combined with cash balance retirement plans, which can allow you to contribute more than $200,000 in pre-tax retirement savings depending on your age.

This makes 401 plans vastly superior for any business whose owners or employees are high-earners who want to maximize their retirement savings.

Heres a table to sum it all up:

|

401 vs SIMPLE IRA – Which is Better for Building Wealth? |

||

|

Defined contribution maximum limit |

$58,000 |

401s are powerful tools for building wealth, but thats not the only reason theyre so popular

Recommended Reading: What Is Max Amount You Can Put In 401k

Iras Require Some Investment Knowledge

The flip side of having many investment choices in an IRA is that you have to know what to invest in, and many participants simply arent in a position to do that. And thats where a 401 may offer a better option for workers, even if the investment selection is more limited.

A 401 is often turnkey, says Claire Toth, senior wealth strategist at Peapack-Gladstone Bank in Summit, New Jersey. Set it and forget it.

So while a 401 may offer fewer choices, says Toth, they do provide okay default investment options for participants without knowledge and they may offer coaching to help participants understand their choices.

Still, if you do have that knowledge already, Lackwood says, you can manage your IRA how you see fit with quick attention and with possibly less administrative cost.

Saving For Retirement: 401 Ira Or Both

According to recent research, 31% of Americans have an individual retirement account and 32% save in a 401 plan, making them among the most popular ways to save for retirement.

Both types offer tax advantages and feature similar treatment of contributions and distributions. But the two differ in many other ways. Below are summaries of their key features.

Also Check: Can You Withdraw Your 401k When You Leave A Company