Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $19,500 in 2021 and 2020 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

How Do The Immediate Tax Savings Work With My 401 Account

Jenae earns $75,000 per year and doesnt contribute to a retirement plan. Jenae is single with no dependents. She is eligible for one personal exemption of $4,050 and the standard deduction of $6,300 for a total deduction of $10,350. Jenae will owe $11,933.75 in Federal income tax. Heres how her tax return will look:

-

Adjusted gross income: $75,000

-

Taxable income: $64,650

-

Tax due : $11,933.75

Now, imagine that Jenae to her 401 account. Her adjusted gross income is reduced from $75,000 to $57,000 and her Federal tax liability decreases to $7,433.75 from $11,933.75 for a 37.71% savings. Heres Jenaes tax picture after contributing $18,000 to her 401:

-

Adjusted gross income: $57,000

-

Taxable income: $46,650

-

Tax due : $7,433.75

So, the immediate tax benefit of contributing the maximum amount allowed by law to a 401 is a juicy 37.71% tax savings, or $4,500 for Jenae.

Are Roth Iras Still A Good Idea

If you have earned an income and meet income limits, a Roth IRA can be an excellent tool to save for retirement. But remember, its only part of an overall retirement strategy. If possible, its a good idea to contribute to other retirement accounts as well.

Is a Roth IRA a good idea right now?

Roth IRAs are ideal retirement savings accounts if youre in a lower tax bracket now than you expect to be in retirement. Millennials are well positioned to make the most of the tax benefits of a Roth IRA and decades of tax-free growth.

Are ROTH IRAs high risk?

But they should follow Thiels example in one respect: Roths accounts are a great place for high-risk, high-return investments. Unlike a traditional individual retirement account or 401, Roths are funded with after-tax dollars.

Read Also: Do I Have To Pay Taxes On 401k Rollover

Solo 401k Contribution Limits And Types

IRS records show that, in Tax Year 2014, an estimated 53 million taxpayers contributed almost $255 billion to tax-qualified deferred compensation plans. A popular form of deferred compensation plans, known as a solo 401 plans, permits employees to save for retirement on a tax-favored basis.

Video Slides:2020 & 2021 Solo 401k Annual Contribution Deadline

First Place To Look: Iras

Contributing to an IRA in addition to your 401 is one option. Whether you contribute to a Roth IRA or a traditional IRA, your money will grow tax-free until you retire just as it does in your 401k. Once you start making withdrawals, you’ll pay income taxes on the money you withdraw from your traditional IRA or 401k, but not on withdrawals from your Roth IRA. However, a Roth doesn’t give you a tax deduction or tax savings in the year in which you make the contribution unlike a traditional IRA or 401.

Read Also: How Many Loans Can I Take From My 401k

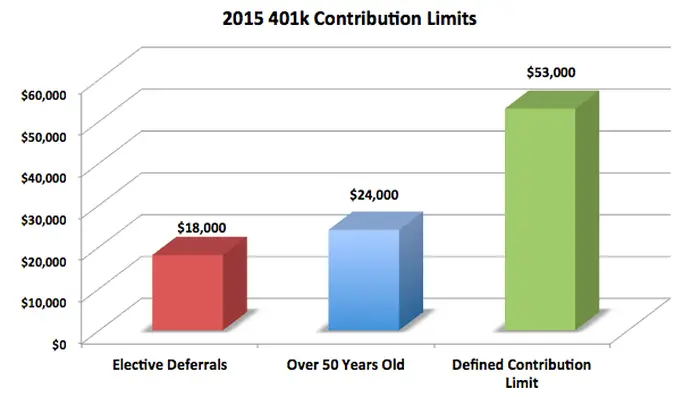

Do 401 Contribution Limits Include Employer Match

401 contribution limits only apply toward the employees contributions. For example, an employees 2020 contribution limit is $19,500. An employers match doesnt count toward that contribution limit, but the employer match does have its own separate limit and theres a cap on the total contribution amount from the employee and employer combined.

For instance, an employee can contribute up to $19,500 each year toward their 401 plus the employers matching contribution. The employer can match the employee contribution as long as it doesnt exceed the separate $57,000 employer-employee matching limit.

Retirement Contribution Limits And Income Ranges: What To Know

If youre proactive about retirement savings or want to up your savings game this year, you may already know that retirement contribution limits stayed the same for 2021. Let’s break down what this and other recent changes can mean for your retirement plans, whether youre already saving or just getting started.

Also Check: How Much Should I Put In My 401k

How Is Roth 401k Calculated On Paycheck

Calculating Roth 401 Withholding First, divide your annual salary by the number of pay periods per year to calculate your gross income per pay period. Second, multiply your gross income per pay period by the percentage youve elected to contribute to your Roth 401 plan to determine your 401 plan withholding.

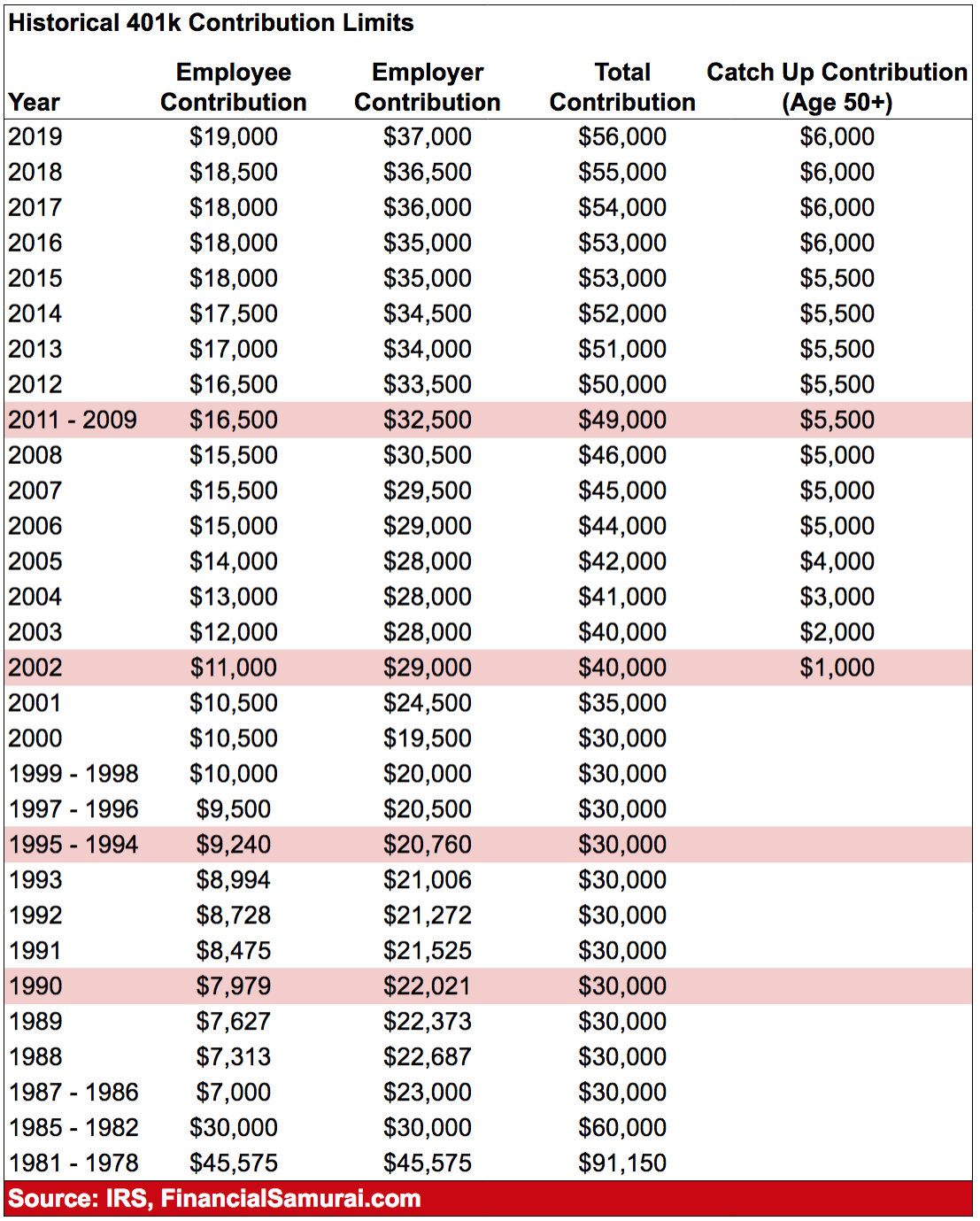

Contribution Limits : How They Differ From 2020 And 2019

The 401 contribution limit for 2021 stays flat with 2020. The IRS lifted basic 401 contribution limits for 2020 to $19,500. And it raised the catch-up contribution cap for the first time in five years.

If you’re aged 50 or older, 2020 was even more of a boon for your 401. The so-called catch-up contribution limits, for older workers, also rose to $6,500 for 2020. Before this year, catch-up contributions stayed the same, $6,000, from 2015 through 2019.

Also Check: Can I Borrow From My 401k

Other Important Financial Goals To Consider

Based on your own unique financial situation, you should keep a few other things in mind as you decide how much to contribute to your 401:

- Do you have a formal estate plan with wills and other critical papers ?

- Can you cover health care expenses? If you have a high-deductible health plan with a health savings account combo, make sure you are putting enough into your HSA to cover medical expensesboth now and in the future.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more?

- If you’re nearing retirement, do you have long-term care plans in place?

Employer Plans May Differ

The IRS contribution limits are ceilings for the amount that you can contribute each year, meaning employers may set lower limits. In addition, employers do not have to allow for catch-up contributions. However, if you work for multiple employers, you may be able to get around this restriction by contributing money to both companies’ plans. For example, in 2012 the elective deferral limit, not including catch-up contributions, is $17,000 and $22,500 including catch-up contributions. If you work for two companies that do not permit catch-up contributions, you could contribute $11,250 to each company’s plan. In doing so, you stay under each plan’s limits and under the IRS’ annual limits.

References

Writer Bio

Based in the Kansas City area, Mike specializes in personal finance and business topics. He has been writing since 2009 and has been published by “Quicken,””TurboTax,” and “The Motley Fool.”

Don’t Miss: Should You Always Rollover Your 401k

How Much Can A Married Couple Contribute To A 401

The amount you contribute to your own 401 does not impact the amount your spouse can kick into his or her own 401, if you both are members of 401 plans at work.

Both of you can contribute up to the annual maximum 401 contribution limits allowed. In 2020, that’s $19,500 plus up to an additional $6,500 if each of you is age 50 or older.

And both of you are eligible for company contributions, if your employer offers any.

Contribution Limits In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Read Also: How To Get Money Out Of 401k Without Penalty

Work With A Financial Advisor

Whether you have questions about your 401 investment options or want to open up a Roth IRA, working with a trusted and qualified financial advisor can go a long way. They can help answer all your investing questions and give you the guidance you need to start investing for retirement and building wealth.

Dont have an advisor? We can help with that! Our SmartVestor program can connect you with up to five financial advisors who are ready to help you take the next step toward the retirement youve always dreamed about.

Ready to get started? Find your SmartVestor Pro today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

What Is The Maximum An Employer Can Contribute To Your 401 In 2021

One of the best things about a 401 is that most employers offer some kind of match on your contributions, usually up to a certain percentage of your salary. In fact, about 86% of companies with a 401 plan provide a match on employee contributions.2 And the average employer 401 match is around 4.5% of your salary.3 Thats great news for you. After all, an employer match is basically free money!

But there is a limit on how much you and your employer can put in together. Between you and your employer, the maximum that can be put into your 401 in 2021 is $58,000 .4

Also Check: How To Move 401k To Another Company

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Is A Roth Ira A Good Idea Right Now

Roth IRAs are ideal retirement savings accounts if youre in a lower tax bracket now than you expect to be in retirement. Millennials are well positioned to make the most of the tax benefits of a Roth IRA and decades of tax-free growth.

Can a Roth IRA make you a millionaire?

Fully fund a Roth IRA each year, build a diversified portfolio, and you can become a millionaire in time to retire. As long as you start early enough.

How much does a Roth IRA grow in 10 years?

Typically, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and you have just opened a Roth IRA, $6,000 in contributions each year for 10 years with an interest rate of 7% would accumulate to $83,095.

Recommended Reading: How Much Income Will My 401k Generate

Contribution Limits : You’ve Got Time

You’ve got about two months left in 2020 to jack up your contribution level, if your employer lets you. And chances are you are not yet saving the maximum allowed. During 2019, only 12% of members of 401 plans overseen by Vanguard were ponying up the basic maximum permitted. And only 15% of plan members age 50 or older took advantage of their right to kick in up to another $6,000.

Taking advantage of opportunities to contribute to your 401 account matters. Turbocharged by tax deductions and tax-deferred earnings, 401 plans are the most common retirement savings plans in the U.S., says the American Benefits Council. One key survey shows that 401 and similar plans are the only retirement savings programs offered to new hires by 81% of firms.

So how much can you put into your 401? What are the 401 contribution limits for 2021 and 2020?

Highlights Of Changes For 2022

The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased to $20,500, up from $19,500.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements , to contribute to Roth IRAs, and to claim the Saver’s Credit all increased for 2022.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. Here are the phase-out ranges for 2022:

- For single taxpayers covered by a workplace retirement plan, the phase-out range is increased to $68,000 to $78,000, up from $66,000 to $76,000.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is increased to $109,000 to $129,000, up from $105,000 to $125,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the phase-out range is increased to $204,000 to $214,000, up from $198,000 to $208,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and remains $0 to $10,000.

Don’t Miss: How To See How Much Is In My 401k

Key Employee Contribution Limits That Remain Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

The catch-up contribution limit for employees aged 50 and over who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan remains unchanged at $6,500. Therefore, participants in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan who are 50 and older can contribute up to $27,000, starting in 2022. The catch-up contribution limit for employees aged 50 and over who participate in SIMPLE plans remains unchanged at $3,000.

Details on these and other retirement-related cost-of-living adjustments for 2022 are in Notice 2021-61 PDF, available on IRS.gov.

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $56,000 for 2019, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,000 employee contribution to the Roth solo 401k for 2019, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,000 employee contribution on the Roth solo 401k. Note that you can also split up the $19,000 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,000 of catch-up contributions to work with if you are age 50 or older in 2019 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

You May Like: Why Cant I Take Money Out Of My 401k

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Taking out a loan.

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn 55 or after

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Last year, due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allows. These withdrawals had to be before the end of 2020. If you took a hardship loan in 2020, you can avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years. Consider consulting with a tax professional as you prepare your taxes if youre in this position, since it involves filing amended returns.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Read Also: How Do I Transfer My 401k To A Roth Ira