And 2018 401k Contribution Limits

In the 2017 tax year, the contribution limit per year per person was $18,000, meaning you could not contribute more than that total in the year 2017 to your 401k. The figure went up to $18,500 for 2018, and it may increase again in the future to account for inflation.

For example, if you make $200,000 per year and contribute 10 percent of each paycheck’s pretax dollars, you’ll be over the limit, as your contributions would reach $20,000 for the year. Your plan will stop taking contributions after you reach $18,500. However, if you turned 50 during the calendar year or you are over 50, you may be able to make additional contributions depending upon the type of 401k plan and how much you’ve already contributed. These “catch up” contributions are $6,000 for traditional and safe harbor 401k plans or $3,000 for SIMPLE 401k plans.

Importantly, your 401k contribution limit only applies to your contributions, not to your employer’s matching contributions. If you contribute the max $18,500 from your pay in 2018, your employer’s additional contributions are still permitted.

References

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Phathom Pharmaceuticals Announces New Data At Acg 2021 Annual Scientific Meeting

For people who have to consider what they can afford to contribute, the best advice is to regularly check up on their 401 status. Every quarter or so consider how much you are dedicating to your retirement account, compare it to the cap and check to see if you can budget for a little bit more. As you get older, work harder to increase those contributions, and perhaps even consider signing up for an automatic increase plan if your employer offers one.

The standard advice is to try and contribute between 15% to 20% of each paycheck to your retirement account. For many people, this is an enormous amount of money, but it is possible. The median American makes approximately $59,000. This means finding of $9,000 in the budget . It won’t be easy, which is why you should make it an active part of your budgeting process. If you treat your 401 like a fire-and-forget, it will be easy to miss opportunities to put more money in.

Also Check: How To Know If I Have 401k

How This Should Impact Your 401 Deferral Strategy

The purpose of an employer match is to get employees to contribute to their 401 plans. Vanguards figures suggest this is fairly successful 65% of 401 plan participants contribute at least enough to qualify for the maximum employer match available from their plans.

The flip side, though, is that this means over one-third of plan participants are not contributing enough to maximize the money they could be getting from their employers.

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Also Check: Should I Rollover My 401k When I Retire

Calculate 401 Future Value And Retirement Income

This 401 Retirement Calculator will calculate how much your 401 will be worth by the time you reach the age you plan to retire.

The calculator includes options for factoring in annual salary increases and employer matching contributions. You can also print out printer-friendly reports for any number of what-if scenarios.

Finally, the calculated results include a year-by-year salary, contribution, and balance chart, plus a written summary.

If you want to see how your 401 fits within your overall retirement needs I suggest you visit the comprehensive Retirement Plan Calculator.

Save Your Raise? What a Great Idea!

What led to the creation of this calculator was the following excerpts from an email I received from a visitor to the site.

I have searched the web over for something I thought would be there but isn’t. I work at a large company where we are encouraged to save our raise by upping the % we contribute to our 401K each year. With “save your raise” being such a common slogan, I would think that a calculator that helped you realize the benefits of doing that would be out there. I would love to see one. — Trey

Of course, the first thing I realized after receiving the email is that I didn’t have a 401 calculator on the site, much less have one with a “Save Your Raise” feature.

Thank you, Trey, for taking the time to submit your valuable and enlightening request.

Take Stock Of Monthly Payments

For some of you, tucking away $19,500 might seem easy in the grand scheme of things. However, dont forget about the other expenses you have to prioritize. Imagine, for example, that you make $150,000 per year. After taxes, lets estimate that your take-home pay is around $90,000 per year, approximately $7,500 per month. Thats nothing to sneeze at, but you also have a mortgage or rent payment to think about. The national average monthly mortgage at that income level is around $1,600. Now youre down to $5,900 per month. Think about any debt youre trying to pay down. According to Student Loan Hero, the average monthly student loan payment is $351 . The average American has $6,375 in credit card debt. Then there are other expenses groceries, utilities, car payments, kid-related expenses, and other investments. Finally, factor in a $1,583.33 contribution to your 401k. Even though that contribution is pre-tax, your take-home pay may decrease faster than you realize, so its important to take a comprehensive look at your finances to understand what maxing out your 401k will look like on a month-to-month basis.

Read Also: How Much Will My 401k Grow If I Stop Contributing

Nice Jobcongratulations On Taking Advantage Of Your Company’s Employer Match To See How Your Money Is Going To Grow Over Time Try Out Our Compounding Calculator

This calculator is intended as an educational tool only. John Hancock will not be liable for any damages arising from the use or misuse of this calculator or from any errors or omission in the same.

Employer match is not available for all plans. See your Summary Plan Description for availability and information about your employer’s vesting schedule.

John Hancock Retirement Plan Services ⢠200 Berkeley Street ⢠Boston, MA 02116

NOT FDIC INSURED. MAY LOSE VALUE. NOT BANK GUARANTEED

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the “Calculate” or “Recalculate” button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

- Years invested

- Your initial balance

You may change any of these values.

Using the calculator

In the following boxes, you’ll need to enter:

Salary

- Your expected annual pay increases, if any.

- How frequently you are paid by your employer.

Contribution

- The amount of your current contribution rate .

- The proposed new amount of your contribution rate. Be sure to verify the maximum contribution rate allowable under your plan. Also, pre-tax contributions are subject to the annual IRS dollar limit.

Pre-tax Contribution Limits 401, 403 and 457 plans |

|

|---|---|

| 2020 | |

| After 2020 | May be indexed annually in $500 increments |

Employer Match

Investment

- The length of time that you anticipate you will invest this money.

- The amount of your current account balance.

- Your hypothetical assumed annual rate of return.

Also Check: Should I Get A 401k

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

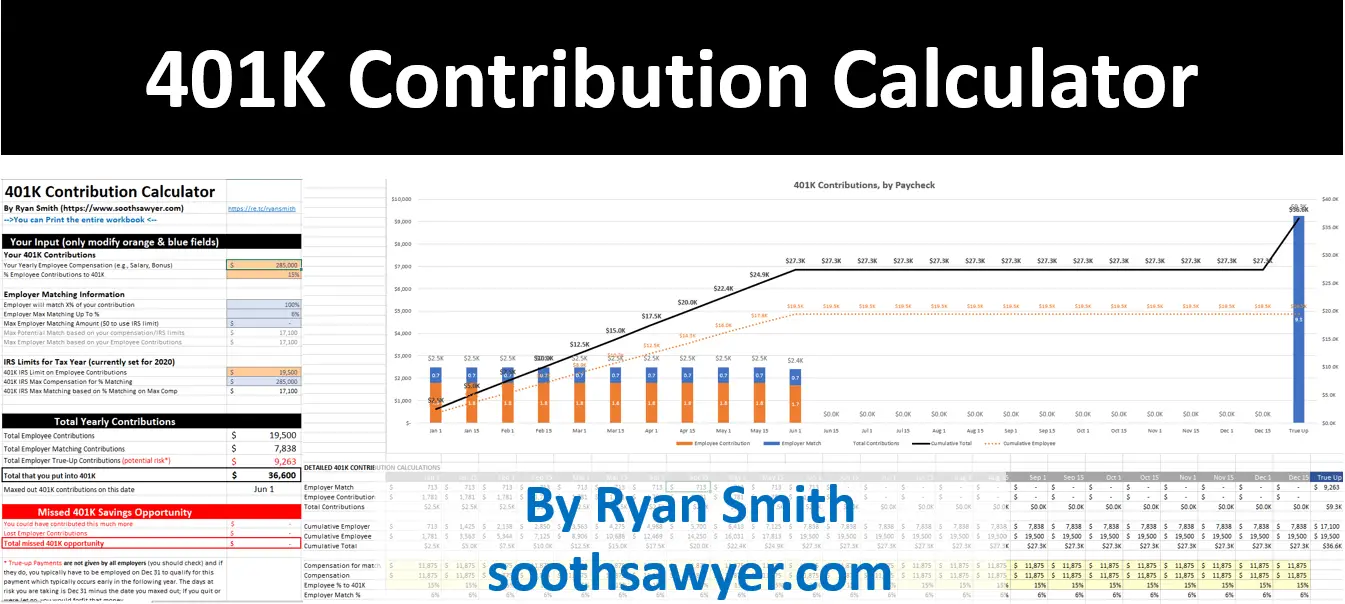

K Max Contribution Calculator For Front Loading Each Year

Last Updated: 3min. read

Ive always tried to front load my 401k contributions to reach the annual limit. Front loading refers to contributing more earlier in the year to get money in the market sooner and then dropping the contribution election down for the rest of the year. For my personal situation, for example, I front load heavily in the first 3 months of the year.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

Also Check: How To Open A 401k Plan

Contribution Limits For 2021

Contributing to your 401 is a great way to prepare for retirement, allowing for tax-deferred growth and, in some cases, employer matching contributions. If you really want to boost your savings, you might even contribute the maximum to the account. For 2021, the 401 annual contribution limit will remain unchanged from 2020 at $19,500. For employees over 50, there are also catch-up contributions. The limits for these will also remain unchanged from 2020 at $6,500. Note that the IRS also has rules surrounding 401 employer matching. Many taxpayers work with a financial advisor to maximize their retirement strategy. Lets take a look at the contribution limits and rules for 2021.

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Don’t Miss: How To Pull 401k Early

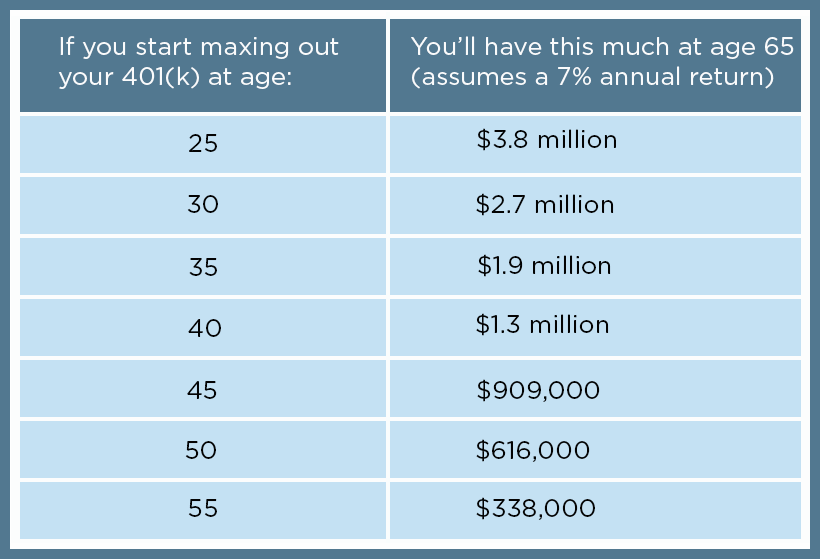

What Else Can You Learn From Maxed Out 401s

From our study, we learned some interesting things about maxed out 401s:

- Ignoring recent account start dates, if you always maxed out your 401 starting in 2009 you have best results out of any year. You’d have seen a huge 12.95% annual return!

- Maxed out 401s that started in 1996 performed the “worst”… but still boast an awesome 8.35% annual return.

- The median annual return if you always maxed out your 401 and started between 1982 and 2018 was 9.46%

- The average annual return if you consistently maxed your 401 and started between 1982 and 2018 was 10.09%

- If you always maxed out your 401, your leverage becomes massive after enough time. Accounts started in 1982 have $3.2 million balances on only $500,000 in personal contributions!

One of the features you can see in our chart is that we estimated annual return percentages if you always maxed out your 401.

This used a function called ‘XIRR’, which we built into our S& P 500 Periodic Investment tool. XIRR allows you to find out the actual return on money based on periodic investments, as opposed to ‘simple’ returns based on a lump sum up front. XIRR is a weighted average, so each month’s contributions matter in the final result.

Tax And Investment Benefits Of A 401

The most notable benefit of a 401 is that all contributions are tax-deferred. Your plan is funded directly from your paycheck, with the money coming out before its subject to income taxes. By reducing your taxable income, youre essentially taking a tax deduction, for now. Furthermore, because less of your paycheck is going towards taxes, youre able to contribute more to your retirement funds.

With a 401, youll have a choice of investing in multiple types of investments. These often include some combination of mutual funds, exchange-traded funds , index funds, bond funds and various market capitalization funds. Many 401 plans provide access to investments called target-date funds, which automatically rebalance your portfolio to reduce riskiness as you approach your target retirement age.

Don’t Miss: Who Has The Best 401k Match

What Are Average 401 Account Balances

Thanks to a Fidelity analysis of Q3 2018 balances we know in 2018:

- The average 401 balance was $106,500

- The average IRA balance was $111,000

Unfortunately, looking only at 401 balances doesn’t tell the whole story, which is why we included IRA balances.

One of the awesome features of 401s is portability. When you leave a job, you are able to roll over your 401 into an IRA.

This means that any study of 401s will have a reverse survival bias – you’ll only see balances for people still with their current company, or who have chosen to not roll over their 401 into an IRA.

Take the two together as roughly $215,000. We estimate that, in theory, any maxed 401 account started before 2012 and invested only in the S& P 500 would already be higher.

Also, see how you would have fared if you always maxed an IRA.

Solo 401k Contribution Calculation For A Sole Proprietorship Partnership Or An Llc Taxed As A Sole Proprietorship

Salary Deferral ContributionAlthough the term salary deferral is used, these businesses do not provide a W-2 salary to the business owner. For businesses of this type, the salary deferral contribution is based on net adjusted business profit. Net adjusted business profit is calculated by taking gross self employment income and then subtracting business expenses and then subtracting 1/2 of the self employment tax. In 2020, 100% of net adjusted business profits income up to the maximum of $19,500 or $26,000 if age 50 or older can be contributed in salary deferrals into a Solo 401k .

Profit Sharing ContributionA profit sharing contribution can be made up to 20% of net adjusted businesses profits. Net adjusted business profit is calculated by taking gross self employment income and then subtracting business expenses and then subtracting 1/2 of the self employment tax. You will want to ask your tax professional for assistance with this calculation.

Don’t Miss: How To Check My 401k Plan

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

- All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

- Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .