Withdrawals For Early Retirees

The IRS has a special rule for people who are forced to leave their job or who retire or quit at age 55 or older. In this case, the IRS waives the 10 percent penalty for taking a 401 withdrawal before age 59 1/2. The 401 withdrawal is still taxable as a normal distribution and cannot be rolled over to an IRA to avoid taxes.

Will A 401 Loan Affect My Credit

Taking out a 401 loan has no direct impact on your credit scores.

- You don’t need a credit check to qualify for a 401 loan, so taking one out doesn’t trigger a hard inquiry and result in a temporary dip in credit scores.

- Payments on 401 loans are not tracked by the national credit bureaus , so they do not appear in your credit reports and cannot factor into credit score calculations. If you miss a payment or even default on the loan, your credit scores will not change.

Note, however, that the extra tax and penalty expenses that come with a 401 loan default can make it difficult to pay your credit bills, which can jeopardize your credit standing indirectly.

What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

Recommended Reading: Where Should I Put My 401k Money

What Is A 401 Loan

If your employer provides a 401 retirement savings plan, it may choose to allow participants to borrow against their accounts although not every plan will let you do so. Borrowing from your own 401 doesnt require a credit check, so it shouldnt affect your credit.

As long as you have a vested account balance in your 401, and if your plan permits loans, you can likely be allowed to borrow against it. Just like with any other loan, youll need to repay a loan from your 401 with interest within a set time frame.

Consider A 401 Rollover

If you take a distribution from your 401 and roll it over to a qualifying IRA within 60 days, there are no taxes or penalties on the money transferred. Like an IRA rollover, this is an option for obtaining a short-term loan after retirement. If you already have an IRA, consolidating all your retirement funds in one account can be easier to manage. Just be sure to deposit all of the funds into the new IRA account in time to avoid taxes or an early withdrawal penalty if you are under age 59 1/2.

You May Like: Can You Withdraw Your 401k If You Quit Your Job

Can 401k Loans Be Paid Off Early

Can 401 loans be paid earlier than the five-year amortizing payment schedule? Find out what the IRS says, and the options you have.

A 401 loan can be a convenient tool if you are looking for a quick source of cash to pay for emergencies. You can borrow from your retirement savings to pay for college, roof replacement, or to purchase your primary residence. Most employers allow employees to borrow from their 401 retirement savings up to 50% of their vested balance up to $50,000.

A 401 participant can decide to pay off a 401 loan early by making extra payments towards the loan repayment. If the plan requires loan payments to be made through payroll deduction, you can adjust the withholding on the applicable paychecks to increase the loan repayments. 401s do not charge early repayment penalties to participants who pay off the loan early. The loan statement will show the additional credits to the loan account, and the remaining 401 loan principal balance.

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

You May Like: What Happens With My 401k When I Quit

Those Who Truly Need It

It really comes down to need. If you need to withdraw your money, then withdraw your money. Thats really the essence of the CARES Act. It simply makes a need-based withdrawal less harmful. If you dont need to, then dont, says Brandon Renfro, a financial advisor and assistant professor of finance at East Texas Baptist University.

Its important to consider what things will be like after you take a withdrawal and once things are back to a new normal. Under the CARES Act, you have to repay your withdrawal within three years. If you just need a withdrawal to get you through the next few months before you start earning regular paychecks again, it could be a good option.

How Borrowing From Your 401 Works

Most 401 programs let you set up a loan all on your own, without any assistance, via the website you use to handle other 401 tasks, such as changing your contribution amounts and allocating your savings to different investment funds.

Setting up the loan is as simple as finding the loan page on the 401 site and specifying the amount you want to borrow. The online form won’t let you borrow more than you’re entitled to, and interest rate and payroll deduction payments based on a standard five-year repayment period will be calculated automatically.

Once you authorize the loan, the amount of the loan will likely be included with your next paycheck .

If you have any questions about the process, you’ll find an option for contacting fund administrators on the webpage.

Read Also: How To Transfer 401k From Fidelity To Vanguard

What Are The Potential Advantages

| Flexibility |

|

|---|---|

| Low rates | |

| Clear & simple |

|

Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

Also Check: Can You Roll A 401k Into A Self Directed Ira

Alternatives To Borrowing Against Your Pension

If you find yourself in a financial bind, dont get a pension advance loan. Try everything else first. Ask your bank or if you are eligible for a short-term loan. Check with your credit card company about a cash advance. The annual percentage rate on a cash advance from your credit card is high, but by any standards, its better than the terms on a pension advance loan.

If you own your home, consider a home equity loan or reverse mortgage. If you are not eligible for any other loan type, contact your creditors and tell them that youre unable to pay and would like to negotiate a payment plan. This is a good time to contact a credit counseling agency.

As a last resort, you can consider bankruptcy. In most cases, your pension is safe if you file for bankruptcy. Even if youre in a panic because of mounting bills, dont sign away the source of income that you will need to live on going forward. Nearly every other financial option is better than a pension advance loan. There are reasons that the Federal Trade Commission , Consumer Financial Protection Bureau, and personal finance experts advise staying away from these loans.

How To Use Your 401k To Buy A House

Buying a home is one of the biggest purchases youll make in your lifetime. If youre like many homebuyers, you may not have abundant amounts of cash lying around to make a substantial down payment. However, the larger your down payment, the lower your monthly mortgage payments will be. For this reason, you might consider borrowing from your 401k for down payment funds.

Read Also: How To Find 401k From An Old Employer

Failing To Repay A 401 Loan

If you fail to make scheduled payments for a 401 loan, the entire remaining balance of the loan will be treated by the IRS as a distribution. Also, if you leave your job before repaying the loan, you have a limited amount of time to repay it or it will be treated as a distribution. A 401 loan thats treated as a distribution is classified as taxable income by the IRS. In addition, workers below age 59 1/2 in this situation are subject to a 10 percent IRS penalty for early withdrawal from their retirement account. Retired workers with reduced incomes should carefully consider 401 loan repayment after leaving the job to avoid the tax penalties for defaulting.

How To Get A Pension Loan

Getting a pension loan is an easy way for an employee to borrow money against their vested contribution. A pension plan is a retirement plan that is sponsored by an employer for the purpose of providing retirement income to employees. The most common type of pension plan is a defined benefit plan, which provides retirees with guaranteed lifetime payments. An employee who borrows against their pension is essentially borrowing their own retirement money and in most cases the proceeds of the loan are treated as a distribution which you do not have to claim on your income taxes unless you go into default.

Don’t Miss: How To Cash Out 401k After Leaving Job

Ways To Help Manage A Margin Line Of Credit

To ensure that you’re using margin prudently, it may be possible to manage your margin as a line of credit by employing the following strategies:

- Have a plan. You should never borrow more than you can comfortably repay. Think about a process for taking out the loan and ensuring that it aligns with your financial situation, and consider how you’ll respond in the event of various market conditions. Among other things, you should know how much your account can decline before being issued a margin call. Find out more on managing margin calls

- Set aside funds. Identify a source of funds to contribute to your margin account in the event that your balance approaches the margin maintenance requirement. This can be anything from cash in another account to investments elsewhere in your portfolio .

- Monitor your account frequently. Consider setting up alerts to notify you when the value of your investments declines by an amount where you need to start thinking about the possibility of a margin call.

- Pay interest regularly. Interest charges are automatically posted to your account monthly. It’s important to have a plan for reducing your margin balance to minimize the interest amount you’re charged which you can do by selling a security or depositing cash into your account.

Loans & Hardship Distributions

As a participant in the Stanford Contributory Retirement Plan , you may be eligible to take a loan from your account balance held in Fidelity and Vanguard funds. Loans give you the opportunity to borrow from your account balance, and then repay yourself.

You may take out a loan against your account balance in your Tax-Deferred Account and/or Contributory Retirement Account, as long as your funds are with Vanguard or Fidelity. To request a loan you must have a total account balance in these funds of at least $2,000. Fidelity and Vanguard funds are subject to certain rules and restrictions, including those set by the U.S. Internal Revenue Service.

TIAA does not allow loans from their investment options.

NOTE: The following information pertains to ordinary loans and hardship distribution rules you may have alternative options in 2020 as provided in the Coronavirus Aid, Relief, and Economic Security Act. Read more about the CARES Act distribution and loans in this FAQ.

Recommended Reading: How To Withdraw My 401k From Fidelity

What Are The Penalties Fees Or Taxes Involved In Borrowing From Your 401

If you borrow the money, youll be required to repay the loan, typically within 5 years. Youll be paying interest while you do it, which is generally at the interest rate of 2 points over prime rate. But the interest will be used to pay yourself, which makes it a bit less onerous. However, remember these loans are paid with after-tax dollars so youre missing out on the tax benefits that make 401 accounts so attractive in the first place.

And note that if you use a 401 loan and then leave your job, the full amount must be repaid before you file taxes for the year in which you left your job . If you dont, it’s considered a withdrawal, which means it will be taxed at ordinary income tax rates.

Not All 401 Plans Will Allow You To Borrow

Not all 401 plans allow you to borrow against your retirement account. If your employer doesn’t permit it, you won’t have this option available to you.

Further, while the CARES Act allows employers to enable larger loans, it doesn’t require them to do so. Even some 401 administrators that generally permit borrowing may not double the loan limits.

You’ll need to check with your plan administrator to see if you’re allowed to borrow at all and, if so, how much you can borrow.

Read Also: What Are The Best 401k Funds To Invest In

Potential Benefits Of A Margin Loan

Some of the reasons you might consider using margin as a loan source include:

- Speed and convenience. Once your account is approved for margin, you can access a margin loan immediately, or at any time later on, without new forms or application fees.

- Relatively low interest rates. Margin rates, which use a base lending rate and a premium or discount based on the amount borrowed, can be broadly similar to rates on home equity loans for many investors, depending on loan size. And both are usually lower than the interest rates on unsecured loans, such as credit cards. Margin rates are typically on a tiered schedule, so that the higher the borrowing amount, the lower the rate. The amount you can borrow is variable, depending on the securities you pledge as collateral, and also subject to regulatory limits.

- Repayment flexibility. So long as you maintain the required level of equity in your account , you can pay back margin loans on your schedule. There is no monthly principal payment required and no term in which you need to repay the loan, although you’re allowed to repay part or all of your loan at any time.

- Potential tax advantages. Margin loan interest may be tax deductible depending on your situation.1 Consult your tax advisor to learn more.

Stern Advice: Should You Tap Your 401to Buy A House

By Linda Stern

5 Min Read

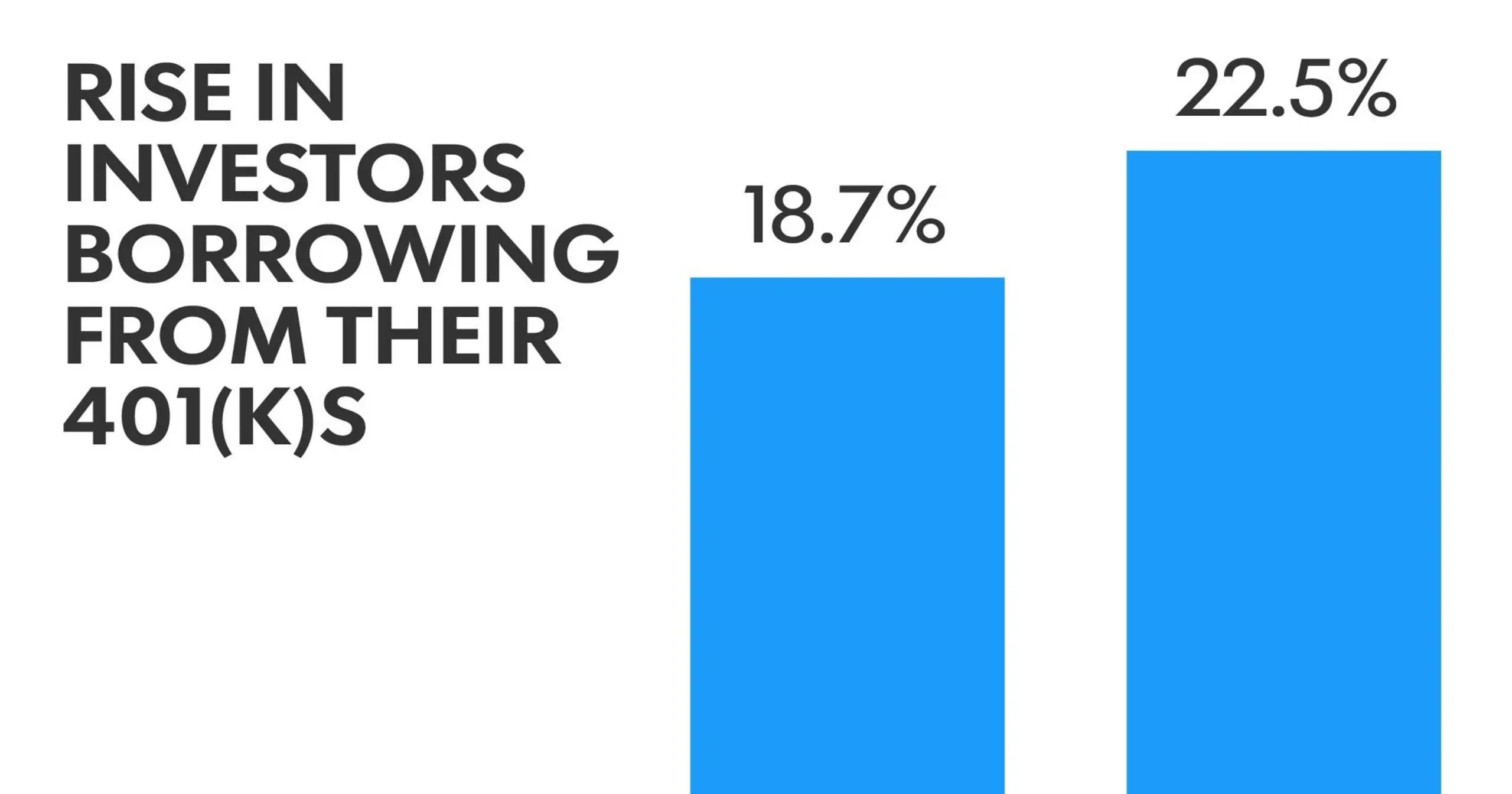

NEW YORK – It makes sense, given the gains workers have seen in their retirement plans and in home prices in recent years, that they would consider tapping their 401 accounts to buy homes. And that is exactly what a growing number of workplace savers are doing, according to a new study from Fidelity Investments.

Over the past year alone, more than 27,000 investors took loans specifically for the purchase of a home, said Fidelity, which looked at data from workplace retirement plans it runs.

The investment firm said workers who borrowed from their 401s for home purchases tended to borrow more – $23,500 on average – and could be putting themselves at risk of reducing or stopping their retirement contributions.

Millennials who borrow an average of 37 percent of their accounts, or $17,100, might particularly find the loan a stretch for people who are also taking on a mortgage and might be saddled with student debt, Fidelity said.

To be sure, cash-poor workers who borrow to the max to buy a house can get into trouble quickly if they dont have the reserves to handle emergencies. As any homeowner would attest, the boiler will break and the roof will leak when they least expect it.

And a worker who borrows from his 401 and then leaves his job usually has to pay back the loan within a few weeks or face a big tax hit as he is forced to treat the loan as a distribution.

Here are some considerations.

Read Also: What Is The Max Percentage For 401k