Which Account Is Right For You

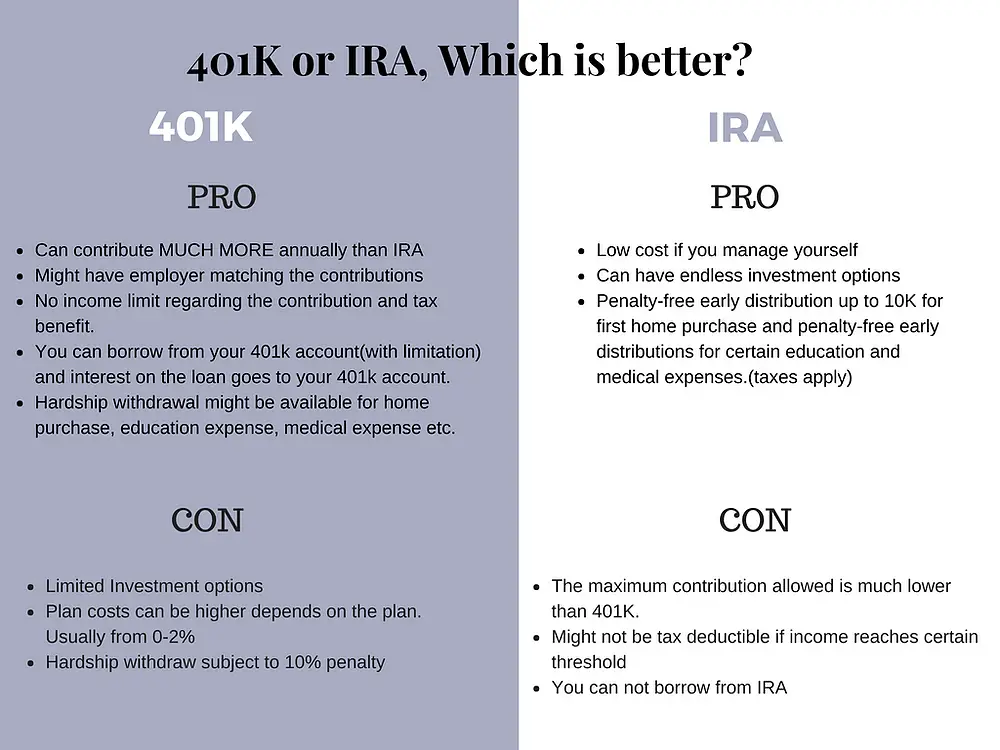

The main difference between a 401 and an IRA is that the former is offered through an employer and the latter is initiated by an individual or small business. If your employer offers a 401, there are several reasons to take advantage of it. Employers often offer matched contributions, which is another form of compensation. In addition, the 401 annual contribution limits are much higher at $19,500 when compared to $6,000 for IRA.

However, if your employer has a strict vesting schedule and you dont plan on staying long-term, it may still make sense to look beyond 401. An IRA may also make sense for employees who dont receive any type of matched contributions or dont have access to a workplace retirement account at all.

A Roth IRA, in particular, may be more attractive to younger professionals since contributions are taxed at a time when their tax brackets are lower and distributions can be made tax-free at a time when they are likely in a higher tax bracket. On the flip side, if youre earning a substantial income already, you may benefit more from getting the tax deduction now through a Traditional IRA. The same guidance applies to employees debating between a Traditional 401 and a Roth 401.

S Offer Higher Contribution Limits

In this category, the 401 is simply objectively better. The employer-sponsored plan allows you to add much more to your retirement savings than an IRA.

For 2021, a 401 plan allows you to contribute up to $19,500. Participants age 50 and older can add an additional $6,500, for a total of $26,000.

In contrast, an IRA limits contributions to $6,000 for 2021. Participants age 50 and older can add an additional $1,000, for a total of $7,000.

Thats a clear advantage for the 401.

S Let Employers Contribute More To Key Employees

When accounting for both the employee deferrals and the employer contribution, the maximum the IRS allows to be put into a defined contribution retirement plan is $58,000 a year . Reaching that limit, however, is only possible with a 401.

401 plans allow employers to make profit sharing contributions. Depending on the formula used, these contributions can allow business owners to funnel large sums of money to themselves, or to make generous contributions to key employees.

If youre a real high roller, 401s can also be combined with cash balance retirement plans, which can allow you to contribute more than $200,000 in pre-tax retirement savings depending on your age.

This makes 401 plans vastly superior for any business whose owners or employees are high-earners who want to maximize their retirement savings.

Heres a table to sum it all up:

|

401 vs SIMPLE IRA – Which is Better for Building Wealth? |

||

|

Defined contribution maximum limit |

$58,000 |

401s are powerful tools for building wealth, but thats not the only reason theyre so popular

Recommended Reading: How Much Money Do I Have In My 401k

What Is The Difference Between A Roth And An Ira

The main difference between a traditional IRA and a Roth IRA is how contributions for tax credit are deducted. While traditional IRA contributions are deductible or non-deductible, Roth IRA contributions are not yet deductible. As a result, Roth IRAs offer tax-free growth, while traditional IRAs offer tax-free growth.

Roth meaning Rosa makes sense to you?The sooner you start a Roth IRA, the better, but when you’re going to receive a Roth IRA can still make sense In any case A Roth IRA is an individual retirement account that allows fixed distributions or withdrawals to be free under certain conditions.Why is Ross better than the Irish Republican army?If you are not eligible for a deduction, the best option to contribute to a Roth IRA is if you are eligible for assis

Who Is Eligible To Contribute To A Roth Ira & Traditional Ira

Before you contribute to an IRA, you must check that you are eligible first. For a Roth IRA, there are two main criteria. The first one is that you need to have earned income. In other terms, you must have a job and be getting paid. If you left your job to focus on raising your child for an entire year and you didnt have income, you cannot contribute to a Roth IRA. The second criteria is that your income needs to be below a certain amount. To contribute to a Roth IRA in 2021, single tax filers must have a modified adjusted gross income of less than $140,000. If married and filing jointly, your joint MAGI must be under $208,000 in 2021. If you are eligible and planning to contribute to a Roth IRA, make sure you watch our video on the three common mistakes with Roth IRAs.

For a traditional IRA, the only criteria is that is you need to have earned income, either a W-2 or 1099. Regardless of how much money you make, you can contribute to a traditional IRA. Now, if your income is below a certain amount, as I mentioned earlier, you get to deduct that contribution from your tax return. If your income is above that limit you can still contribute to a traditional IRA but you cannot deduct it from your tax return. This is essentially called a nondeductible traditional IRA. This is a key step in doing whats called a backdoor Roth IRA.

Don’t Miss: How To Find 401k From An Old Employer

How Much To Invest In A 401k And A Roth Ira Difference

As expected, the 401 portfolio is growing significantly faster than the Roth IRA. This is because you do not have to pay taxes upfront and you can invest more. At age 60, the price of the 401k drops to $1,829,768. Roth IRA drops to $1,427,647.

Can you take money out of a roth iraWhat is the Roth IRA 5-year rule? Five year rule for withdrawals. The Roth IRA’s five-year rule for withdrawing capital gains requires that you hold your account for a minimum of five years before using that income without penalty. It is important to note that this rule applies specifically to investment income.How do you withdraw from a Roth IRA?Withdrawal of Roth Contributions. Withdrawing from a Roth IRA

Traditional Ira Vs Roth Ira Vs 401

- Alvin Carlos

Should you contribute to a Roth IRA, traditional IRA, or a 401k? We share with you everything you need to know about a Roth IRA, traditional IRA, and a 401k to help you decide which one you should contribute to. Your decision can impact how much retirement savings you can accumulate and how much money you will save in taxes. I will also share a bonus tip at the end.

Also Check: How Do I Open A 401k

When An Ira Is Better

An IRA could be better than a 401 if you’re looking for more flexibility in your retirement planning.

“Unlike a 401, with an IRA the investment world is at your fingertips,” says Taylor J Kovar, Certified Financial Planner and CEO of Kovar Wealth Management. “Stocks, bonds, mutual funds, and real estate are all available while with a 401, you are limited to just the funds the plan allows you to invest in.”

Another reason why an IRA could be a better option is if you currently have low tax rates but anticipate higher tax rates during retirement. By contributing to a Roth IRA, you’ll pay your taxes upfront so your growth and withdrawals during retirement are tax-free.

Not all employers offer a 401 plan, so an IRA is one of the best alternatives to help you save for retirement on your own.

| Pros | |

|

|

If Your Employer Offers A 401 Match

1. Contribute enough to earn the full match. Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401 plan, do not bypass this opportunity to collect your free money.

A company matching program is one of the biggest benefits of a 401. It means that your employer contributes money to your account based on the amount of money you save, up to a limit. A common arrangement is for an employer to match a portion of the amount you save up to the first 6% of your earnings.

Even if a 401 has limited investment choices or higher-than-average fees, carve out enough money from your paycheck to get the full company match, as its effectively a guaranteed return on those dollars. Also note that employer contributions dont count toward the 401 annual contribution limit.

2. Next, contribute as much as youre allowed to an IRA. Depending on which type of IRA you choose Roth or traditional you can get your tax break now or down the road when you start withdrawing funds for retirement.

-

A traditional IRA is ideal for those who favor an immediate tax break. Contributions may be deductible that means your taxable income for the year will be reduced by the amount of your contribution. But, if you’re also covered by a 401, your deduction may be reduced or eliminated based on income. If you has a workplace retirement plan, check out the IRA limits.

You May Like: How To Get Money From 401k After Retirement

Ira Vs 401k: What Are The Key Differences

IRA vs 401k: is there a difference?

Yes, there is a big difference between an IRA and 401k. The main difference between the two is that an IRA is a form of retirement plan that you can create and fund yourself.

Whereas, a 401k plan is a tax advantaged retirement plan created by your employer, in which you can contribute a certain amount from your salary.

Lets explore more key differences between IRAs and 401s.

Note, if you have questions beyond an IRA and 401k plans, a financial advisor can help you determine the best saving options to help you reach your retirement income goals.

The Differences Between A 401 And A Simple Ira

When evaluating a SIMPLE IRA vs. 401 plan option, it’s important to acknowledge that each plan may be a better fit for certain companies, based on factors such as business size as well as the wants or needs of employees. Understanding the differences between 401 plans and IRAs help companies make sound decisions about their benefit plans.

- A 401 plan can be offered by any type of employer, but a SIMPLE IRA is designed for small businesses with 100 or fewer employees.

- Contribution limits for SIMPLE IRA plans are lower than traditional 401 plans.

- SIMPLE IRAs require an employer contribution. 401 plans do not, although many employers do choose to make contributions.

- With SIMPLE IRAs, employees are always 100 percent vested, while 401 plans may have different vesting rules for employer contributions.

You May Like: When Can I Rollover 401k To Ira

How Are Iras And 401s Different

The government wants you to prioritize saving for retirement. As a result, they provide tax incentives for IRAs and 401s. Some IRAs and all 401s offer tax-deferred growth, and other IRAs protect those who have them from having to pay taxes down the line.

The main difference between the two is that 401s are qualified employer-sponsored retirement plans. You typically only have access to these plans through an employer who offers them as part of a full-time compensation package.

In addition, your employer may choose to provide matching funds as part of your compensation, which may be equal to a percentage of the amount you contribute.

Not everyone is a full-time employee. You may be self-employed or work part-time, leaving you without access to a 401. Fortunately, there are other options available to you.

Anyone can set up an Individual Retirement Account as long as youre earning income. In fact, even if you already have a 401, you can still open an IRA and contribute to both accounts.

The two types of accounts also differ in how much money you are allowed to contribute and the types of investments you have access to.

Heres a deeper look at both types of accounts and the advantages each offers.

What Is A 401

When a company hires you to work, they may offer you a retirement savings option in the form of a 401 account. These plans have been widely offered since the early 1980s after Congress established the Revenue Act which made it easier for employers to offer tax-advantaged savings accounts for employees.

With a 401, your employer will automatically deduct a percentage of your income from that pay period and contribute it to an investment account. Some employers will even offer to match your contributions if you contribute a specific amount, like 3% of your income, for example.

Quick Tip: The term “401” refers to a specific section of the Internal Revenue code that allows employees to defer taxation on a portion of their income when they choose to invest it.

Don’t Miss: How To Figure Out Your 401k Contribution

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Ira Vs : The Quick Answer

Both 401s and IRAs have valuable tax benefits, and you can contribute to both at the same time. The main difference between 401s and IRAs is that employers offer 401s, but individuals open IRAs . IRAs typically offer more investments 401s allow higher annual contributions.

If the IRA vs. 401 comparison is weighing on you, heres the quick answer:

-

If your employer offers a 401 with a company match: Consider putting enough money in your 401 to get the maximum match. That match may offer a 100% return on your money, depending on the 401. For example, some employers promise a 100% match up to 3% of salary. That means, if your salary is $50,000, your employer will put in $1,500, as long as you also contribute at least $1,500. Once you get the match, then consider maxing out an IRA for the year, return to the 401 and resume contributions there.

-

If your employer doesnt offer a company match: Consider skipping the 401 at first and start with an IRA or Roth IRA. You’ll get access to a large selection of investments when you open your IRA at a broker, and you’ll avoid the administrative fees that some 401s charge. After contributing up to the IRA limit, think about funding your 401 for the pre-tax benefit it offers. Here’s how and where to open an IRA.

Here’s more on the pros and cons of the IRA vs. 401 question:

» Want to turn a 401 into an IRA? See our guide to rollover IRAs

Also Check: Is It Better To Rollover 401k To Ira

How A 401 Works

Now we will dive into a little more detail on exactly how a 401 plan works. As previously stated, most 401s are sponsored by your employer. In the case where you are both the employer and the employee, you are allowed to open a self-employed or solo 401. Your employer will decide exactly how the plan operates within the rules set forth by the IRS. For example, your plan may or may not allow loans. Your plan administrator will also determine which types of investments are available in your plan. Generally, you have access to stocks, mutual funds, bonds, and other publicly traded securities.

In some cases, you may be automatically enrolled in your employers 401 when you begin work. You make contributions to the plan on a pre-tax basis. This means that the money is automatically withheld from your paycheck and placed into the account. Your employer might also match the funds that you place into the account. There is usually a limit on the employer match, and that amount is typically anywhere from 2%-4% of your salary. Since you are using pre-tax dollars to fund the account, this means that your taxable income in the current year is lower. In 2021, you are allowed to contribute up to $19,500 into your 401.

How Much Can I Contribute To An Ira Or 401

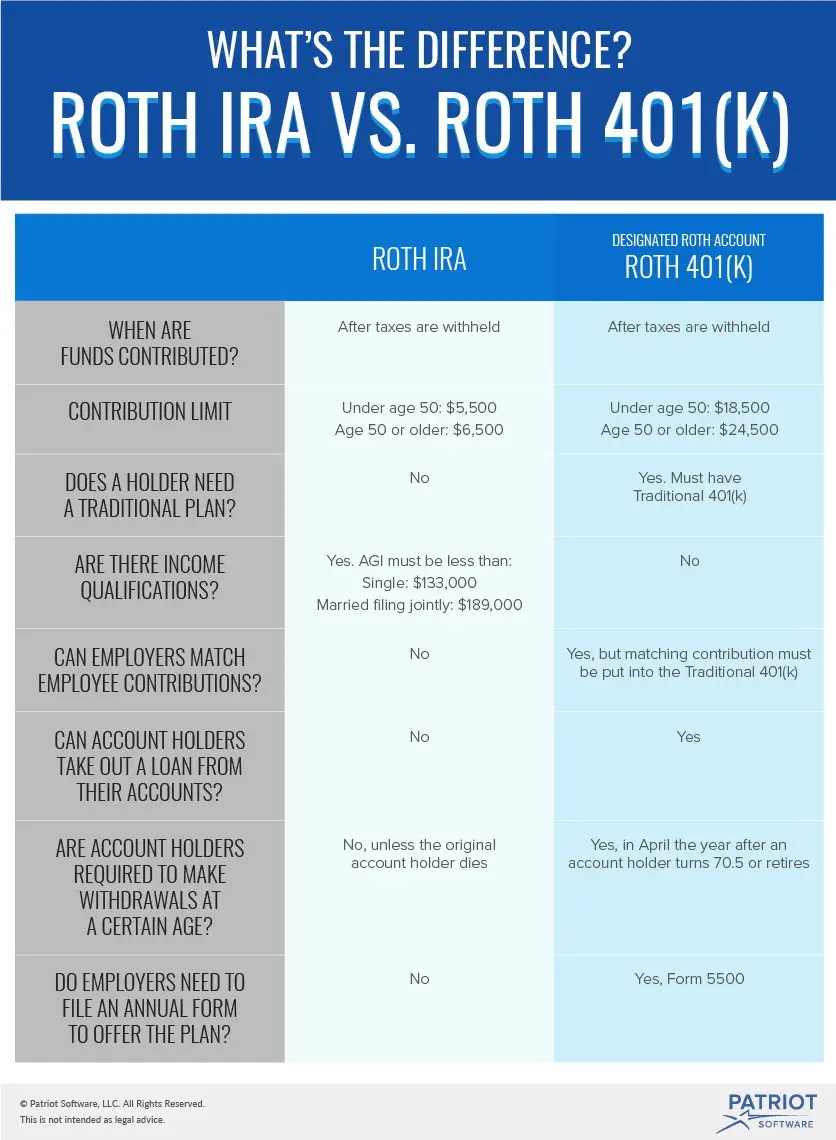

Each account IRA and 401 has different contribution limits. However, both have raised limits for contributors over the age of 50. The amounts listed below are for 2019.

IRAs: The contribution limit for a person under the age of 50 is $6,000. Once youve reached 50, you get an additional $1,000 to catch up for retirement. That means you can contribute a total of $7,000.

401s: For an employee under the age of 50, the contribution limit is $19,000. This is considerably more than the IRA contribution limit. The catch up addition is also great at $6,000 for a total contribution of $25,000 once youre 50 years old.

Regardless of how many accounts you have, IRA or 401, the limit stays the same. For example, if you have two IRAs, you can contribute $4,000 to one and $2,000 to the other, or you can contribute $6,000 entirely to one. This concept also applies to 401s. While you can contribute to only a 401 plan with your current employer, some allow you to have both a traditional and a Roth 401.

You May Like: How Do I Get A 401k Plan