Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Dont Miss: What Is Max Amount To Contribute To 401k

How Much Can I Borrow From My 401k

The IRS generally allows employees to borrow the lesser of $50,000 or 50% of their vested account balance.

For example, if your 401 is valued at $10,000, you can only apply for a loan of $5,000. If your account balance is $300,000, you can only borrow $50,000.

Some plans allow for the full vested balance to be loaned for amounts under $10,000. Some plans only allow for loans from specific sources

Remember to check with your plan for specifics related to your situation.

Are 401k Loans Taxable

As mentioned earlier, 401 loans are not taxable, as long as they are properly structured. As long as you do not default on the loan, meaning you continue to make timely loan repayments, you will not owe any taxes on the outstanding balance.

However, if you do default, there will be tax consequences, such as income taxation on the outstanding balance of the loan on top of the 10% early withdrawal penalty.

For example, lets assume you took out a loan for $15,000, paid down $5,000, and did not pay the remaining $10,000. The $10,000 would be included as income in the tax year that you defaulted. If applicable, youd also have to pay a $1000 penalty if it was considered a premature withdrawal.

As always, everyones tax situation is different. Consult a tax professional with questions related to your individual circumstances.

Read Also: How To Calculate 401k Minimum Distribution

Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Is A 401k Loan Taxed Twice

Another myth is that when you borrow from your 401k, you are being taxed twice because youre paying the loan back with after-tax money.

But in truth, only the interest part of the repayment is treated that way. And being twice taxed on interest from this kind of loan is likely to cost less than what it would cost to borrow money in another way.

Recommended Reading: How Do I Find My Old 401k Account

Consider A 401 Withdrawal

Some providers will allow you to take an early withdrawal if you demonstrate an emergency financial need. Circumstances can include, but may not be limited to:

- Medical care expenses

- Costs of purchasing your principal residence

- Tuition and other educational fees for you, your spouse or your dependents

- Eviction or foreclosure prevention costs

- Funeral expenses

- Damage repair expenses on your principal residence

The withdrawal amount will be limited to what is needed to cover the expense. While you dont have to repay a 401 hardship withdrawal, youll lose the money from your retirement account, and you may be taxed at 10%.

Reasons To Take Out A 401k Loan

So now youre wondering, under what circumstances can I take a loan from my 401k? The answer is many.

And in those situations there are several incentives to doing so.

Typically speaking, 401 loans work best for short-term needs, where you can repay the money quickly.

Some of the best reasons to take out a 401 loan include:

- Purchasing a home

- Pursuing higher education

- Financing a business or investment

In some cases, you might be eligible for a loan extension if you used the money as a down payment on a house.

Thats great, youre saying, but can I use my loan to help alleviate financial hardship?

You might be especially curious about this question if you owe money in back taxes to Uncle Sam.

In most cases, you can use the money however you want, including paying for taxes.

This can be an appealing option if the amount of interest youll pay is smaller than potential tax penalties.

However, some plans do place restrictions on how the money can be used. Before you take out a loan make sure you know if such restrictions exist and what they entail.

More importantly, be wary of potential downsides linked to borrowing money from your 401k.

Don’t Miss: Is Rolling Over 401k To Ira Taxable

Benefits Of Taking Money Out Of Your 401 Earlier

Your 401 is likely a centerpiece of your retirement income plan. Taking distributions sooner than a typical retirement age around 65, like in your early 60s, can have benefits.

It can make an early retirement possible. Depending on your financial situation, you may have the financial freedom to step out of the workforce by the time youâre 60. Itâs your nest egg, and youâve worked hard to build it by making regular contributions during your working years. 401 distributions, along with other sources of retirement income, can set the stage for this new phase of your financial life.

It can help you delay taking Social Security. You canât begin claiming Social Security until age 62. Still, generally, it can be beneficial to delay taking Social Security. Thatâs because your monthly benefit will increase every year that you wait until age 70. Since Social Security pays guaranteed income that will last for as long as you live, a larger monthly benefit could pay off over time.

Getting A 401 Loan For A Home

If you’d like to use your 401 to cover your down payment or closing costs, there are two ways to do it: a 401 loan or a withdrawal. It’s important to understand the distinction between the two and the financial implications of each option.

When you take a loan from your 401, it must be repaid with interest. Granted, you’re repaying the loan back to yourself and the interest rate may be low, but it’s not free money. Something else to note about 401 loans is that not all plans permit them. If your plan does, be aware of how much you can borrow. The IRS limits 401 loans to either the greater of $10,000 or 50% of your vested account balance, or $50,000, whichever is less. For example, if your account balance is $50,000, the maximum amount you’d be able to borrow is $25,000, assuming you’re fully vested.

In terms of repayment, a 401 loan must be repaid within five years. Your payments must be made at least quarterly and include both principal and interest. One important caveat to note: loan payments are not treated as contributions to your plan. In fact, your employer may opt to temporarily suspend any new contributions to the plan until the loan has been repaid. That’s significant because 401 contributions lower your taxable income. If you’re not making any new contributions during your loan repayment period, that could push your tax liability higher in the interim.

Read Also: How Can I Withdraw My 401k Without Penalty

Extraction & Tax Return

After a completed conference call with the financial institution, ourtax planning attorneys will be able to fully extract your U.S. pension, tax free. After 5-7 business days, the funds will either be deposited into a financial institution of your choice, or a check will be sent out to an address you provide. Afterwards, we will need to file your next tax return including the treaty position disclosure. Without this, you risk the IRS imposing penalties, so its best for us to handle this.

Our Other Services

- AMT Tax Planning

Our tax attorneys will help reduce the odds that youll owe the AMT through proper tax planning.

- Estate Planning

Domestic & International trusts, assistance with life planning documents and services for businesses, which include customized retirement plans.

- Inheritance Tax Planning

Received an inheritance? Our tax attorneys will help structure a tax efficient strategy that works for you.

- Pre-Residency Tax Planning

Before moving to the U.S. make sure that you have all your financial affairs in order. We can help with this process as well.

- Exit Tax Planning

Before departing the U.S. it is important to know how you will be taxed upon leaving. Exit tax planning is crucial.

- Offshore Tax Compliance

Demerits Of Obtaining A Personal Loan

If you take these loans regularly this will put you in a debt trap from which it is very difficult to come over.

You have to pay high interest with the principal.

Late payments will damage your credit score which will make it difficult for you to take any other loan.

Interest can be higher sometimes.

This shows that you are in financial trouble.

Loans may lead to high pressure on your mind.

Dont Miss: How To Take A Loan From My 401k

You May Like: How Do I Get A 401k Plan

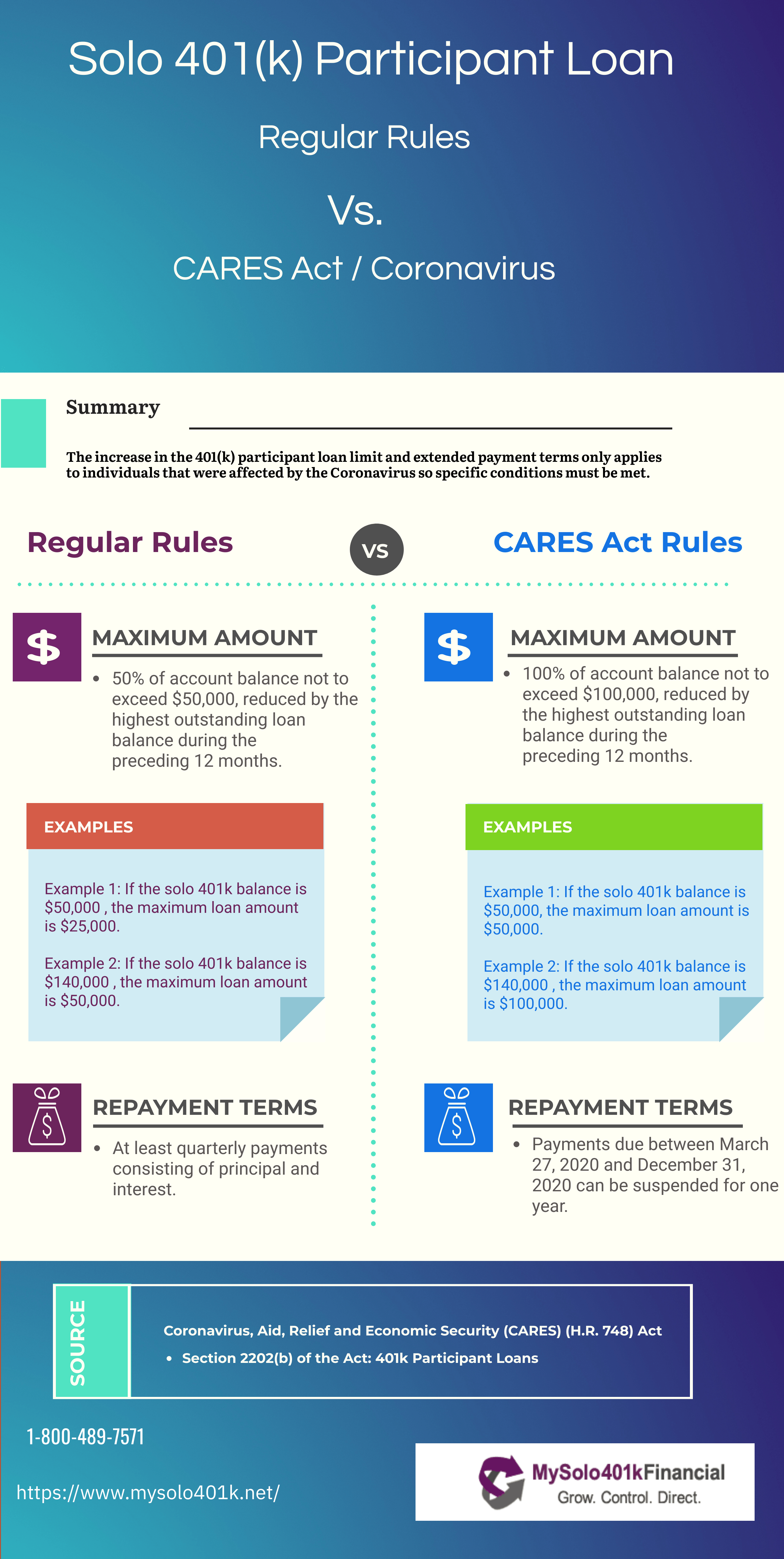

The Cares Act And 401 Loans

The Coronavirus Aid, Relief, and Economic Security Act, which became law on March 27, 2020, enables people who had taken out a 401 loan to delay for up to one year payments owed from that date through December 31, 2020. Interest would still accrue on your outstanding balance during the period of delayed payments.

The CARES Act also eliminated the 10% federal tax penalty on early withdrawals made from your 401 through the end of 2020.

The CARES Act enabled employers to increase the amount of a loan that employees could take against their 401 to $100,000 or the entire vested portion of their account, whichever was lower. However, that ability expired on September 22, 2020, and the maximum loan amount returned to $50,000 or 50% of the available amount, whichever is less.

To be eligible for any of the provisions of the CARES Act, you, your spouse, or your dependent must have been diagnosed with the coronavirus or its associated disease using a test approved by the Centers for Disease Control and Prevention. You also must have experienced financial hardship for one of the following reasons:

- You were quarantined, furloughed, or laid off, or your work hours were reduced due to the coronavirus pandemic.

- You were unable to work because of a lack of child care due to the coronavirus pandemic.

- You closed or reduced the hours of a business you owned or operated due to the coronavirus pandemic.

Also Check: How To Find A Deceased Persons 401k

Find Out If Your Plan Allows Loans

Many 401 plans allow you to borrow against them, but not all. The first thing you need to do is contact your plan administrator to find out if a loan is possible. You should be able to get a copy of the Summary Plan Description, which will give you the details. Even if your plan does allow loans, there may be special conditions regarding loan limitations. While there are legal parameters for 401 loans, each plan is different and can actually be stricter than the general laws. So get the facts before you start mentally spending the money.

Don’t Miss: What Is A Solo 401k Plan

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How Long Does It Usually Take To Get Your 401k After You Quit

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Recommended Reading: When Can I Borrow From My 401k

If You Have Filed For Bankruptcy When You Can Take Out A Loan From Your 401k Retirement Fund Depends On Whether You Filed For Chapter 7 Or Chapter 13 Bankruptcy

By Cara ONeill, Attorney

You can take out a 401k loan after you file for Chapter 7 bankruptcy without risk of losing the money to the Chapter 7 bankruptcy trustee assigned to your case, although it would be prudent to wait until after your case ends. By contrast, in Chapter 13, youre prohibited from borrowing against your 401k without first getting permission from the bankruptcy judge.

If youre thinking that youd prefer to borrow against your 401k loan before filing for Chapter 7 or Chapter 13, keep in mind that it can be riskyespecially if you dont use the funds beforehand for a necessary expenditure and instead, deposit the money in a bank account.

When Faced With A Sudden Cash Crunch It Can Be Tempting To Tap Your 401 More Than A Few Individuals Have Raided Their Retirement Account For Everything From Medical Emergencies To A Week

But if youre under 59-1/2, keep in mind that an early withdrawal from your 401 will cost you dearly. Youre robbing your future piggy bank to solve problems in the present.

Youll miss the compounded earnings youd otherwise receive, youll likely get stuck with early withdrawal penalties, and youll certainly have to pay income tax on the amount withdrawn to Uncle Sam.

If you absolutely must draw from your 401 before 59-1/2, and emergencies do crop up, there are a few ways it can be done.

Hardship withdrawals

You are allowed to make withdrawals, for example, for certain qualified hardships though youll probably still face a 10% early withdrawal penalty if youre under 59-1/2, plus owe ordinary income taxes. Comb the fine print in your 401 plan prospectus. It will spell out what qualifies as a hardship.

Although every plan varies, that may include withdrawals after the onset of sudden disability, money for the purchase of a first home, money for burial or funeral costs, money for repair of damages to your principal residence, money for payment of higher education expenses, money for payments necessary to prevent eviction or foreclosure, and money for certain medical expenses that arent reimbursed by your insurer.

Loans

Most major companies also offer a loan provision on their 401 plans that allow you to borrow against your account and repay yourself with interest.

You then repay the loan with interest, through deductions taken directly from your paychecks.

Read Also: Where To Put My 401k Rollover

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

Read Also: Can I Contribute To Traditional Ira And 401k