How Long Can You Stay On Each Page

For security reasons, there are time limits for viewing each page. You will receive a warning if you dont do anything for 25 minutes, but you will be able to extend your time on the page.

After the third warning on a page, you must move to another page. If you do not, your time will run out and your work on that page will be lost.

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred. But the IRS requires that you begin to take withdrawals known as required minimum distributions by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while theyre still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

How To Invest 401 Money

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

Read Also: How Do I Get Access To My 401k

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Recommended Reading: Can An Llc Have A Solo 401k

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways we’ll need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, it’s okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially “free money” so you don’t want to leave any sitting on the table.

You May Like: How To Opt Out Of 401k Fidelity

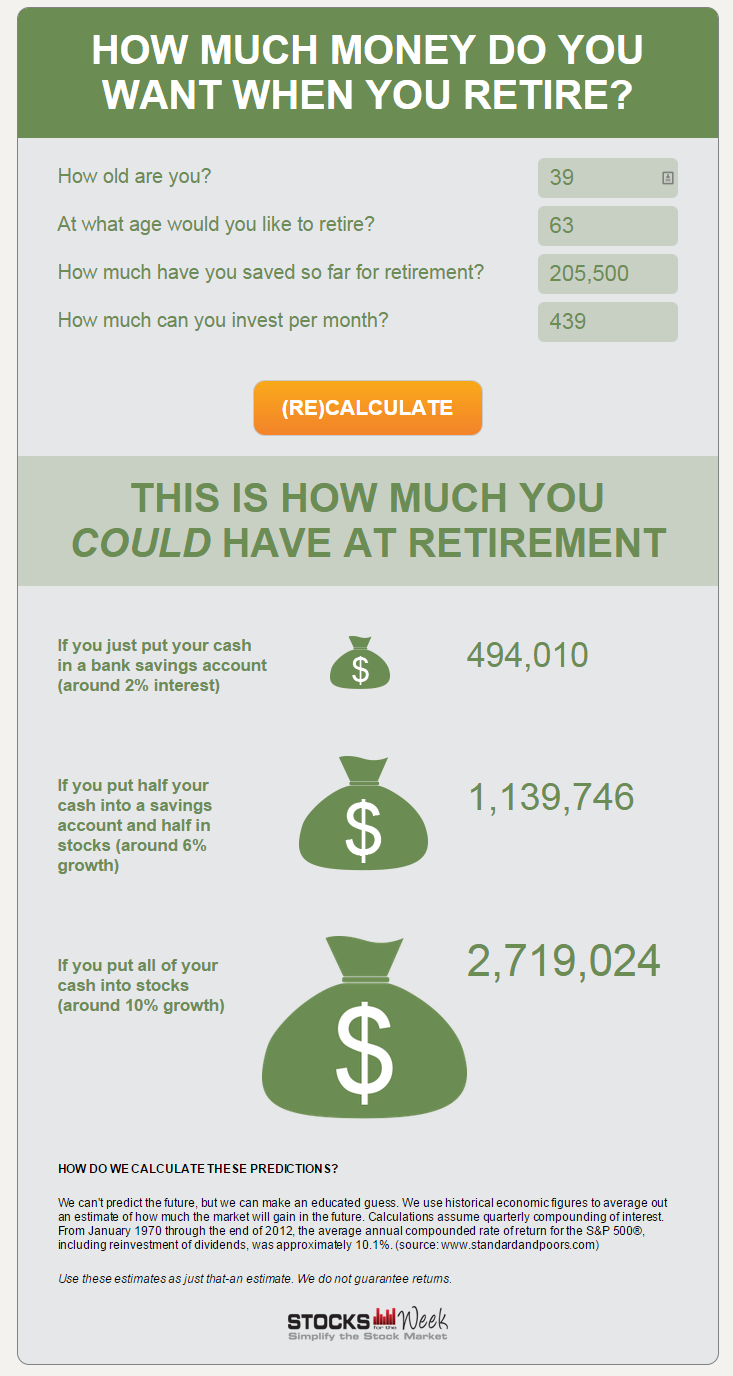

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

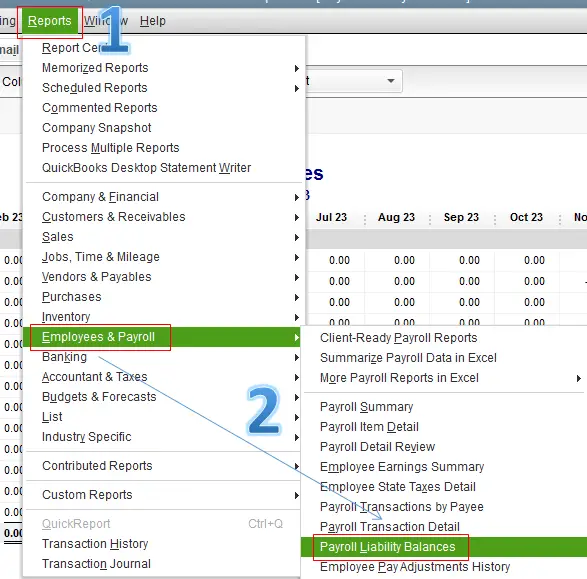

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Don’t Miss: Can You Rollover A 401k Into An Annuity

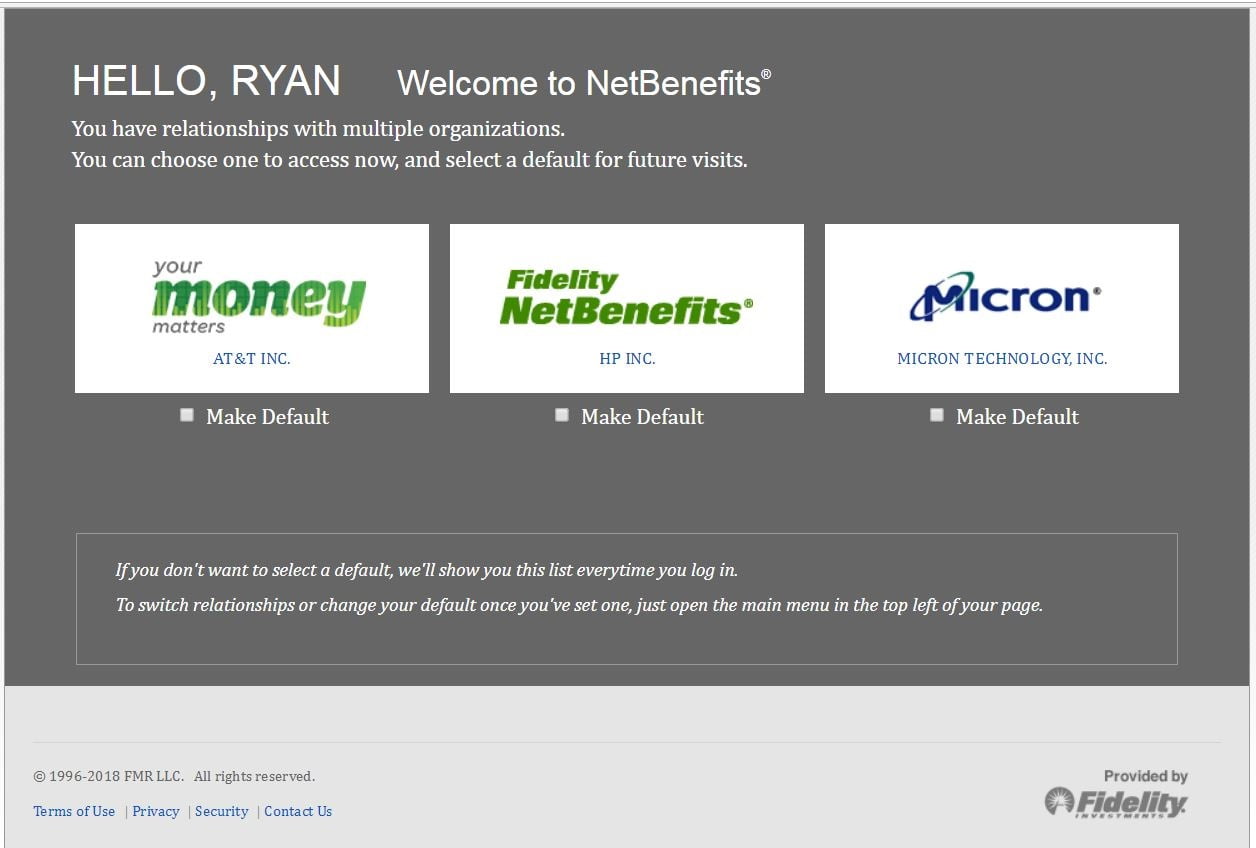

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Read Also: How To Get Your 401k Without Penalty

How To Get Money Out Of Your 401

Your 401 money is meant for retirement. It’s not easy to take money out while you’re still working, without incurring a steep financial loss. The account is structured that way on purpose you let the money grow for your future use.

There are certain circumstances under which you can take funds out of your 401 without paying any penalty. You’ll still need to pay income taxes on the money, since it most likely went into your account on a pre-tax basis.

You can start taking withdrawals once you reach 59 1/2 years of age. You can also take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday. This is known as the IRS Rule of 55.

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

Recommended Reading: What To Do With 401k When You Leave A Company

How To Find Money In An Old 401 Account

If you need to track down money from an old 401 account, no central agency exists with information on all 401 plans in the United States. However, the federal Employment Retirement Income Security Act, or ERISA, protects 401 deposits. So relax. Even if you can’t find a former employer to retrieve 401 funds, you have several free ways to search for old accounts.

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Recommended Reading: Can I Roll My 401k Into A Self Directed Ira

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

Also Check: Who Can Open An Individual 401k

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

Withdrawals After Age 59 1/2

Age 59 1/2 is the magic number when it comes to avoiding the penalties associated with early 401 withdrawals. You can take penalty-free withdrawals from 401 assets that have been rolled over into a traditional IRA when youve reached this age. You can also take a penalty-free withdrawal if your funds are still in the 401 plan, and youve retired.

You can take a withdrawal penalty-free if youre still working after you reach age 59 1/2, but the rules change a bit. Check with the plan administrator about its specific rules if youre still working at the company with which you have your 401 assets.

Your plan might offer an in-service withdrawal that allows you to access your 401 assets penalty-free, but not all plans offer this option. And remember, the withdrawal will still be subject to income taxes, even if its not penalized.

You May Like: How To Find Out If I Have A 401k

Pay Taxes Now Or Later

There are different types of 401 contributions, and each has different tax implications. When deciding on which to choose, consider what your income in retirement might be. Generally, if you expect your income tax rate to be lower in retirement than while youre working, then pretax contributions may make sense, since you will be taxed when you take a withdrawal. If you expect to have a higher income tax rate in retirement, then maybe Roth contributions will make sense for you.

Start Earning More For A Better Financial Future

The answer to How much should I have in my 401k? is an important one but its not the only way to ensure your financial future.

We are going to let you in on a little secret. It is one that has helped thousands of people live their Rich Life:

Theres a limit to how much you can save, but theres no limit to how much money you can earn.

Bonus:

Many people dont understand this and because of that, theyre content with contributing very little to their retirement accounts. When they actually retire, theyre surprised when their nest egg is a lot smaller than they thought and they have to get a job as a Walmart greeter to pay for their condo.

If you realize that your earning potential is LIMITLESS, you can truly get started working toward living a Rich Life today.

We recommend three ways to start earning more money:

1. Negotiate a salary raise. 99% of people are content with not asking for a salary raise. So if you are willing to negotiate, that puts you in the 1% and showcases to your boss that youre a Top Performer willing to work hard for more money.

2. Start a side hustle. One of my favorite money-making tactics is starting your own side hustle. We all have skills. Why not leverage those skills to start earning more money in your free time?

We want to help you get started on one of these tactics today: Starting a side hustle.

Thats why we want to offer you my Ultimate Guide to Making Money.

Stuff like:

UGH.

Read Also: How Much Is The Maximum Contribution To 401k