What Are An Employers Form 5500 Filing Requirements

The governments Form 5500 series includes 3 versions. Generally, the Form 5500 version a 401 plan must file for a year is based on its participant count. A description of each version – and when it must be used is below. For more information, see the DOLs Reporting and Disclosure Guide for Employee Benefit Plans.

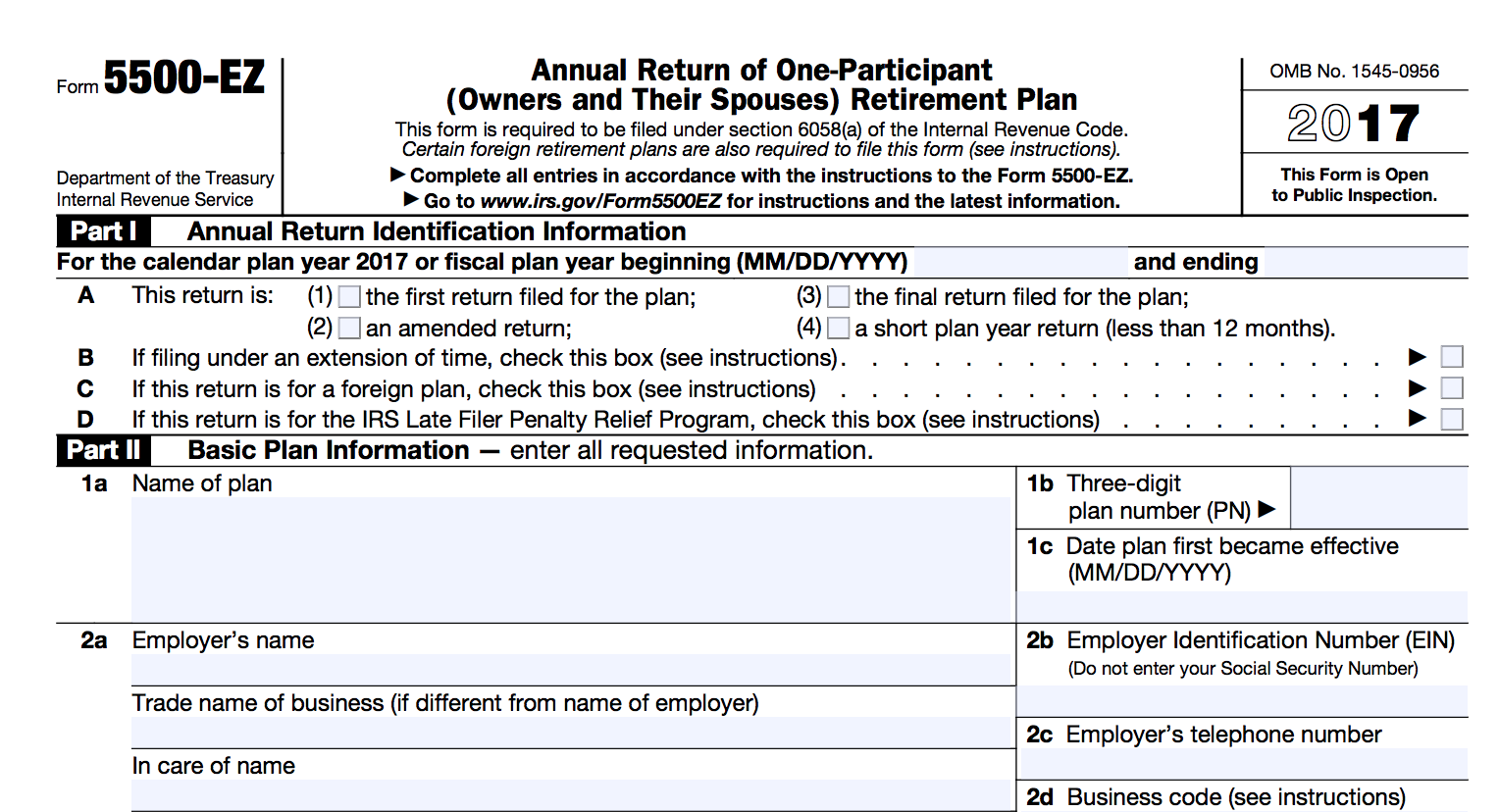

- Form 5500-EZ Only solo 401 plans which just cover a business owner and their spouse can file this return.

- Solo 401 plans with less than $250,000 in plan assets as of the last day of the plan year dont have to file a Form 5500-EZ .

- Form 5500-SF Small 401 plans a plan that covers less than 100 participants on the first day of the plan year can file a simplified version of the Form 5500 by meeting the following eligibility requirements:

Must Form 5500 Information Be Disclosed To Plan Participants

Yes. Participants must receive a Summary Annual Report . The SAR is a summary of the Form 5500. It must include the following information:

- Administrative fees paid from plan assets

- Distributions paid to participants and beneficiaries

- The total value of the plan

- Each participants right to request a full copy of the Form 5500

The deadline for distributing the SAR to plan participants is the later of: 1) nine months after the end of the plan year or 2) two months after the Form 5500 was due .

Potential Evidence Of Noncompliance

All 401 plans must follow ERISA rules in order to stay in compliance with regulations. No two 401 plans are exactly alike, but there are some qualities that can cause the DOL to take a closer look for noncomplianceor a breach of any of ERISAs rules. Note that some of these red flags must be accounted for when filing the Form 5500, as they represent greater administrative problems with a plan. Any of the following issues could stand out as a red flag, even though they may not be an issue for your plan in particular:

Keep in mind that the presence of any of these scenarios in your Form 5500 filing may be unavoidable due to the administration of your plan during the calendar year in question. In the event that you find yourself reporting any of the above, it may be in your best interest to correct problems immediately in order to avoid future issues with future year filings.

The IRS offers three programs for correcting plan failures. The Self-Correction Program allows employers to correct certain plan failings without the need to pay a fee or contact the IRS. In early 2019, the SCP was expanded to cover several additional plan failures involving 401 loans. Additionally, for issues that cannot be self-corrected, there is the Voluntary Correction Program which requires contact with the IRS, and the Audit CAP which is used to correct plan failures uncovered during an audit.

Also Check: Can Rollover 401k To Roth Ira

How Do I Complete Form 5500

Here are the parts of Form 5500. All of the information is for a specific plan year:

Part I: Annual Report Identification Information includes the type of the plan.

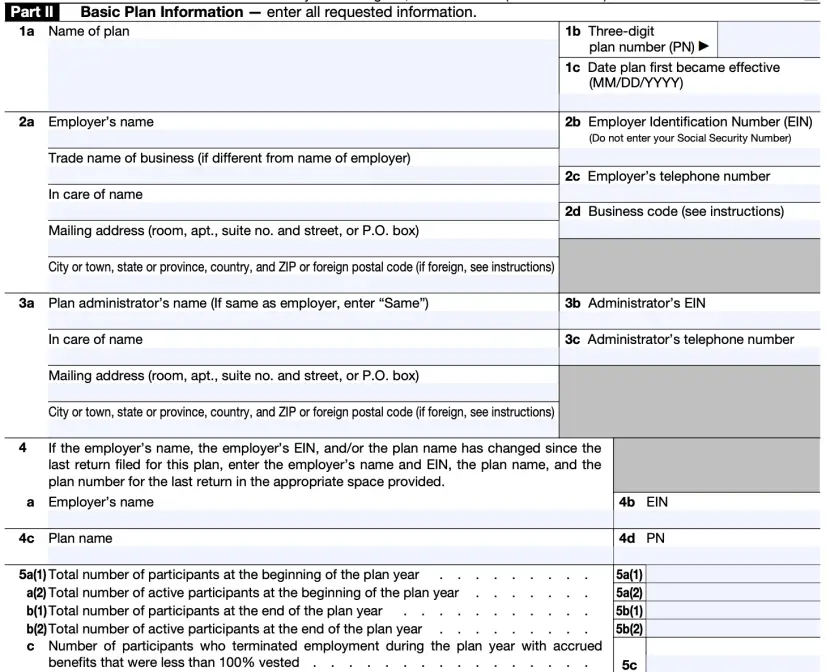

Part II: Basic Plan Information includes:

- The name of the plan

- Information about the plan sponsor and the plan administrator

- The number of participants, retirees, and beneficiaries at the beginning and end of the year

- Plan-funding arrangements

- Schedules included with the form

Here are some of the main schedules for Form 5500:

- Schedule A: Insurance information, including contract coverage, fees, and commissions

- Schedule C: Service provider information for someone receiving only eligible indirect compensation

- Schedule G: Financial transactions, including loans or fixed income obligations that are in default or classified as uncollectible

- Schedule H: Financial information, including assets and liabilities at the beginning and end of the year and an income/expense statement for the year, with some compliance questions and an accountants opinion

- Schedule I: Financial information for small plans, including summaries of plan assets and liabilities, income, expenses, and transfers for the plan year, with a list of compliance questions

- Schedule R: Retirement plan information, including information about distributions , funding, and single-employer- and multiemployer-defined benefit pension plans

You can use the IFILE free online software to complete Form 5500 and then electronically sign and submit it through EFAST2.

How To File Form 5: The Filing Process

The DOL requires that all Form 5500 annual returns be filed electronically using its EFAST2 program. The agency no longer accepts paper filings, except for filers submitting Form 5500-EZ.

To start the filing process, you must log in to the EFAST2 processing system and begin completing the correct version of Form 5500. EFAST2 is similar to other online tax systems you will input identifying information, answer questions about your business and retirement plan details, and add any required supporting documentation. At the end of the process, you will be asked to sign the form electronically and submit the Form to the IRS through the portal.

As you are completing your electronic filings, remember that accuracy and completeness are important. While you may incur penalties or fines for failing to submit on time, both the DOL and IRS may also impose fines or penalties for inaccuracies in your submission. Penalties may apply for anything the IRS deems as willful violations or making false statements, and they may also reject the submission of your Form 5500 if you provide insufficient information, including unanswered questions, which can lead to late fees.

Don’t Miss: What To Invest My 401k In

Irs Eliminates 2020 Form 5500 Filing Requirement For Certain Retroactively Adopted Retirement Plans

Available at

The IRS has announced that certain retirement plans adopted retroactively for the 2020 taxable year will not be required to file Form 5500 for 2020. For plans adopted for taxable years beginning after December 31, 2019, the SECURE Act permits employers to elect to treat a plan adopted after the close of a taxable year as if it had been adopted on the last day of the taxable year, provided the plan is adopted by the due date of the employers tax return for that year . According to the announcement, if an employer timely adopts a plan during the 2021 taxable year and elects to treat the plan as having been adopted as of the last day of the 2020 taxable year, the first Form 5500 required to be filed for the plan will be the 2021 Form 5500. On that Form 5500, a box will need to be checked indicating that the employer is electing to treat the plan as retroactively adopted. The IRS anticipates that similar rules will apply for plans retroactively adopted after the 2021 taxable year.

Contributing Editors: EBIA Staff.

Is A Fidelity Bond Required For Retirement Plans

ERISA requires every plan fiduciary and anyone else who handles or has the authority to handle plan assets to be covered by a bond. A fidelity bond is an insurance policy that names the plan as the insured party and covers anyone who handles or has the authority to handle plan assets. The fidelity bond protects the plan against loss due to of acts of fraud or dishonesty on the part of persons required to be bonded.

The required amount of bond coverage is the lesser of 10% of plan assets at the beginning of the plan year, or $500,000.

Also Check: How Do I Look At My 401k

How Many Forms 5500 Or 5500

For benefits provided by a single business entity, the number of annual reports to file depends on how many separate ERISA plans the plan sponsor maintains. A plan sponsor can determine how many separate ERISA plans it maintains by reviewing its employee benefit plan documents. For plan sponsors that are part of a controlled group, generally only one Form 5500 or 5500-SF is required for each employee benefit plan maintained by the controlled group. However, in a controlled group setting, consideration must be given to whether or not the funds contributed by controlled group members are available to provide benefits to all eligible employees of the controlled group.

Plan sponsors may decide to combine more than one type of ERISA welfare benefit into a single plan to consolidate annual reporting. The intention to combine benefits into a single plan should be reflected in the governing plan documents, such as a wrap document. If ERISA welfare benefits are combined into a single plan, the plan administrator would generally only be required to annually file one Form 5500 or 5500-SF for the plans benefits.

When Must An Audit Report Be Filed With The Form 5500

Large 401 plans that dont meet the DOLs audit waiver requirements) must file an independent audit report – prepared a third-party Certified Public Accountant with their Form 5500. This report must include an opinion by the CPA regarding the plans financial statements – specifically, whether they have been fairly presented in accordance with U.S. Generally Accepted Accounting Principles .

A 401 plan have a full-scope or limited-scope audit. Under a limited-scope audit, the CPA does not audit the plan investment information certified complete and accurate by an eligible asset trustee or custodian which generally makes this audit type less expensive.

An audit can add thousands of dollars to the cost of filing a Form 5500, so employers typically try to avoid this requirement by keeping their 401 plans participant count as low as possible. A popular way to do that is cashing out small account balances related to terminated plan participants.

Don’t Miss: How To Get Money Out Of 401k Without Penalty

What Is Form 5500 And Who Must File It

Form 5500, the annual report form for all employee benefit plans, is required by the Employment Retirement Income Security Act .

The form includes the following information about the previous year:

- Changes in the number of participants and beneficiaries

- Financial activities

- Funding and insurance information

The form must be filed electronically through the U.S. Department of Labor . The report is filed by a benefit plan administrator, a person or service responsible for day-to-day administration). The report must also be given to plan participants and beneficiaries who ask for it, along with other plan documents and reports.

Retirement or pension benefit plans must be filed through Form 5500 even if they are not tax qualified by the IRS. This includes profit-sharing plans, stock bonus plans, money purchase plans, 401 plans, and others. Welfare benefit plans must also be filed through Form 5500, including medical, dental, and life insurance, apprenticeship and training, scholarship funds, severance pay, disability, and more.

Some types of retirement and welfare plans are exempt from filing Form 5500. See pages 3-4 of the Instructions for Form 5500 for these exceptions.

I Annual Return Identification: Suggestions And Guidelines

Most plan years are from January 1st to December 31st. This information can be found on page 3 of the Adoption Agreement, item 6, Plan Year.

Check box A if this is the first filing for this plan. This checkbox is only for your very first 5500-EZ.

Select A if you are filing an amended Form 5500-EZ to correct errors and/or omissions in a previously filed annual return.

Check box A if you closed your Solo 401k and distributed all the assets.

Select A if this form is filed for a period of less than 12 months. Show the dates at the top of the form this will not typically apply to most Solo 401k accountholders

If none of these situations apply to you, do not check any boxes. If this your 2nd, 3rd, 4th year filing the 5500-EZ, you dont need to check any box in section 1A.

Don’t Miss: How To Invest In A 401k For Dummies

When Is Form 5500

The 5500-EZ is due on the last day of the seventh month of your plan year. For most account holders, thats July 31st. The IRS requires you file the form if your Solo 401k plan had $250,000 or more in assets at the end of the calendar year last year.

Example: If on December 31st, 2020 your Solo 401k had $250,000 or more in total assets, you would file form 5500-EZ by July 31st, 2021. If you just set up your plan this year, you dont need to file your 5500-EZ until next year. The 5500-EZ is filed for the previous calendar year.

Am I Required To File A Form 5500 Or 5500

Administrators of ERISA employee benefit plans are required to file an annual Form 5500 or 5500-SF, unless a reporting exemption applies. More specifically, if you are the administrator of a profit sharing plan, stock bonus plan, money purchase plan, 401 plan, defined benefit plan, 403 plan or welfare benefit plan, you must file a Form 5500 or 5500-SF for the plan each year.

Certain welfare benefit plans are exempt from all or part of the Form 5500 series reporting requirements. For example, there is an exemption from Form 5500 series reporting for small welfare benefit plans that are unfunded, fully insured or a combination of unfunded and fully insured. More information on which welfare benefit plans are exempt from the filing requirement is provided below.

The Form 5500 filing requirement does not apply to cafeteria plans based on the rationale that cafeteria plans are merely funding vehicles. However, a Form 5500 or 5500-SF is required for any component benefit plan that is an ERISA welfare plan , unless an exemption applies.

As another illustration, assume the same facts, except that there are 250 employees participating in both the cafeteria plan and underlying fully insured health plan. In this scenario, a Form 5500 is not required for the cafeteria plan, but the employer must annually file a Form 5500, with all required schedules and attachments, to satisfy the ERISA reporting requirement for the health plan.

You May Like: Can I Check My 401k Online

What Is My Employee Benefit Plans Number

The employer assigns the plan number. The plan number should appear in the plans summary plan description. Once a plan number has been used for a plan, it should not be used for any other plan, even if the first plan has been terminated. Generally, retirement plans are numbered sequentially from 001, and welfare benefit plans are numbered sequentially from 501.

Who Prepares The Form

You as the employer will prepare and file the form if you maintain the plan. If you outsource plan administration to a third-party administrator , they will take care of preparing the form on your behalf. Even if you use a TPA, however, its important that you understand it remains your responsibility to make sure its completed accurately and filed on time.

You May Like: What Is My Fidelity 401k Account Number

Why Is The Form 5500 Importantas A Fiduciary

Many plan sponsors outsource the preparation of this important form and then simply sign on the bottom line and electronically file it without giving it a second thought. But, a closer review of the form reveals that it covers areas such as fidelity bonding, timely deposit ofemployee deferrals, and defaulted participant loans, just to name a few important details.

In addition, the statement that appears directly above the signature line reads:

Under penalties of perjury and other penalties set forth in the instructions, I declare that I have examined this return/report, including accompanying schedules, statements and attachments, as well as the electronic version of this return/report, and to the best of my knowledge and belief, it is true, correct, and complete.

While the Department of Labor isnt in the habit of throwing people in jail for perjury for making an honest mistake on a Form 5500, they do expect plan sponsors to take it seriously and report all of the requested information in a complete and accurate manner.

As a result, we highly recommend that you review your Form 5500 and work with the preparer to ensure you understand what is reported.

Whats A Form 5500 Heres Everything You Need To Know

If your business is looking to start a 401 plan or you just recently started one, you might see some references to Form 5500 and wonder, what the heck is that? Hereâs the deal. The 5500 is a form that collects and provides info regarding the qualification of the plan, its financial condition, investments and the operations of the plan. A good 401 provider will provide you a signature-ready form for your review that youâll need to file each year.

Why the need for the Form 5500?The IRS, DOL, and Pension Benefit Guaranty Corporation jointly developed the Form 5500-series of returns for employee benefit plans to create a clear means to satisfy the Internal Revenue Code needs, as well as satisfy the rules within the Employee Retirement Income Security Act . The 5500 your firm files is based on number of employees, and for self-employed 401 users , you may or may not need to file based on the amount of money in your plan.

If I sponsor a 401 plan, do I have to file Form 5500?Itâs required for most plan sponsors however, if your plan has fewer than 100 participants, youâll likely be able to file a simplified, short-form version . Plans with over 100 employees will file the standard 5500. Both are pretty easy to submit and are typically done electronically on the DOLâs site via the EFAST2 filing.

FYI, ShareBuilder 401k plans offer signature-ready 5500s.

Recommended Reading: Do You Need A Tpa For A Solo 401k

How Do I Know My Total Solo 401k Plan Asset Value

Add up all the assets in your Solo 401k plan . This includes :

Helpful Hint: Make sure you have the Solo 401k Adoption Agreement provided to you when you set up your plan with Nabers Group, and a record of your cumulative plan assets before you get started.