Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

What Kind Of Investor Are You

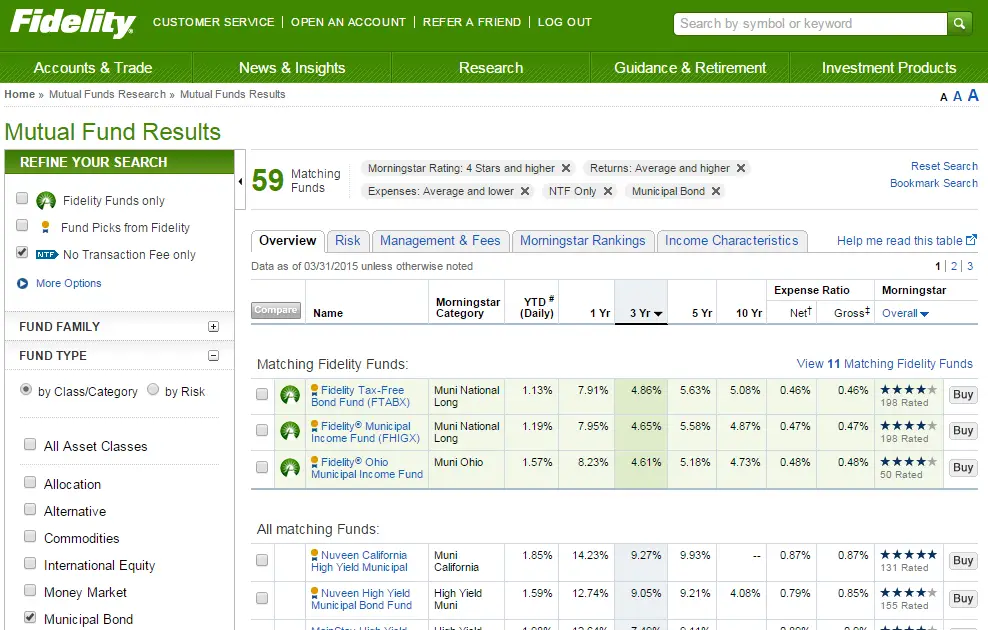

Don’t have the time, expertise, or interest it would take to choose investments and maintain an appropriate mix of investments in your IRA? Consider a professionally managed target date or asset allocation fund.

Target date funds let an investor pick the fund with the target year closest to their expected retirement. The target date fund manager then selects, monitors, and adjusts the investment mix over time. Asset allocation funds can be another simple way to diversify your portfolio using a single fund. In these funds, the manager sets and maintains a fixed asset mix.

For those doing it on their own, a diversified mix of investments is important. That way, a portfolio isn’t dependent on any one type of investment, although diversification does not ensure a profit or guarantee against loss. If you want to do it yourself, consider funds that hold a mix of investments in companies both big and small, from different parts of the world, and in different industries and sectors.

Low-fee investments that simply track the broad market through a benchmark index, may also be worth considering.

How We Chose The Best Solo 401 Companies

To choose the best solo 401 companies, we looked at 10 top providers of solo 401 accounts. In evaluating providers, we focused on pricing, investment options, account features, and trading platforms.

Pricing and fees were the single biggest factor considered, followed by investment choices. The ability to make Roth contributions or take out a 401 loan was the third major factor considered, as they may be less important to some investors. Account trading platforms, both online, desktop, and mobile, were also considered but carried less weight, as they are not as important to the typical retirement account investor.

Also Check: How Do Companies Match 401k

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

You May Like: What Is The Difference Between A Pension And A 401k

How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Read Also: How To Select 401k Funds

Fidelity Vs Vanguard: Comparing 401 Providers

Fidelity and Vanguard are among the largest fund companies in the world, and both offer 401 plans as parts of their services. Since 401 plans operate under the same tax laws and regulations, there are three main areas of comparison: the companies themselves, the funds offered, and provider features.

Recommended Reading: What Is The Best Fund To Invest In 401k

Convert To An Ira And Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Don’t Miss: How To Check Your 401k Balance Online

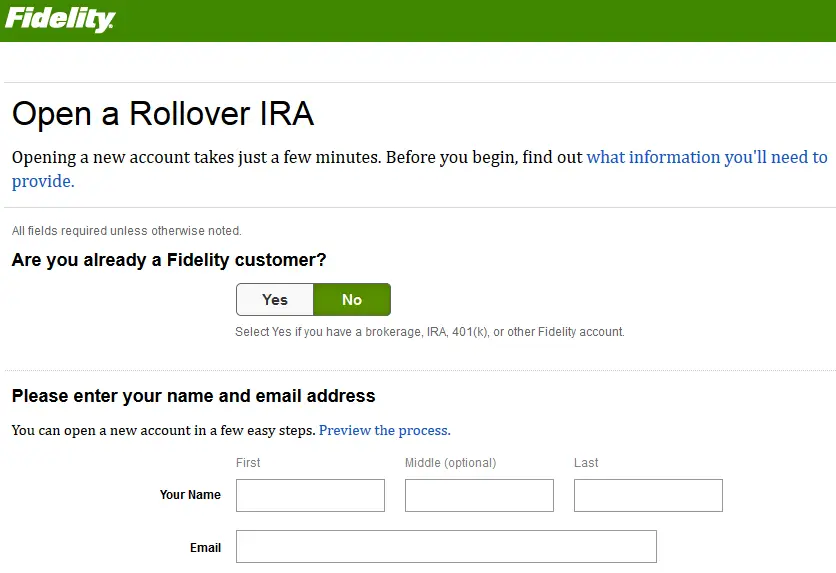

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Can You Take Out Dividends From 401k

A 401k account often holds mutual fund and stock shares, some of which may yield dividends. The dividends are paid to the plan custodian, and the earnings are either re-invested in other securities or deposited in a cash account within your 401k plan. When you remove dividends and other money from a pension plan, you normally have to pay income tax rather than capital gains tax. However, 401k dividends are difficult to get, and if you take them out, you may be subject to a penalty fee in addition to regular income tax.

Don’t Miss: Where Is My Fidelity 401k Account Number

Sysco 401 Plan Enhancement

When you need to take a loan or withdrawal from your 401 plan, it can take days or even weeks to access your funds due to waiting periods. In an effort to support our associates impacted by coronavirus, weâve partnered with Fidelity to make Electronic Funds Transfer and eCertified Hardships available, so you can access your funds quickly.

Electronic Funds Transfer â Starting today, we have eliminated the 10-day waiting period for EFTs. Now, when a participant enters their banking information in NetBenefits, they no longer have a 10-day waiting period to receive funds. EFTs are immediately available for any loans or withdrawals that are $50,000 or less. In addition to eliminating wait times, this will also reduce cost to the participant.

eCertified Hardships â If you need to make a hardship withdrawal, you may be able to initiate a withdrawal in as little at 48 hours through eCertification. You can speak with a representative or initiate a qualifying hardship withdrawal anytime on NetBenefits.

To learn more about accessing your retirement funds for coronavirus-related relief, call Fidelity at 1-800-635-4015 or visit the Fidelity website. Review the rest of the content on this page to learn more about the Sysco 401 Plan.

Recommended Reading: Can I Transfer Money From 401k To Ira

Investing In You And Your Future

After one year of service American will provide you with an employer contribution to your 401 account. The amount contributed will depend on your workgroup.

Team members with prior service or who transfer to American from one of its wholly owned subsidiaries will have their prior service at the subsidiary credited towards the one-year eligibility requirement and toward the service requirement for vesting full ownership of your 401 account balance.

American will contribute 16% of your eligible compensation to your 401 account up to the IRS limits. Participation is automatic, and you will be eligible for this nonelective company contribution* after completing one year of service.

If you do not have an investment election on file, your nonelective company contributions will be made to the Target Date Fund closest to the year you will turn age 65.

You are always 100% vested in your contributions, the nonelective company contributions and any associated earnings.

*A nonelective company contribution is a contribution to your 401 account that the company makes regardless of whether you are making your own contributions.

Flight Attendants receive a nonelective company contribution*, plus you are eligible to receive matching company contributions based on your eligible compensation. You become eligible to receive the following employer contributions after completing one year of service:

TWU-designated team members

You May Like: How Do You Take Money From Your 401k

How Financial Situation Can Affect How Much To Invest In Stocks

If your goal is retirement in 20 years, your ability to take risk in a retirement account would be higher than in the account you use to pay your monthly bills. Your retirement account has time to recover from setbacks, and any immediate losses could be recovered. In your bill-paying account, a loss could very well jeopardize your ability to pay rent next month.

If the outlook for your financial situation seems uncertain, it can make sense to have a relatively lower allocation to stocks.

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employerâs 401, certain steps are necessary.

You May Like: How To Protect Your 401k In A Divorce

Set Up Your New Account

If you don’t already have a rollover IRA, you’ll need to open onethis way, you can move money from your former employer’s plan into this account. If there are both pre-tax and post-tax contributions in your 401, you might need to open a Roth IRA too.* Which IRA should you consider for your rollover?

Are You Investing Enough For Retirement

Periodically, you may decide to invest more for retirement. This can be easily done using the following steps:

Also Check: Does Max 401k Contribution Include Employer Match

The Potential Tax Consequences On Retirement Plan Distributions

Apart from my own rollover, and according to the IRS, there are three permitted methods for doing a rollover of any kind:

Also Check: How To Do A Direct 401k Rollover

Placing Real Estate Investment Question:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Read Also: How To Convert 401k Into Roth Ira

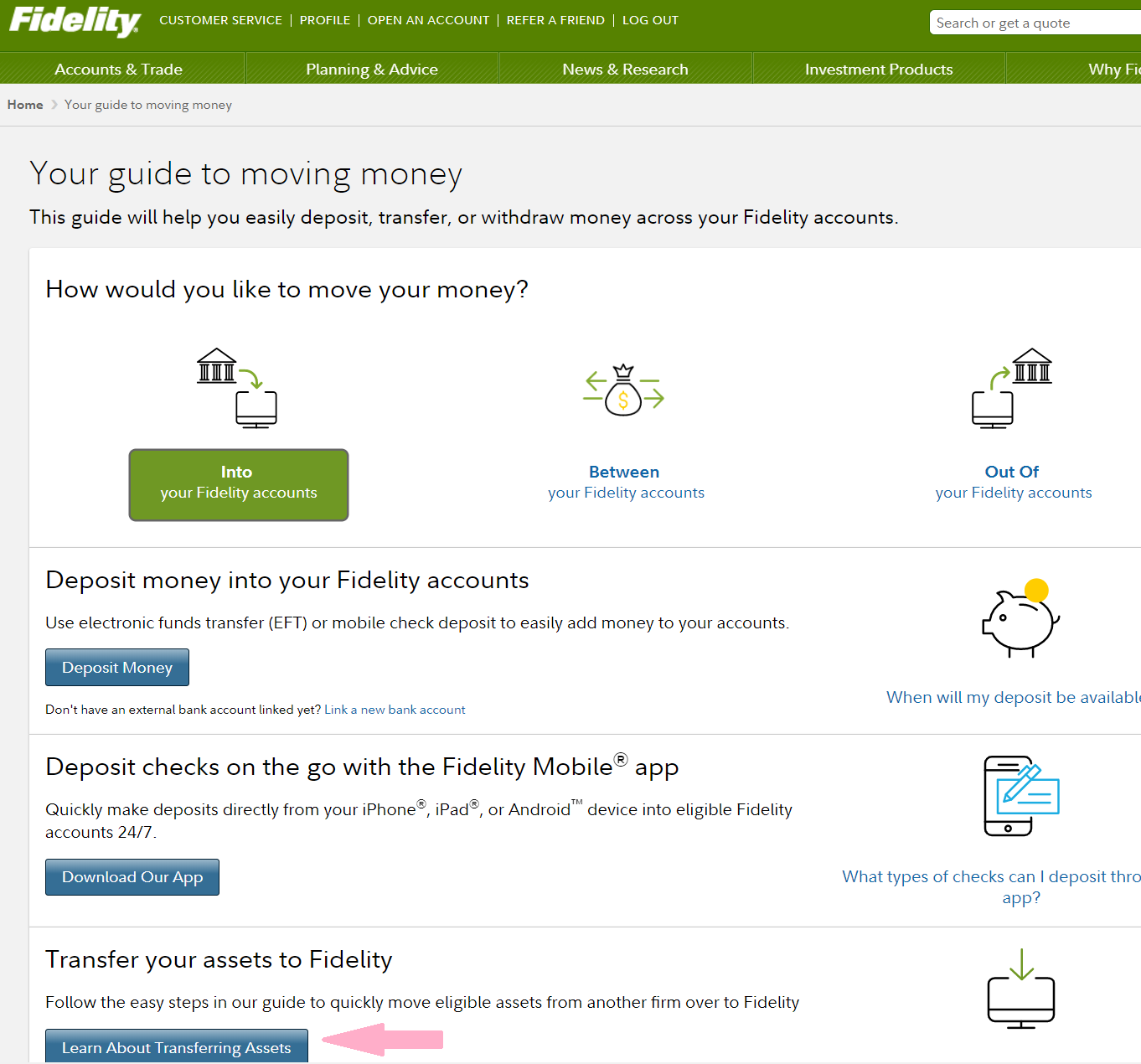

Deposit Your Money Into Your Fidelity Account

You can have the money sent directly to us to deposit into your account, or deposit it yourself.

Important: The check should be made payable to Fidelity Management Trust Company , FBO . Be sure to ask your former plan administrator to include your IRA account number on the check.

Please note: When a rollover check is made payable directly to you, you must deposit the money into your IRA within 60 days of receiving the check to avoid income taxes and a possible early withdrawal penalty.

|

Covington, KY 41015-0037 |

Rollover Existing Fidelity Solo 401k/keogh/psp: Question:

Yes your existing solo 401k with Fidelity Investments would get restated to our solo 401k plan which allows for 401k participant loans and investing in alternative investments such as real estate. We would then fill out new Fidelity brokerage account forms so that Fidelity can open a new brokerage account for the self-directed solo 401k that we offer. Note that Fidelity will not simply re-title the existing account. They require new brokerage forms. Subsequently, we would prepare an internal Fidelity transfer form to have Fidelity internally transfer the existing solo 401k equity holdings and cash to the new brokerage account for the self-directed solo 401k. You will then receive a checkbook in the mail from Fidelity for the new solo 401k for placing your alternative investments, and/or you can process the investments via wire.

Also Check: What Happens To My 401k If I Switch Jobs

What To Know About Fidelity Online Trading Services

Usage of Fidelitys online trading services constitutes agreement of the Electronic Services Customer Agreement and License Agreement. Before investing, consider the funds investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Don’t Miss: How To Choose 401k Investment Options

Calculate Your Risk Tolerance

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you don’t want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

You’ll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in “safer” investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until you’re going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When you’re older, you’ll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.