Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Locate Office Of Employees Provident Fund Organisation

- Informational

Locate Employees Provident Fund Organisation office in various states in the country. Users can find details upon choosing the name of the state, office location and district name from the drop down menu. Information on region code and office code is also available in the search results.

Manage Your Retirement Account Online

You made a commitment to your employees by offering them a way to help plan for their futures. Let us help you keep that commitment by offering an easy-to-use online retirement plan management website. You can view participant requests, manage transactions, and track participation anytime, anywhere.

See how our website can help you and your employees by watching this video. You can also read on to learn more.

You May Like: How Is 401k Paid Out

You May Like: How Much Does Fidelity Charge For 401k

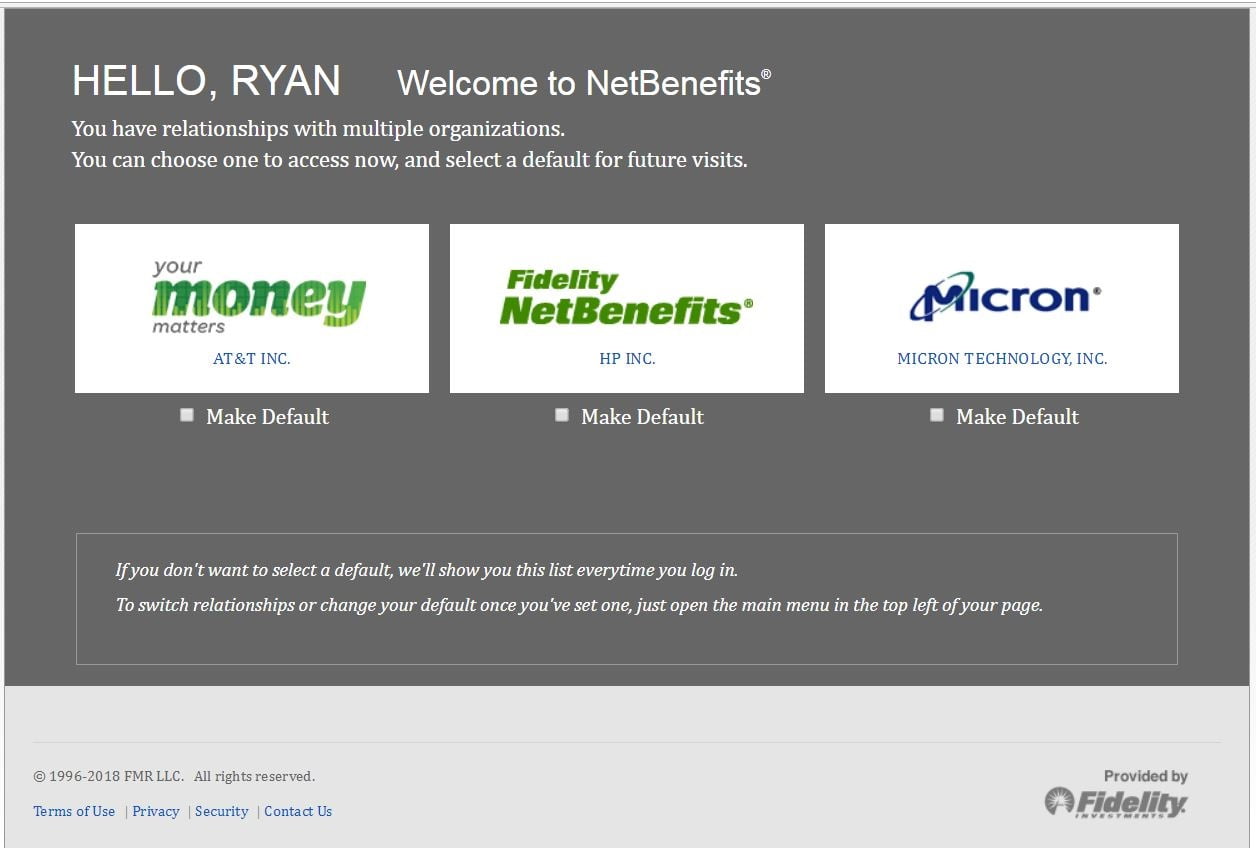

How To Check Your 401

First things first, how do you even check your 401 account online? Start by going to the website of your 401 provider. If youre not sure who your 401 provider is, go onto your employer intranet and it should be listed under a HR resources section. Once youre on their website, if you get stuck hit forgot username. If youve never set up an online profile this process will alert you to that pretty quickly. Itll take a couple of steps to get your username and password retrieved / set up. Once you have this bookmark the page and save your username / password either through a password manager or somewhere you can reference later.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Much Does A 401k Cost A Small Business

Also Check: What Happens To My 401k When I Leave My Job

Us Department Of Labors Abandoned Plan Search

In certain cases, such as in bankruptcies, employers abandon the 401 plans they provided to employees. If that happens, theyre required to notify you so you can receive the funds owed to you. If you werent notified or believe your plan may have been abandoned, you can use the U.S. Department of Labors Abandoned Plan Search. You can search by employer or plan name, and if a plan is found, youll receive the plan administrators contact information.

How Can I Check My Account Balance Via Passbook

Usually, banks issue passbooks to everyone on account opening. The passbook contains information about all the transactions in your account. To check your account balance, you can open your passbook. You can see the list of all debit and credit transactions. Hence, its essential to keep your passbook updated every time. However, to update your passbook, you need to visit the bank each time.

Read Also: Can You Use 401k To Refinance A House

A National Database To Find Forgotten 401s And Pensions Could Be On The Way But Savers Should Take Action Now To Locate Any Missing Retirement Accounts

At a time when many Americans are worried that they wont have enough money to retire comfortably, thousands have lost track of billions of dollars in savings.

There are more than 24 million forgotten 401 accounts containing some $1.35 trillion in assets, according to a report from Capitalize, which helps workers roll over their retirement plans when they change jobs. Companies are also holding on to billions in unpaid pension payments earned by former employees.

The problem is so widespread that Congress is considering legislation to address it. SECURE Act 2.0, which includes a wide range of benefits and protections for retirement savers , would create a national online lost-and-found database to help people track down these orphaned plans.

Brian Stivers, owner of Stivers Financial Services, in Knoxville, Tenn., says he typically meets one to two new clients a month who are in this situation. Most of the time, theyve changed jobs and forgotten about an old plan, usually because it had a small balance. Retirement plans are also misplaced when one spouse dies and the survivor is unaware of accounts with his or her former employers.

Where Has My 401 Gone

There are a few scenarios in which someone might lose track of their 401.

If you did a bit of job-hopping early in your career, you may have moved on and forgotten about your 401 plan. Or perhaps your company merged with another, but your 401 plan didnt transfer over. In other cases, you may have automatically enrolled in your companys 401 plan without realizing it.

You know all the paperwork from human resources you ignored? The information youre looking for probably was in there.

Regardless of why you lost track of a 401 plan, the good news is that whatever contributions you made no matter how long ago that may have been are yours to keep and always will be. Heres what you need to know to track down your old 401 and make it work in your favor again.

You May Like: How To Get A Loan From My 401k

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your companys HR department or plan administrator to see if its an option for you.

If it is and you decide its your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you dont handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers dont allow you to transfer money out of your 401 if youre a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Dont Miss:

How Can I Check My Account Balance Via Atm Cum Debit Card

You can also check your account balance through an ATM. They also provide the updated account balance. By visiting the nearby ATM, you can insert the ATM card or debit card and follow the on-screen instructions. It is suggestible to use your own banks ATM or an ATM network which your bank uses. Usually, other ATMs charge fees even if you dont withdraw cash. Also, your bank may charge additional fees if you use a foreign ATM. To check balance over a foreign ATM can be chargeable.

The steps following are the steps to check the balance in an ATM

- Swipe the ATM cum debit card

- Enter the 4 digit ATM pin

- Select the Balance Enquiry Option.

- Finish the transaction

Currently, RBI has put a limitation on the number of free transactions per ATM card. Even a balance enquiry is counted as a transaction. Once you exhaust the free transactions, you will have to pay a transaction charge for every transaction in that month.

Hence, it is advisable to use ATM cards for cash withdrawals or other services only. You can use mobile or different online ways to check bank account balances which are convenient and cost-effective.

You May Like: How To Find Lost 401k

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Vesting Of Employer Contributions

Your employer, however, may implement a vesting schedule for contributions they make on your behalf, such as matching contributions. However, theres only so much time the employer can require you to work before you become fully vested. Each vesting schedule must vest at least as fast as one of two options. The cliff vesting schedule requires that all employees be fully vested in employer contributions by the end of the third year of working. The graduated vesting schedule requires that employees be at least 20-percent vested after two years and vest an additional 20 percent each year after that.

For example, a vesting schedule that vests employees in employer contributions 10 percent after the first year, and then an additional 30 percent each year thereafter, would qualify because its always ahead of the graduated vesting schedule. However, a vesting schedule that fully vests employees after four years, but doesnt vest at all prior to that point, would fail the test because, at the end of year three, the employee isnt vested at all, which is behind both options.

Also Check: Where To Check 401k Balance

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Track How Your Retirement Plan Is Doing

View detailed participant data.

How is employee participation at your company? Are you doing enough to encourage your younger workers to start saving for retirement? You can answer these questions and view trends by reviewing your participants and their data, including loan amounts and contribution rates. If you find an area you want to focus on, we can provide suggestions to help.

Read Also: How To Rollover Ira To 401k

Do I Have A 401k I Don’t Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

Check Your 401 Beneficiary

While youre in your online account dont forget to check that youve named a beneficiary for your 401 account. Typically, a spouse must be the beneficiary unless they sign a waiver. If youre not married its important to name a beneficiary in your account. The Motley Fool shares additional tips on when someone inherits a 401.

You May Like: What Are The Different 401k Plans

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart, compounding interest is no joke.

How Much Social Security Will I Get If I Make $100 000 A Year

If youre making $ 100,000 a year right now, congratulations! You roughly triple the Social Security Administrations estimated 2019 median annual earnings of $ 34,248, doubling the average individual annual earnings of $ 51,916 a figure that is skewed higher by a handful of super-earners.

How much Social Security tax would a person who makes $100000 a year pay?

The Social Security Administration charges 6.2% of your earnings up to the first $ 142,800 . Any income beyond this figure is not subject to additional FICA taxes. It is, of course, subject to higher income tax rates.

How much SS will I get if I make 100k a year?

If youre making $ 100,000 a year right now, congratulations! You roughly triple the Social Security Administrations estimated 2019 median annual earnings of $ 34,248 and double the average individual annual earnings of $ 51,916 a figure that is skewed higher by a handful of super-earners.

Also Check: Should You Always Rollover Your 401k

Also Check: What To Do With 401k When You Retire

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

How And Why To Check On Your 401

If youre like many Americans, you may feel some unease when there is volatility in the markets. No matter what happens, try not to cash out your retirement savings, a move that could trigger taxes and reduce your retirement security in the long run. Be patient, and let your money keep growing through the markets ups and inevitable downs. But, do pay attention to the investment choices you make within these plans and their diversification.

Now could be the perfect time to give yourself a retirement plan checkup, perhaps with the help of a CFP® professional or your accountant. Just like your car, your retirement plan needs regular maintenance to make sure it will get you where youre going. A retirement plan tune up can feel like a chore. But you may get a pleasant surprise as you open the statements and check your online balances.

Here are five steps to a retirement plan tune up.

1. Remember all your different retirement accounts. Many people have multiple IRAs and 401s from different employers. Make a list. If you have old 401s at previous employers and havent accessed the accounts or collected the paper statements, now would be a great time to reach out either to the employer or the financial institution that held the account to get copies of statements. You might also have to reset passwords to gain access to online accounts.Consider rolling over your old 401s into your current one, or into IRAs. That will make it easier to do your financial checkup each year.

Also Check: Can You Do A 401k On Your Own