% Of Small Businesses Add Safe Harbor Contributions

Safe harbor 401 plans are very popular with small businesses. Unlike a traditional 401 plan, they automatically pass the ADP/ACP and top heavy nondiscrimination tests when mandatory contribution and participant disclosure requirements are met. This benefit is well worth the cost for many business owners, who often bear the brunt of the consequences when nondiscrimination tests fail.

% Of Small Businesses Add A Discretionary Match

One of most effective ways a small business can persuade employees to contribute pre-tax or Roth salary deferrals to a 401 plan is by matching some portion of them. This is unsurprising when you consider an employer match is like a guaranteed return on salary deferrals – or free money.

Most employer matches that arent intended to meet safe harbor 401 requirements are discretionary in nature so small businesses have the option to make them or not. A discretionary match made to a traditional 401 plan must pass the ACP test to be considered nondiscriminatory, while a discretionary match made to a safe harbor plan can be exempt from the ACP test when certain conditions are met.

What’s The Difference Between A Pension Plan And A 401 Plan

- A pension plan is funded by the employer, while a 401 is funded by the employee. contributions.)

- A 401 allows you control over your fund contributions, a pension plan does not.

- Pension plans guarantee a monthly check in retirement a 401 does not offer guarantees.

Pension plans have been in existence for a long time, while 401s are now more common. In fact, the 401 will most likely be replacing pension plans all together in the near future.2 However, there are still employers who offer both a pension plan and a 401 plan – if you’re lucky enough to be in that fortunate situation.

All Learning Center articles are general summaries that can be used when considering your financial future at various life stages. The information presented is for educational purposes and is meant to supplement other information specific to your situation. It is not intended as investment advice and does not necessarily represent the opinion of Protective Life or its subsidiaries.

Learning Center articles may describe services and financial products not offered by Protective Life or its subsidiaries. Descriptions of financial products contained in Learning Center articles are not intended to represent those offered by Protective Life or its subsidiaries.

Companies and organizations linked from Learning Center articles have no affiliation with Protective Life or its subsidiaries.

Read Also: How To Figure Out Your 401k Contribution

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual â the individual who rolls over his or her existing retirement 401 withdrawal funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business. A C corporation must be set up in order to roll the 401 withdrawal.

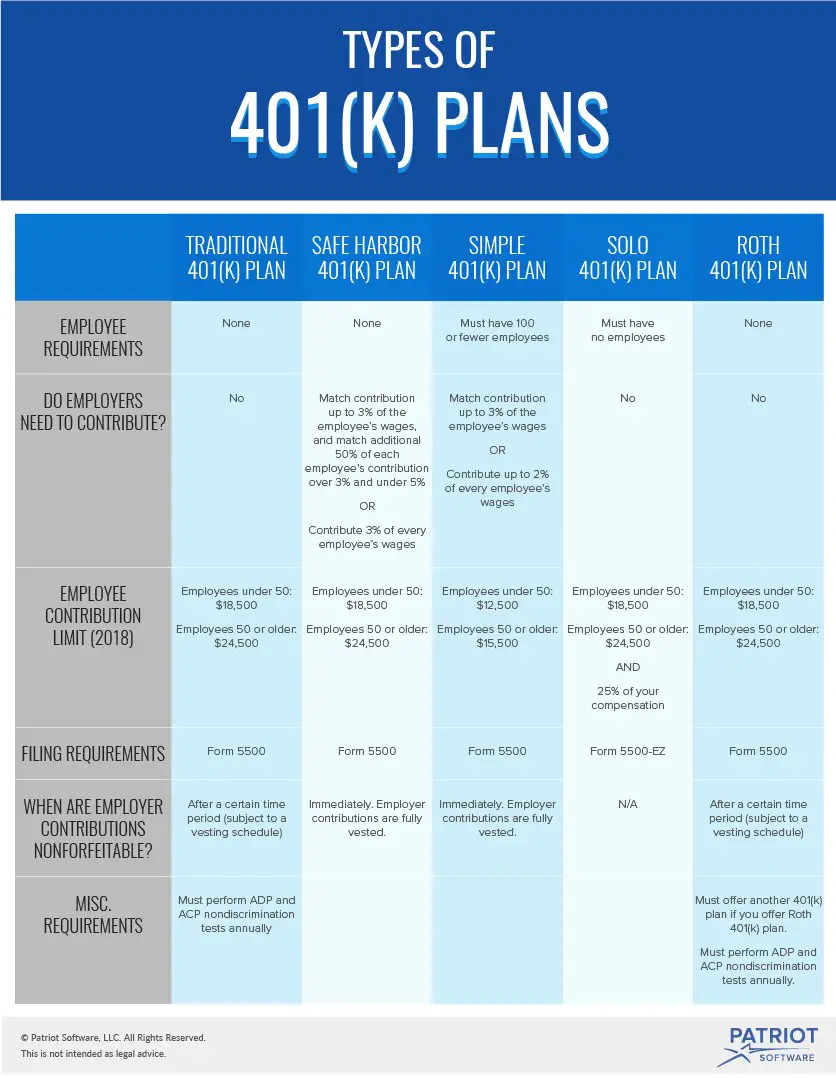

Safe Harbor 401 Plans

A safe harbor 401 plan is a special type of retirement plan that automatically passes the nondiscrimination test. This means that you dont have to pass an ADP and ACP test each year like you do with a traditional 401 plan.

Safe harbor 401 plans are popular with small businesses because employers can avoid the time and money it takes to pass nondiscrimination tests each year. But theres one caveat: you are required to contribute to an employees safe harbor retirement plan.

With a safe harbor plan, you must contribute to an employees 401, regardless of their title, compensation, or length of service.

Get more facts about safe harbor 401 plans below:

- Who can offer a safe harbor plan:

- Businesses of any size can offer a safe harbor 401 plan

Don’t Miss: Can You Rollover A 401k Into A Traditional Ira

Retirement Accounts For Small

According a 2020 Bureau of Labor Statistics report, 33% of workers don’t have access to a workplace retirement plan. At companies with fewer than 100 workers, roughly half of employees are offered a retirement savings plan.

If you work at or run a small company or are self-employed, you might have a different set of retirement plans at your disposal. Some are IRA-based, while others are essentially single-serving-sized 401 plans. And then there are profit-sharing plans, which are a type of defined contribution plan.

Main advantages of plans for the self-employed:

-

Plans for contractors, the self-employed and small-business owners have higher contribution limits than most employer plans and IRAs.

-

These plans often offer more investment choices than employer-sponsored plans, such as 401s.

-

Many of these plans are easy to set up and therefore not much of a burden on the employer that’s you, if you’re a small-business owner.

-

You might be able to set up your account at a financial institution you already use.

-

If you’re self-employed, you can give yourself a generous profit-sharing contribution, plus make your elective deferral with catchup as the employee.

Main disadvantages of plans for the self-employed:

Retirement Plans Offered By Employers

There are typically two types of retirement plans offered by employers: Defined benefit plans : The employer invests money for retirement on behalf of the employee. Once the employee retires, they receive regular payment as long as they meet the plans eligibility requirements.

Pensions and cash balance accounts are examples of defined benefit plans.

Defined contribution plans : The employee invests a portion of their paycheck into a retirement account. Sometimes, the employer will match up to a certain amount . In retirement, the employee has access to the funds theyve invested.

401s and Roth 401s are examples of defined contribution plans.

Lets get into the specific types of plans employers usually offer.

401 Plans

A 401 plan is a type of work retirement plan offered to the employees of a company. Traditional 401s allow employees to contribute pre-tax dollars, where Roth 401s allow after-tax contributions.

Income Taxes: If you choose to make a pre-tax contribution, your contributions will reduce your taxable income. Additionally, the money will grow tax-deferred and you will pay taxes on the withdrawals in retirement. Additionally, some employers allow you to make after-tax or Roth contributions to a 401. You should check with your employer to see if those are options.

Contribution Limit: $19,500 in 2020 and 2021 for the employee people over the age of 50 can contribute an additional $6,500.

Solo 401 Plans

Cons: You cant open a solo 401 if you have any employees .

Recommended Reading: Should I Get A 401k

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Best Retirement Plans: Choose The Right Account For You

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Gone are the days when workers could count on an employee pension plan and Social Security to cover their costs during those golden years. Today, pensions are a rarity and Social Security isnt a slam-dunk for future generations.

That’s why Uncle Sam wants needs you to save for retirement and is offering tax breaks on retirement accounts. Here’s how to to find the best retirement plans to save for your future.

Read Also: How To Invest My 401k Money

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a section of the U.S. Internal Revenue Code.

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2020 and 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above.

If the employee also benefits from matching contributions from their employer, then the combined contribution from both the employee and the employer is capped at the lesser of $58,000 or 100% of the employees compensation for the year.

Recommended Reading: How Do I Look At My 401k

Reasons To Add A Safe Harbor 401 Feature

- You expect your plan to be top heavy. A top heavy 401 plan must generally make a 3% minimum contribution to non-owners. That means adding a safe harbor contribution to a top heavy 401 plan may add little to no cost. A safe harbor match might even lower the cost of your plan if participants defer at low rates.

- You expect your plan to fail ADP/ACP testing. A safe harbor plan allows HCEs to maximize annual contributions without the risk of corrective refunds due to failed testing.

- You want to offer a generous retirement benefit to employees.

What Is A Retirement Savings Plan

A retirement savings plan is a strategy for accumulating the money needed to meet ones retirement goals. It may entail different account types , etc.) and guidelines for budgeting and spending.

Saving and investing for retirement isnt always so straightforward, beginning with the question of where to save and invest: There are many different types of retirement plans, and it can be confusing to know which is right for you.

Lets get into the specifics for different types of retirement accounts.

You May Like: How Much Does A 401k Cost A Small Business

How Does A Profit

A profit-sharing plan is a feature that is added to a normal 401 plan. In this arrangement, employers have flexibility in making contributions. Employers can offer but are not required to contribute matches to a 401 plan. In a profit-sharing plan, employers can contribute a set amount of percentage to all contributors that amount is adjustable and purely at the employers discretion. Employers can change that amount every year. In fact, an employer can decide to contribute nothing at all in a given year to an employees profit-sharing plan. For example, if an employer does not make a profit in a given year, they do not have to make contributions that year . Because the companys financial performance influences the employers decision to make a contribution one year but not the next, this is called a profit-sharing plan!

Here are some factors employers can consider when creating their profit-sharing plan:

In the years when a company makes contributions in its profit-sharing plan, the company must come up with a set formula for profit allocation. The most common way to determine contributions in profit-sharing plans is referred to as the comp-to-comp method.

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

Don’t Miss: What Is A 403b Vs 401k

What Are The Differences Between A 401 And A Simple Retirement Plan

Companies moving from a SIMPLE IRA to a 401 plan are usually seeking some additional flexibility and have outgrown their current SIMPLE plan. The questions arise: What is a SIMPLE retirement plan? And how is it different from a 401?

SIMPLE is an acronym for a Savings Incentive Match Plan for Employees. There two SIMPLE plans, SIMPLE IRA and SIMPLE 401. Both are tax-deferred retirement plans provided by employers. The goal of a SIMPLE plan is similar to other retirement plans: to allow employees a simple way to save and invest money for retirement. Weve outlined a few of the basics of SIMPLE and traditional 401 plans to highlight some important similarities and differences.

Types Of Retirement Plans To Be Aware Of

If youre going to enjoy your golden years in peace, youre going to need to be aware of the different types of retirement plans. By being knowledgeable, youll put yourself one step ahead of the game.

Start weighing your options today to find the best retirement program for you. The next step for preparing for your retirement is taking care of your debts. Visit the Get Out of Debt section of our blog to learn more.

Also Check: How Much Does 401k Cost Per Month

What Are The Different 401k Benefits

Planning for retirement can be a daunting, task because there are so many saving options. A 401k plan is one of the more popular options because it simplifies those options. The many 401k benefits include tax-free deductions, employer matching of contributions, early removal options and investment control. These elements all combine to form a retirement plan that gives its owner strong options for the future.

A 401k program is a retirement plan that traditionally takes deductions from a paycheck and deposits them directly into a savings account. Based on investment choices, that money earns interest according to a number of stock market factors. At a specified retirement age, the money and all of the accrued earnings are available to the holder.

One of the most compelling 401k benefits are its tax-free deductions. The money that is removed from a paycheck comes out before income taxes are removed. This is an enticing aspect of the 401k plan, because it means that this money is earned tax-free until it is removed at retirement.

Contributing To Both A Traditional And Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

Read Also: Can I Pull Out My 401k

Reasons To Add A Profit Sharing Feature

- A new comparability or integrated formula can be the cheapest way to get business owner contributions up to the IRS legal limit .

- Profit sharing contributions are discretionary. If your business is a startup, has erratic profitability, or frequently acquires other companies, you may not be in a position to make an employer contribution every year. This isnt a problem with profit sharing contributions. At the end of each year, you have control over whether to contribute, and if so, how much.

- Because profit sharing contributions are usually made in good years only, the feature can help incentivize employees to care more about your bottom line.

- Profit sharing contributions can be flexible enough for you to target individual employees for more generous contributions.

- Unlike an employer match, employees are not obligated to contribute salary deferrals themselves to receive a profit sharing contribution. If you have a lot of employees who dont earn enough to save for retirement, profit sharing could be an excellent way to take care of them and make your benefits more competitive.