Other Options For Getting 401 Money

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

401 loans must be repaid with interest in order to avoid penalties.

About two-thirds of 401s also permit non-hardship in-service withdrawals. This option, however, does not immediately provide funds for a pressing need. Rather, the withdrawal is allowed in order to transfer funds to another investment option.

Can You Pull Money Out Of 401k

youfrom401KyouyouYouyou cash outfundsfrom

. Furthermore, can I cash out my 401k while still employed?

Internal Revenue Service rules prohibit workers from cashing out a 401 while they are still employed at the company that sponsors the plan. By leaving the company that sponsors the plan, you can cash out your 401 account even if you’re currently working for another company.

Additionally, when can you withdraw from a 401k? The age 59½ distribution rule says any 401k participant may begin to withdraw money from his or her plan after reaching the age of 59½ without having to pay a 10 percent early withdrawal penalty.

Likewise, people ask, can you withdraw from 401k without penalty?

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year.

How much will I get if I cash out my 401k?

If you withdraw money from your 401 account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax, on the distribution. For someone in the 24% tax bracket, a $5,000 early 401 withdrawal will cost $1,700 in taxes and penalties.

Series Of Substantially Equal Periodic Payments

This is the classic Section 72t ) method for early withdrawal exceptions to the penalty. Essentially you agree to continue taking the same amount from your plan for the greater of five years or until you reach age 59½. There are three methods of SOSEPP:

7. Required Minimum Distribution method uses the IRS RMD table to determine your Equal Payments.

8. Fixed Amortization method in this method, you calculate your Equal Payment based on one of three life expectancy tables published by the IRS.

9. Fixed Annuitization method this method uses an annuitization factor published by the IRS to determine your Equal Payments.

Section 72 provides additional methods for premature distribution exceptions which can occur before leaving employment :

10. High Unreimbursed Medical Expenses for yourself, your spouse, or your qualified dependent. If you face these expenses, you may be allowed to withdraw a limited amount without penalty.

11. Corrective Distributions of Excess Contributions under certain conditions, when excess contributions are made to an account these can be returned without penalty.

12. IRS Levy when the IRS levies an account for unpaid taxes and/or penalties, this distribution is generally not subject to penalty.

And lastly, here are a few additional ways that you can withdraw your 401k funds without penalty:

Originally by Financial Ducks In A Row, 1/20/20

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

Recommended Reading: How Can I Track My 401k Check

If Youve Already Taken A Withdrawal Or Loan You Can Recover

Stay calm and make steady progress toward recovery. It can be done. Build up a cushion of at least three to nine months of your income. No matter what incremental amount you save to get there, Poorman says, the key detail is consistency and regularity. For instance, have the sum automatically deposited to a savings account so you cant skip it.

Scale back daily expenses. Keep your compact car with 120,000 miles and drive it less often to your favorite steakhouse or fashion boutique.

Save aggressively to your 401 plan as soon as possible and stay on track. Bump up your 401 contribution 1% annually, until you maximize your retirement savings. Sock away the money earned from any job promotion or raise.

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Recommended Reading: Can You Buy A House With 401k

How Much Can You Withdraw From A 401k Or Ira Early

Before the pandemic, according to the IRS, the maximum amount that the retirement plan can permit as a loan is the greater of $10,000 or 50% of your vested account balance, or $50,000, whichever is less.

For example, if you have a 401k balance of $40,000, the maximum amount that you can borrow from the account is $20,000.

After the CARES Act passed, you are now allowed withdrawals of up to $100,000 per person taken in 2020 to be exempt from the 10 percent penalty. You cant get the special tax and CARES Act treatments for withdrawn amounts greater than $100,000 in total across all of your accounts. Now that its 2021, there may be new rules. Double check with your accountant.

The CARES Act also eliminates the 20 percent automatic withholding that is used as an advance payment on the taxes that you may owe on employer-provided plans like your 401k.

Just know that hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, youll be paying income taxes on the contributions and earnings withdrawn.

You then get a three-year period to pay the taxes to the IRS. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

With Biden as President, there continues to be pandemic relief of all sorts.

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early-withdrawal penalties if you are under 59 1/2 .

Read Also: Is There A Fee To Rollover 401k To Ira

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

You May Like: How To Transfer 401k From Fidelity To Vanguard

Legitimate Reasons To Withdraw Funds From A 401k Or Ira Early

Updated: by Financial Samurai

Partially due to the pandemic, more people are wondering whether they should withdraw funds from a 401k or IRA before retirement to help pay for life. There are plenty of reasons to withdraw money from a 401k or IRA early. Unfortunately, some people go too far and end up using their 401k or IRA like a checking account instead of as a retirement account.

Withdrawing funds early from a 401k or IRA is like constantly picking at a scab. The more you do it, the slower your wound will heal. Pick it too often and the wound might actually begin to fester and result in a potential amputation .

Once you start withdrawing from your 401k or IRA early to pay for things, you may come to rely on your retirement funds as a crutch. As a result, you may never end up building a strong third leg for your retirement stool.

In general, treat your 401k and IRA like a black hole where money only goes in and never comes out. Then work to build your after-tax investment accounts in order to generate passive income.

Of course, if you are facing a life or death situation and the funds in your 401k or IRA are all you have, then withdraw what you need. But look what happened to stocks in 2020. The S& P 500 closed up 18% and the NASDAQ closed up 43%. If you withdrew funds from your 401k, you missed out.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Read Also: How Do I Get My 401k

Take An Early Withdrawal

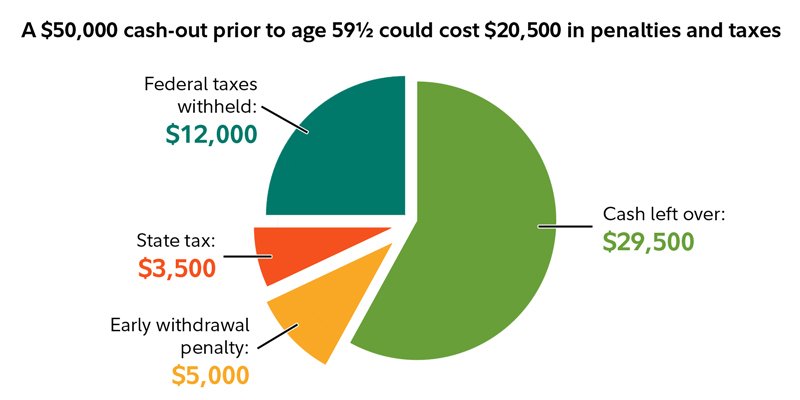

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59½ is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

Taking Money Out Of A Retirement Account May Have Financial Penalties

There are different rules on early withdrawals depending on the type of account. The type of account you want to take money out of will determine the penalties.

401

You maybe able to withdraw funds from your 401 via a loan or hardship withdrawal, but there may be plan limitations on these withdrawals. Note loans must be repaid, and hardship withdrawals are subject to a 10% penalty and income tax. If you have a 401 plan from a previous employer you may be able to access that savings with less restrictions but early withdrawals before age 59 1/2 are subject to the same 10% penalty and income taxes.

Traditional IRA

Traditional IRAs are subject to similar penalties and taxes on distributions as the 401 is, but the exceptions are a little more relaxed. For example, first time home buyers can take out $10,000 from their Traditional IRA without paying the 10% fees. You do still need to pay income tax on this withdrawal though. The same applies for qualified education expenses and health insurance premiums while unemployedyou wont pay the 10% fee, but you will pay income taxes.

Roth IRA

You May Like: How To Transfer 401k To Bank Account

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

Withdrawal Taxes And Early Distributions

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.

Also Check: How Does A 401k Loan Work

Withdrawing From 401k Plan At/after 595 Years

Have you checked into an age 59.5 withdrawal?

Generally speaking, a 401k plan must allow a participant age 59.5 and older to take withdrawals from their account even if the person is still working.

So, if you need money from your 401k plan, there is no better time than being 59.5 to take a withdrawal if you need it. Since, according to the IRS, you are standard retirement age, you can take this withdrawal without fear of paying the dreaded 10% early withdrawal penalty.

Of course, be careful not to drain your account too soon, or you could be in trouble down the road when you really are retired.

If you dont need the money, but you do want a little more flexibility within your retirement vehicle, this is a great opportunity for you to roll money over into an IRA. Since a 59.5 withdrawal is eligible to be rolled over, you can take all or a portion of your 401k assets and place them into an IRA even if you are still employed.

One word of warning, however. Always be mindful of the investments you hold in your 401k plan. Just because you can take a good portion of your money out and roll it to an IRA, doesnt necessarily mean that you should. If your account has suffered some recent losses due to poor market activity, it may not be a good time to transfer assets, since you will quite likely have to sell your investments to transfer the funds , and will be selling at a loss.

Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.

You May Like: What Happens With My 401k When I Quit