How Much Can High Fees Hurt My Retirement Savings

Compound interest is the eighth wonder of the world. He who understands it, earns it he who doesnt pays it.

This Albert Einstein quote gets bandied about pretty frequently in finance, but in this case, its particularly appropriate. What can be defined simply as “interest on interest,” compound interest occurs when the interest you earn on a balance is reinvested. If youre in your 20s or 30s, todays contributions to your 401 now will grow for decades before you retire. And anything that eats away at those contributions will have an outsize effect.

An extra 1% in fees can be brutal when it compounds over time. And extra 401 fees add up even more quickly for higher-income workers. A scenario from NerdWallet analyzes a 25-year-old who plans to retire at 65, has $25,000 in retirement savings, saves $10,000 in the account each year, and earns a 7% average annual return. In this example, paying just 1% in fees costs the saver more than $590,000 in sacrificed returns over 40 years of saving.

What Is The Range For Average 401 Fees

Typically, 401 plans cost somewhere between 1% and 2% of the plan assets, or the money saved in the account. Some outliers can see fees as high as 3.5%, but these high fees can have a significant impact on your employees ability to retire and should be avoided if at all possible.2 There are many factors which can impact the cost of a plan, from the amount of money in the plan, to the investment options you choose to include, to the level of service you receive.

Similarities Between 403 And 401 Plans

Tax deferral. Both plans allow for tax-deductible contributions, as well as tax deferral of investment income earned within the plans.

Employer match. Both plans provide for employer matching contributions.

Contribution maximums. Both plans enable employees to contribute up to $19,000 per year, or up to $25,000 per year if they are age 50 or older .

Withdrawal restrictions. Ordinary income taxes must be paid on any distributions from either plan. Both plans require that you wait to make withdrawals until you reach age 59½. Otherwise, you will be subject to the 10% early withdrawal penalty tax in addition to ordinary income tax. Both plans also require that you begin taking required minimum distributions beginning at age 70½.

Roth provisions. Both plans allow you to also pay up to $6,000 per year into a Roth provision in your plan, or $7,000 if you are age 50 or older.

Loan provisions. Both plans allow you to borrow up to 50% of the vested balance in your plan, not to exceed $50,000.

Recommended Reading: Should I Move Money From 401k To Roth Ira

Consider Mobile Check Deposit

If youre already a Vanguard client and youre registered for online access, remember that you can use our mobile check deposit option offered through the Vanguard app. Its faster than mailing a check!

When youre logged on and using the app, just tap the Mobile check option under the main menu and then follow the instructions. Learn more about mobile check deposit

Fees: What Is Reasonable

The goal of protecting your employees retirement savings is worthwhile in and of itself, its also a fundamental part of your legal responsibility as a fiduciary to your company 401 plan. The Employee Retirement Income Security Act of 1974 requires that employers who sponsor a 401 plan take a personal, legal responsibility to make good decisions on behalf of their employees. Managing fees and ensuring employees dont pay more than they should for their retirement plan is a key element of this responsibility.

But how do you tell what is reasonable when it comes to those 401 fees? Though weve already shared that fees in the range of 1-2% are average2, evaluating your plans fees isnt a simple matter of comparing your expense ratio to the average. No two retirement plans are the same, and the level of service your plan receives might be different from another companys. For that reason, its important to periodically benchmark your plans fees against those paid by other companies with similar 401 plans. This should come as part of a broader review whose aim is to give you total clarity on all of the service providers being paid out of your plan, what service they are providing, and how much theyre being paid.

Also Check: What Happens To Your 401k When You Die

Potential For Hidden Or Overlooked 401 Fees

In late 2020, the DOL released a final version of its fiduciary rule proposal. Improving Investment Advice for Workers & Retirees Exemption requires fiduciaries to recommend retirement options that adhere to a best interest standard, a reasonable compensation standard, and a requirement to make no material misleading statements. Essentially, investment professionals cannot put their own interests ahead of the interests of their clients . While the rule originally went into effect in February 2021, the DOL extended the grace period for fiduciaries to comply through the end of January 2022.

Even with this forthcoming fiduciary rule, there could still be 401 fees that go unnoticed. An example of commonly overlooked fees are plan management and service fees, because some administrators dont send yearly bills. Or, participants may receive statements that dont itemize individual fees and instead show fees in relation to the plans reduced net returns. Whats more, 401 statements may use technical terms that arent easy to decipher, . Regardless, its usually still possible to figure out what the numbers really represent if you know to look for them.

Monitor And Manage 401 Fees For Your Employees Sake

Its critical employers understand exactly how much their employees will pay in 401 fees. These fees can add a lot of cost to your employees, and thats not good. Even an extra 1% in annual fees can reduce an employees 401 account balance by about one-third after 35 years, meaning the average American household will pay $155,000 in 401 fees over a lifetime!4 The pursuit of clarity around your plans fees will help you not only better understand the value of the service youre receiving, but also better find opportunities to keep money in your employees accounts. After all, every dollar saved is a dollar that can grow and secure your employees futuresand thats what your 401 plan is all about.

Also Check: Do I Have A 401k Out There

How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

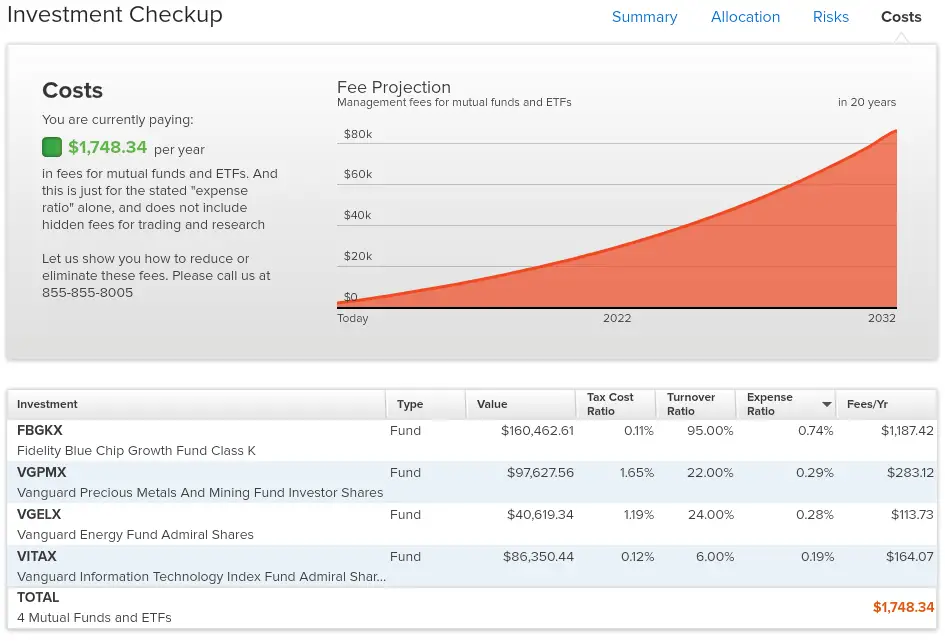

Mutual Fund And Etf Fees

When you’re staring at the fees charged by your 401 account itself, it is easy to forget about the fees charged by each underlying investment. Hopefully, your 401 offers investments you can buy and sell with no load fees or transaction fees. But that doesn’t mean the funds are free.

Most mutual funds charge an annual management fee reported as an expense ratio, or fee rate as a percent of assets. If you have $10,000 in a fund with a 1% expense ratio, you would pay $100 per year to have those funds managed.

Read More: Dual-income couples tend to make a major mistake that jeopardizes their retirement

Some funds charge additional marketing fees, so beware which funds you choose to invest in. Funds from Vanguard, Schwab, and Fidelity tend to charge less than 0.20% in fees. Other funds charge well over 1%. Every investor should know and understand where their money is going.

Don’t Miss: Where To Check 401k Balance

Expense Ratio Individual Fund Fees That Youll Deal With Regardless Of You 401k Provider

My Cost: 0.015%, or $15 of $100,000 portfolio

Most of us know that well pick from a list of several funds within our 401k plan to invest our money, and these funds come with a fee known as an expense ratio, ranging from .001% to a full 1.0%. Of course, Id recommend a low-cost fund such as one that tracks the S& P 500 index, often on the low end of the fee spectrum. Even a target date retirement fund, which will likely cost an extra tenth of a percent but will rebalance your investments automatically, is a great low-cost option. Actively managed mutual funds will cost you anywhere from half a percent to more than one percent, and you dont often get what you pay for. When I first began investing in my 401k, I assumed this was the only fee I had to concern myself with. Turns out, like usual, I was wrong.

Its important to keep expense ratios low, but even more so when your account is bleeding fees worth an additional percent of your account balance. In my case, I invested in the Fidelity S& P 500 fund, FXAIX, which carries a very low expense ratio of 0.015%, or less than two-hundredths of a percent. Control the fees you can control, I say.

Now, for the Fidelity administrative fees that I didnt know I was paying.A large portion of my net worth is tied up in index funds, including roughly $150,000 in my employer-sponsored 401k plan. But lets go with a $100,000 portfolio as an example to keep the math even simpler.

Fidelity Investments 401 Review 2021

Fidelity Investments is a multinational company based in Boston. The company ranks among the largest financial asset managers, operating a brokerage firm, a large offering of mutual funds, retirement services, wealth management and life insurance. Fidelity can serve as a full-service firm to small businesses that wish to do more than just administer a 401 plan through Fidelity.

Also Check: Can You Self Manage Your 401k

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

What Are Reasonable Fidelity 401 Fees

This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, investment, legal or tax advice. Please refer to your plan’s fee disclosure for more details.

Also Check: When I Withdraw From My 401k

How Do I Move Cash From An Existing Fidelity Account

You can withdraw money from your current Fidelity account by making a money transfer. You can choose between a one-time translation or a monthly machine translation. For external customers, you can link your external bank account to use wire transfers. The last form is a check.

Compare Your Fees Against Other 401 Providers

Now that you know how much each service provider is charging, compare those numbers to other, similar plans to see how those plans fees stack up against yours. This is called benchmarking.

It can be hard to know how much similar plans are paying for similar services, or what similar even looks like. If your provider is doing very little for you, it might make sense that their fees are lower than the industry benchmark you find while comparing expenses. Likewise, a provider that offers an exceptionally high level of service might reasonably charge higher fees. But there is lots of grey area between those two extremes, and thats why its so important to look at as many plans as possible to get a sense for where yours sits along the spectrum of service and cost.

Ask your 401 adviser for a report from a third-party benchmarking tool for an unbiased comparison. Review at least 100 plans in the benchmark so that you can really get a good view of how your plans fees compare to comparable plans, but also so you can look at the subset where the services are very similar.

Don’t Miss: How To Transfer Your 401k To Another Company

Compare To Similar Brokers

|

when you open and fund an E*TRADE account with code: BONUS21 |

Promotionin free stock for users who sign up via mobile app |

Promotionno promotion available at this time |

Get more smart money moves straight to your inbox

Become a NerdWallet member, and well send you tailored articles we think youll love.

Is Fidelity Good For Beginners Buying

With all these advantages in mind, Fidelity Investments is very suitable for beginners. Remember that Fidelity accounts are for people only. To start trading, you need a brokerage account. Setting up a brokerage account with Fidelity is quite easy and you can usually verify and deposit your account within 3 days.

You May Like: Can You Transfer 403b To 401k

Cashing Out: The Last Resort

Avoid this option except in true emergencies. First, you will be taxed on the money. In addition, if youre no longer going to be working, you need to be 55 to avoid paying an additional 10% penalty. If youre still working, you must wait to access the money without penalty until age 59½.

Most advisors say that if you must use the money, withdraw only what you need until you can find another income stream. Move the rest to an IRA or similar tax-advantaged retirement plan.

Also Check: How To Make 401k Grow Faster

How Do We Review Robo

NerdWalletâs comprehensive review process evaluates and ranks the largest U.S. robo-advisors by assets under management, along with emerging industry players, using a multifaceted and iterative approach. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs.

DATA COLLECTION AND REVIEW PROCESS

We collect data directly from providers, and conduct first-hand testing and observation through provider demonstrations. Our process starts by sending detailed questionnaires to providers to complete. The questionnaires are structured to equally elicit both favorable and unfavorable responses from providers. They are not designed or prepared to produce any predetermined results. The questionnaire answers, combined with product demonstrations, interviews of personnel at the providers and our specialistsâ hands-on research, fuel our proprietary assessment process that scores each providerâs performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

RATING FACTORS

FACTOR WEIGHTINGS

INFORMATION UPDATES

Writers and editors conduct our broker reviews on an annual basis but continually make updates throughout the year. We maintain frequent contact with providers and highlight any changes in offerings.

THE REVIEW TEAM

CONFLICTS OF INTEREST

Best Online Brokers

Don’t Miss: What Is The Max Percentage For 401k

Want To Ask Your Employer For A Lower

Here at Human Interest, our HI advisory fee is on average 0.50%2, and employers can choose to cover most of that. We offer access to nearly every mutual fund and index fund on the market, including low-cost funds from Vanguard, Dimensional Fund Advisors, BlackRock, Charles Schwab, and more. In fact, the average fund fee for our model portfolios is 0.07%, for a total average fee of 0.57%. By offering lower charges than the average 401 fees, expenses, and other costs, we can help plan participants such as yourself maximize your retirement savings.

If your companys 401 provider is charging high fees or doesnt offer low-cost funds, tell your HR manager about Human Interests investment policy were committed to making retirement possible for everyone. Get in touch with our helpful representatives to find out more about our 401 services.

Article By

Anisha Sekar

Anisha Sekar has written for U.S. News and Marketwatch, and her work has been cited in Time, Marketplace, CNN and more. A personal finance enthusiast, she led NerdWallet’s credit and debit card business, and currently writes about everything from getting out of debt to choosing the best health insurance plan.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Do I Have To Pay Taxes On 401k Rollover