Cashing Out Your 401 After Leaving A Job

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

A Few Notes Beforehand

I REPEAT

Also Check: How To Manage Your 401k Yourself

What Are The Exceptions To The Penalty Rules

Even an emotionless bureaucracy like the IRS recognizes that extenuating circumstances can force even the most prudent savers into the tough decision of tapping into their 401 plans early.

A 401k participant typically needs to reach a qualifying event in order to access their 401k balance, Compton said.

Qualifying events, however, are few and far between and even then, theres no guarantee that youll get to keep all your money.

Anyone withdrawing from their 401k before age 59 1/2 will still have to pay taxes on the distribution as ordinary income, said Laura Vogel, a FINRA member, licensed registered representative and financial services professional with New York Life. That being said, the extra 10% penalty that usually comes along with early withdrawals can be waived for things like higher education costs, a first-time home purchase, and some medical expenses.

Read: 29 Brilliant Retirement Ideas for Any Age

The direst circumstances can leave people with few other good options.

You may want to consider an early withdrawal if you become permanently disabled, Wilson said. Disability is a situation that is exempt from IRSs early withdrawal penalty.

But in other cases, its up to the individual to decide if the circumstances truly justify an early withdrawal.

For example, Vogel thinks it makes sense to tap your funds early for a down payment on a home, but Wilson doesnt think thats an extraordinary enough circumstance to qualify.

It Doesnt Matter Why Your Employment Ended

It doesnt matter whether you were fired, quit or were laid off. As long as you are no longer employed by the company maintaining the plan, and your employment was terminated during or after the year you turned 55, you will qualify for penalty-free early withdrawals from that 401.

Additionally, you dont even need to be retired to avoid paying taxes or penalties. If you have a 401 with Company ABC and quit at age 57, youll be able to access those savings without penaltyeven if you immediately take a job with Company XYZ.

Recommended Reading: How To Avoid Taxes On 401k

Continue To Invest In Your Ira When You Can

It goes without saying that you should try to leave your 401k and IRA money untouched as long as possible so even if you want to retire early leave your investment accounts alone if you can. Also note that throughout this entire distribution period your investments will continue to grow in your IRA even though you are taking distributions. I personally plan on both taking distributions and adding to the IRA account during this time period so I can actively use money in my 401k as needed in my early-retirement.

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Read Also: How Can I Find My 401k

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

There are many valid reasons for dipping into your retirement savings early. However, try to avoid the mindset that your retirement money is accessible. Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. So before you take any money out, ask yourself: Do you actually need the money now?

Think of it this way: Rather than putting money away, you are actually paying it forward. If you are relatively early on in your career, your present self may be unattached and flexible. But your future self may be none of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

With all this talk of 10% penalties, and not touching the money until youre retired, we should point out that there is a solution if you feel the need to be able to access your retirement funds before you reach age 59 ½ without penalty.

Contribute to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Keep in mind that there are income limits on contributing to Roth IRAs, and that you will still be taxed if you withdraw the funds early or before the account has aged five years, but some people find the ease of access comforting.

For some folks, however, a Roth-type account is not easily available or accessible to them.

Risks Of 401 Early Withdrawals

While the 10% early withdrawal penalty is the clearest pitfall of accessing your account early, there are other issues you may face because of your pre-retirement disbursement. According to Stiger, the greatest of these issues is the hit to your compounding returns:

You lose the opportunity to benefit from tax-deferred or tax-exempt compounding, says Stiger. When you withdraw funds early, you miss out on the power of compounding, which is when your earnings accumulate to generate even more earnings over time.

Of course, the loss of compounding is a long-term effect that you may not feel until you get closer to retirement. A more immediate risk may be your current tax burden since your distribution will likely be considered part of your taxable income.

If your distribution bumps you into a higher tax bracket, that means you will not only be paying more for the distribution itself, but taxes on your regular income will also be affected. Consulting with your certified public accountant or tax preparer can help you figure out how much to take without pushing you into a higher tax bracket.

The easiest way to avoid these risks is to resist the temptation to take an early 401 withdrawal in the first place. If you absolutely must take an early distribution, make sure you withdraw no more than you absolutely need, and make a plan to replenish your account over time. This can help you minimize the loss of your compound returns over time.

Don’t Miss: How Much Should I Put In My 401k

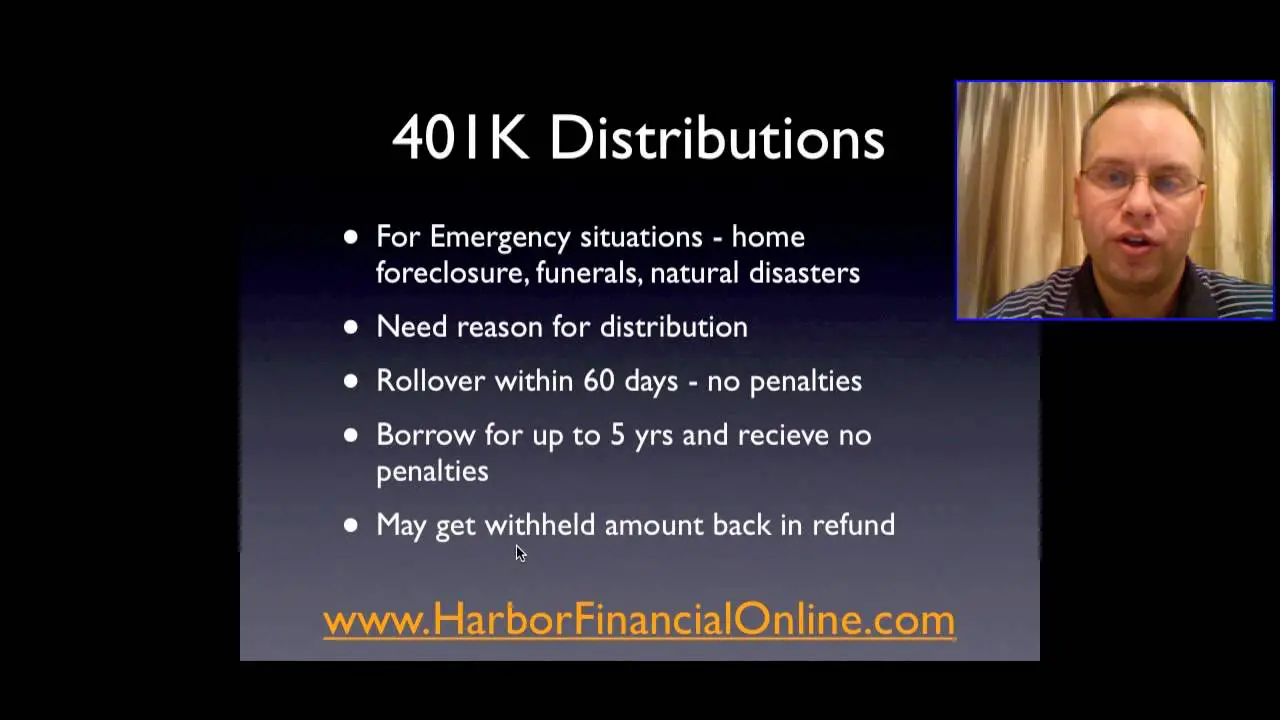

Options To Get Money Out Of Your 401k

Taking money out of a 401K is called a distribution or withdrawal. Generally, distributions cannot be made until a distributable event happens.

A distributable event is an event that allows distribution of a participants plan benefit and includes the following situations:

- The employee terminates or is terminated from their employment

- Your employer discontinues your plan and offers no new plan

- The employee suffers a significant financial hardship while still employed

- The employee reaches age 59½

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

You May Like: Can I Roll A Roth Ira Into A 401k

Should You Withdraw Early From Your 401k

Ask yourself honestly . . . are you tempted to cash out your 401k early?

You probably have a long list of all the great things you can do with those funds right now. But is an early withdrawal from your 401k really a good idea?

This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401 â or even your IRA â versus rolling it over to a tax-deferred account.

Make a smart decision. Use the calculator to let the math prove which is the optimum choice.

Do You Get Your 401 If You Quit

Be aware of the following rules regarding your old 401 account:

-

If your 401 has a total investment of more than $5,000, your employer may allow you to leave the account with them even after you quit the job.

-

If your account has a balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check.

-

If the total investment amount in your old 401 is between $1,000 and $5,000 and your employer wants to force you out, they must transfer the amount to your IRA.

You May Like: Can You Roll A 401k Into A Self Directed Ira

To Keep Your Living Arrangements Intact

Being at risk of eviction or foreclosure is a serious emergency for you and your family, in which case using retirement funds can be a viable option. If your landlord or mortgage lender hasn’t provided any options or assistance during this difficult time, you may consider paying your rent or mortgage with this money.

What Exactly Qualifies As A Hardship Withdrawal

Financial withdrawals are permitted when a certain event is in a dire need of financial aid. For example, emergency medical procedures fall into this category. The amount that you borrow must be used entirely to cover said hardship. In these circumstances, you wont have to pay any early withdrawal penalties, but youll still have to deal with the taxes.

Recommended Reading: Can You Transfer Your 401k

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

- Taking a coronavirus-related withdrawal: There are special rules in place in 2020 allowing a penalty-free withdrawal of up to $100,000 if you’re experiencing hardships related to the coronavirus.

You May Like: Can You Set Up Your Own 401k

New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

What Is A 401 K

If you’re a member of the US workforce, you probably have a rough idea of what a 401 k account is. Many employers offers a 401 k. A 401 k is an account that part of your pay/income goes towards. A financial institution uses this money to invest. Once the investment is profitable, you get a share of the returns.

An 401 k account is subject to different taxes than a regular savings account. You can keep the money in such an account for years without paying taxes on it. The amount of time that the funds sit in your account isn’t important, though. It’s actually expected that the funds stay in your 401 k account until you reach retirement age.

You May Like: Can I Transfer Part Of My 401k To An Ira

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is permanent. While you won’t have to pay the money back, you will have to pay the taxes right away and possibly a penalty. Additionally, by pulling out money early, you’ll miss out on the long-term growth that a larger sum of money in your 401 would have yielded. A loan has to be paid back, but on the upside, if it is paid back in a timely manner, you at least won’t lose out on long-term growth.

Recommended Reading: How Do I Open A Roth 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

How To Take Money Out Of Your 401 Early

An employer-sponsored 401 encourages you to save for retirement by allowing pretax contributions from your paycheck and tax-deferred growth on your investment. The catch is that you generally cant withdraw the money before you turn 59 1/2 unless you are experiencing a serious financial hardship or are willing to incur a 10% penalty and both options have additional consequences you need to consider before you make an early withdrawal. But if youve explored all other options and still feel like you need your 401 now, you might be able to take a distribution even if youre not in the midst of hardship.

Don’t Miss: How Much Can You Contribute To 401k