Irs Updates Guidance On Expansion Of Simple Ira Rollover Options

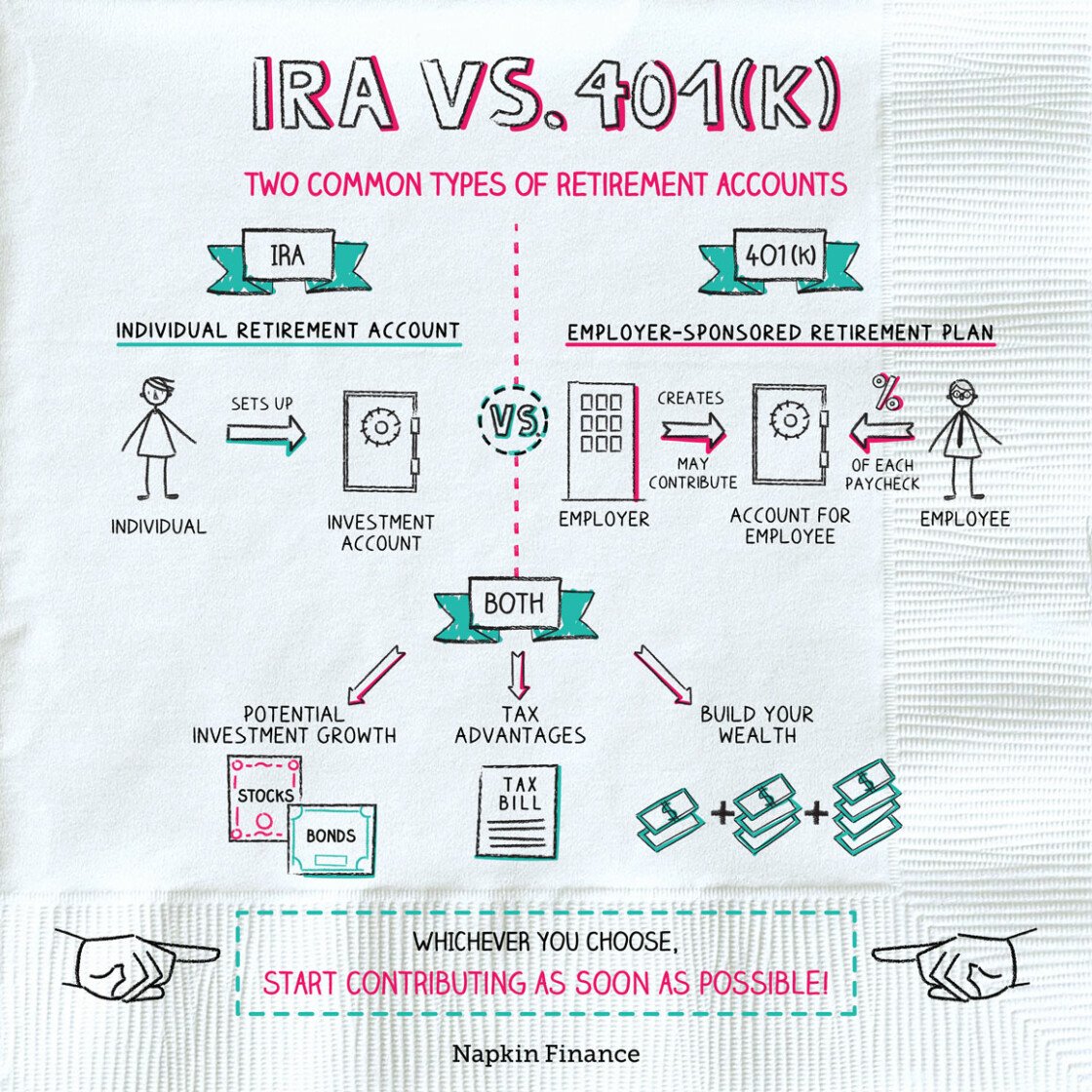

The IRS has updated the information it provides on the expansion of rollover options, which includes SIMPLE IRA plans. The information is contained in an issue snapshot that describes the change made by the Protecting Americans from Tax Hikes Act of 2015 to Code Section 408 to allow SIMPLE IRAs to accept contributions from other plans under certain circumstances.The PATH Act expanded the portability of retirement assets by permitting taxpayers to roll over assets from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403 or 457 plan, into a SIMPLE IRA plan.

Restrictions

There are some restrictions to the changes made by the PATH Act:

- SIMPLE IRAs cannot accept rollovers from Roth IRAs or designated Roth accounts.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law applies to rollovers from other plans to SIMPLE IRAs made after Dec. 18, 2015, the date the PATH Act was enacted.

- The one-per-year limitation that applies to IRA-to-IRA rollovers applies to rollovers from a traditional, SIMPLE, or SEP IRA into a SIMPLE IRA.

The IRS also notes that the PATH Act did not change the limitations for payments made from a SIMPLE IRA during the two-year period following initial participation.

Audit Tips

The IRS offers the following audit tips related to the changes the PATH Act made.

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: When You Leave A Job Where Does Your 401k Go

Can You Convert A Simple Ira To Aroth Ira

As someone who is working to save for retirement, you probably haveheard that you should try to save around$1 million or more to be comfortable. Having a sizeable nest eggcan help to generate enough cash on which to live.

If you have stashed away money into a simple IRA through your formeremployer, you might want to consider a simple IRArollover to a Roth IRA. Can you convert a simple IRA to a Roth IRA?The answer is yes, but there are some rules that you must follow to convert asimple IRA to a Roth IRA.

The answer to can you convert a simple IRA to a Roth IRA is yes, butyou must wait for at least two years after you first began participating inyour employers simple IRA plan. If you dont wait, the amount will be countedas a distribution. This means that you will have to include it in your incomeand pay apenalty of 25 percent unless you are older than age 59 1/2.

How To Roll Over Your 401 Into A Gold Ira

Home » IRA » How to Roll Over Your 401 into a Gold IRA

Are you tired of the high fees and limitations on your 401? While a 401 is one of the most common vehicles for retirement savings, its not the only one. Learn about the advantages of gold IRAs and how to roll over your 401 into one of these IRAs.

Recommended Reading: How To Set Up 401k For Small Business

Choose Your Precious Metals

The good news is you dont have to make this decision on your own. Your Precious Metals Specialist at Birch Gold Group can provide you with information and even make recommendations based on your current situation.

For example, what are your choices? Your Specialist can go over the metals choices in more detail with you. There are four precious metals that are approved to become a part of your IRA. The IRS has determined some specific criteria you will need to follow to make sure they are eligible.

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Dont Miss: How Does A 401k Loan Work

Read Also: Can You Have A Roth Ira And A 401k

How To Roll Over Your 401 To A Roth Ira

Rolling over your 401 plan to a Roth IRA is a taxable event. Youll have to pay income tax on your contributions, your employer-match contributions and all earnings. Depending on the size of your account, this could push you into a much higher tax bracket, so you shouldnt proceed before youve done the math. You may also want to consult a financial advisor to make sure this move is the right one for you.

Roll Over Your 401 To A Traditional Ira

If you’re switching jobs or retiring, rolling over your 401 to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are tax-deferred1 retirement accounts.

- Pros

-

- Your money can continue to grow tax-deferred.1

- You may have access to investment choices that are not available in your former employer’s 401 or a new employer’s plan.

- You may be able to consolidate several retirement accounts into a single IRA to simplify management.

- Your IRA provider may offer additional services, such as investing tools and guidance.

- Cons

-

- You can’t borrow against an IRA as you can with a 401.

- Depending on the IRA provider you choose, you may pay annual fees or other fees for maintaining your IRA, or you may face higher investing fees, pricing, and expenses than you would with a 401.

- Some investments that are offered in a 401 plan may not be offered in an IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

- Whether or not you’re still working at age 72 RMDs are required from Traditional IRAs.

You May Like: Can I Get Money From My 401k

Can I Cash Out My 401 Instead

If you withdraw funds from your 401 without rolling them into another retirement account, your withdrawal will be treated as an early distribution. Unless youâre age 59½ or older or you qualify for an early withdrawal , youâll have to pay a 10% early withdrawal penalty and regular income tax on the amount you cash out.

Read Also: What Can You Roll Your 401k Into

How Long Does It Take To Rollover A 401 To An Ira

How long does it take to rollover 401 to an IRA? Find out the rollover rules for moving funds from a 401 to IRA, including the time limits and costs involved.

If you are changing jobs, one of the considerations you should make is what to do with your 401 plan. Do you cash it or roll it over to an individual retirement account ? While cashing it out is an option, you will get a lower payout after tax and penalty deductions. Your best bet is to move funds to an IRA.

A 401 rollover to an IRA takes 60 days to complete. Once you receive a 401 check with your balance, you have 60 days to deposit the funds in the IRA account. If you choose a direct custodian-to-custodian transfer, it can take up to two weeks for the 401 to IRA rollover to complete.

Generally, when choosing what to do with your 401 money, remember the IRS wants the retirement money to remain in a retirement account. If you cash it out or do an early withdrawal, the distribution will be subjected to ordinary income taxes and penalties. However, moving funds from a 401 to an IRA keeps the funds intact as long as you observe the 60-day deadline.

Also Check: How Much Can You Put In Your 401k A Year

Recommended Reading: How To Allocate My 401k

Rolling Into A Traditional Ira

Choosing to roll your traditional 401 to a traditional IRA preserves your tax-free money. In this case, your total account would be transferred over to an IRA and no taxes would be due until its time to withdraw. This can be a better solution if you anticipate having a lower tax rate in the future.

Delay Required Mandatory Distributions

Workers with traditional IRAs and 401s both face the same reality when it comes to taking mandatory distributions. The IRS requires that you begin taking distributions by April 1 of the year following your 72nd birthday. However, you may delay taking RMDs from your 401 if youre still working and own less than 5% of the company that sponsors the plan.

Don’t Miss: Can You Move An Ira To A 401k

Why Roll Over An Ira Into A 401

There are a few reasons you might want to roll a traditional IRA into a 401, though it should be noted you can do this only if your company plan accepts incoming transfers . Here are the pro IRA-to-401 rollover highlights:

Compare costs among your retirement plans to find out where youre getting the better deal.

-

Protection against creditors: 401s have protections against creditors that IRAs dont provide, including in bankruptcy and against claims from creditors. IRAs are protected in bankruptcy up to a limit of $1,283,025 dont ask us why the amount is so exact across all plans. IRA protection from creditors may vary by state.

-

You may be able to put off distributions if you work longer: A traditional IRA requires minimum distributions to begin at age 70½. A 401 does, too the IRS wants to get its hands on the taxes you owe when you take those distributions, because theyve been deferred since the contributions were made but if youre still working, you can postpone distributions from a 401 until you retire.

-

401 loans: These are, lets be clear, a last resort. But if youre in dire need of money and you have nowhere else to get it, a 401 might offer you the option to take a loan from your own account, then pay yourself back with interest.

» See how a 401 could improve your retirement: Try our 401 calculator.

You Are At The Center Of Everything We Do

-

Get expert guidance you can trustOur associates are salaried professionals with no sales commissions or quotasso you can be confident that your needs always come first.

-

Keep more of your money with low costsOver 90% of our funds for individual investors have expense ratios below their peer category averages.4

-

Access our latest thinking and planning resourcesFrom powerful tools and planning guides to our experts perspectives on the markets, we offer a wide range of resources to help you make informed investing decisions.

Don’t Miss: Can I Withdraw Money From 401k

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

What Is A Simple Ira

A simple IRA is a typeof retirement account that is established by employers for the benefit of theiremployees. It may be used by small businesses that do not have 401 plans, includingsole proprietorships and partnerships.

With this type of plan, employers make matching contributions into theIRA. The contributions that employees make are made on a pre-tax basis, meaningthat they will have to pay taxes when they begin taking distributions.

Also Check: How Do I Get A 401k Account

Already Have An Ira With Principal

Log in to view account information online or add to your account.

Learn more about rollover IRAs:

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investment and insurance products are:

- Not insured by the Federal Deposit Insurance Corporation or any federal government agency.

- Not a deposit, obligation of, or guaranteed by any Bank or Banking affiliate.

- May lose value, including possible loss of the principal amount invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the member of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754,member SIPC. Principal Life and Principal Securities are members of Principal Financial Group® , Des Moines, IA 50392.

Principal, Principal and symbol design, and Principal Financial Group are trademarks and service marks of Principal Financial Services, Inc., a member of the Principal Financial Group®, Des Moines, IA 50392.

Moving Assets To An Sdira

How does the average person go from their existing retirement accounts into a self-directed IRA? Your Birch Gold Precious Metals Specialist will help here, making the process as smooth as possible.

Most commonly, people resort to 401 rollovers and IRA transfers. There can also be rollovers from other employer-sponsored retirement accounts, such as a 403, TSP, 457, and so forth.

Transfers versus rolloversA transfer moves funds between retirement accounts of the same type, like between two IRAs. On the other hand, a rollover takes funds from one retirement account type to another. You can roll over several accounts into another one, blending different types of accounts together and, with a rollover, the tax-deferred status of your assets can be preserved.

Read Also: How To Take Out 401k Money For House

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

Recommended Reading: How To Roll An Old 401k Into A New 401k