Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

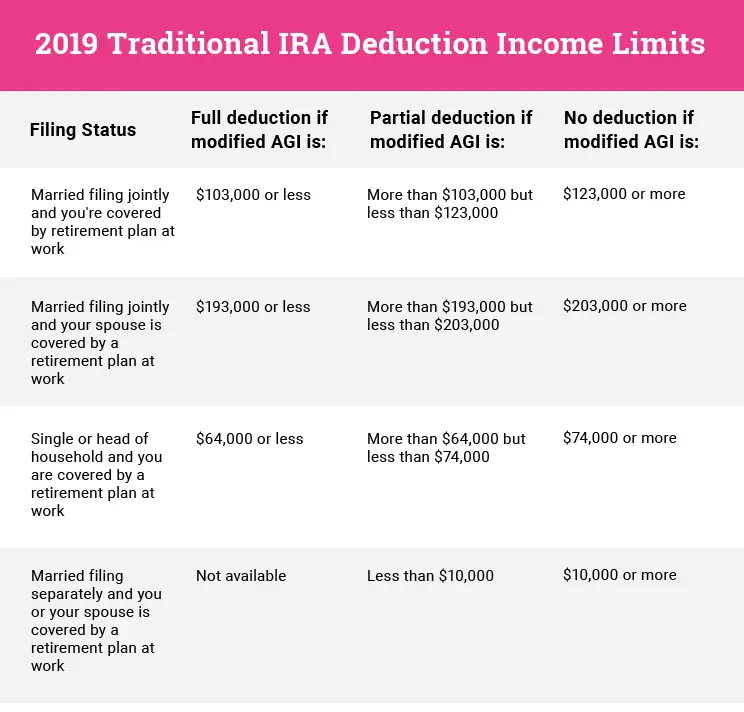

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

Also Check: How Do I Get My 401k From My Old Job

How Do I Avoid Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Saving Tips For Retirement

- Need help planning for retirement? Talk with a financial advisor about your goals. SmartAssets financial advisor tool can match you with up to three local financial advisors, and you can choose the one who is best for you. If youre ready, get started now.

- Take advantage of any 401 match that your employer offers. Be sure to contribute enough to your 401 to qualify for the matching funds. See if youre on track to save enough for retirement by using SmartAssets 401 calculator.

Read Also: How Can I Get Money Out Of My 401k

Also Check: Can You Invest Your 401k In Stocks

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words direct rollover are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there arent any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you arent incurring higher account fees.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Read Also: Can I Keep My 401k After I Leave My Job

Roll It Into A New 401 Plan

The pros: Assuming you like the new plans costs, features, and investment choices, this can be a good option. Your savings have the potential for growth that is tax-deferred, and RMDs may be delayed beyond age 72 if you continue to work at the company sponsoring the plan.

The cons: Youll need to liquidate your current 401 investments and reinvest them in your new 401 plans investment offerings. The money will be subject to your new plans withdrawal rules, so you may not be able to withdraw it until you leave your new employer.

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Its also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, its a good way to save money, stay organized and make your money work harder.

Read Also: How To Pull Money Out Of My 401k

Read Also: How To Invest My Fidelity 401k

How To Roll Over A Pension Into An Ira

Private sector employers that once offered workers traditional pensions, typically defined benefit plans, have been encouraging people to roll over their pensions into tax-advantaged plans like individual retirement accounts and 401s. If youre considering such a move, its important to understand your options, the pros and cons of each option and the tax-related rules about such a move. Before you do anything, though, consider working with a financial advisor who can help you make the best choices.

During the 1980s, 60% of private-sector companies offered their workers traditional pension plans, which were usually defined benefit plans. As the years have passed and employees stopped staying with the same company for life, the defined benefit plan is going the way of the dinosaur. Today, only 4% of private companies offer defined benefit plans.

As private-sector companies have discontinued their traditional pension plans, they have encouraged workers to launch a pension rollover to an IRA. Some have replaced the defined benefit plan with a 401, a defined contribution plan. They have encouraged their workers to either roll over their pension money to the new 401 or initiate a pension rollover to an IRA.

Roll Over Your 401 To A Roth Ira

If youre transitioning to a new job or heading into retirement, rolling over your 401 to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free.2

- Cons

-

- You cant borrow against a Roth IRA as you can with a 401.

- Any Traditional 401 assets that are rolled into a Roth IRA are subject to taxes at the time of conversion.

- You may pay annual fees or other fees for maintaining your Roth IRA at some companies, or you may face higher investing fees, pricing, and expenses than you did with your 401.

- Some investments offered in a 401 plan may not be offered in a Roth IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

Also Check: How To Transfer 401k From Charles Schwab To Fidelity

You May Like: How To Cash In Your 401k Early

Rollover To A Traditional Ira

Transferring funds between a traditional 401 and a traditional IRA or between a Roth 401 and a Roth IRA is relatively straightforward. In many cases, you can do a direct rollover, also called a trustee-to-trustee transfer. This involves your 401 provider wiring funds directly to your new IRA provider. Alternatively, your 401 provider may send you a check that you then deposit into your new IRA.

Look out for any taxes your provider may have preemptively deducted. You shouldnât owe any taxes or penalties as long as you deposit money in a tax-advantaged retirement account within 60 days.

Move Money To New Employers 401

Although theres no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans. I have counseled employees who have two, three, or even four 401 accounts accumulated at jobs going back 20 years or longer, Ford said. These folks have little or no idea how well their investments are doing.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

Recommended Reading: When Is A 401k Audit Required

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Tread Carefully With Company Stock

Some retirement savers hold company stock in their 401 alongside their other investments. In that situation, if you roll over all your 401 assets to an IRA, you lose the potential to get a more favorable tax treatment on any growth those shares had while in your 401.

It gets a bit confusing, but the idea is that if the company stock has unrealized gains, you transfer it to a brokerage account instead of rolling it over to the IRA along with your other 401 assets. Upon transferring, you are taxed on the cost basis .

Its a complex transaction, and if done incorrectly, the strategy loses its tax advantage.Melisssa BrennanFinancial planner with ARS Private Wealth

However, when you then sell the shares from your brokerage account whether immediately or down the road any growth the stock experienced inside the 401 would be taxed at long-term capital gains rates . This could be less than the ordinary-income tax treatment youd face if the stock went into a rollover IRA and then were withdrawn.

Heres an example: If the cost basis of your company stock is $10,000 and the gains on it were $20,000, you would pay ordinary taxes on the $10,000 when you transfer the shares to a brokerage account.

The $20,000 in gains, however, would be taxed at long-term rates once the stock is sold. Any further growth from the point of transfer to sale would be taxed as either short- or long-term gains, depending on how long you held it before selling.

Read Also: Can I Invest In A 401k On My Own

Don’t Miss: How To Open 401k For Individuals

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

A financial advisor like me can guide you through the process if you have questions.

What to Say

You May Like: Can I Roll My 401k Into A Roth Ira

Start Your 401 Rollover With Human Interest Today

Be patient with the rollover process and dont be surprised if you may have to jump on the phone a couple of times with your former and new plan administrators. We believe you should focus on the retirement account that is best suited for your long-term retirement saving plans and not on the one offering the least amount of paperwork.

As a reminder, if you are a current participant in a 401 plan administered by Human Interest, you wont be responsible for any future transaction fees. Interested? Contact us today to start your 401 rollover. Were here to provide you the resources you need to save the way you deserve.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment education, and integration with leading payroll providers.

You May Like: How To Check Your 401k Balance

Cashing Out Or Depositing Into A Savings Account

In case it hasnt been drilled into your head yet by seemingly everyone: Unless the circumstances are extremely dire, withdrawing any funds from a 401 before you turn 59 ½ is never a good idea. Why? Because not only will your 401 provider automatically withhold 20% of the total for tax purposes, youll also get hit with a 10% penalty fee come tax season.

But along with potentially giving up 30% of the money, you also stand to lose out on the unique security retirement accounts provide: Thanks to a 1974 law known as the Employee Retirement Income Security Act , the money in your employer-sponsored retirement plan is protected from an assortment of financial fallouts. For example, the money in a 401 cant be seized by creditors if youre in debt, and your account is exempt from bankruptcy proceedings. Traditional and Roth IRAs are also protected from being seized . If you put that money in a savings account or personal investment portfolio, you lose those protections.

Youve worked your entire life for this savings and that retirement money is protected in a way that so many other accounts arent, Meadows says.

For those with smaller sums in their old 401, it may not seem like that big of a deal , but every dollar counts after you stop earning a regular paycheck which is often earlier than you think.