Whats The Difference Between A Withdrawal And A 401 Loan

With a 401 loan, you must repay the money back into your account over a period of time. With a standard withdrawal, there are no repayment requirements. You will be charged interest on the loan, although you are technically paying the interest back to yourself. The money goes back into your 401 account, and you usually can spread the payments out up to 5 years. If you are using the money for a down payment on a home, you can even spread them over 15 years. A loan is usually a much better option than a withdrawal because at least you will be replacing the money. However, not all plans offer 401 loans, so that might not be an option for you.

Convert The 401 To An Ira

Individual retirement accounts typically have different withdrawal rules compared to 401s. So, converting to an IRA first might save you the 10% early withdrawal penalty.

Theres also no mandatory tax withholding on IRA withdrawals, so youre almost certain of a bigger check. Youll still pay the tax when its time to file returns, but youll have more money to deal with the situation in the immediate term.

Its a perfect option to go with for those in a lower tax bracket sure of getting refunds.

However, before switching to an IRA, you need to make sure you understand the peculiarities, including fees.

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Recommended Reading: What Happens To 401k During Divorce

Definition And Example Of The Rule Of 55

If you have a 401 plan, you may know there is usually a 10% penalty for withdrawing any of the funds before you reach age 59 1/2. One exception to this rule affects those not yet retiredthose between ages 55 and 59 1/2.

For example, suppose you’re 57 years old and are laid off from your job. Now that you don’t have income from work, you may need to dip into your 401 funds. If you were younger than 55, you would have to pay a penalty in order to do that. However, per the Rule of 55, because distributions were made to you after you separated from service with your employer and after the year you reached age 55, you can withdraw from your retirement savings penalty-free.

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Recommended Reading: How Do I Open A Solo 401k

What Happens To My 401k If Im An Immigrant On H1b Visa And Have To Leave The United States

- Nothing happens to it but you have some choices about what to do with it. As discussed above, if you terminate your employment and leave the United States, you may

- Leave the 401K where it is

- Roll the 401K into an IRA

- Cash out the funds in the 401K

When To Consider A Retirement Early Withdrawal

You should consider making withdrawals from a retirement account only under dire circumstances. Given the financial and emotional impact that situations such as the COVID-19 pandemic as well as national disasters have had on Americans, there are situations when it could make sense to withdraw early.

Recommended Reading: How To Contribute To 401k Without Employer

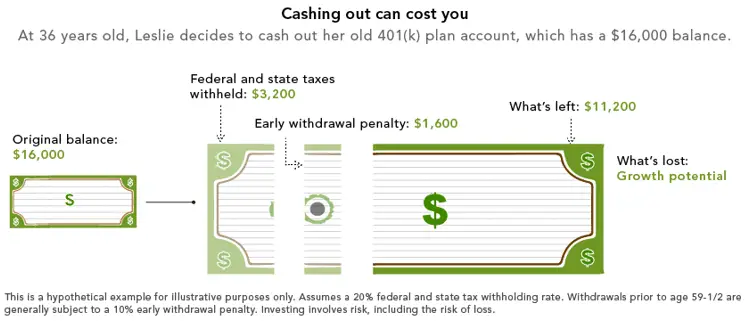

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2, even if you haven’t retired. The best idea for old 401 accounts is to roll them over when you leave a job. If you are 59 1/2 or older, you will not be hit with penalties if you withdraw from your old accounts. However, you need to check with your human resource department about the rules around withdrawing from your current 401 if you are still in the workplace.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Also Check: When You Leave A Company What Happens To Your 401k

Roll Money Into An Ira

If you are not satisfied with the 401 investment options, you can rollover the money into an IRA since the latter has more investment options and offers greater control. You can reallocate your portfolio of investments to help you grow your investments further in years to come.

If you have a string of old 401s when you retire, you should consolidate them into an IRA for better management of your retirement savings. Also, you can reduce the administration fees of your retirement money, and even qualify for discounts on sales charges.

How The Rule Of 55 Works

The rule of 55 affects how and when you can access your retirement savings. If you are between ages 55 and 59 1/2 and get laid off or fired or quit your job, the IRS rule of 55 lets you pull money out of your 401 or 403 plan without penalty. It applies to workers who leave their jobs anytime during or after the year of their 55th birthday.

There is a slight catch. The Rule of 55 only applies to assets in your current 401 or 403. Thats the one you invested in while you were at the job you leave at age 55 or older.

Money in a former 401 or 403, is not covered. You would have to wait until age 59 1/2 to begin withdrawing funds from those accounts without paying the 10% penalty.

There is a strategy to use if you know you will be leaving the job. You can get penalty-free access to plans from former employers if you roll them into your current 401 or 403. Once that is done, you can leave your current job before age 59 1/2 and withdraw the money using the Rule of 55.

The rule of 55 does not apply to individual retirement accounts . If you were to move assets into a rollover IRA upon leaving your job, you would not be eligible for early withdrawal with no penalty.

Don’t Miss: Can I Move My 401k To A Self Directed Ira

Tips For Retirement Planning

- Meet with your financial advisor to discuss the pros and cons of retiring early. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering leaving the workforce ahead of your normal retirement age, learn how it changes your retirement income plan. Use a retirement calculator to estimate how much youll need to retire. A 401 calculator can give you an idea of how much youll be able to grow your savings. This is important to know ahead of your target retirement date.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Don’t Miss: How To Invest In Stocks Using 401k

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

How Does A Cares Act 401 Withdrawal Work

Plan participants should speak to their plan administrator to ask about the process for requesting a 401 or IRA withdrawal. The participant may need to complete a withdrawal form and provide documentation to substantiate the nature of their hardship.

The request will need to be approved by either a committee or a designated person responsible for making hardship-withdrawal decisions. If the participant qualifies for a hardship withdrawal based on IRS regulations, the plan administrator will process the request. Depending on the plan administrator, approving and processing the hardship request can take several weeks. For that reason, a hardship withdrawal may not be a great option for the most time-sensitive financial needs.

If the participant doesnt qualify for the distribution, the administrator will deny the request and notify the participant.

Prior to the CARES Act, plans would automatically withhold 20% of early withdrawals for tax purposes. The CARES Act eliminated the 20% automatic withholding on 401 withdrawals. However, participants may want to avoid spending the full amount withdrawn in order to have funds available to cover the tax bill later.

You May Like: Where Can I Cash A 401k Check

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Read Also: Do I Have Unclaimed 401k

When To Begin Taking Rmds

You are generally allowed to take penalty-free distributions starting at age 59½. However, by April 1 of the year after you reach age 72, you are required to begin taking RMDs from your IRAs.

Depending upon the terms of your 401 or other employer plan, you may be able to delay taking RMDs until April 1 of the year following the later of the year you attain age 72 or the year you retire, provided you are not a 5% or greater owner of the business. Check with your plan administrator for details.

For subsequent years, you must withdraw your RMD amount from your plans by Dec. 31 of each year. This includes the year after you turn age 72, even if you take your first withdrawal that year. NOTE: If you were born on June 30, 1949 or earlier, you were required to begin taking RMDs by April 1 following the year you reached age 70½.

For example, if you turn 72 in October 2021, your first RMD must be taken by April 1, 2022 and your second RMD must be taken by Dec. 31, 2022. Most IRA owners will take their first RMD in the year they turn 72 rather than delaying until April 1 of the next year to avoid having two taxable distributions in one year.

What you do with RMDs is generally up to you you may be able to take distributions in cash or in kind which you can then move to a non-qualified brokerage account. The amount of each years RMD depends on your age and the account balance at the end of the previous year.