Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Borrowing From Your 401

Because that money is meant for retirement, withdrawals are discouraged before you reach age 59 ½. There is a 10% penalty on the loan amount and youll have to pay federal income tax on the amount withdrawn, if you choose to withdraw money before that age.

Exceptions to this include: youre using the money to pay medical expenses, youve become disabled, if youre required to perform military duty and/or youre required to follow a court order. The other exception is if you’re 55 and an employee who is laid off, fired, or who quits a job between the ages of 55 and 59 ½, you may access the money in your 401 plan without penalty, according to the IRS.

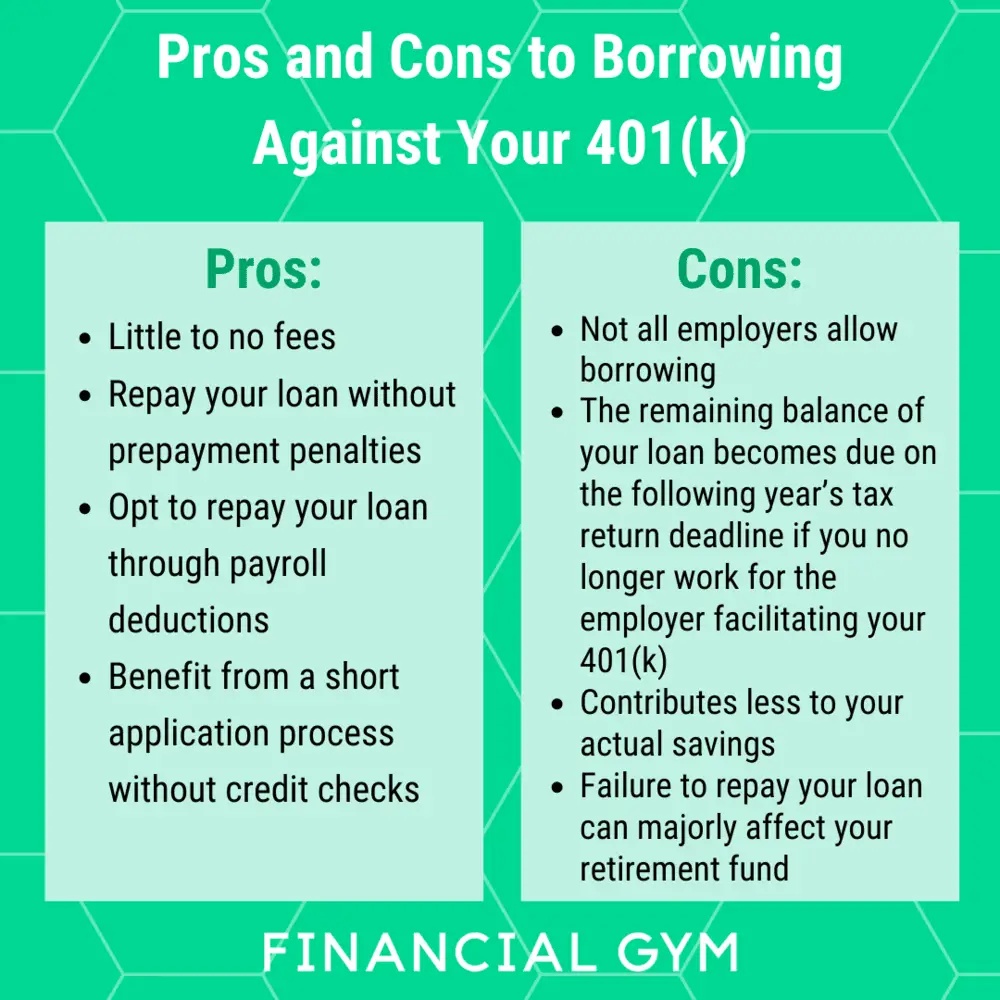

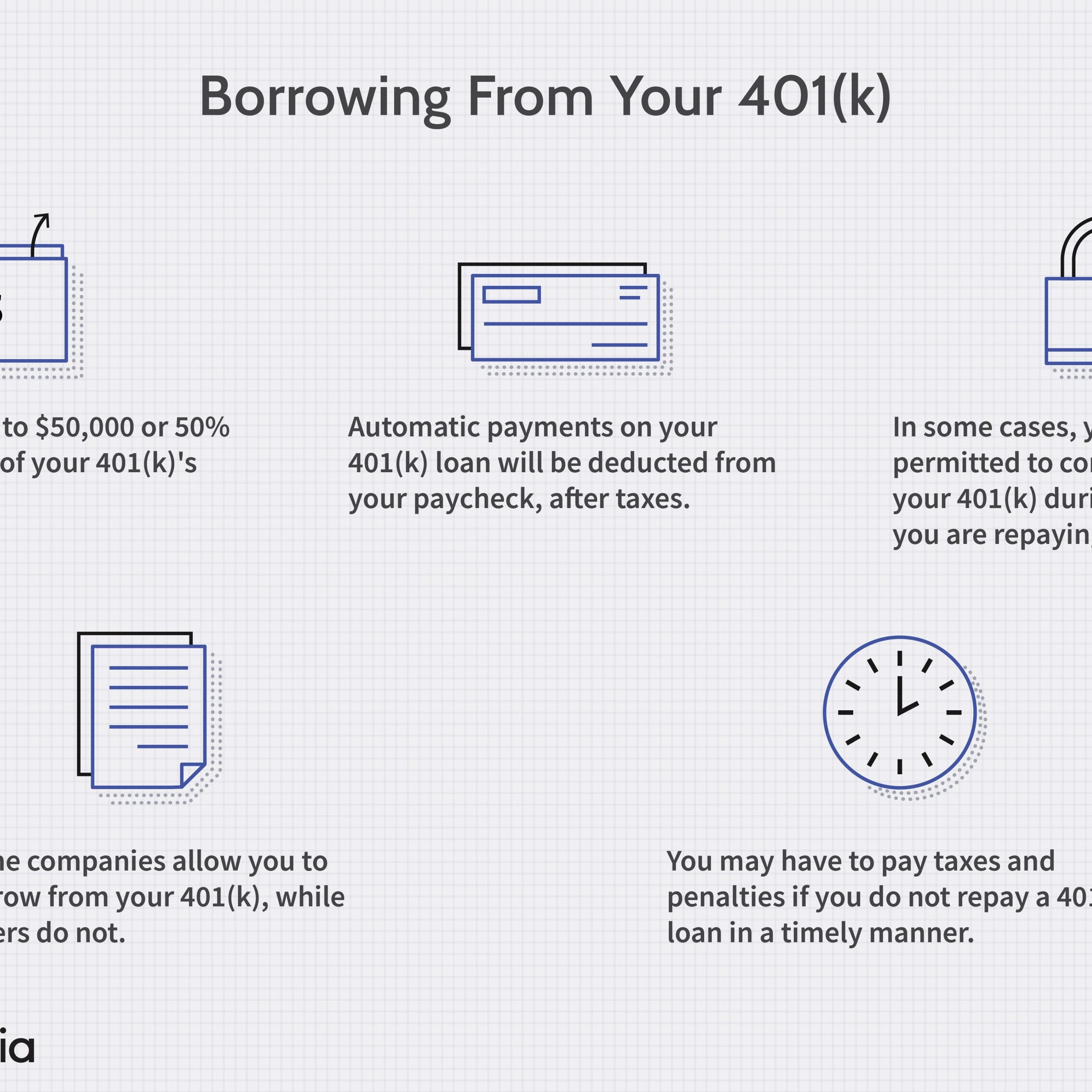

Some 401 plans allow participants to borrow from their retirement savings. If you’ve built up some money in a retirement account, that may be a source of funds for consolidating your debt. It can be easier to borrow from your 401 than getting approved for a loan from an outside lender. Plans often require employees to repay through payroll deductions so your monthly take-home pay will be reduced by the loan payment.

401 plans typically require that loans be repaid within five years meaning your monthly payments will be higher than loans with a longer term. Some plans do not allow participants to contribute to the plan while they have a loan outstanding. You’ll also miss out on any matching contributions from your employer during that time.

If You Lose Your Job You May Have To Repay The Money By Tax Day Next Year

Leaving your job used to trigger a requirement that you repay your loan within 60 days. However, the rules changed in 2018 under the Tax Cuts and Jobs Act. Now you have until tax day for the year you took the withdrawal to pay what you owe.

So, if you borrow in 2021, you will need to repay the full balance by April 15, 2022, or by Oct. 17, 2022, if you apply for an extension. If you borrow in 2022, you’ll have to repay the full balance by April 17, 2023, because April 15 of that year falls on a Saturday, or by Oct. 16, 2022, since the 15th of October falls on a Sunday.

This longer deadline does slightly reduce the risks of borrowing. But, if you take out a loan now, spend the money, and then are faced with an unexpected job loss, it could be hard to repay your loan in full.

Recommended Reading: How To Pull From Your 401k

Who Should Borrow From A 401

If you have a large amount of high-interest debt, such as from credit cards, tapping your 401 to pay off that debt and then pay yourself back at a lower interest rate makes sense.

You may also find yourself in an immediate financial emergency, such as needing money to pay the $6,000 deductible on your high-deductible health insurance plan before you can get medically necessary treatment. In that scenario or a similar one, you may understandably feel that you have no choice but to take the 401 loan.

A Quick Review Of The 401 Rules

A 401 account is earmarked to save for retirementthat’s why account holders get the tax breaks. In return for giving a deduction on the money contributed to the plan and for letting that money grow tax-free, the government severely limits account holders’ access to the funds.

Not until you turn 59½ are you supposed to withdraw fundsor age 55, if you’ve left or lost your job. If neither is the case, and you do take money out, you incur a 10% early withdrawal penalty on the sum withdrawn. To add insult to injury, account holders also owe regular income tax on the amount .

Still, it is your money, and you’ve got a right to it. If you want to use the funds to buy a house, you have two options: borrow from your 401 or withdraw the money from your 401.

You May Like: How To Cash In My 401k

Considering A Loan From Your 401 Plan

Your 401 plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your 401.

If you dont repay the loan, including interest, according to the loans terms, any unpaid amounts become a plan distribution to you. Your plan may even require you to repay the loan in full if you leave your job.

Generally, you have to include any previously untaxed amount of the distribution in your gross income in the year in which the distribution occurs. You may also have to pay an additional 10% tax on the amount of the taxable distribution, unless you:

- are at least age 59 ½, or

- qualify for another exception.

Comparing Loan Vs Cashing Out

While cashing out may result in a higher mortgage and lower interest payments, there is one financial drawback with this option: You may not be able to replace the money in your 401k. Each year, there is an annual maximum on 401k contributions. Once you take this money out, you cannot add it back in if your contributions will be over the annual maximum. Therefore, you could be permanently reducing the funds in your 401k with this option, which will significantly reduce the money you can save and earn for retirement.

References

Also Check: When Can I Take 401k

Is It Smart To Borrow From 401k

Key Takeaways. When done for the right reasons, taking a short-term 401 loan and paying it back on schedule isnt necessarily a bad idea. Reasons to borrow from your 401 include speed and convenience, repayment flexibility, cost advantage, and potential benefits to your retirement savings in a down market.

How To Borrow From A Pension Or Retirement Savings

Your 401 or individual retirement account enables you, and possibly your employer, to make pretax contributions that can compound throughout your working years. Generally, the Internal Revenue Service doesn’t allow penalty-free withdrawals from retirement accounts until you’re age 59 1/2, although some special circumstances apply, such as hardship withdrawals and fund rollovers. However, in some cases, you may be able to borrow against your 401 or IRA.

Also Check: Can You Withdraw Your 401k If You Quit Your Job

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Be Aware Of Potential Penalties

As mentioned earlier, there are also potential penalties to consider.

The U.S. Chamber of Commerce explains, If you leave your job or your employment is terminated, you will have to repay the loan or pay the tax consequences of early withdrawal.

Lets say you cant handle working and running a new business, so you quit. Youll have to pay back the loan much sooner.

The same rule applies if you change jobs or get laid off.

Under the Tax Cuts and Jobs Act passed in 2017, 401 loan borrowers have until the due date of their tax return for the year of distribution to pay it back.

In the event you cannot repay the total loan balance in the mandated time frame, the loan will be treated as an early withdrawal.

If this happens, in addition to having to pay the 10% early withdrawal penalty if you are under age 59½, youll also owe income taxes on the full balance of the loan.

You May Like: Can You Rollover A 401k To Another 401 K

What Is A 401 Withdrawal

A 401 withdrawal is, like it sounds, when you cash out a portion of the money in your account without the intent of replenishing the account. Pre-CARES Act rules state that youre required to pay a 10% early withdrawal penalty on top of the federal and state income taxes.

Under the CARES Act, 401 withdrawal rules have changed. The 10% early withdrawal penalty is being waived on hardship distributions. And you have three years to pay any taxes you incur from the withdrawal . Also, if you replenish your account within three years the CARES Act allows you to recover the taxes you paid on the early 401 withdrawal.

All that said, if youre going to withdraw money from a retirement account, your better choice is to tap your Roth IRA for cash first.

How The Coronavirus Changed 401 Loans

The CARES Act that was signed into law last month doubles the amount you can borrow from your 401 or 403 to $100,000, or up to 100% of your account, whichever is lower.

Borrowers also can defer loan payments for a year. So you essentially have six years to pay back your loan. The additional year for paying back the loan also applies to existing loans, but check with your plan administrator before you delay any repayments.

Note that interest will still accrue during this time. But you wont owe income tax out the amount you borrowed as long as you pay it back within the loan timeframe.

Don’t Miss: How Much Is The Max You Can Contribute To 401k

Alternatives To Taking Out A 401 Loan

If youre unsure about using a 401 loan, think about other ways to get money for the time being.

- Stopping 401 contributions. Instead of continuing to stash that money away, pause contributions so you can pocket more of your cash right now.

- Take a hardship distribution from your 401. The CARES Act waives the 10% penalty for hardship distributions, which means if you are younger than 59 ½, you can take money out of your retirement without facing the extra tax charge.

- Take out a different type of loan. A personal loan doesnt borrow from your future self and doesnt require any collateral. A home equity loan or line of credit might get you a lower interest rate and longer repayment terms, but youd be borrowing against your home, like a second mortgage. Even so, this might be an easier or less-expensive way to borrow money quickly.

Making A 401 Withdrawal For A Home

Compared to a loan, a withdrawal seems like a much more straightforward way to get the money you need to buy a home. The money doesn’t have to be repaid and you’re not limited in the amount you can withdraw, which is the case with a 401 loan. Withdrawing from a 401 isn’t as easy as it seems, though.

The first thing to understand is that your employer may not even allow withdrawals from your 401 plan due to age. If they do allow employees to tap 401 funds early, you may have to prove that you’re experiencing a financial hardship before they’ll allow a withdrawal. Under the IRS rules, consumer purchases generally don’t fit the hardship guidelines.

You may be able to withdraw funds from a 401 plan that you’ve left behind at a previous employer and haven’t rolled over to your new 401. This, however, is where things can get tricky.

If you’re under age 59 1/2 and decide to cash out an old 401, you’ll owe both a 10% early withdrawal penalty on the amount withdrawn and ordinary income tax. Your plan custodian will withhold 20% of the amount withdrawn for taxes. If you withdraw $40,000, $8,000 would be set aside for taxes upfront, and you’d still owe another $4,000 as an early-withdrawal penalty.

Don’t Miss: What Do You Do With Your 401k When You Quit

When To Borrow From Your 401

Only borrow from your 401 when no other reasonable loan rates are available and only if the situation is dire.

Vacations are ruled out. So are 50-inch 4K TVs, shopping sprees and any form of consumerism that might be considered excessive. There are, however, emergencies or dead-end scenarios when a 401 loan may be your best or only option.

If youre suffering a medical setback and need cash fast, your 401 may be a good place to look. You may even qualify for a hardship withdrawal. In this case you wont have to pay the loan back, but youll still have to pay income taxes, plus the 10% early withdrawal fee.

The qualifications for hardship withdrawal differ from plan to plan. Check with your employer to see what yours may cover.

If youre looking at your 401 as a way out of debt, youre looking in the wrong direction. Debt is often the result of undisciplined spending or an unforeseen emergency like job loss or medical setback. Its rarely a one-time purchase that sends the consumer into financial despair.

Those Who Truly Need It

It really comes down to need. If you need to withdraw your money, then withdraw your money. Thats really the essence of the CARES Act. It simply makes a need-based withdrawal less harmful. If you dont need to, then dont, says Brandon Renfro, a financial advisor and assistant professor of finance at East Texas Baptist University.

Its important to consider what things will be like after you take a withdrawal and once things are back to a new normal. Under the CARES Act, you have to repay your withdrawal within three years. If you just need a withdrawal to get you through the next few months before you start earning regular paychecks again, it could be a good option.

Recommended Reading: Can I Take Money Out Of My Fidelity 401k

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

The New Rules Of Borrowing Money From Your 401 And Better Options To Consider

The COVID-19 pandemic has caused millions of people to lose their jobs or temporarily stop earning an income. The halt in cash flow means you or any of your friends and relatives cant afford basic necessities, like making home payments and buying food.

If there were no global pandemic, experts would be singing in unison to avoid borrowing money from your 401 or 403. But desperation and hardship are very real for millions of Americans. If youve emptied your emergency fund and your checking and savings accounts are exhausted, taking a 401 loan to cover current costs may be your next best alternative.

Heres what you need to know about 401 loans and taking out money from your retirement accounts before you retire.

Recommended Reading: How Do I Transfer 401k To New Employer

How Much Can Be Borrowed From A 401 Loan

It depends on how much you have in your account. You can borrow up to 50% of your vested account balance, but you cant borrow more than $50,000. Even if you have a balance of $200,000, the IRS wont let you touch more than $50,000 of it.

The only time you can borrow more than 50% is when you have a balance of less than $20,000. In that case, you can borrow up to $10,000, even if you only have $10,000 stashed away.

Can I Borrow Against My Vanguard Account

Vanguardloanborrowing againstloanaccount’sVanguardloans againstaccountscan

. Beside this, how long does it take to get a loan check from Vanguard?

It typically takes 7-10 business days for Vanguard to receive the check. You can send a cashier’s check, bank check, or money order, but not a personal check. Your printed loan payment form must be sent with the check.

Beside above, how can I borrow against my 401k? How to Borrow from Your 401

Just so, can I withdraw money from my Vanguard 401k?

Once you reach age 59½, you can make withdrawals from your 401 Savings Plan account balance. Rollover withdrawals. You can withdraw assets that you rolled over from another employer-sponsored retirement savings plan or an IRA. Hardship withdrawals.

How do I take money out of my investment account?

Withdrawing money when you need to sell stocks to come up with the cash

Recommended Reading: How Much Can We Contribute To 401k