Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

When Can You Withdraw From A Roth Ira

You can withdraw the contributions you’ve made to a Roth IRA at any time. If you withdraw earnings before age 59 1/2, they’re subject to income taxes and a 10% tax penalty. You can withdraw earnings without a penalty under certain circumstances, including using it for a first-time home purchase and for qualified educational expenses.

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Read Also: How To Get Your 401k

Hardship Withdrawals Allowed With No Penalty:

Why Did Gethuman Write How Do I Withdraw My Retirement Or 401k Money From My Merrill Lynch Account

After thousands of Merrill Lynch customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I Withdraw My Retirement or 401k Money from My Merrill Lynch Account? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting Merrill Lynch if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

Also Check: Why Is A 401k Good

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

Risks And Penalties Of Withdrawing Early

There are three main disadvantages to making an early withdrawal from your 401:

- Early withdrawal penalty. Because these funds were held from your paycheck pretax, the IRS charges a 10% early withdrawal penalty.

- Applicable taxes. Taxes apply to 401 disbursements, so expect to forfeit 20% of your withdrawal for automatic tax withholding.

- Lost interest. Funds in a 401 grow out of compounding interest, so it may not be possible to recoup what you lose over time.

How can I avoid the 10% penalty?

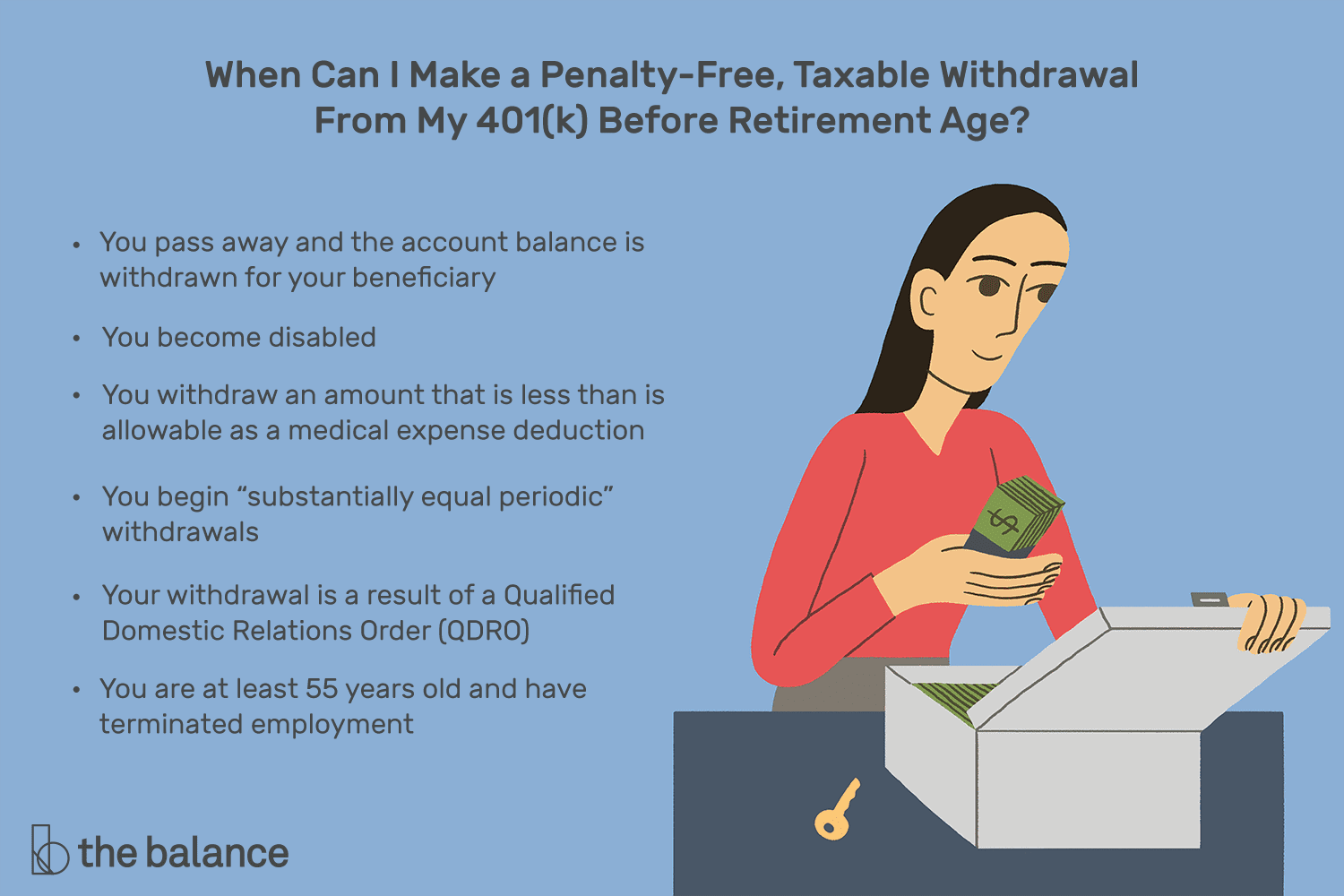

Generally speaking, taxes and lost interest are unavoidable. But in some circumstances the IRS waives the 10% tax penalty:

- Substantially equal periodic payments . The IRS may waive the 10% penalty if you agree to take at least one payment annually after you stop working for a minimum of five years, or until you reach the age of 59½ whichever comes last.

- You leave your job. If you leave your job in the year you turn 55 or later and want to draw from your 401 ahead of schedule, the IRS may waive the early withdrawal penalty.

- You get divorced. If you need to cash out your 401 to divide it between you and your former spouse, you could have the penalty waived.

There are a few other life circumstances when the IRS could waive the 10% penalty on an early 401 withdrawal:

- You become disabled.

- Youre called to active military duty.

- You roll your account into another retirement plan.

- You gave birth to a child or adopted a child.

- You overcontributed.

Hardship withdrawals

- Medical expenses

Read Also: How Does A 401k Loan Work

What Is A 401 Early Withdrawal

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% penalty by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the penalty is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

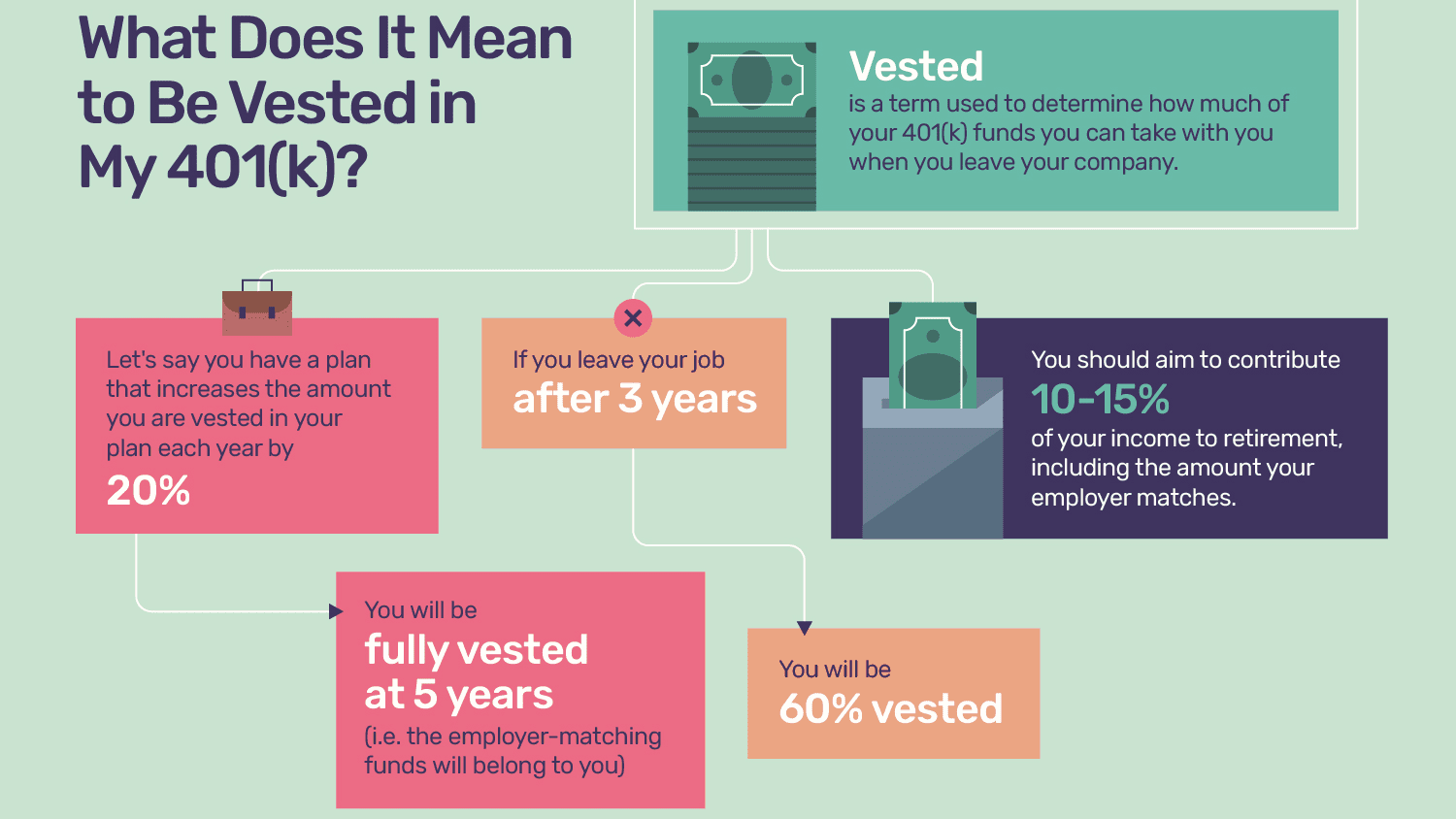

The Rules For Accessing Your Money Are Determined By Your Employer’s Plan

Whether you can take regular withdrawals from your 401 plan when you retire depends on the rules for your employers plan. Two-thirds of large 401 plans allow retired participants to withdraw money in regularly scheduled installments — say, monthly or quarterly. About the same percentage of large plans allow retirees to take partial withdrawals whenever they want, according to the Plan Sponsor Council of America , a trade association for employer-sponsored retirement plans.

Other plans offer just two options: Leave the money in the plan without regular withdrawals, or take the entire amount in a lump sum. ‘s summary plan description, which lays out the rules, or call your company’s human resources office.) If those are your only choices, your best course is to roll your 401 into an IRA. That way, you won’t have to pay taxes on the money until you start taking withdrawals, and you can take money out whenever you need it or set up a regular schedule.

If your company’s 401 allows periodic withdrawals, ask about transaction fees, particularly if you plan to withdraw money frequently. About one-third of all 401 plans charge retired participants a transaction fee, averaging $52 per withdrawal, according to the PSCA.

Also Check: How To Use Money From 401k

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Also Check: How Do I Cash Out My 401k After Being Fired

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

Better Options For Emergency Cash Than An Early 401 Withdrawal

It can be scary when suddenly you need emergency cash for medical expenses, or when you lose your job and just need to make ends meet.

The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, a financial professional with Principal® who helps clients on household money matters.

The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

In short, he says, You may be harming your ability to reach and get through retirement. More on that in a minute. First, lets cover your alternatives.

Read Also: What Should You Invest Your 401k In

How Taking A 401 Distribution Affects Your Retirement

Time in the market and compounding interest are critical factors when it comes to your retirement savings. While investment returns will vary, in general more money in the market means more at retirement, while anything you withdraw now is that much less youll have for your golden years. Plus, taking money out means missing any potential gains your investments would have seen along the way, even if you reinvest the money down the road.

Thats why its important to carefully assess your situation if youre experiencing a true emergency and your retirement is your only financial source, consider limiting the amount you take out to only what you need. If youre certain that you can pay yourself back, theres also less of a risk in going this route. But if you can go without touching your nest egg, over time you may be able to reap the rewards of compound interest and avoid any potential losses.

Dont Miss: What Happens To My 401k After I Quit

Can I Borrow From My 401k If I No Longer Work For The Company

401k Plan Loans An Overview. There are opportunity costs. If you quit working or change employers, the loan must be paid back. If you cant repay the loan, it is considered defaulted, and you will be taxed on the outstanding balance, including an early withdrawal penalty if you are not at least age 59 ½.

Dont Miss: When Can You Use Your 401k

Read Also: Can You Rollover A Roth 401k To A Traditional Ira

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

Retirement Planning With Merrill Edge

For more information on rolling over your IRA, 401 , 403 or SEP IRA, visit our rollover page or call a Merrill rollover specialist at 888.637.3343. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Recommended Reading: How Do I Find Previous 401k Accounts

Rules About 401 Required Minimum Distributions

Again, the minimum age for RMDs was changed in recent years. Before, you had to start taking them either when you retired or when you turned 70.5. However, this age requirement still holds for anyone who turned 70.5 in 2019 or earlier. Anyone who has yet to turn 70.5 can wait until April 1 of the year after theyre 72 to start taking RMDs.

The year in which April 1 is your RMD deadline is your starting year. After the starting year, the deadline shifts to December 31. So your second year and thereafter, you must take your RMD by December 31.

If you wait until April 1 of your starting year to take your RMD, you will have to take two years worth of RMDs the same year. You should avoid this, as it will increase your income for that year, likely putting you in a higher tax bracket. If you fail to take any RMD or you dont take a large enough RMD as required by the IRS, you may have to pay a 50% penalty on the money you should have withdrawn.

Most People Have Two Options:

- A 401 loan

- A withdrawal

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Don’t Miss: Can You Leave Money In 401k At Your Old Job

Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about withdrawals from 401 participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

What You Should Do Instead To Pay Off Your Credit Card Debt

In hindsight, Nitzsche says he would have handled his credit card debt differently, such as reaching out to the specific issuers to inquire about a financial hardship plan or participating in a debt management plan through a credit counselor.

He also recommends using balance transfer credit cards, which allow qualifying cardholders to move their credit card balances from one card to the next.

If you have credit card debt, this could be a good option as long as you have a plan to pay off the transferred balance within the card’s introductory no-interest period , otherwise you accrue more interest on top of that debt.

The Citi Simplicity® Card offers 0% intro APR for 21 months for balance transfers from date of first transfer . To qualify for these longer interest-free periods, you will most likely need to have good or excellent credit, but there are options available for fair credit as well.

The Aspire Platinum Mastercard® is one where applicants with fair or good credit may qualify, but the balance transfer period is shorter at only six months. After the intro period, there’s a relatively low variable APR of 9.65% to 18.00%.

Note that depending on your credit, you may not get approved for a credit limit high enough to cover the full balance of your debt. And while there are some balance transfer cards with no fee, most usually require a 2% to 5% fee .

Read Also: How To Convert A 401k To Roth Ira

When Should You Make A 401 Early Withdrawal

Considering the 10% penalty, financial planners often advise taking an early withdrawal from your 401 as a last resort. Since penalty-free withdrawals are available for a number of financial hardships and situations, plan participants who take an early withdrawal with a penalty are often in serious financial straits.

Ive seen people take withdrawals for a number of reasons, Stiger says. Everything from a childs tuition to a spouses burial expenses the hope is that distributions are used for larger, more unexpected expenses like medical emergencies, keeping a home out of foreclosure or eviction, and in a down period, putting food on the table.

Taking an early withdrawal can make sense if you are able to take advantage of a penalty-free exception, use the Rule of 55 or the SEPP exemption. But might make sense to exhaust other options firstcheck out these 10 ways to get cash now. And keep in mind, contributions to a Roth IRA can always be withdrawn without penalty if youre truly in a bind.