Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

What Are The Implications And Risks Of A Lost Participant

When an employee is terminated from your company but remains a participant of your retirement plan, youre still required by law to send plan notifications to these participants. However, if youre unable to locate them, doing this can be very difficult which is problematic, as you can be subject to Department of Labor penalties for failing to comply with reporting and disclosure requirements.

There is also a cost to maintaining the accounts of lost participants. If your plan allows you to cash out participants below a certain balance, doing so would be prudent to lower your costs. Of course, doing this is incredibly difficult if you cant locate the participant.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

You May Like: How To Change 401k Investments

What Other Sites Can I Visit To Check For Lost Money

As I mentioned earlier, lost retirement accounts are just one type of unclaimed money. Here are some other resources that can help you find missing money:

- MissingMoney.com: a government database of unclaimed property.

- HUD.gov: If youve ever gotten a Federal Housing Administration loan, you may be due a refund.

- FDIC.gov: Search for unclaimed funds from failed banks and other financial institutions on this site.

- USA.gov: This site is full of resources to search for unclaimed money, including federal money such as tax refunds and bonds.

- FindMyFunds.com: links to the official website of at least 25 states including some not covered by MissingMoney.com.

Recommended Reading: How Do You Rollover Your 401k To A New Employer

What Causes Missing Participants

Missing participants are caused by a combination of factors that include:

- Employee turnover / job-changing: DC plan participants change jobs 10 times over the course of a 40-year career. Each year, 14.8 million DC participants will change jobs

- Relocation: Americans will move almost 12 times over the course of a lifetime. In any given year, almost 1 of every 6 Americans will relocate.

- Mortality: 16% of plan participants will die between 40 and 65. One of six participants die prior to normal retirement age

- Lack of retirement savings portability: Barriers to portability result in high volumes of cashouts, plus a growing number of accounts that are stranded at job change

- Plan features and changes: Auto enrollment increases the number of small-balance and unknown accounts, particularly at low deferral rates. In addition, events occur that change key elements of the plan, such as company mergers, acquisitions, name changes, recordkeeper transitions, etc.

Recommended Reading: How To Make A Loan From 401k

The Takeaway On Finding Lost 401 Money

If you suspect that you’ve left a 401 behind somewhere and don’t attempt to locate it, you’re risking losing the plan — and the money — for good.

But if you don’t respond, a company holding an old 401 account has no obligation to pursue the issue further, and eventually will relinquish your old account to the state, and all of the funds held, as well.

Don’t let that happen to you. Use the tips listed above to make every effort to find your lost 401 account and get the money back for yourself, and don’t let “free” retirement slip out of your control.

If You Find The Money

What to do with your 401 funds when you find the account largely depends on where you find it.

If the account resides in your employer’s plan, you do have the option to leave the money and the account there — just note you can no longer contribute money to it.

To get back in the game with your sidelined 401, roll it over into an individual retirement account or a current employer’s 401 plan. That way you can put the fund money to work by investing in stocks, bonds and funds that appreciate in value and accumulate more money for your retirement, on a tax-efficient basis.

Also Check: How To Invest My 401k Money

How To Start Your Search For Lost Retirement Assets

In a perfect world, you would have an old statement or benefit information. But Im guessing that is not the case if you are still reading this post.

Your first step should be to track down your previous employers. Send them an email or letter requesting information about your accrued retirement benefits. Of course, this will only work if the company still exists.

For those of you who cant find your former employer, the task can be daunting. However, free help is available from sources like the Labor Department and six nonprofit pension counseling centers. These centers are funded by the US Department of Health and Human Services . The Pension Benefit Guarantee Corporation also provides help tracking down traditional pensions.

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isnt a good example of that mindset.

Exhibit A is the U.S. Department of Labors Abandoned Plan Database. The database can tell you if your companys old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plans name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Don’t Miss: Can I Set Up My Own 401k Plan

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Find Accounts From Failed Banks

You have a couple options if your bank failed and you have yet to claim your money:

- You can find unclaimed money from banks that have failed at this Federal Deposit Insurance Corp. website.

- If your unclaimed money was held at a failed credit union, you can track it down at this National Credit Union Administration website.

You May Like: How To Transfer 401k From Vanguard To Fidelity

Find Your Retirement Accounts

In order to corral all your accounts, you first must locate all your retirement plans.

If you know you had a plan with certain employers but dont know how to access it, reach out to your former company. They should provide you with the information you need to access the account.

What happens if the company is no longer in business? Well, your retirement account should still be held somewhere. Its your money, after all. You can go to the Abandoned Plan database Opens in new window, hosted by the Department of Labor. There you can search the company, and you will be provided with information on how to locate the lost plan.

You can also search the National Registry of Unclaimed Retirement Benefits Opens in new window to find plans under your name.

Once you find one account, you can potentially spot a few more, as theres a possibility you have multiple plans hosted by the same company. The other accounts should come up as you log into the management companys website.

National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

Recommended Reading: How Do I Get My 401k

What About Using Unclaimed Property Funds Maintained By Some States

It may be a viable option to transfer remaining balances to a state unclaimed property fund via the escheatment process in the state of the participants last known residence or work location. Because there are variations in how this process works, please consult the applicable state before proceeding.

Search For Money From A Former Employer

You have at least a couple ways to track down money from a former employer:

- If you think youre owed back wages, you can turn to the Department of Labors database and see if its holding your cash. The department holds unpaid wages for up to three years.

- If youre searching for unclaimed pensions because a company went out of business or ended a defined benefit plan, you can turn to the Pension Benefit Guaranty Corp.s website. More than 80,000 people have earned a pension but havent claimed it, the organization says.

Read Also: Can You Transfer 403b To 401k

Government And Military Pension Resource

Depending on your role in the military, some pensions are available to both veterans and their survivors. Be sure to refer to the U.S. Department of Veterans Affairs website for more information.

- Department of Veteran Affairs: If you or your deceased spouse is a veteran, you can find information on your pension at the VAs pension website.

- State government websites: If you were an employee of your state or local government, be sure to check your states government website to search for information regarding your pension.

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

You May Like: What Age Can I Start Withdrawing From My 401k

How Retirement Benefits Go Missing

It is rare for a person to stay with one company an entire career. Additionally, some companies go out of business after several years of successful operations. With both people and companies in constant transition, it is common for people to lose track of their accrued retirement benefits. Whats more, people might know they have retirement benefits available to them but not know how to find what they have.

For example, lets say a person worked for a company from ages 25 to 35, but now is age 45. The company the person worked for over a decade ago has gone under. He is still entitled to his benefits it just might be challenging to find them.

Lost Participants: I Ain’t Missing You At All

Nope, this isnt an article about bad pop songs from the 1980s, but it is about something that can be just as much of a bother lost participants with remaining balances in your retirement plan. Whether you are trying to clean up small residual balances or trying to wrap up a plan termination, there are few things as frustrating as trying to locate missing participants. Fortunately, there are some helpful rules that provide guidance on how to handle these situations.

Don’t Miss: How To Roll 401k Into New Job

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Consider The Amount Of Money In Your Old 401 Account

Your past employer doesnt have to keep overseeing your 401 account if your balance is less than $5,000.

At less than $1,000, your old company can just write you a check.

If you hold more than $1,000 but less than $5,000 in a 401 account with a company for which you no longer work, you should receive a request for payout instructions from your former employer. If you fail to respond to those instructions, your former company can roll the money into an IRA of its choice.

You can search the FreeERISA website to find an old IRA. You wont have to pay to use the site, but it does require you to register to search its database.

Also Check: Can You Leave Money In 401k At Your Old Job

Ways Of Finding My Old 401s Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

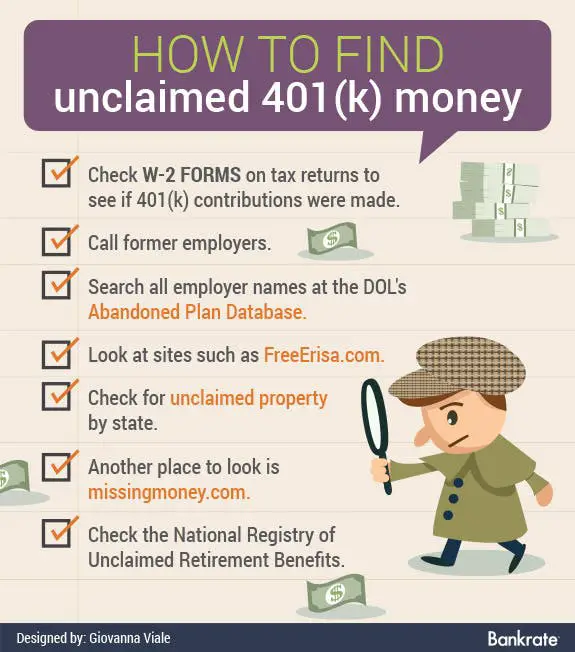

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some free help to find your 401 accounts from companies like Beagle.

Free Ways To Find Unclaimed Money

If you think you have unclaimed money or that a relative does, one of the best steps is running through old financial statements to see if you can find evidence of it. That could be useful if the relative has passed on and you dont know where to begin. If you discover an account such as a 401 or IRA, you can contact the plans administrator and go from there.

But many times, the process is more complicated. Here are the places to go next.

Recommended Reading: Does Employer Match Count Towards 401k Limit

How To Find Unclaimed Retirement Benefits

Many employers offer retirement benefits, and some will even match their employees contributions. However, most people leave employers several times throughout their careers. In leaving one job and taking on another, some employees forget to take their 401 or other retirement accounts with them. If theres a chance you have unclaimed retirement benefits but arent sure how to access them, heres how to find your unclaimed retirement benefits. Keep in mind that getting help from a financial advisor might save you a great deal of time in finding that money.

Where To Look To Find Missing 401k Assets

There are also databases that list corporations and bankruptcies. These databases may be able to help you track down the missing retirement plans because each plan is required to file an annual report form 5500 with the IRS. If you can track down this form it should contain the plans contact information and employers identification number. With this information, you can likely track down where the plan is now or who inherited it during a corporate merger.

If your previous employer has terminated its defined benefit pension plan check with the PBGC. Part of what this agency does is maintain a database of missing participants in the underfunded pension plans it has taken over. Who knows? You may discover that youre missing more pension than you remembered. I had one client uncover four missing pensions. While this discovery isnt going to make my client rich, it was still a good amount of money that will add up over time. Also, not too shabby for money they didnt know they had until we looked.

Recommended Reading: How To Start Withdrawing From 401k