Social Security And Medicare Costs

The formulas for Social Security taxes, Medicare Part B and Medicare Part D use so-called modified adjusted gross income, or MAGI.

If half of your Social Security payments plus MAGI is more than $34,000 , up to 85% of those benefits may be taxable.

However, the bigger issue for retirees above certain income levels may be the surcharge for Medicare Part B, known as the Income Related Monthly Adjustment Amount, or IRMAA.

While the base amount for Medicare Part B premiums is $170.10 for 2022, payments go up once income exceeds $91,000 . The calculation uses MAGI from two years prior.

Roth withdrawals, however, won’t show up on tax returns, said Gessner, meaning retirees don’t have to worry about these distributions causing Medicare premium increases.

What Is The Tax On 401 Withdrawls After 65

Putting money aside in a 401 during your working years is one of the most effective ways to accumulate wealth for your retirement years. But accumulating that money is only half of the battle. The other half is devising a strategy that allows you to meet your daily living expenses while minimizing your taxes. Understanding how 401 withdrawals impact your taxes makes devising such a strategy a lot easier.

When The Traditional 401 Is Better

Heres when the traditional 401 plan is probably the better option:

Youre in a high tax bracket and save money

Because the traditional 401 gives you a tax break on contributions today, it can make sense to use that break today when your tax costs are high.

If someone is in the highest tax bracket , and they think they will be earning less as they approach retirement, then it may make sense to contribute on a pre-tax basis, says Ma.

Thats the course of action recommended by Marianela Collado, CFP, at Tobias Financial Advisors in Fort Lauderdale, Florida, but she adds an important stipulation.

Having said that, even this only makes sense if you are disciplined enough to take the savings associated with making that traditional 401 contribution and you save that, too, says Collado.

Collado says that if youre not disciplined enough to invest that tax savings from the traditional 401, then the tax-free growth will far outweigh what you couldve accumulated in a traditional plan on an after-tax basis.

You cant get matching contributions on a Roth 401

Some employers dont offer matching contributions for 401 plans at all. However, some subset of employers provide this perk for traditional 401 plans only but not Roth 401 plans, because of how tax laws benefit these traditional plans.

Using Schindlers strategy you can still capture the full employer matching which advisers universally agree is the thing you must do with early-year contributions to a traditional plan.

Also Check: Can I Transfer 401k To Roth Ira

Withdrawal Timing To Save Taxes

Using a tax-deferred 401 does not mean you never pay taxes, however. Participants pay Uncle Sam when they withdraw their earnings and contributions.

As a retiree, your income often drops, putting you into a lower tax bracket than you had as an employee. Money you take from a tax-deferred 401 during retirement years therefore, gets taxed at a rate lower than what you pay while fully employed.

- Withdraw money early, though, and you pay taxes and a 10% penalty.

- The IRS lets you begin to withdraw without a penalty at age 59 1/2, and requires you to begin withdrawing by April 1 the year after you turn 72 or after age 70 1/2 if you attained this age prior January 1, 2020. However, required minimum distributions from 401s and IRAs were suspended for 2020.

Using Tax Rates Before Retirement

Contributing pre-tax dollars to a tax-deferred retirement account in the years before you retire, such as a traditional IRA or a 401, minimizes your taxable income in those years. It would reduce your taxable income in the year you make the contribution. This is particularly beneficial if you’re in a high tax bracket now and expect to be in a lower bracket when you start taking withdrawals in retirement.

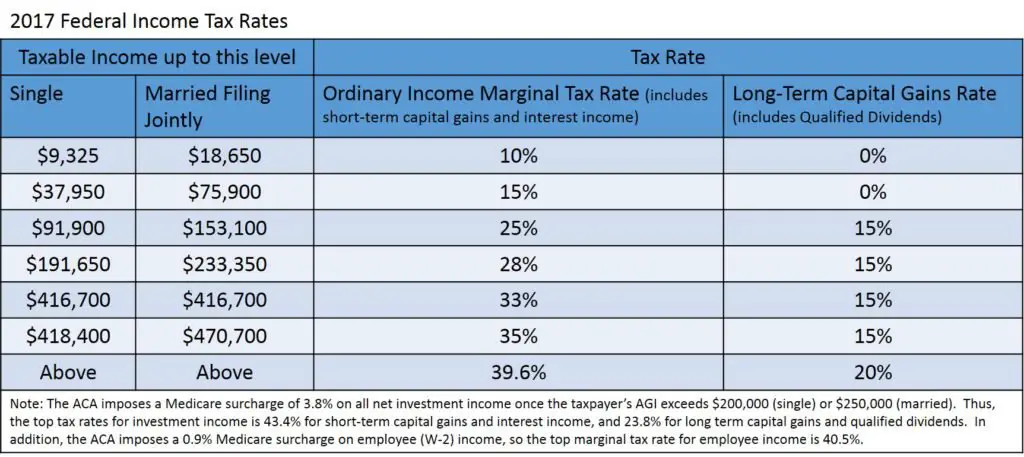

If a single filer with a taxable income of $72,000 contributes $2,000 to a traditional IRA, that $2,000 would save them taxes at the 22% rate, reducing their tax bill by $440 in total.

The benefit of contributing to a traditional IRA begins to diminish if you expect a taxable income of only $25,000 for the year because the tax-deductible contribution of $2,000 would only save you tax at the 12% rate. This would reduce your tax bill by just $240. Contributing with post-tax dollars to a Roth IRA might make more sense in this scenario.

It might not make sense to continue making tax-deductible contributions if you find yourself earning less.

Consider using your expected tax bracket in retirement to determine which type of account to fund each year if your income varies, such as if you work on a commission basis. This decision should also be revisited if you’re easing into retirement. Determine if you have investment income that could be repositioned to reduce your overall annual tax bill.

Read Also: Can I Move My 401k To Roth Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Tax Charged On 401 Distributions

A withdrawal from a 401 is known as a distribution in âIRS lingoâ. When you take a 401 distribution, the distribution will only be subject to income taxes. For example, if you withdraw $4000, you will only pay income tax on that $4000 in retirement. FICA taxes only apply during your active working years. However, how much you pay as income tax depends on how and when you take a distribution.

When you are 59 ½, you can start taking distributions without paying a penalty tax. For a Roth 401 account, the withdrawals you make are not taxed, since you already paid income taxes when putting money into the account. You can start taking penalty-free and tax-free distributions from a Roth 401 account once you are at least 59 ½.

Once you hit 72 and already retired, you will be required to start taking the required minimum distributions. If you delay in taking the minimum distribution after age 72, IRS will impose a 50% penalty of the amount not distributed.

Recommended Reading: Should I Roll Over 401k From Previous Employer

Federal Taxes And Penalties

Typically, the federal tax policy of the state of California continues with IRA distributions, which means it also pays federal amounts if it pays California taxes or fines. Most IRA distributions are fully taxable at ordinary federal income rates. In addition, premature distributions will give a federal fine of 10 percent. All federal taxes and fines are at state amounts.Check out my favourite picks-

Are the 401 taxable distributions?

The short answer is: your taxable 401 distributions.

This may be against, as there is some confusion about how retirement accounts work. People often refer to retirement accounts as 401 s as a tax advantage or deferred tax. What this means is that your investments grow within your 401 or tax-free ARA. However, things change when you start getting 401 distributions. As you withdraw money, there will be income taxes on the funds. 401 will automatically maintain a 20% plan of your account to pay taxes. You should check with your plan provider to find out how your specific 401 works.

Are you thinking when you can start financing? When you turn 59 and a half, you can withdraw money from your 401 . If you still do not need the money, you can wait until you reach 70 years of age 2/2 to withdraw funds. However, when it reaches 70 1/2, it is no longer an option to withdraw from your 401 , it is mandatory. The IRS has defined the minimum distributions required for certain retirement accounts, including 401 s.

Are You Being Realistic About Retirement Income

Many workers mistakenly assume they’ll be in the same tax bracket in retirement because they’ll require , income equal to their working years. That’s often not the case.

For example, after factoring in historic market volatility, generating $500,000/year in pre-tax income for 35 years would require a $12M starting retirement portfolio.²

Don’t Miss: When Can I Draw From My 401k Without Penalty

Tax Rules: Withdrawals Deductions & More

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pre-tax money in 2021. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

What Is The Tax Rate Of Withdrawing From 401 Before 59 1/2

Anyone who withdraws from their 401 before they reach the age of 59 1/2, they will have to pay a 10% penalty along with their regular income tax. However, you can withdraw at the age of 55 without penalty in a circumstance where you cannot be a employee of a company who runs your 401 and you must have left the company, during or after the calendar year when you turn 55. This is also called as a rule of 55.

You May Like: How Do I Know Where My 401k Is

The Tax Benefits Of Saving For Retirement In A Pre

Scott Spann is an investing and retirement expert for The Balance. He is a certified financial planner with over two decades experience. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance.

The Balance / Katie Kerpel

Congress established 401 plans to encourage and help workers save for retirement. Traditional 401 plans offer major tax benefits at the time you’re making contributions. You also accumulate the money to achieve financial independence later down the road in retirement.

Taxes On Employer Contributions To Your 401

In addition to your contributions, an employer may also put money into your 401. Once that money is in your account, the IRS treats it the same as your contributions. You wont pay any taxes while the money is in your account, but you will pay income taxes when you withdraw it. Unlike your own contributions, you dont pay any payroll taxes when your employer contributes to your account. Its truly free money. It doesnt even count toward the $19,500 contribution limit for 2021.

Also Check: Is A Rollover From A 401k To An Ira Taxable

How Long Does A 401 Distribution Take

There is no universal period of time in which you must wait to receive a 401 distribution. Generally, it takes between three and 10 business days to receive a check, depending on which institution administers your account and whether you are receiving a physical check or having it sent by electronic transfer to a bank account.

Other Factors Affecting Social Security Benefits

In some cases, other types of retirement income may affect your benefit amount, even if you collect benefits on your spouse’s account. Your benefits may be reduced to account for the income you receive from a pension based on earnings from a government job or from another job for which your earnings were not subject to Social Security taxes. This primarily affects people working in state or local government positions, the federal civil service, or those who have worked for a foreign company.

If you work in a government position and receive a pension for work not subject to Social Security taxes, your Social Security benefits received as a spouse or widow/widower are reduced by two-thirds of the amount of the pension. This rule is called the government pension offset .

For example, if you are eligible to receive $1,200 in Social Security but also receive $900 per month from a government pension, your Social Security benefits are reduced by $600 to account for your pension income. This means your Social Security benefit amount is reduced to $600, and your total monthly income is $1,500.

The windfall elimination provision reduces the unfair advantage given to those who receive benefits on their own account and receive income from a pension based on earnings for which they did not pay Social Security taxes. In these cases, the WEP simply reduces Social Security benefits by a certain factor, depending on the age and birth date of the applicant.

You May Like: How Can I Get My 401k Money Without Paying Taxes

Your 401 Distribution And Taxes

Distributions from your 401 are taxed as ordinary income, based on your yearly income. That income includes distributions from retirement accounts and pensions and any other earnings. As a result, when you take a 401 distribution, it is important to be aware of your tax bracket and how the distribution might impact that bracket. Any 401 distribution you take will increase your yearly earnings and could push you into a higher tax bracket if you’re not careful.

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal. Tax-loss selling on poorly-performing investments is another way to counter the risk of being pushed into a higher tax bracket.

Deferring taking Social Security is another way of reducing your tax burden when you take a 401 withdrawal. Social Security benefits are not usually taxable unless the recipient’s overall annual income exceeds a set amount. Sometimes a large 401 withdrawal is enough to push the recipient’s income over that limit. Here’s a look at these and other methods of reducing the taxes you need to pay when you withdraw funds from your 401

Roth And Traditional: Both Good Options

Saving for retirement makes sense whether you make Roth or traditional contributions. Both options offer tax benefits. Our traditional vs. Roth analyzer can help you compare the two. You could also consider making both types of contributions.

Check with your employer to see if the Roth option is available in your plan. You should consult a financial professional or tax adviser to find out more.

* Withdrawals from Roth accounts are tax-free if you are at least 59-1/2 years old, or are disabled or have died also, the Roth account must have been established at least five years before. For nonqualified distributions, earnings are taxable and may be subject to a 10% early withdrawal penalty.

Traditional vs. Roth 401/403 analyzer

Use our Roth comparison calculator to see which contribution option might make sense for you.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

- STAY CONNECTED:

Recommended Reading: What Percent To Put In 401k

Is Social Security Income Taxable

Some of you have to pay federal income tax on Social Security benefits. between $ 25,000 and $ 34,000, you may have to pay income tax up to 50 percent of your benefits. over $ 34,000, up to 85 percent of your benefits may be taxable.

Do I pay tax on my pension in France? If you live in France and are receiving a State Pension, Private Sector or Lifetime Pension from the UK, this is taxable in France. Only occupational, stakeholder and personal pensions that are granted a tax credit on contributions or the lump sum is tax-free qualify for taxation as retirement income.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Can You Rollover A 401k Into An Annuity