Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Why Would You Want A Participant Loan

This can be useful when someone is thinking about distributing money out of their Solo 401k plan for some reason. We recently spoke with a a man who was going to distribute his $100k IRA to pay for finishing the repairs of 2 fixer upper houses. After we spoke, his strategy was amended to instead:

- Setup a Solo 401k plan and transfer IRA funds into it

- Take a participant loan of $50k

- Use the loan proceeds to finish rehabbing Property #1

- Do a cash out refinance on Property #1 once rehab is complete

- Use refi proceeds to finish rehabbing Property #2 & pay back the Solo 401k participant loan

In his situation, it made sense to pull some equity out of Property #1 to pay for the completion of Property #2 because the rental income of Property #1 covered about 350% of its new loan payments.

The result of the new strategy

- Avoided IRA distribution

- Avoided $35,000 in distribution taxes

- Paid participant loan back within a few months

- The rental income of Property #1 will payoff its mortgage within 6 years

- Left $100k in his retirement account for maximum tax deferred growth

There are many other common uses for a Solo 401k participant loan. If a person wants to make a < $50k investment that would otherwise be a prohibited transaction, they can just borrow the money and do the investment as an individual.

Additionally, the Participant Loan is a compliant way to get cash from the Solo 401k to infuse into your business.

What Are The Benefits Of A Solo 401 Plan

In addition to increased contribution limits over SEP IRAs, solo 401 plans offer self-employed individuals many of the same benefits of a traditional 401, including easy plan conversions, Roth options, loans, and additional saving opportunities with Cash Balance. Below each of these benefits are highlighted:

Also Check: What Is The Current Interest Rate For A 401k Loan

It Pays To Know Your Solo 401 Plan Options

Solo 401 plans are popular with business owners because they offer unrestricted contributions including mega back door Roth IRA contributions up to the 415 limit. The kicker? Theyre typically much less expensive than other 401 plans because theyre small and not subject to many plan qualification requirements.

However, you want to avoid 401 providers that limit your solo 401 plan design options. Their limitations can keep you from maximizing your plan benefits.

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation.

The total contribution limit for a solo 401 as both employer and employee is $58,000 for 2021, and $61,000 in 2022 or 25% of your adjusted gross income, whichever is lower.

People ages 50 and above can add an extra $6,500 a year as a “catch-up contribution.”

In other words, in 2021 you can contribute a total of $58,000 along with a $6,500 catch-up contribution if applicable for a maximum of $64,500 for the year.

You can have a solo 401 even if you’re moonlighting. If you have a 401 plan at both jobs, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. If you’re one of these lucky folks with two retirement savings plans, talk to a tax adviser to make sure you follow the IRS rules.

Recommended Reading: How Do I See How Much Is In My 401k

Best For Low Fees: Charles Schwab

Charles Schwab

The Individual 401 Plan from Charles Schwab is our top choice for low fees. The account has no opening or maintenance fees as well as no commission trades for stocks or ETFs and over 4,000 no-load, no-transaction-fee mutual funds. Customers can also use its robo-advisor, Schwab Intelligent Portfolios, with no extra fees.

-

Accounts are free to open and charge no recurring fees

-

Access to trade stocks, ETFs, and thousands of mutual funds for free

-

Option for a no-cost robo-advisor

-

No solo 401 loans

-

High fees for some mutual fund trades and broker-assisted trades

Charles Schwab is our top choice for low fees in a solo 401 plan. Schwabs version charges no recurring fees and no setup fees. It offers commission-free trades for all stocks and ETFs as well as over 4,200 no-transaction-fee funds on the Schwab OneSource funds list. While Schwab offers excellent customer service, be aware that automated phone trades cost $5 and broker-assisted trades cost $25 each. However, many customers could use this account without paying any fees.

Schwabs Solo 401 doesnt offer 401 loans. Its active investment platform may not satiate all expert investors, and its active charting and analysis tools lag behind some other brokerage platforms for active traders. However, the pending integration of TD Ameritrade will bring the coveted thinkorswim platform under the Schwab umbrella, which is something active traders at Schwab can look forward to.

What Else Do I Need To Know About Solo 401 Plans

- Once the balance in the solo-K reaches $250K you’ll be subject to some compliance measures including filing form 5500 with the IRS annually.

- You need to open the solo-K by 12/31 of the calendar year but you’ll have until tax day, including extensions, to fund it. So the absolute latest you can fund it is by 10/15 the following year.

Also Check: Can I Roll My 401k Into An Ira

What Is A Solo 401 Plan And How Does It Work

A solo 401 plan, also called a one-participant 401 or a solo K, offers self-employed people an efficient way to save for retirement. There are no age or income restrictions, but participants must be business owners with no employees .

The solo K has very high and flexible contribution limits, typically allowing more contributions than SEPs, traditional IRAs and Roth IRAs or SIMPLEs, says Joe Conroy, CFP and founder of Harford Retirement Planners in Bel Air, Maryland.

One key difference between the solo 401 and other self-employed retirement plans is that employees can contribute all of their salary up to the annual maximum contribution. Theyre not limited to 25 percent of their salary, as in some other plans. This feature can allow them to minimize taxes, though this contribution doesnt help them avoid the self-employment tax.

In other respects, the solo 401 operates like any other 401 plan, whether its a traditional 401 or a Roth 401. If you set up your solo 401 to take tax-deductible contributions, it will operate like a traditional 401, allowing you to contribute pre-tax money and get a break on this years taxes. On the other hand, if you opt for a Roth, youll make after-tax contributions, but will benefit from the tax-free withdrawals in retirement.

If you think tax rates will be higher in the future, like I do, then a Roth can be a very valuable account to reduce your future tax burden in retirement, Conroy says.

What Are The Tax Benefits Of A Solo 401

A one-participant 401 has a number of tax advantages that make it an attractive retirement savings plan for self-employed workers.

- Your contributions are tax-deductible. As previously mentioned, the money you put into a solo 401 as an employee will reduce your tax liability during your pre-retirement years. That money also enjoys tax-deferred growth. There are some tax benefits on the employer side as well. Profit-sharing contributions count as a deductible business expense for businesses that are incorporated. If not, they’ll likely count as a personal income deduction.

- You can opt for a Roth solo 401. Traditional 401s are funded with pretax dollars not so with Roth 401s. These types of retirement accounts are funded with contributions that have already been taxed. While you’ll miss out on the tax deduction today, you can enjoy tax-free distributions in retirement.

Recommended Reading: What Do I Do With 401k When I Retire

Who Is Eligible For A Solo 401

Solo 401 plans are intended for the self-employed. If you have employees and are looking for a retirement plan, then you have other options such as the or SIMPLE IRA, both of which allow you to provide tax-advantaged benefits to your employees. A lesser-known program called a SIMPLE 401 also allows businesses to set up retirement plans.

While solo 401 plans are intended for one-person businesses, there is an exception. The spouse of the business owner can also participate in the plan. With a spouse in the plan, your small business can really stash away cash for retirement. A qualifying couple could save as much as $114,000 annually in the plan, and even more if they were eligible for catch-up contributions.

Solo 401k Checking Account Question

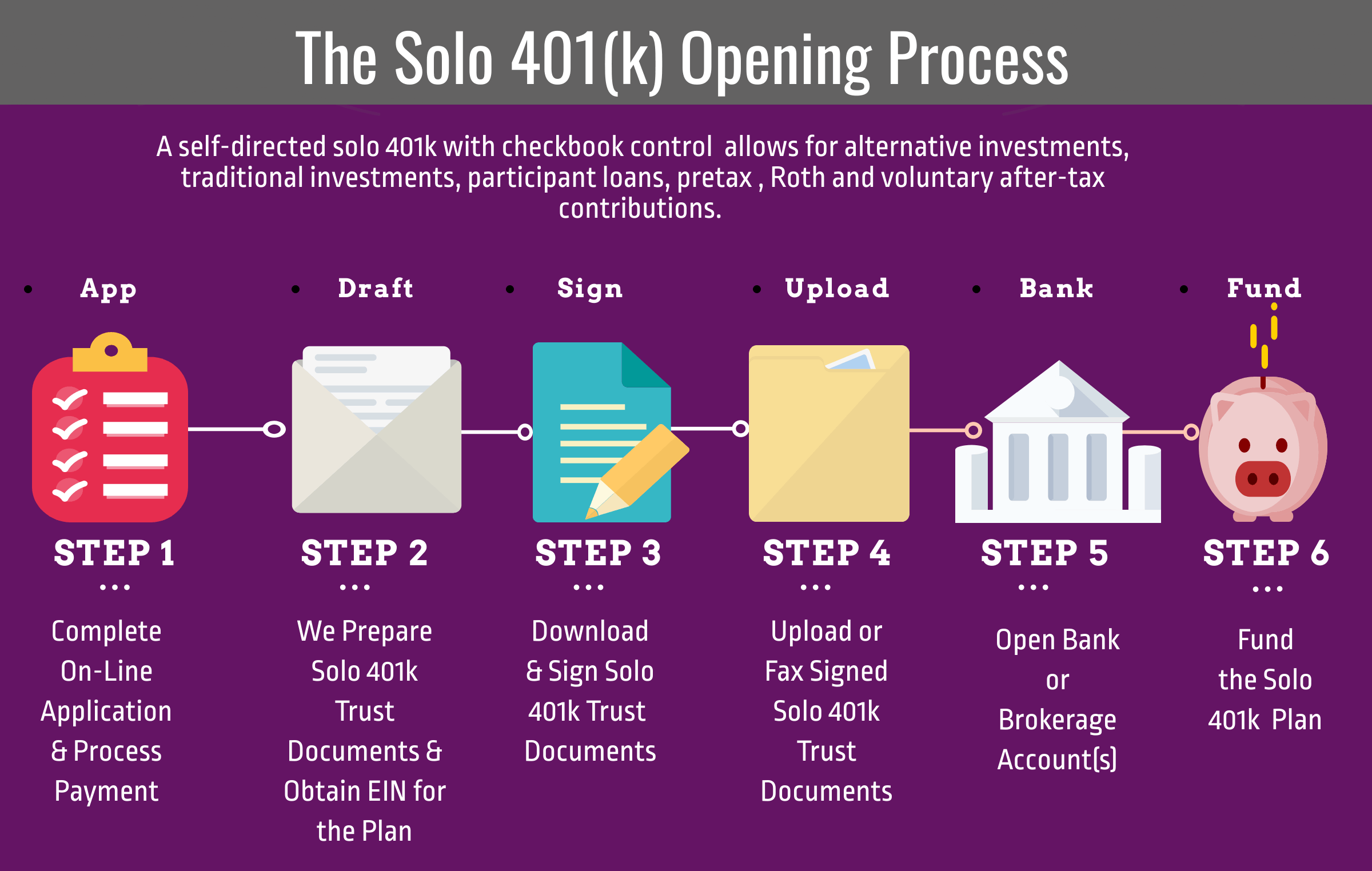

With our solo 401 plan, we will handle getting it set up with an account at the bank and/or brokerage of your choice where you will have checkbook control.

Our customers have their solo 401 accounts at hundreds of different banks, credit unions, etc. as well as brokerage firms such as Fidelity and Schwab just to name a couple.

If you want a brokerage account, we will prepare all the forms that the brokerage firm needs to open a free account and many firms offer a free checkbook feature.

If you want a bank account, we will prepare a packet that you can use to open an account at the bank of your choice. We will also be available to speak with your banker if he or she has any questions.

Don’t Miss: How To Split 401k In Divorce

Here’s How To Plow Some Of Your Profits Into Retirement Savings

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Just because you are a one-person outfit, a freelancer, or an independent contractor doesn’t mean you have to do without a retirement savings plan or the tax benefits that accompany them.

One option If you are self-employed is the solo 401, also known as an independent 401 plan. In fact, the Solo 401 has some benefits over other types of retirement accounts available to the self-employed.

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Don’t Miss: How To Maximize Your 401k

Why A Solo 401k

There are a number of features of the Solo 401k that make it the qualified retirement plan of choice to an owner-only business.

Following are some of the benefits of the solo 401k plan:

Alternative Assets & Equity Investments

In addition to investing in stocks and mutual funds, our Solo 401k allows you to invest in many types of investments such as real estate, private equity, hedge funds, gold, private loans, and much moreall by writing a check. For a list of investment options .

Access to Participant Loans

Solo 401k permits you to take a loan or borrow from your retirement funds. This comes in handy if you have a growing company. Loans can be processed from the Solo 401k at 50% of the account balance but cannot exceed $50,000. To find out more about the loan option visit: Solo 401k Loan and Solo 401k Loan Facts.

For example, Gary has an account balance of $200,000. Fifty percent of his account is $100,000 however, the maximum loan that can be taken from a plan is $50,000.

Also, after the loan option has been exhausted, you may qualify to take a hardship withdrawal from the plan, provided certain criteria dedicated by the IRS are met. Please contact us at 800-489-7571 or e-mail us at to find out more about this option.

Roth-Solo 401k

to learn more on how to maximize Roth sol0 401k contributions by making voluntary after-tax solo 401k contributions.

Voluntary After Tax Contributions-Solo 401k

Following are some of the rules regarding this type of contribution:

Does A Solo 401 Plan Allow For Roth Contributions

Yes, you can choose to make Roth 401k contributions to your solo plan. Similar to a Roth IRA, you will contribute after-tax dollars and then enjoy tax-free withdrawals at retirement. Just be sure that you specify this designation when completing your opening paperwork. If you need the money early, make sure you know how to take an early withdrawal without a penalty.

Don’t Miss: How Much Can You Contribute To 401k Per Year

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

Change In Business Name Affect On Contributions Question:

You can still setup the solo 401k in 2021 under your sole proprietor business. Next year in 2022, we can update the plan to list the new self-employed business. All else would remain the same . The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.

You May Like: Can I Take A Loan From My 401k

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

How To Fix The Mistake:

IRC Section 72 imposes a 10% additional tax for distributions that don’t meet an exception, such as death, disability or attainment of age 59 ½, among others. To avoid this additional tax, correct excess deferrals no later than April 15 of the following year. If you don’t correct by April 15, you may still correct this mistake under EPCRS however, it won’t relieve any Section 72 tax resulting from the mistake.

Under Revenue Procedure 2021-30 PDF, Appendix A, section .04, the permitted correction method is to distribute the excess deferral to the employee and to report the amount as taxable both in the year of deferral and in the year distributed. These amounts are reported on Forms 1099-R. In the case of amounts designated as Roth contributions, the excess deferral will already have been reported in income in the year of deferral. However, the amount will be reported as taxable in the year distributed.

Recommended Reading: What To Do With 401k When You Leave Your Job