What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. That means if you left your job in January 2020, you would have until April 15, 2021 when your 2020 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Unfortunately, this worst-case scenario isnt rare. A 2014 study from the Pension Research Council at the Wharton School of the University of Pennsylvania found that 86% of workers in the sample who left their jobs with a loan outstanding eventually defaulted on the loan.

The Benefits Of A 401 Loan

While borrowing from your retirement fund isn’t ideal, it does have a couple of distinct advantages over taking out a short term loan from a bank or credit union. In the first place, the application process is relatively simple, and in many cases can even be completed online. You only have to log into your account, fill out a form, and click a few buttons. If you are applying for a personal loan, you won’t even be asked what the money is for. Once your loan is approved, you can even have the funds deposited directly into your bank account. Compared to traditional lenders, applying for a 401 loan is remarkably quick and easy.

The second most important benefit of a 401 loan concerns the interest. With a traditional loan the interest you pay goes directly to the lending institution. It’s the price you pay for the luxury of borrowing money from a bank or credit union. However, with a 401 loan the interest you pay goes back into your retirement fund. Essentially, you are borrowing money from yourself and you reap the benefits of the paid interest. Keep in mind that while the proceeds of your loan are tax exempt, the interest on that loan is not. Still, the balance almost always works in your favor.

Should You Use 401 To Cover Emergency Expenses

Life is filled with emergencies. Even if you have medical insurance, your carrier likely wont pick up the entire tab.

If you had an open home equity line of credit, you might be tempted to tap those funds first. HELOC rates may be very close to what you’d get from a 401 loan. And, a HELOC may be tax advantaged .

But if you dont have one, theres all that initial paperwork to fill out. Plus, HELOCs adjust monthly, usually with no limit on the size of the adjustment.

Caution: You could lose your home if you fail to repay the borrowed funds through your HELOC.

You May Like: Am I Able To Withdraw Money From My 401k

How To Create An Esignature For The Prudential 401k Loan Form On Android

In order to add an electronic signature to a prudential 401k loan rules, follow the step-by-step instructions below:

If you need to share the prudential retirement loan with other parties, you can easily send it by electronic mail. With signNow, you are able to eSign as many files in a day as you need at an affordable price. Begin automating your eSignature workflows today.

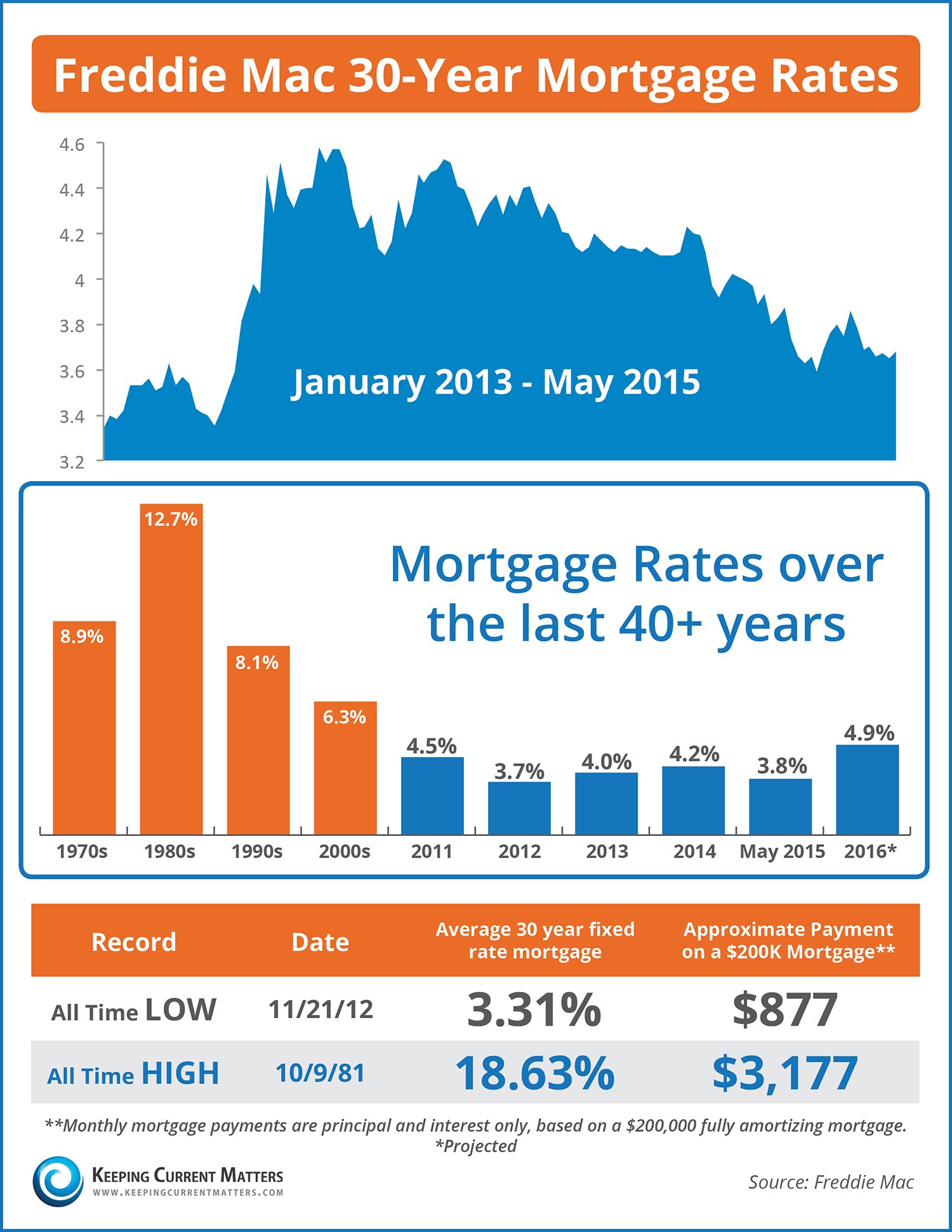

Historical Interest Rates For The G Fund

The G Fund interest rate is near all-time lows. But if you look back further in history to the late 1980s, the G Fund returned over 9 percent per year:

The G Fund compares very favorably to other risk-free investments. For example, in July 2013, the G Fund interest rate was 2.125%. By comparison, the best Bank CDs were yielding 0.45% for a 3-month term, or 1.8% for a 5-year term. Also, from the chart above you can see that the interest rate on the G Fund is almost always higher than the 3-month Treasury Bill yield.

Recommended Reading: How To Get Money Out Of 401k Without Penalty

Is It A Good Idea To Take A 401 Loan

A 401 can be a good or bad idea depending on the purpose for which you are borrowing the money. For example, if you are borrowing to fund home improvements such as roof replacement, it can be beneficial since it increases the value of the property. If you are planning to sell the property, the additional value obtained from the home improvements can help offset the forgone retirement savings.

Also, a 401 can be beneficial if you are borrowing to repay a high-interest debt. For example, if you have a credit card debt with high interest, you can take a 401 loan to offset the outstanding debt. A 401 loan has a lower interest rate than a credit card loan, and it can help you reduce the amount of interest you would otherwise pay on the credit card loan.

On the downside, it will be a bad idea to borrow a 401 loan for entertainment purposes. For example, borrowing a 401 loan to buy a birthday gift for a friend or family member is a bad idea, since you will not derive any benefit from it. Therefore, you will be better off leaving the money in the 401 to continue compounding, and use other sources of cash to buy the gift.

Tags

Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2020 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans gave participants the option to borrow based on 2017 data. So you may need to seek funds elsewhere.

You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to use it.

You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under the new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

You May Like: How To Rollover My Fidelity 401k

The Prime Rate And The Libor

Only banks in the United States use the prime rate. International banks have traditionally relied on a benchmark rate called the London Interbank Offered Rate . For over 40 years, international banks have used the Libor to set their rates for loans to each other and to customers.

Theres no official connection between the U.S. federal funds rate and the Libor. However, the two have tended to go up and down in tandem, with the Libor three-month rate hovering a few tenths of 1% above the federal funds rate.

Thus, the Libor was usually 2.5% to 3% below the U.S. prime rate. When the Libor and federal funds rate diverged, it was usually a sign of some sort of problem in the financial markets.

However, as Forbes reported in December 2020, international banks are beginning to move away from the Libor as a benchmark.

One reason is the role the Libor played in the financial crisis of 2007 to 2008, when the Fed kept lowering the federal funds rate, but the Libor actually rose as international banks tried to make it harder for U.S. banks to borrow from them.

Another problem with the Libor became apparent in 2012 when investigators learned that numerous banks, including Barclays, UBS, and Deutsche Bank, had been deliberately manipulating Libor rates for profit. And, on top of these scandals, changes in the way banks do business have made the Libor less reliable as a benchmark than it used to be.

Is A 401k Loan Taxed Twice

Another myth is that when you borrow from your 401k, you are being taxed twice because youre paying the loan back with after-tax money.

But in truth, only the interest part of the repayment is treated that way. And being twice taxed on interest from this kind of loan is likely to cost less than what it would cost to borrow money in another way.

You May Like: How Much Should I Have In My 401k At 60

Using A Personal Loan Calculator To Weigh Interest Rates

If youre ready to shop around for personal loan interest rates, its wise to keep a personal loan calculator handy. After all, your quoted APR determines your monthly payment. You can use a free online tool to estimate your monthly dues for each potential rate.

You can also employ personal loan calculators to determine your ideal loan repayment term. You might opt for a longer term at the expense of a slightly higher APR, for example, if it keeps your monthly payments in line with your cash flow.

In other words, personal loan rates are a key factor in determining which loan is best for you, but theyre far from the only factor to consider. Talk with lenders about repayment terms and protections as well as discounts and fees before choosing the best overall loan for your situation.

Personal Loan Interest Rates Plunge: Borrowers Can Save On 3

The latest trends in interest rates for personal loans from the Credible marketplace, updated weekly.

Borrowers with good credit seeking personal loans during the past seven days prequalified for rates that were lower for 3-year fixed-rate loans and 5-year fixed-rate loans compared to the previous seven days.

For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender between Dec. 30 and Jan. 6:

- Rates on 3-year fixed-rate loans averaged 11.17%, down from 11.76% the seven days before and 11.37% a year ago.

- Rates on 5-year fixed-rate loans averaged 13.73%, down from 14.64% the previous seven days and 14.53% a year ago.

Personal loans have become a popular way to consolidate and pay off credit card debt and other loans. They can also be used to cover unexpected expenses like medical bills, take care of a major purchase or fund home improvement projects.

Personal loan interest rates dropped for both 3-year and 5-year fixed terms over the last week. Rates for a 5-year term fell by nearly 1%, while rates for a 3-year term sunk by more than half a percentage point. Personal loan interest rates continue to trend downward, despite daily fluctuations. Borrowers can take advantage of significant savings if they lock in a 3-year or 5-year fixed-rate personal loan right now.

It’s always a good idea to comparison shop on sites like Credible to understand how much you qualify for and choose the best option for you.

Don’t Miss: How To Open A Solo 401k

How Much Can Be Borrowed From A 401 Loan

It depends on how much you have in your account. You can borrow up to 50% of your vested account balance, but you cant borrow more than $50,000. Even if you have a balance of $200,000, the IRS wont let you touch more than $50,000 of it.

The only time you can borrow more than 50% is when you have a balance of less than $20,000. In that case, you can borrow up to $10,000, even if you only have $10,000 stashed away.

How To Find The Mistake:

Review the loan agreements and loan repayments to verify they’ve met the IRC Section 72 rules to prevent the loans from being treated as taxable distributions. This review should include:

- Determining whether there are written loan agreements for outstanding loans. If not, the loan is a taxable distribution to the participant.

- Reviewing the terms of each loan agreement to ensure that it meets the rules required to prevent the loan from being treated as a taxable distribution, including:

- Are loans due within 5 years?

- For a loan over 5 years, is there documentation in the file showing the employee used the loan to purchase a main home?

Read Also: How To Pull Money From 401k

Should You Use Your 401 To Buy A House

As you can see, there are a variety of drawbacks and risks involved in using a 401 to buy a house. These include:

- Missing out on making new contributions while you pay yourself back

- Having to pay penalties, fees and interest depending on the specifics of your companys 401

- Losing out on the compounding interest your money could earn if you left it in the retirement account

- Missing out on your companys match

- Finding yourself in a bind if you change jobs and have to pay your 401 back in a lump sum

How The Prime Rate Is Set

Technically, there is no official, nationwide prime interest rate instead, each lender sets its own. However, most banks set their prime rates at the same level and adjust them at the same time.

When people talk about the prime lending rate, theyre often referring to the WSJ Prime Rate, a benchmark calculated by The Wall Street Journal based on a survey of the 10 largest banks in the U.S. If at least 70% of these banks adjust their prime rates, the WSJ Prime Rate shifts in response.

Don’t Miss: How To View My 401k

K Loan Repayment After Leaving A Job

The biggest fear that surrounds borrowing from a 401k is what will happen if you leave the job either voluntarily or involuntarily. Before the Tax Cuts and Jobs Act, loan repayments must have been met within 60 days.

Nowadays you have until your tax returns due date for the year you left your job.

For example, if you left your job in 2020, youd have until April 15, 2021, to repay your loan .

Any outstanding loan balance not repaid on time will be seen as an early withdrawal and subject to an early withdrawal penalty.

This understandably freaks people out. Ideally, you wont borrow against your 401k if you feel that you are in danger of losing your job or you plan to leave shortly. If your job is stable, this fear is mostly unfounded.

Of course, all of us are expendable. What if you do lose your job and have to pay the money back?

Well, we dont have debtors prisoners anymore , so its not like youll be locked up. What will happen is that the IRS will classify the remaining balance as an early withdrawal, hit you with a 10% penalty on that amount, and require you pay taxes on the distribution.

Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

You May Like: When Can You Start Drawing From Your 401k

Choose A Shorter Loan Term

Personal loan repayment terms can vary from one to several years. Generally, shorter terms come with lower interest rates, since the lenders money is at risk for a shorter period of time.

If your financial situation allows, applying for a shorter term could help you score a lower interest rate. Keep in mind the shorter term doesnt just benefit the lender by choosing a shorter repayment term, youll pay less interest over the life of the loan.