The Results Can Be Pretty Incredible

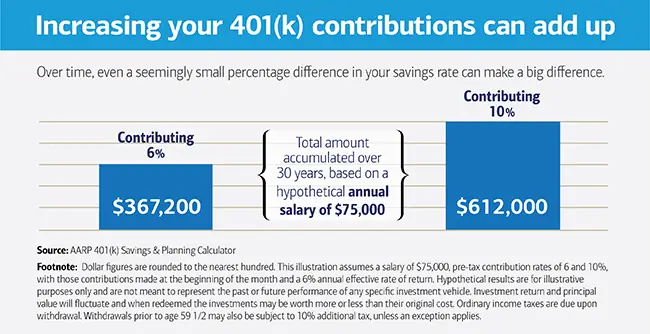

Of course, many self-employed people don’t have the ability to contribute the maximum amount allowed to a solo 401. However, even modest contributions add up over time.

For example, let’s say that you’re self-employed and that you’ll have $80,000 in net self-employment income for 2021. You decide to set aside a total of 10% of your net self-employment income in a solo 401. Not only could this reduce your taxable income by $8,000 for the year, but if you repeat the process every year, you could end up with a retirement nest egg of more than $928,000 after 30 years — and that assumes just 2% annual income increases and a historically conservative 7% annual rate of return.

Imagine if you decided to invest even more. With a solo 401, you can dramatically reduce your taxable income while building up a million-dollar nest egg.

Contribution Limits : You’ve Got Time

You’ve got about two months left in 2020 to jack up your contribution level, if your employer lets you. And chances are you are not yet saving the maximum allowed. During 2019, only 12% of members of 401 plans overseen by Vanguard were ponying up the basic maximum permitted. And only 15% of plan members age 50 or older took advantage of their right to kick in up to another $6,000.

Taking advantage of opportunities to contribute to your 401 account matters. Turbocharged by tax deductions and tax-deferred earnings, 401 plans are the most common retirement savings plans in the U.S., says the American Benefits Council. One key survey shows that 401 and similar plans are the only retirement savings programs offered to new hires by 81% of firms.

So how much can you put into your 401? What are the 401 contribution limits for 2021 and 2020?

Benefits Of Contributing To Your 401 Plan

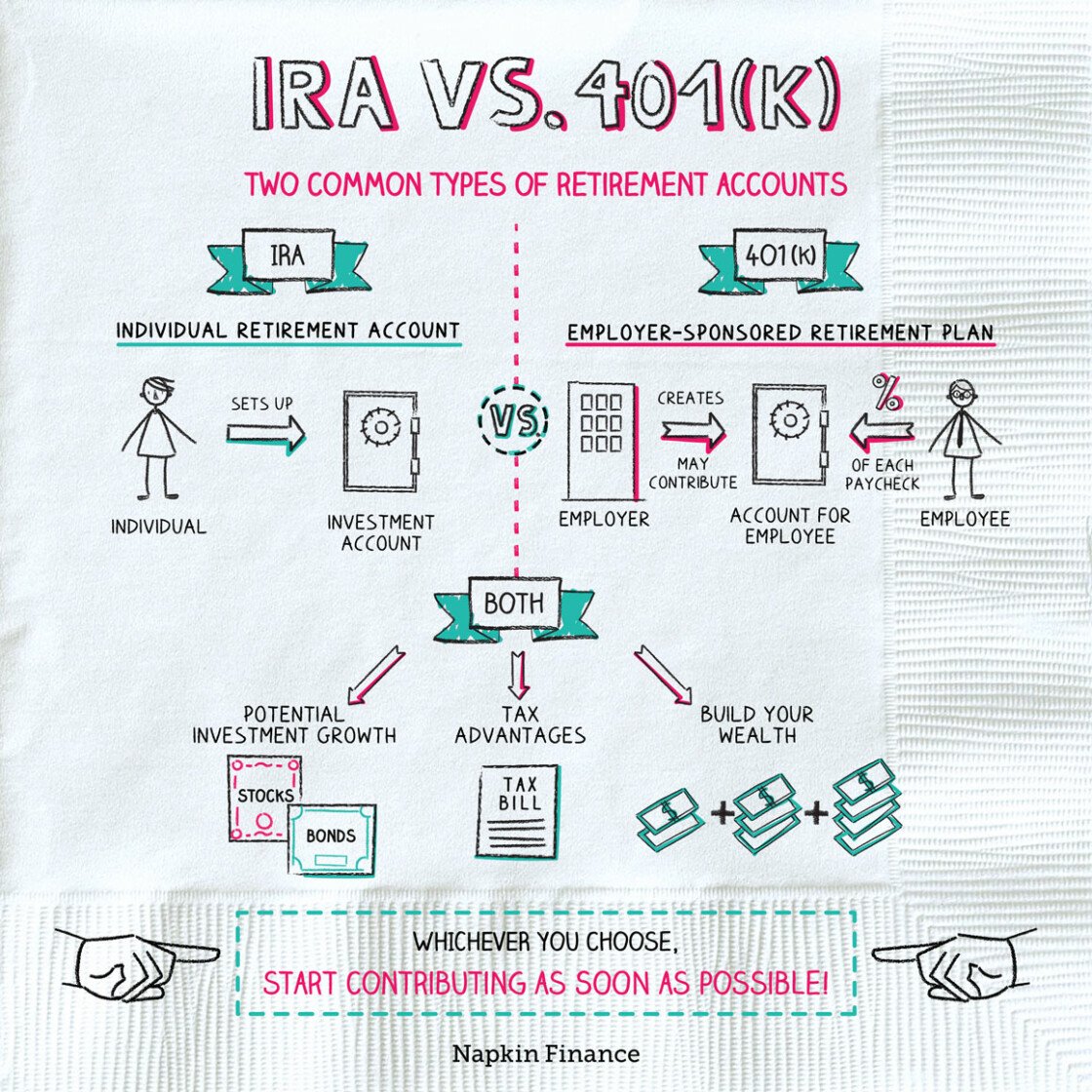

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

Don’t Miss: What To Do With Your 401k

Solo 401k Contribution Limits And Types

IRS records show that, in Tax Year 2014, an estimated 53 million taxpayers contributed almost $255 billion to tax-qualified deferred compensation plans. A popular form of deferred compensation plans, known as a solo 401 plans, permits employees to save for retirement on a tax-favored basis.

Video Slides:2020 & 2021 Solo 401k Annual Contribution Deadline

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

Recommended Reading: Can I Set Up My Own 401k Plan

Could You Increase Your 401 Contribution

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road.

Cutting or reducing non-essentials could allow you to bump up the money youre putting into your 401 or 403. Like the gym membership you havent used in 6 months, for example. Or buying a certified used car instead of a new one. How about those merit increases or a bonus?

A little could go a long way in the future. Consider this example1 for a $35,000 annual income:

| Additional contribution | Reduction in bi-weekly take-home pay | Estimated additional monthly retirement income | Total employee contributions over 30 years |

|---|---|---|---|

| 5% | |||

| $18,068 |

Imagine if you could increase it to 10% of your pay?

If youre wondering how to save more toward retirement, read 5 smart money tips from super savers.

Tip: Dont forget inflations impact on retirement savings. You may feel like youre saving enough to maintain your current lifestyle. Even though your income may increase over the years, so will your cost of living . If you spend $50,000 a year to live in todays dollars, for example, how much more will it take 30 years from now?

Does The Contribution Limit Include My Company Match

The annual 401 contribution limits above are for employees. Additional, separate limits apply to amounts contributed by employers. Those are made as matching contributions by the employer or as profit-sharing contributions.

In 2022, the combined cap on 401 contributions by plan members and employers is 100% of the worker’s compensation or $61,000, whichever is lower, or $67,500 for workers who are 50 or older.

Recommended Reading: How To Pull Out Of 401k

Start Side Hustling Already

I hope everyone now knows how to calculate what they can contribute to their self-employed 401k plan. Go over the example a couple more times if you are still confused. And check with an accountant if you want to be extra sure. Make sure you dont contribute too much to your self-employed 401k plan. If you do, it can be a pain to unwind the contribution.

Given the benefits of being able to contribute to a self-employed 401k plan, I highly recommend you start your own online business. Not only can you contribute your operating profits to a tax-deferred self-employed 401k plan, you can also deduct business expenses.

If you dont want to start an online business that cant be shut down during the coronavirus pandemic, be a rockstar freelancer. Being one allows you to contribute to a solo 401 as well.

If you are only a W-2 employee, your 401k contribution is capped at the maximum a a year + any 401k employer match . Unfortunately, very few employers are generous enough to contribute ~20% of their operating profits to you.

For those who work at startups or money-losing organizations, you are SOL in terms of receiving any profit sharing. Youll get paid below market rate, have options likely not worth what you hope, and get minimal retirement benefits.

What If You Contribute Too Much

If you discover that you have contributed more to your IRA than you’re allowed, you’ll want to withdraw the amount of your overcontribution, and fast. Failure to do so in a timely way could leave you liable for a 6% excise tax every year on the amount that exceeds the limit.

The penalty is waived if you withdraw the money before you file your taxes for the year in which the contribution was made. You will also need to calculate what your excess contributions earned while they were in the IRA and withdraw that amount from the account, as well.

The investment gain must also be included in your gross income for the year and taxed accordingly. What’s more, if you are under 59½, you’ll owe a 10% early withdrawal penalty on that amount.

You May Like: Can I Transfer Money From 401k To Ira

Maximizing Your 401 And Ira Retirement Contributions

When you contribute to a 401, 403, or IRA, youre already on a path to help secure your financial future. But could you save more? Making the most of your organizations retirement plan now could help ensure your golden years are even more golden.

Read 5 steps to creating your retirement plan to help you get started.

How To Boost Your Retirement Savings

DON’T know where to start? Here are some tips on how to get going.

- Understand where you start: Before you consider your plans for tomorrow, you’ll need to understand where you stand today. Look into your current pension savings and research when youll be eligible for social security benefits, if at all.

- Take advantage of a 401k: The 401k plans are tax-effective accounts put you in a better place financially for your retirement. If you save, your employer may too.

- Take advantage of online planning tools: Financial provider Western & Southern Financial Group and comparison site Bankrate have tools that give you an idea of what your retirement income will be based on how much you’re saving.

- Find out if your workplace offers advice: Some employers offer sessions with financial advisers to help you plan for your future retirement.

You May Like: How To Figure Out Employer Match 401k

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

K Contribution Limits For Highly Compensated Employees

401k plans are an attractive benefit for employees because employers generally match a percentage of the employees contributions.

The employer matching contribution can be a particularly powerful incentive to boost 401k savings, especially for lower-salaried individuals.

Employees who earn a higher annual salary may find themselves in an interesting predicament though when it comes time to determine how much they should contribute to their 401k plan:

Employees who are classified as HCEs must be careful not to exceed the maximum elective deferral limit or face significant tax penalties.

Recommended Reading: How Do You Rollover Your 401k To A New Employer

How Does Employer Matching Work

Some employers offer a 401 employer matching plan, which means they match the amount of pay an employee contributes toward their 401. The amount an employer matches varies on the company and the Internal Revenue Services limits. Some employers match a portion of the employees contribution, while others match the full amount.

You can make the same contribution for all employees, or it can vary on how much salary each employee makes and change annually based on how much the employee earns. For example, if an employee receives a raise at the end of the year, their employer may increase their match amount as well. The most popular matching plan employers use is matching up to 6% of their employees annual income.

Related: X Luxury Perks to Attract and Keep Employees

How Much Can I Withdraw From A 401k

You can withdraw any money you’ve put in a 401k early, but it should only be considered as a last resort.

This is because you’ll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

You also have to pay normal income taxes on the withdrawn funds.

There are exceptions to the penalty though, such as using the funds to pay for your medical insurance premium after a job loss.

You can also take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday.

This is known as the IRS Rule of 55.

Last March, former President Donald Trump also signed an emergency stimulus bill that lets those affected by Covid withdraw up to $100,000 without the penalty, even if they’re younger than 59 1/2.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Alternatively, you can repay the withdrawal to a 401k and avoid owing any tax.

Lastly, you can also take money out of your 401k by taking a loan from your account.

The amount is limited to 50% of vested funds worth up to $50,000 – but keep in mind it must be paid back with interest within five years.

Also Check: How To Access My Fidelity 401k Account

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $58,000 in 2021, up from $57,000 in 2020. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $290,000. Even at that level, the employer would have to contribute a hefty amount to reach the $58,000 limit.

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

You May Like: Can I Invest My 401k In Gold

Contribution Limits Rules And More

Your 401 contribution limits are made up of three factors:

- Salary-deferral contributions are the funds you elect to invest out of your paycheck.

- Catch-up contributions are additional money you may pay into the plan if you are age 50 or older by the end of the calendar year.

- Employer contributions consist of funds your company contributes to the plan also known as the “company match” or “matching contribution,” they may be subject to a vesting schedule.

There are two types of limits. One is a limit on the maximum amount you can contribute as a salary deferral. The other limit is on the amount of total contributions, which includes both your and your employer’s contributions.

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Don’t Miss: Can I Start A 401k For My Child

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $56,000 for 2019, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,000 employee contribution to the Roth solo 401k for 2019, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,000 employee contribution on the Roth solo 401k. Note that you can also split up the $19,000 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,000 of catch-up contributions to work with if you are age 50 or older in 2019 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

Contribution Limits In 2020 And 2021

For 2021, the 401 limit for employee salary deferrals is $19,500, which is the same amount as the 401 2020 limit. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $58,000 in 2021, up from $57,000 in 2020.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $180,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | none |

Don’t Miss: How To Get Your 401k Without Penalty