Open A Custodial Roth Ira

There are a handful of ways you can gift a Roth IRA. One option is to open a custodial account for a minor.

Let’s say you’re a parent or grandparent and you want to help the kids secure their financial futures. Instead of just telling them about Roth IRAs, you could help them start one in their own name.

Since theyre minors, it has to be a custodial account. No worries: An increasing number of brokerages offer Roth IRAs for kids, sometimes waiving or reducing the usual account minimums to set one up. A Roth IRA can help save not just for retirement, but for college or a first home, as well.

The Roth may even encourage the child to get a job or even start a little side business so they can add money to the account. You or someone else can also contribute gifts directly to it.

If you contribute to someone else’s Roth IRA, that money will count against your limit on tax-free gifts you can give one person annually. For 2019, that’s $15,000.

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

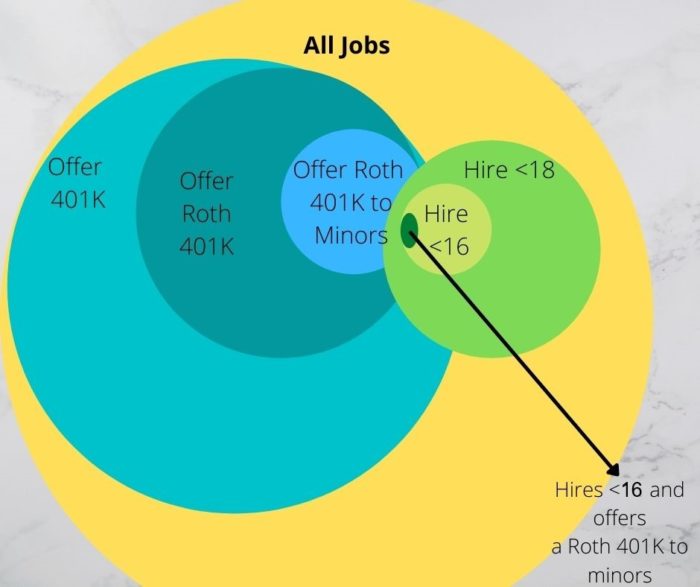

The first thing you need to know is that your account options will depend in large part on where and how you work.

About The Site Author And Blog

In 2018, I was winding down a stint in investor relations and found myself newly equipped with a CPA, added insight on how investors behave in markets, and a load of free time. My job routinely required extended work hours, complex assignments, and tight deadlines. Seeking to maintain my momentum, I wanted to chase something ambitious.

I chose to start this financial independence blog as my next step, recognizing both the challenge and opportunity. I launched the site with encouragement from my wife as a means to lay out our financial independence journey and connect with and help others who share the same goal.

Recommended Reading: How Do You Find Out About Your 401k

Here’s How To Open A Roth Ira For Your Kids

Your childs income is what makes him eligible for the Roth IRA, but a parent or other adult will have to help open the account. Roth IRA providers typically require an adult to open and manage a custodial Roth IRA on behalf of a minor.

The process is simple and should only take about 15 minutes you’ll need to provide Social Security numbers for you and your child, birthdates and other personal information.

Opening An Ira For A Child

If you want to open an IRA account for a minor, it must be a custodial account, meaning it’s held by the parent or guardian in the name of a minor. That parent or guardian maintains control of the account until the child is of legal age, which varies by state but is usually either 18 or 21. The account must be transferred to an independent account in the child’s name as soon as the child reaches the age required by your state. There’s usually no minimum amount required to open a child’s IRA or Roth IRA account, but certain investments may require a minimum initial investment.

Not all banks offer custodial IRAs, but two that do are Fidelity’s Roth IRA for Kids and Charles Schwab’s Schwab One Custodial Account.

To open a custodial account for your child, you’ll usually need to provide the following:

- Your identifying information

- The child’s identifying information

- Your contact information

- Your employment information

Read Also: How To Close Vanguard 401k Account

Why A Roth Ira Can Be Right For Kids

Now that you know whether your kids can have a Roth IRA, you might be wondering if they should. Aside from the momentum of investing early, there are several reasons why a Roth IRA in particular can be a good choice for children:

1. Contributions can be withdrawn at any time

Retirement accounts are known sticklers about distributions many charge a 10% penalty on money taken out before age 59½. Thats tough on kids, who arent exactly known for their ability to delay gratification.

But a Roth IRA is different. The money contributed to the account can be withdrawn at any time and used for anything from a Matchbox car to a first real car.

That flexibility is balanced by stricter rules for the Roth IRA accounts earnings, or the return on contributions that are invested. Distributions of investment earnings may be taxed as income, penalized with a 10% early distribution tax or both.

Those two rules make the Roth IRA a nice middle ground between kids who want easy access to their cash and parents who want to make sure some of that cash is saved for the future.

» Get the full details on Roth IRA early withdrawals

2. More time means more growth

Is waiting that long a hard sell? Maybe mention that a one-time contribution of $6,000 in a Roth IRA — with no additional contributions at all — would grow to about $200,000 in 60 years .

3. Investing trumps saving

4. The tax advantages are prime for kids

5. The money can be used for more than retirement

Keep Company Stock In Check

Dont fall into the trap of not paying attention to your assets, including stock in the company you work for. If your shares in the company have done well, they may make up a big chunk of your retirement investments.

Financial planners generally agree that company stock, or any other single equity, should never exceed 10 percent of your portfolio. More than that and you may be putting your retirement at great risk. Your savings shouldnt be determined by the health of a single company, Rinaldi says.

Slott agrees. Its the old adage, you dont put all your eggs in one basket, he says. The last thing you want is to lose your job and your retirement savings at the same time because their stock is down.

Also Check: How To Put 401k Into Ira

How To Open An Rrsp For Your Child

If youve decided that opening an RRSP for your child is the right step, heres what your child needs:

- Income: Your child must have earned an income, been issued a T4 by their employer in the previous year and filed an income tax return. Earning an income creates contribution room, which will be equal to 18% of the previous years earned income.

- Consent: Your child must have a letter of consent from a parent or legal guardian.

The process of opening an RRSP for your child is otherwise very similar to opening one for yourself, including the process of deciding what to do with the contributions.

Should I Open An Rrsp For My Child

There are a few good reasons to open an RRSP for your child:

- To promote healthy habits: If you want your child to learn to save money, an RRSP is a good choice.

- To buy a house: With soaring home prices, buying a house is a hurdle for the next generation. But your child can get a head start by contributing to their RRSP and then take advantage of the Home Buyers Plan later in life.

- Investing early: Your child can also take advantage of the magic of compound interest by investing early. For example, if your child starts working at age 14 and invests $100 per month, theyll end up with a much larger nest egg by age 65 than someone who starts investing the same amount at age 30. The comparison chart below illustrates the benefits.

Age to Start Investing

Total Value of Investment at 65 years old

$403,311*

* Assuming 6% interest rate, compounded monthly

Don’t Miss: Should I Rollover 401k To New Employer

M1 Finance: Best For Custodial Iras And Financial Management For Kids

- Available:

- Price: Free trades, $125 subscription to M1 Plus required for custodial account

If you wish to open a custodial Roth IRA for your child, the custodian of a childs account holds responsibility for taking on the management and control of an accounts assets until the termination age as determined by state law.

At which point, the assets and the account turn over to their possession.

Work with them while theyre young and looking to engage in teenage investing opportunities. This can provide valuable information and guidance as a way for teaching kids about money management.

You can use this to help them begin financial planning for the long-term.

Heres how to do it: If your child is a minor , you will find many of the best stock investing apps for beginners will let you set up a custodial IRA.

One such app, M1 Finance, allows you to open a custodial Roth IRA through enrolling in their M1 Plus subscription. For the first year, the company offers this as a free service. Thereafter, it amounts to $125/year.

One way to invest for your childs future is to automate investments by creating a child investment plan with this app. You can use the app to diversify your custodial IRA portfolio with index funds and stocks.

Why you might want to pick M1 Finance for your custodial Roth IRA is because it also comes with the ability to add a paired banking app and debit card for kids.

- Available: Call 551-8631

- Price: Free trades on ETFs

How To Pass Money On To Your Children

You dont need to have millions to be able to leave something for your children after you die.

Between life insurance, wills and other financial tools, many parents of more meager means can also take steps to make sure their kids will be okay financially after theyre gone. And as much as families despise talking about money, the measures dont always require a lot of work.

Regardless of how much wealth you have, says Gregory Popera, a private wealth adviser with Bank of America Merrill Lynch, having some type of estate plan and financial power of attorney are sort of the financial building blocks to make sure your assets go where you want them to go.

Start with a will.

The document, best drafted with the help of an attorney, should lay out plans for how assets such as a home, investments and family heirlooms should be divided among children, other relatives and charitable organizations, Popera says. Directions for other items, such as furniture, clothing and photographs, can be explained in a separate letter, he says. Wills can be used to name an executor, or the person responsible for paying final bills and dividing up the estate.

Leave them your retirement accounts.

Buy life insurance.

Open a 529 account.

Create a trust.

Simpler ways.

Read More:

Recommended Reading: How Does A 401k Loan Work

Put Your Child’s Earnings To Work

A contribution to a Roth IRA for Kids can be made if a minor has earned income during the year. Eligible income can include formal employment income or self-employment income. Activities like babysitting or mowing lawns can qualify a minor for Roth IRA contributions. Note that in some cases self-employment taxes can apply so it’s advisable to consult with a tax professional. The current maximum annual contribution is $6,000, or the total of a childs earned income for the yearwhichever is less. For example, if your daughter earned $2,000 during a summer job, you could contribute up to $2,000 to a Roth IRA in her name. If your child is not filing a tax form that covers his or her earned income, consider maintaining a written log of their earnings in case the IRS asks questions. Unlike traditional IRAs, contributions to Roth IRAs are made with after-tax dollars. This means the account owner cannot claim a tax deduction for his or her contributions. However, since most kids have low annual earnings, their income tax rate is already quite low or even zero. Therefore, tax deductions may not be an important factor at this stage of their lives. Moreover, when it comes time to tap their savings at retirement age, distributions from a Roth IRA will be tax-free, unlike distributions from a traditional IRA.

Choose The Best College Savings Option For You

First, its important to choose the investment vehicle that meets your needs. There are several fund types to choose from, all with their own rules and tax consequences. You can even have more than one account, depending on how your finances change over time. Below are some college saving products to consider:

Recommended Reading: What Is A Pension Vs 401k

Learn The Earned Income Requirement For Roth Iras

Still, you have to be very, very careful if you help fund an IRA for a minor child. Why? Because anyone with a Roth IRA must have earned income during the year that a contribution is made to the account.

That earned income can come from part-time jobs like babysitting or working at the grocery store. Odd jobs are okay, too, but the wages have to be reasonable. You okay with $25 to weed the garden? Sure. But you can’t get away with paying your grandkids $1,000 to mow the lawn.

There’s also this: The contribution amount is limited by the amount of earned income the account holder has. If your grandson earned $2,500 working during the year, he can only contribute that much, even though the overall contribution limit is $6,000 for 2020 and 2021.

Still, there’s no stipulation in the IRS guidelines that says the $2,500 he invests in the Roth IRA has to come directly from his earnings. He can earn $2,500 and spend it on a mountain bike and car insurance if he so desires.

You can come around and give a very nice gift of $2,500 for him to put into the Roth IRA. Just make sure the amount you give doesnt exceed what he earned.

Investing For Kids: How To Open A Brokerage Account For Your Child

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Investing isn’t just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start.

Read Also: How To Find Out What You Have In Your 401k

Can I Open A Roth Ira For My Kids

So far we’ve discussed why you might want to contribute to a Roth IRA for your kids. But whether parents can contribute to a Roth IRA for a minor is another issue.

There are a couple of basic requirements that need to be met before Americans can contribute to a Roth IRA:

- First, the minor’s income needs to be below a certain limit. As you can probably imagine, this is typically not an issue for children. But for the 2021 tax year, the IRS income limit to make a Roth IRA contribution is $140,000 for single tax filers. For the 2022 tax year, the limit is $144,000.

- Second, the annual contribution limit for a minor’s Roth IRA in 2021 is $6,000 or total earned income for the year, whichever is lower. Earned income means money from a job or a business you actively participate in — not interest income, dividends, or other passive sources. This is the requirement that is typically the roadblock for children, especially those without jobs.

Before we move on, it’s important to emphasize that it doesn’t necessarily need to be your child’s money that is contributed — in other words, as long as your child has enough earned income to justify it, there’s no reason you can’t make a Roth IRA contribution on your kid’s behalf or match some of the money he or she contributes.

What Is The Best Investment Account For A Child

The best investment account for a child will vary depending on circumstance. If you need to save money for college, the best bet would be in a 529 plan or Coverdell Education Savings Account, not a retirement account like a Roth IRA.

Financial experts will tell you to consider your overall investment objective and then make the maximum contribution possible to achieve this desired outcome.

This can be to pay for qualified education expenses, earn tax free returns in a Roth retirement accounts, or even invest money through custodial brokerage accounts despite having fewer tax advantages with the investment earnings.

Recommended Reading: What Should I Invest In 401k

How And When To Start A College Fund For Your Child

Many parents want to help their children attend college without accruing debt, and they know that its best to start saving early to achieve this goal. They understand the benefit of a college education not only in terms of personal growth but also in earning potential, career opportunities and financial stability.

However, college expenses have risen considerably over the years, making it difficult for many families to afford without accruing some debt. Tuition and living costs can run over $60,000 for a year at a private college and more than $30,000 per year at a state university.

Fortunately, there are ways to start a college fund that can help you and your child cover tuition. Heres what you can do: