Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Investment Choice And Fee Transparency

With our open architecture platform, you can choose from thousands of investment options with no proprietary requirements. Fee transparency means you know exactly what youre paying for, and our return of mutual fund revenue share policy gives revenue share payments from mutual funds back to participants.

Conventional And Roth Iras

What do you do when you have maxed out your 401 or need to save much more through the use of a well known funding automobile? Fortunately, there are lots of choices obtainable to you, together with traditional IRAs and Roth IRAs.

Youll be able to contribute as much as $6,000 to both kind of IRA in 2022. When youre age 50 or older, you may add a $1,000 catch-up contribution. Conventional IRAs and 401s are funded with pre-tax contributions. You get an upfront tax break and pay taxes on withdrawals in retirement. The Roth IRA and Roth 401 are funded with after-tax . Which means you arent getting an upfront tax break, however certified distributions in retirement are tax-free.

When you or your partner is roofed by a retirement plan at worktogether with a 401you mayt take the total deduction in your conventional IRA contributions. And with Roth IRAs, you mayt contribute in case you make an excessive amount of cash.

You May Like: When Can I Use My 401k

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

Don’t Miss: How To Locate Lost 401k

Increase Your Deferral Rate

Taking advantage of a company match helps you capture valuable contributions from your employer, but it may not be enough. Many 401 providers recommend saving at least 10% annually over the course of your career.3 But, the average 401 contribution is closer to 6%.4

If you arent able to save 10% to 15% of your pay at the beginning of your career, aim to gradually increase your deferral rate over time. One smart tactic is to boost your 401 deferral rate every time you get a raise or bonus. This enables you to save more without reducing your take-home pay.

Another way to consider for enhancing your savings rate is to increase your deferral rate by 1 percentage point every year. Some companies offer an automatic escalation feature that will periodically increase your savings rate with a simple click of a box other companies require you to manually make this change.

A good time to review your contribution amount is at the beginning of the year when youre looking carefully at other benefits elections, such as medical and dental insurance, since the amount you put towards these benefits will have an impact on your paycheck. Another good time to revisit your contribution amount is when you receive additional compensation, whether through a raise, promotion or bonus.

What To Do With Your Old 401

What should I do with my old 401 is one of the most common questions I get asked by new financial planning clients. Answering this question is often one of the biggest financial decisions you need to make when switching jobs. You essentially have four options to choose from, keep your old 401 where it is, rollover your 401 to an IRA, rollover your old 401 to your current 401, or cash out your retirement plan.

There are a few things to consider when making this choice, including your age, your 401 balance, your investing knowledge, and the investment options in both your old and new retirement plans.

Recommended Reading: Is Rolling Over 401k To Ira Taxable

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Can You Provide Tax Advice

No. For tax advice, please call your Tax Advisor or the IRS at 1-800-829-1040 or visit their website at .

Online Statements require Adobe® Acrobat® PDF reader. The length of time Online Statements are available to view and download varies depending on the product: up to 12 months for auto loans and student loans up to 2 years for credit cards, home equity lines of credit, and personal loans and lines of credit and up to 7 years for deposit accounts, home mortgage accounts, and trust and managed investment accounts. The length of time the specific product statements are available online can be found in Wells Fargo Online® in Statements & Documents. Availability may be affected by your mobile carrier’s coverage area. Your mobile carriers message and data rates may apply.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® brokerage accounts are offered through WFCS.

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

Also Check: How To Take Out A Loan Against 401k

Contact Wells Fargo By Phone

Wells Fargo offers Individual Retirement Accounts , and it also services employee-sponsored 401 retirement plans.

Video of the Day

Access your existing Wells Fargo IRA by calling a representative at 1-800-237-8472 between 8:00 a.m. and 10:00 p.m. Eastern Time or between 8:00 a.m. and 5:00 p.m. Eastern Time on Saturday.

Access your existing Wells Fargo employee-sponsored retirement account, such as a 401 or 403 plan, or find out how to make a Wells Fargo 401 withdrawal by calling 1-800-728-3123 between 7:00 a.m. and 11:00 p.m. Eastern Time on Monday through Friday.

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, you’ll want to consider two factors before making a decision:

Recommended Reading: How Does A 401k Retirement Plan Work

How To Help Maximize Your 401 Plan

One of the simplest and most effective ways to save for retirement is to contribute to your companys 401 plan. A 401 plan allows you to defer a portion of your paycheck to your retirement account each pay period automatically, while potentially reducing your tax bill this year. But are you getting the most out of your 401?

Here are three 401 retirement strategies to consider.

What Will Be The Future Value Of Your 401k

Will your 401k savings be enough to secure your financial future?

The last thing you’d want is to reach retirement age realizing that you’re going to need to work for another 20 years.

Proper financial planning results in a secure future, and your 401k can be a key contributor. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years.

Recommended Reading: What Is A Pension Vs 401k

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Also Check: What Is The Tax Penalty For Early 401k Withdrawal

Withdrawing After Age 595

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

Recommended Reading: What Is The Difference Between A Pension And A 401k

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $19,500 in 2021 and $20,500 in 2022.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

Also Check: When Can You Access 401k

Average 401k Balance At Age 65+ $471915 Median $138436

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

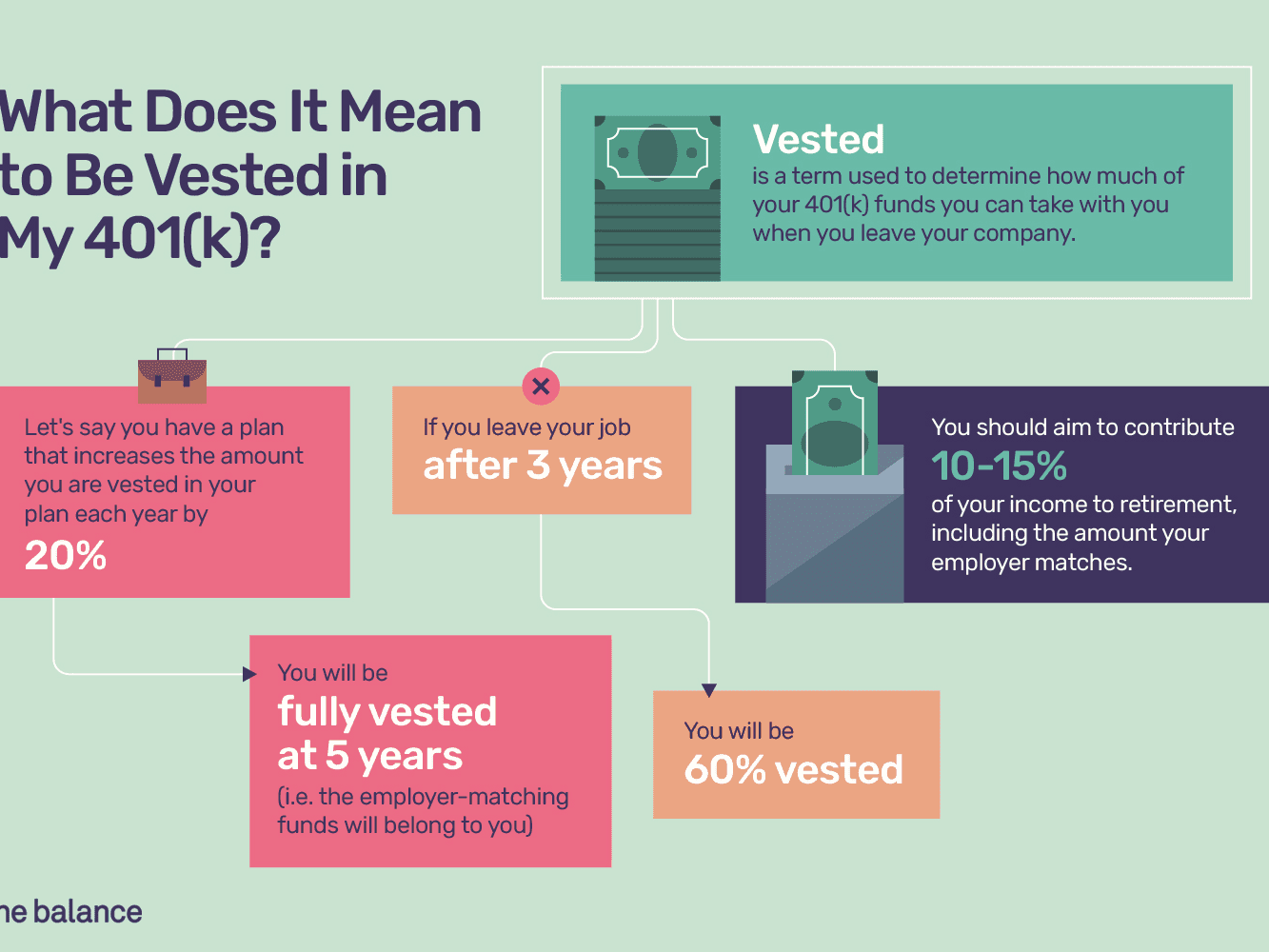

Vested Versus Unvested Amounts

When you find your 401 balance, you might notice that some of the account is vested and some of it isn’t. Amounts that are vested are yours no matter what if you leave the company, you get to take that money with you, but you would lose any unvested amounts. You’re always 100 percent vested in your contributions. However, your employer may make contributions to your 401 plan on your behalf but might put vesting requirements on the money. According to federal law, contributions must vest at least as fast as either the cliff vesting or graded vesting schedules. With cliff vesting, you must be fully vested at the end of three years of service. With graded vesting, you must be 20 percent vested by the end of your second year of service, and must vest an additional 20 percent each year after that, making you fully vested by the end of your sixth year.

Also Check: Do I Need Ein For Solo 401k