You End Up Paying Taxes On Your Loan Repaymentstwice

Normally, contributing to your 401 comes with some great tax benefits. If you have a traditional 401, for example, your contributions are tax-deferredwhich means youll pay less in taxes now . A Roth 401 is the opposite: You pay taxes on the money you put in now so you can enjoy tax-free growth and withdrawals later.

Your 401 loan repayments, on the other hand, get no special tax treatment. In fact, youll be taxed not once, but twice on those payments. First, the loan repayments are made with after-tax dollars . And then youll pay taxes on that money again when you make withdrawals in retirement.

Whats worse than getting taxed by Uncle Sam? Getting taxed twice by Uncle Sam.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Choose The Fund Option You Want From Unbiased Investment Choices

Making the best possible investment choices for your plan is critical to its success. Whether your advisor is providinginvestment advisory services or you are considering hiring a third party for this support, ADP can accommodate yourplan needs. And as an independent record keeper, we have no investment bias or hidden agenda.

Recommended Reading: Can I Keep My 401k With My Old Employer

Check With Human Resources

Go to your Human Resources department to find out how much money you will get per paycheck if you stop contributing to your 401. Remember that 401 contributions are made before tax is taken from your paycheck. Because of this the amount of money you will get back in your paycheck will not be equal to what you were contributing.

How Does A 401 Loan Work

If you want to borrow money from your 401, youll need to apply for a 401 loan through your plan sponsor. Once your loan gets approved, youll sign a loan agreement that includes the following:

- The principal

- The term of the loan

- The interest rate and other fees

- Any other terms that may apply

If you have an employer-sponsored retirement planlike a 401, 403 or 457 planyou can usually borrow up to 50% of your account balance, but no more than $50,000.2

When you apply for a 401 loan, you can decide how long the loans term will be, but it cant be more than five yearsthats the longest repayment period the government allows. But do you really want to be in debt for five years?

Most plans will let you set up automatic repayments through payroll deductions, which means youll be seeing less money in your paycheck until the loan is paid off. Those paymentswhich include the principal and the interestwill keep going right into your 401 until the principal is paid off. And keep in mind that some companies wont allow you to put any additional money into your 401 while you are repaying the loan.

Ready for some bad news? Your loan repayments will be taxed not once, but twice. Unlike traditional 401 contributions, which are tax-deferred, you wont get a tax break for your loan repayments. Instead, that money gets taxed before it goes into your 401 and then youll pay taxes again when you take the money out in retirement.

Read Also: What Is The Difference Between 401k And 403b

What To Do When Your Retirement Plan Terminates

- Retirement Planning

- What to Do When Your Retirement Plan Terminates

If your employer is closing your retirement plan, you probably have more than a few questions. Dont worry – plan participants write us with questions about plan terminations all the time, so weve compiled answers to the most common ones below:

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Recommended Reading: Can A Sole Proprietor Have A 401k

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

What Is The Difference Between A 401 Loan And A 401 Withdrawal

The biggest difference between a 401 loan and a 401 withdrawal comes down to taxes.

When you withdraw money from your 401, that money will be treated like ordinary income. That means youll have to pay taxes on that money now . Youre not obligated to put the money you took out back into your 401its yours to do whatever you want with it.

Note: Sometimes, you could qualify for a hardship withdrawal, which would allow you to take money out of your 401 without an early withdrawal penalty under special circumstances .

With a 401 loan, youre just borrowing the money from your own account. Like any other loan, you haveto pay that money backin this case, back into your 401over a certain period of time, plus interest too). Since the money you borrow isnt treated like ordinary income, you wont owe any taxes or have to pay an early withdrawal penalty.

But, like we mentioned earlier, that all changes if you leave your job for whatever reason. If you dont repay the balance on your 401 loan by the time your tax return is due, your loan will be in default and Uncle Sam will be sending you a tax bill.

Read Also: How To Borrow From 401k For Home Purchase

Dmitriy Fomichenko President Sense Financial

If you want to roll over the money into another retirement plan, say an IRA for example, you have to check with your plan administrator about “in-service distribution”. If your plan allows that, you can roll the money out. If it doesn’t, you cannot do a rollover until you stop working for the employer. Withdrawing from a 401k early before retirement age, whether if you are still with the same employer or not, is possible but a penalty tax will apply on top of your regular income tax rates.

After Receiving Notification Your Employees Options Include:

- Transferring the money to a new employers plan

- Moving to an IRA with the current plan provider

- Take a cash-out distribution

- Leave the money in the current plan

- Rollover to existing or new individual retirement account

for a sample employee communication that details the multiple options employees have with their retirement plans.

Special care should also be paid to plans in which loans are allowed. Under new guidance from the CARES Act signed on March 27th, 2020 and the Bi-Partisan Budget Act signed in early 2018, participants may have increased flexibility on how they can avoid a loan default due to the sudden termination of a retirement plan. Participants with outstanding loans at the time of termination should seek individual advice specific to their own circumstances on how best to avoid a loan default.

Employees should always consider the long-term importance of saving for retirement as well as the short-term tax implications of distributing their funds as opposed to rolling them into a new employers plan or an IRA.

Keep in mind a plan cannot be formally terminated until the last of the assets have been distributed. Consider having a financial advisor available to help your employees make this important decision or take the necessary steps to evaluate and select an IRA provider to force the assets out of the plan with proper notice.

Recommended Reading: When You Leave A Job Do You Get Your 401k

You Put Your Retirement Savings At Risk

There are many reasons folks end up taking out a 401 loan, from covering the cost of an emergency to wiping out credit card debt. According to the Ramsey Solutions 2021 Q1 State of Personal Finance study, more than half of those who borrowed money from a 401 in the past year said they did so to cover basic necessities.

But heres the deal: Your 401 is for retirement, not for emergencies, getting rid of debt or going on vacation. When you turn to your 401 for help now, youre putting your retirement future at risk.

Borrowing as little as $10,000 from your 401 when youre 25 years old, for example, could set your retirement back several years and cost you hundreds of thousands of dollars in your nest egg down the linemaybe more.

In fact, a whopping 7 out of 10 people who borrowed money from their account in the past year because of COVID-19 said they regretted that decision.4On top of that, more than half of Americans now feel they are behind on their retirement goals.5

How To Cancel Prudential Retirement Subscription On A Mac Computer

To cancel Prudential Retirement subscription on your Mac, do the following:

Note: Always make sure to use the exact username and ID you used to set up the subscription to manage that subscription when necessary. This is sometimes different from the Apple ID or Android brand ID you have set up.

If you don’t remember your password however, contact the App for help/to reset password.

Recommended Reading: How To Open A Solo 401k

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Company Benefit Plans Are Sheltering In Place

With so many companies forced to close due to shelter-in-place orders and the resulting economic shock, employers are doing whatever they can to reduce expenses and stay in business. For many, that means cutting benefits.

Due to current events, employers want to maintain health care at all costs, said Hansen. Other items employers could cut would be things like the 401 plan or fringe benefits.

For some employers, terminating a 401 plan is easier than simply suspending matching contributions. According to Hansen, thats because 401 plans are regulated by complex tax rules. Most plans have to do some sort of nondiscrimination testing to make sure that theyre not favoring highly paid over lower-paid employees, he said.

You May Like: How Do I Take Money Out Of My Fidelity 401k

What Is A 401 Loan

A 401 loan is an arrangement that allows you to borrow money from your employer-sponsored retirement account with the understanding that youll need to return that money into your 401 over timeplus interest.

Some folks might consider taking out a 401 loan as an alternative to applying for a personal loan through a bank or other lender or from taking out an early withdrawal .

Since youre technically borrowing your own money, most 401 loans get approved pretty easily. There are no banks or lenders involved, so nobody is going to check your credit score or credit history before allowing you to borrow from your 401. Youre the one taking on all the risk .

What Mistakes Do Plan Sponsors Make When Terminating 401k Plans

Typical errors that plan sponsors make:

- Do not file a final Form 5500 series return

- Do not actually terminate their plan

- Mistakenly indicate the plan is terminated when it is frozen

- Mistakenly use the same plan number from a previous or different plan

- Distribute all plan assets but dont mark the final Form 5500 series to show it is the final return

- Distribute all plan assets but do not indicate zero assets at the end of the plan year

- Do not distribute all plan assets as soon as administratively feasible

Why did plan sponsors make these errors?

- Length of time required to find missing participants

- Difficulty in distributing certain types of plan assets

- Not aware all plan assets must be distributed

- Not aware of the difference between a frozen and terminated plan

- Not aware there were still assets in the trust

Recommended Reading: Can You Get A Loan Using Your 401k As Collateral

Notify Your Document Provider

Once you withdraw funds from your plan, notify your document provider that you no longer need the Solo 401k. Your document provider will then mark your plan inactive. Most document providers will need you to sign a cancellation form. Once this is done, youre ready for your final step to terminate the Solo 401k.

File A Final Form 5500

The employer must file a final Form 5500 series report for the final plan year. Depending on the time necessary to complete all distributions, the final plan year may not be the same plan year that contains the plans termination date. The final Form 5500 must be filed by the last day of the seventh month following the close of the final plan year. The end date for the final plan year is the actual liquidation date.

Employers are not required to file Form 5500 for owner-only retirement plans if the plan assets are $250,000 or less at the end of the year. But even if the assets are less than this amount, Form 5500-EZ is required to be filed for the final year when the final distribution occurs.

Also Check: How To Look Up An Old 401k Account

Are You Prepared For Retirement

Find out with My Interactive Retirement PlannerSM

This material is not a recommendation to buy, sell, hold, or roll over any asset, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of any specific person. Investors should discuss their specific situation with their financial professional.

Life and annuity products are issued by Nationwide Life Insurance Company or Nationwide Life and Annuity Insurance Company, Columbus, Ohio. The general distributor for variable products is Nationwide Investment Services Corporation , member FINRA, Columbus, Ohio. The Nationwide Retirement Institute is a division of NISC. Nationwide Funds are distributed by Nationwide Fund Distributors, LLC, Member FINRA, Columbus, OH. Nationwide Life Insurance Company, Nationwide Life and Annuity Company, Nationwide Investment Services Corporation and Nationwide Fund Distributors are separate but affiliated companies.

The Nationwide Group Retirement Series includes unregistered group fixed and variable annuities issued by Nationwide Life Insurance Company. It also includes trust programs and trust services offered by Nationwide Trust Company, FSB.

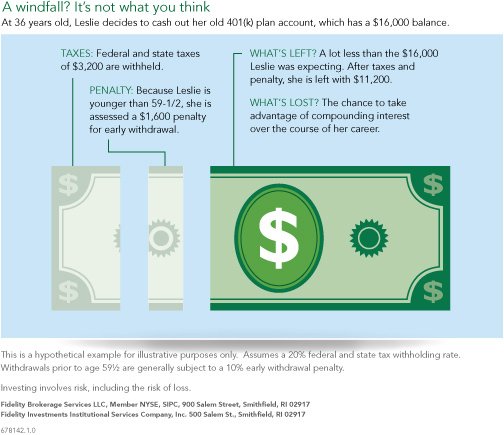

Understanding Early Withdrawal From A 401

The method and process of withdrawing money from your 401 will depend on your employer and the type of withdrawal you choose. Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It’s really a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available. If it is, then you should check the fine print of your plan to determine the type of withdrawals that are allowed or available.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds. For a $10,000 withdrawal, once all taxes and penalties are paid, you will only receive approximately $6,300. There are some non-penalty options to consider, however.

Before deciding upon taking an early withdrawal from your 401, find out if your plan allows you to take a loan against it, as this allows you to eventually replace the funds. You may also want to consider alternative options for securing financing that could hurt you less in the long run, such as a small personal loan.

Read Also: How Does A 401k Work When You Change Jobs