Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

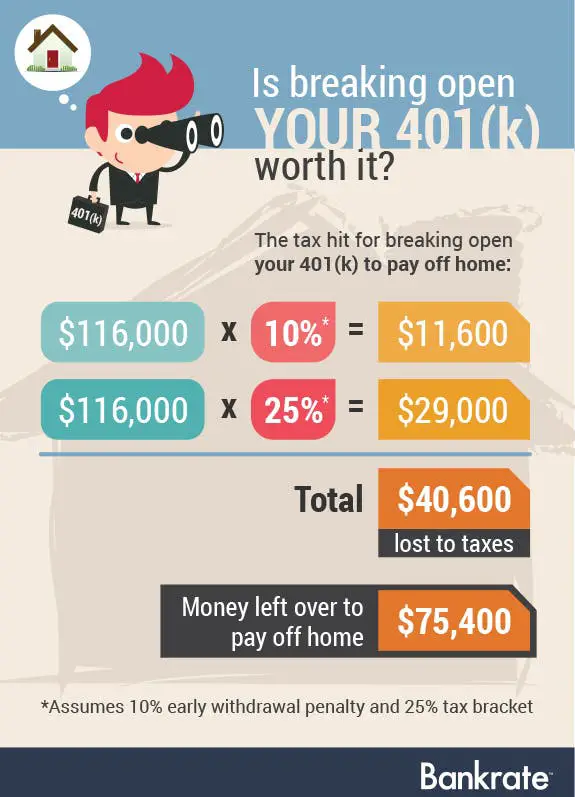

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Read Also: How To Find Out If You Have An Old 401k

Qualified Withdrawals Are Tax

According to the IRS, “qualified withdrawals” from a Roth 401 can be made tax-free. A withdrawal is considered qualified if:

- It occurs at least five years after the tax year in which you first made a Roth 401 contribution

- It’s made after you turn 59 1/2

A qualified withdrawal is not included in your gross income. You also won’t owe any penalties on it.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: Should I Rollover My 401k From A Previous Employer

Will My Credit Score Be Impacted If I Withdraw Early

Withdrawing funds from your 401 early won’t impact your credit directly since the credit bureaus don’t track activity on your retirement accounts.

Making an early withdrawal can indirectly affect your credit when you use the money to pay down outstanding debt. It may seem like an easy way to ease a debt burden or boost your credit, but in most cases, this shouldn’t be the only reason to withdraw funds from your 401. Such a move should only be considered in a financial emergency when you have exhausted all other options.

There’s No Early Withdrawal Penalty

Normally, you pay a 10% early withdrawal penalty if you withdraw funds from your 401 before age 59 1/2. But the CARES Act changed the rules for this year to help people out during the pandemic. For 2020 only, you can withdraw funds from your 401 at any age and you won’t pay the early withdrawal penalty.

You will still owe taxes on your withdrawals, unless the money comes from a Roth 401. However, the rules surrounding taxes on retirement withdrawals are also different this year. More on that below.

You May Like: How To Make 401k Grow Faster

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Understanding The Rules For 401 Withdrawal After 59 1/2

-

Waives the 10% early withdrawal penalty

-

Allows retirees to forgo taking Required Minimum Distributions from a 401 in 2020.

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½. Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

Also Check: Can You Pull From 401k To Buy A House

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Better Options For Emergency Cash Than An Early 401 Withdrawal

We know it can be a struggle when suddenly you need emergency cash for medical expenses, student loans, or crushing consumer debt. The extreme impact of coronavirus on public health and the economy has only compounded some of the more routine challenges of consumer cash flow.

We get it. The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, an advice and planning manager for Principal® Advised Services who helps clients on household money matters.

In short, he says, Youre harming your ability to reach retirement. More on that in a minute. First, lets cover your alternatives.

Read Also: How To Withdraw Funds From 401k

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

Recommended Reading: How To Find Out If You Have Unclaimed 401k Money

It Doesnt Matter Why Your Employment Ended

It doesnt matter whether you were fired, quit or were laid off. As long as you are no longer employed by the company maintaining the plan, and your employment was terminated during or after the year you turned 55, you will qualify for penalty-free early withdrawals from that 401.

Additionally, you dont even need to be retired to avoid paying taxes or penalties. If you have a 401 with Company ABC and quit at age 57, youll be able to access those savings without penaltyeven if you immediately take a job with Company XYZ.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Recommended Reading: What Is 401k In Usa

How Covid Retirement Plan Withdrawals Affect Your Taxes

Though you dont have to pay the 10% penalty on these withdrawals, youll still owe taxes on the money you withdraw. To make things a bit easier, though, the CARES Act allows you to spread the income over three different tax years.

For example, if you borrowed $30,000, you can apply $10,000 to your 2020 taxable income, $10,000 in 2021 and the last $10,000 in 2022. You must take at least one-third of the money in each year, though. You can also opt to take more in any year, including up to all of the money if you so choose.

If, in a later year, youve made back the money you withdrew, that is allowed. Youll have to file an amended return for any years with withdrawal money to get a refund. Again, the same rules apply for IRAs and 401s.

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Read Also: Can I Use My 401k To Buy Stocks

What Are Alternatives

Because withdrawing or borrowing from your 401 has drawbacks, it’s a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it’s a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan3

- Withdrawing from a Roth IRAthese withdrawals are usually tax- and penalty-free

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: How Much Can You Contribute To 401k

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

Don’t Miss: Where Can I Get A 401k Plan

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.