Contrasting Types Of Retirement Plans

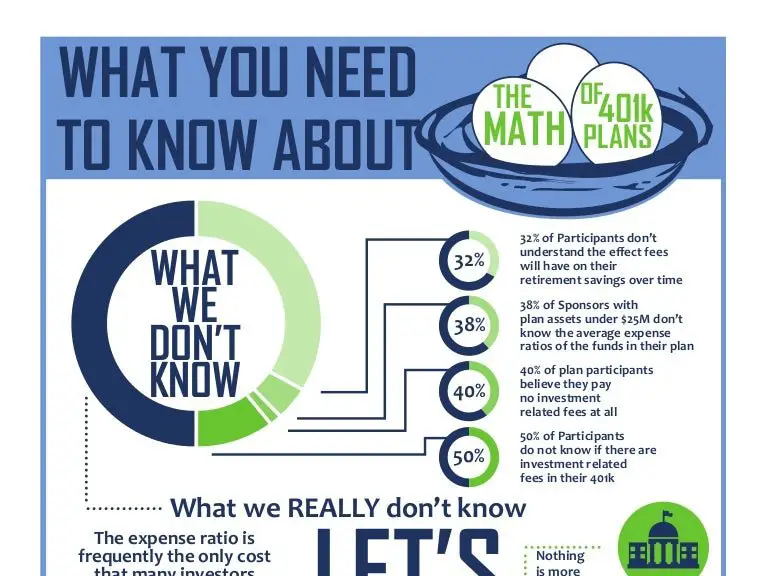

Advocates of Defined contribution plan point out that each employee has the ability to tailor the investment portfolio to his or her individual needs and financial situation, including the choice of how much to contribute, if anything at all. However, others state that these apparent advantages could also hinder some workers who might not possess the financial savvy to choose the correct investment vehicles or have the discipline to voluntarily contribute money to retirement accounts.

What Is A 401 And How Do They Work

A 401 is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck, you can invest that money in the stock market, and you earn some tax perks for participating.

That’s the basic definition of a 401. The more interesting angle is what a 401 can do for you. The 401 is a powerful resource for achieving financial independence, especially when you start using it early in your career. Said another way, if you like money and wish to have more of it in the future, you can use a 401 to make that happen.

Read on for a closer look at how the 401 works, when you can withdraw funds from a 401, and what happens to your 401 if you change jobs.

Get Help From A Financial Advisor

Trying to decide what kind of 401 plan is right for your business is a massive decision. And if youre still on the fence about whether or not a safe harbor 401 is right for your business, you dont have to make that decision alone!

Our SmartVestor program can connect you with a financial advisor who is ready to answer your questions and walk you through all of your options. That way, you can make the best decision for your business.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: How Much Can I Withdraw From My 401k

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

Medical expenses that exceed 10% of your adjusted gross income

Permanent disability

If you leave your employer at age 55 or older

A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation.

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

Options When Leaving An Employer

Upon leaving their employer, GRSP participants have several options.

-

They can convert or rollover their GRSP balance to an individual RRSP account. If they go to work for a new employer who offers a GRSP there is the possibility that this money can become part of that plan as well.

-

If they withdraw the funds, the money will be subject to taxes.

-

GRSP funds must be converted out of the plan by age 71. You can enroll in a Registered Retirement Income Fund or RRIF or into some other similar type of tax sheltered account.

Also Check: How To Put 401k Into Ira

Is It Worth Having A 401 Plan

Generally speaking, 401 plans are a great way for employees to save for retirement. They make it easy to save because the money is automatically deducted. They have tax advantages for the saver. And, some employers match the contributions made by the employees.

All else being equal, employees have more to gain from participating in a 401 plan if their employer offers a contribution match.

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a section of the U.S. Internal Revenue Code.

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

Recommended Reading: Can You Use Your 401k To Pay Off Debt

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2020 and 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above.

If the employee also benefits from matching contributions from their employer, then the combined contribution from both the employee and the employer is capped at the lesser of $58,000 or 100% of the employees compensation for the year.

What Is A Roth Ira

A Roth IRA is a type of individual retirement account similar to traditional IRAs in many ways, but with some significant differences. One of the main differences is how the tax breaks are different: with a traditional IRA, the money you put in isn’t taxed with a Roth IRA the money you take out isn’t taxed. Roth IRA’s also have no requirements on when the money must be taken t, so they can be a good tool to pass along wealth to your beneficiaries if you find you don’t need the money in retirement.

Also Check: Can I Open A 401k For Myself

What Is A 401 Plan And How Does It Work

A 401 Plan is a retirement savings vehicle that allows employees to have a portion of each paycheck directly paid into a long-term investment account. The employer may contribute some money as well.

There are immediate tax advantages for the employee if the account is a traditional 401, and tax advantages after retiring if it is a Roth 401.

In either case, the money earned in the account will not be taxed until it is withdrawn during retirement if it is a traditional 401. If it is a Roth 401, no taxes will be due when the money is withdrawn.

Planning For Your Retirement

Long before you want to retire, you should look at building up cash reserves and develop projections based on various ages to start Social Security. Then, figure out how much you’ll need to spend in each year of your retirement. Depending on how you plan and prepare, you could spend between 10 and 40 years in retirement. Some expenditures you should take into account are:

- Housing and utilities

- Spending on grandchildren

- Leaving money to family

As you are looking for ways to fund your retirement, consider letting your money work for you by investing it. Investing uses the power of compounding returns to make more money. Try to build enough to cover your retirement expenses and goals. Individual retirement accounts , 401 plans, mutual funds, and many other investment instruments exist that can help fund your retirement.

Retirement accounts, mutual funds, and the various investment types all have different return and risk rates. A financial advisor can help you decide what to use to fund your retirement if you’re unsure.

For example, if you start contributing $500 per month into a Roth IRA with a 6% rate of return when you’re 25 years old and don’t miss a single contribution, you’ll have about $1.1 million in the account at age 67. You’ll be able to make withdraws of close to $4,000 per month tax-free, plus receive your FRA Social Security benefit.

Read Also: Should I Rollover My 401k From A Previous Employer

Can I Retire Early

While it’s nice to think that you can retire early, that isn’t always possible. Sometimes life throws things at you that can throw the best plan off track. This is why it’s essential to develop your retirement plan with realistic goals and lots of flexibility so that you don’t miss a contribution payment.

The decision to retire early can be a smart move if you’ve planned and can afford it. Knowing how much you’ll need, when you can receive your benefits, and saving for retirement can help you reach your goal of retiring early.

Need Help With Your Expat 401 Taxes Trust H& r Block

If you have other retirement accounts such as a traditional IRA, Roth IRA, or a foreign pension plan, an expat tax expert from H& R Block Expat Tax Services can help you understand how these accounts might be taxed on your U.S. tax return. Additionally, they can help make recommendations for what you can do in the future to reduce your U.S. tax liability.

Have more questions about your 401? Ready to file? No matter where in the world you are, weve got a tax solution for you. Get started with our made-for-expats online expat tax services today!

Read Also: Can I Cancel My 401k And Cash Out

How Does A 401k Plan Work

A 401k is a qualified retirement plan that allows eligible employees of a company to save and invest for their own retirement on a tax deferred basis. Only an employer is allowed to sponsor a 401k for their employees. You decide how much money you want deducted from your paycheck and deposited to the plan based on limits imposed by plan provisions and IRS rules. Your employer may also choose to make contributions to the plan, but this is optional.

It is the employers responsibility to run the plan in accordance with law, rules and regulations, and provisions of the plan itself. This includes deciding who is eligible for the plan, how much and when they can contribute, how much the employer will contribute to the plan, what investment options you will have, how often you can reallocate your investment assets, hiring the vendors necessary to run the plan, and what features the plan will have .

Here are a couple of things to remember about 401k plans.

Don’t put off participating in your 401k, even if you think you can’t afford to. Time is your best guarantee that you will make your retirement goals, so the sooner you start contributing the better off you are going to be in retirement. Even just one or two percent will make a big difference.

A 401k is a retirement plan, not a savings account. Money placed in a 401k is not easy to access in an emergency. Some plans allow loans and hardship withdrawals, but the rules governing them are restrictive.

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $6,000.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, Pa. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

You May Like: How To Get Money Out Of 401k Without Penalty

Employer Matching For 401 Plans

Additionally, many employers offer a company match, which means that your company will match your contribution, up to a certain percentage or sometimes up to a certain dollar amount.

Heres a simple example of how a company may match by percentage:

Lets say your employer will match whatever percentage you put towards your 401. So you decide to contribute 5% of your salary to your 401k, meaning your employer will match that 5%. If you make $60,000 a year, thats 5% before taxes, which is $3,000. Your employer will contribute that same amount. Thats why its important to contribute at least enough to take advantage of your companys match in full. Free money is always good, right?

However, keep in mind that 401 plans also come with restrictions. In many cases, you cant tap into your companys contributions immediately after youre hired. You must wait a certain amount of time a period called vesting. The IRS also limits the amount of money you can put into your 401 savings, depending on your age and salary. There are also rules on when you can withdraw your money, and you can face penalties for pulling out funds before you reach retirement age.

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Read Also: Can I Move Money From 401k To Ira

How Does A Safe Harbor 401 Work

Weve mentioned these nondiscrimination tests a couple times already, but what exactly is the deal here?

Basically, Uncle Sam wants to make sure that 401s are set up in a way that doesnt favor highly compensated employees over everyone else. These tests compare both plan participation and contributions of rank-and-file employees to owners and managers to make sure the plans are fairly benefitting both groups.

According to the IRS, there are three general nondiscrimination rules traditional 401 plans must follow:

- Highly compensated employees cant contribute more than 2% of the average of all other workers who are eligible to participate in the companys retirement plan.1

- HCEs also cant receive more than 2% in employer contributions than what rank-and-file employees are receiving on average as a group.2

- The value of the assets in key employees retirement accounts cannot be more than 60% of all the assets held in an entire employers 401 plan.3

To show the IRS that a companys 401 plan meets those requirements, the plan has to go through a series of annual nondiscrimination tests that are used to figure out whether or not the plan is fairly balanced.

Larger businesses might have the team and resources in place to keep up with all those requirements, but it can get very time-consuming and expensive for smaller businesses to keep up with. And lets be real, nobody wants to go through testing if they dont have to!

What Role Do Mutual Funds Play In 401 Plan Investing

About 66 percent of 401 plan assets were held in mutual funds as of the end of June 2021. The remaining 401 plan assets include company stock , individual stocks and bonds, guaranteed investment contracts , bank collective trusts, life insurance separate accounts, and other pooled investment products.

Recommended Reading: How To Transfer 401k Without Penalty

Scenario : Monthly Pension

If you receive distributions as a monthly pension, you should check about the status of a tax treaty between the US and your home country. In most cases, you will only have to pay taxes in the country where you are a resident. If you have moved back to India, for instance, you only have to pay taxes in India when you receive your monthly 401 pension. However, you may still be required to file US tax returns. If there is no treaty between the US and your home country, the brokerage has to withhold 30% from the monthly distributions.

Since taxation rules and requirements differ from one country to another, it would be best to consult a tax advisor like MYRA prior to your move to help you create a strategy.

Related Article: When Is It Ok To Withdraw Money Early From Your 401?

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

Recommended Reading: How Do I Find Out Where My Old 401k Is

What To Do With Your 401 When Moving Abroad

What should you do with your 401 when moving abroad? When it comes to taxes when retiring abroad, theres never one solid answer. Each expat 401 transfer situation is different and what you should do depends on where youre living, your current finances, plans for retirement, and where you are along your retirement journey.

For example, if youve moved abroad for good and are ready to give up your U.S. citizenship, it may be in your best interest to transfer your plan to your forever country. If youve got a couple decades before retirement and you know you want to remain a U.S. citizen for life, it may make much more sense to just keep your U.S. 401.