Does Vanguard Administer 401k Plans

Vanguard does administer 401k plans. Vanguard can handle everything from helping a small start-up company get a plan up and running to working with a mega plan. For small to mid-size companies, Vanguard uses the record expertise of Ascensus, a leading record keeper and administrator of retirement plans.

Where Will The Rollover Check Be Sent

Vanguard will accept a check sent directly from the plan or directly from you. Please make sure you/your provider follow the appropriate mailing guidelines to avoid any delays in the process.

If you’re already a Vanguard client and registered for online access, consider using Mobile Check Deposit offered through the Vanguard app.

Where Are All These Fees Coming From

All $260,000 in fees came from one source: expense ratios. Expense ratios are the cost for the administration of the investment fund. Investment funds are those options you select when you first setup your account, such as the Retirement 2050 fund. Each investment fund has an expense ratio thats charged annually as a percentage of the total amount in the fund. They are calculated with a simple equation:

Total investment amount * expense ratio = Annual fee

Lets say for instance I had $10,000 in my 401k and the expense ratio is .45%. That means each year I pay a $45 fee to the broker. That doesnt seem so bad, does it? But lets remember that a retirement account like a 401k is intended to grow over time. And because you cannot withdraw until age 59.5, its an account that most people have for decades. For all of these reasons, that seemingly small annual fee is likely to become a very large amount.

Lets take that same $10,000 401k and account for 10% average stock market growth over 30 years.

| Year |

| $15,863.09 |

| $174,494.02 |

Incredibly, that $10,000 401k is estimated to be worth $174,494 after 30 years assuming a stock market average 10% return rate. This is due to the power of compound interest, and it is the reason why everyone emphasizes saving for retirement asap. The sooner you start saving, the more time you have for your savings to multiply in value.

Don’t Miss: How To Transfer 401k From Charles Schwab To Fidelity

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

You May Like: Can I Contribute To Traditional Ira And 401k

Don’t Miss: How To Start My Own 401k

You May Have Accumulated

There are many factors to keep in mind when considering a 401 rollover, including where you’re at in your career, your current financial status, and your tax and investment preferences. You should consider all of your options before making a decision, and can use the information provided here to help. If you decide a rollover is right for you, contact a Schwab Rollover Consultant at .

Is There A Service Out There Than Can Handle This Process For Me

Yes thats where Capitalize comes in!

Weve made it our mission to make this process easier for everyone. If you choose to do a 401-to-IRA rollover, we can handle the entire process for you. Most of the process can be done online and our rollover experts will guide you through any of the manual parts.

Its 100% free to you .

Recommended Reading: How To Open A Solo 401k

What Happens If A Check From My Former Employer Plan Is Made To Me

The distribution will be subject to mandatory tax withholding of 20%, even if you intend to roll it over later. This withholding can be credited to your income tax liability when you file your federal tax return if you roll over the full amount of any eligible distribution you receive within 60 days.

If you are not able to make up for the 20% withheld, the IRS will consider the 20% a taxable distribution it will be subject to regular income tax and, if you are under age 59½, an additional 10% early-withdrawal penalty.

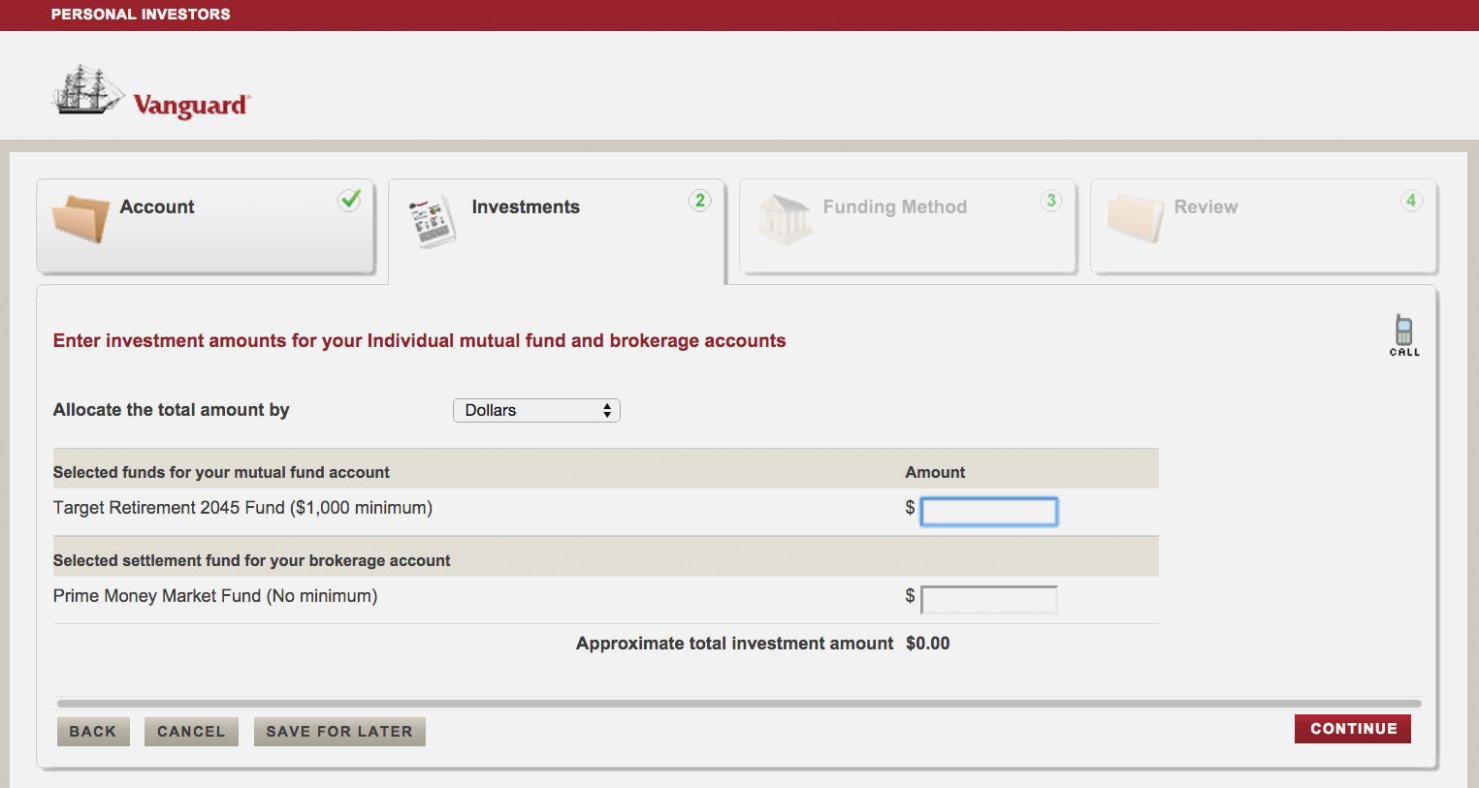

Invest Your Newly Deposited Funds

You’ll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Don’t Miss: What Is The 401k Retirement Plan

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Who Should Do A 401 Rollover

We should really start with why you shouldnt do a 401 rollover, since the list is shorter.

Basically, if youre happy with the old employer plan, you should consider keeping your money there. You can even get help managing the plan through a service called blooom. Its a robo-advisor designed specifically for employer-sponsored retirement plans. It can be added to virtually any employer plan, as it does not require administration approval. You pay a small fee to Blooom and it manages your retirement plan, including moving your money into lower-cost fund options. Its the perfect service for anyone who isnt entirely comfortable managing their own retirement plan.

However, if youre not satisfied with your current plan, either because options are limited or fees are too high, a rollover has to be considered.

Many employers will allow you to roll your old 401 plan into their plan. Check with your new employer and see if this is possible. If upon evaluation you feel that the new plan is better than the old one, you can do the rollover into the new plan.

Read Also: How To Roll Your 401k From Previous Employer

Choose Which Type Of Ira Account To Open

A 401 rollover to an IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you won’t incur taxes if you roll to a Roth IRA.

Determine The Type Of Rollover You Want

Determining the type of rollover youll use to transfer your funds is probably the most important step when determining how to roll over a 401.

In addition to setting the procedures you need to follow, the type of rollover you choose can lead to major financial consequences.

If at all possible, avoid what are known as 60-day or indirect rollovers.

But Im getting ahead of myself.

The IRS defines three types of rollovers:

All three options probably involve communicating with the administrator of your previous employers 401 plan and the person who handles your new IRA or 401. And of course, youll have to fill out some paperwork.

Lets take a closer look at each of the three rollover types.

Also Check: What Is A Pension Vs 401k

You May Be Charged Lower Fees

In 2016, a comprehensive study of annual fees by Employee Fiduciary found that the average 401 participant paid 2.2% of their balance as administrative and fund fees. While some plans had combined fund and administrative fees as low as 0.2%, others charged as much as 5%.

Check with your old 401 provider to see what fees you may owe them annually. By comparing fees, you can figure out if you would save money with an IRA rollover.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

Take Stock Of Unpaid Loans From Your 401

Heres another reason why it doesnt always make sense to take a loan from your 401. If your plan allows you to take a loan, youll generally have up to five years to pay the loan back in full. Participants have until tax day of the following year to repay outstanding loans on their 401. For example, if you are terminated in April 2020, you have until April 15, 2021 to repay a loan.

In the event youre unable to pay back the remaining balance, it becomes an early distribution, triggering income taxes and, if under age 59 1/2, a 10% penalty from the IRS. Some states may charge additional income taxes and penalties. And you cant roll over unpaid loans to an IRA or 401, effectively reducing your nest egg.

This is why when doing a cost-benefit analysis of accepting a new job offer, make sure to include the cost of losing a non-vested portion and paying income taxes on early distributions of your nest egg.

Recommended Reading: What’s The Maximum Contribution To A 401k

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Recommended Reading: How Do You Max Out Your 401k

So I Had To Make A Decision About What To Do With My Original 401

I had a few choices:

1) Leave it: I had enough money in the account to qualify for leaving it alone.

2) Roll my employers contribution into my new 401 and roll the rest into a Roth IRA

3) Roll all of it into IRAs

But wait, why two IRAs? While I had been contributing post-tax money into my 401, my employer had not. The contribution from my former employer needed to be rolled into a pre-tax account. My new, traditional, 401 would qualify and so would a traditional IRA.

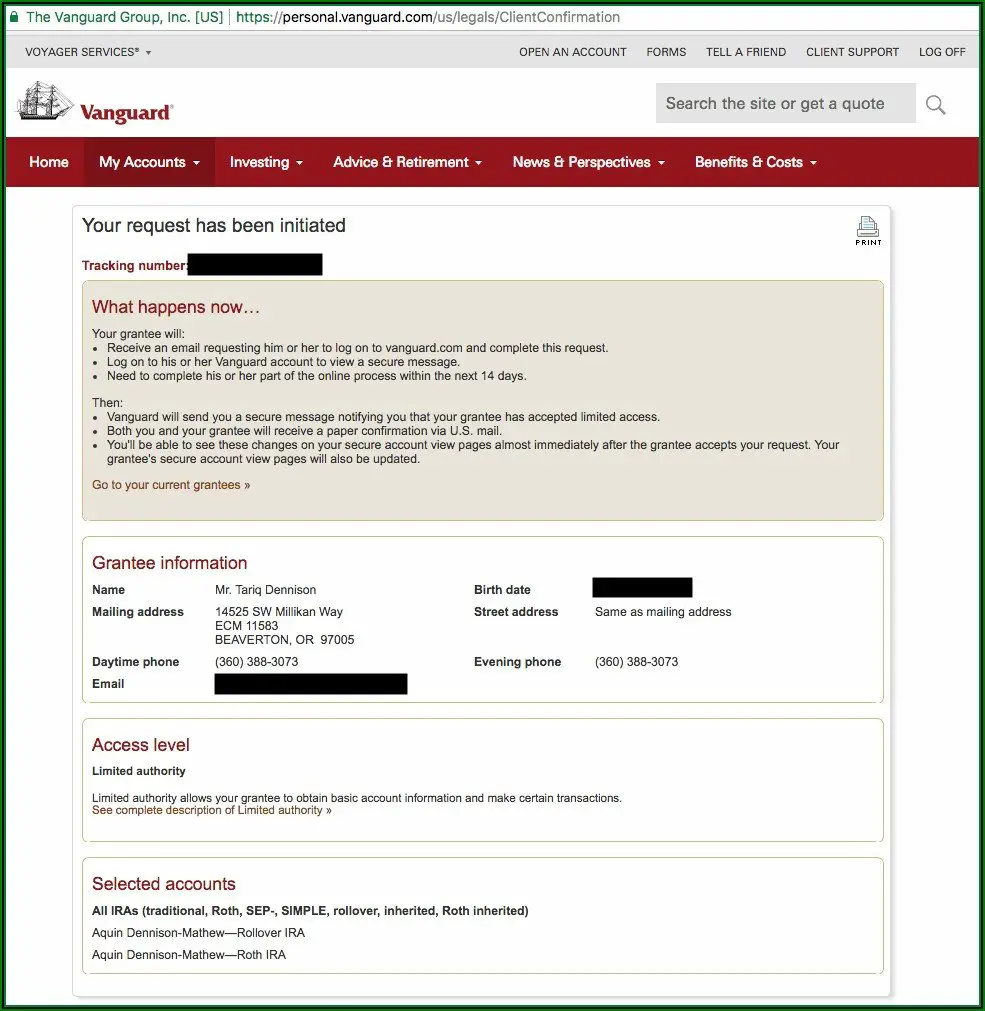

After slight deliberation, I felt it would be easiest to roll my old 401 into two Vanguard IRAs one Roth and one Traditional. I already had a traditional IRA set up with Vanguard, so it took me all of five minutes to get a Roth IRA prepped for my roll over.

Its incredibly simple to rollover a 401 into a Vanguard IRA. I started by doing what any millennial would do:

and was taken to this page:

I clicked on start your rollover online. After answering some simple questions they directed me how to split my 401 into the two IRAs. I found it easiest to just ask the kind folks in charge of my current 401 how much had been taxed and how much had not .

I then filled out paperwork from my former employer to start the rollover process.

How To Roll Over A 401 To Vanguard

If youre looking to roll over a 401 from a previous job into an IRA, Vanguard is a popular option. They offer several accounts, catering to those who want to pick their own investments and people who want their money managed for them. Weve laid out how you can roll over your 401 into Vanguard below!

Read Also: Can I Invest My 401k In Gold

How We Can Help

If you have a 401 and are exploring what options make the most sense for you, we invite you to meet with one of our financial advisors to discuss your situation. He or she will take the time to explain the options available to you, answer any questions you may have and together you can determine whats best for you.

You May Like: Can You Convert Your 401k To A Roth Ira

Do I Have A Deadline To Take Money Out Of My Old 401

When you leave a job, you arent forced to decide what to do with your 401 immediately.

The money already in your 401 is yours, so you can usually leave it as long as you want or roll it into an IRA at any time.

However, there are a few exceptions:

- If you contributed less than $5,000 to your 401, your employer is legally allowed to tell you to take the money and move it elsewhere .

- Contributions of $1,000 to $5,000 are subject to involuntary cash-outs. Thats when your former employer moves the full amount into an IRA.

- If you contributed less than $1,000, your former company can mail you a check for the full amount. You can deposit this amount into another retirement account within 60 days to avoid tax penalties.

Read Also: Can You Withdraw Your 401k If You Quit Your Job

Should I Roll Over My 401 To An Ira

Probably. IRAs have some advantages over 401 plans.

First, IRAs give you many more investment options. You can invest in specific stocks, bonds, mutual funds, ETFs and more. You can also link your IRA to a robo-advisor.

Second, there are IRA accounts that dont charge annual management fees. Many 401 plans charge annual fees. So theres a good chance youll be able to enjoy a cost savings.

Third, tracking down an old 401 can be a hassle that gets more stressful the more time it has been since you worked for the company. Tracking down email addresses or phone numbers from a former company when you no longer know anyone who works there can be a challenge. Plus, the more accounts you have in different places, the more there is for you to track and manage.

However, if your old 401 is inexpensive and offers great investment options, you may not want or need to move it.

Who Should Use Vanguard

Vanguard built a reputation as a platform that creates and offers low-fee mutual funds and exchange-traded funds. This makes it a good brokerage for clients who want to make basic investments and not think too much about them.

In addition, if you want low-cost funds, Vanguard has also grown to offer stocks and bonds. Though, trading these individual equities is much more limited.

Vanguard might also make sense for clients who want to open an IRA and manage it in a very hands-off manner.

At its core, the brokerage is designed for investors who want a simple and straightforward experience. Its accounts and tools are easy to use, and its website boasts a number of educational resources. This makes it extremely welcoming to beginners.

Also Check: Is 401k A Pension Plan