Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

How Much Should I Contribute To My 401

Whether you’re nearing retirement or far from it, you may find yourself wondering, “How much should I contribute to my 401?” The answer is it depends.

The percentage of income to save will depend on several factors. After taking these into consideration, you can make an informed decision about how much you should be saving for retirement.

If You Start At Age :

With a 4% rate of return: $1,641.62 per month

- Annual salary needed if you save 10% of your income: $196,995

- Annual salary needed if you save 15% of your income: $131,336

With a 6% rate of return: $1,052.85 per month

- Annual salary needed if you save 10% of your income: $126,341

- Annual salary needed if you save 15% of your income: $84,231

With an 8% rate of return: $653.91 per month

- Annual salary needed if you save 10% of your income: $78,470

- Annual salary needed if you save 15% of your income: $52,316

Also Check: Can Anyone Open A 401k

Meet Employers Match At Minimum

When employers match your 401 contribution, it serves as the companys pension plan. Some look at it like free money, but its actually a benefit you earn by working for your employer. At the very least, you should contribute the maximum amount to your 401 that your employer is willing to match. If, for example, your company matches the first 5 percent of the money you contribute, defer 5 percent of your salary to your retirement account. And, dont leave money on the table when you leave the job or retire.

What Percentage Should I Be Putting In My 401 Per Week

A 401 is an easy, accessible plan that many take advantage of to save for retirement. Your employer deducts your contributions from your pay and very often matches them up to a certain percentage. If the amount you contribute is small enough, you probably wont even miss the money. But if thats your only method of saving for retirement, you’ll need to consider whether you are adding enough money to your retirement savings account. According to Fidelity, the rule of thumb is that youll need about eight times your annual salary to ensure you dont run out of money in 25 years of retirement.

Don’t Miss: How To Figure Out Employer Match 401k

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

When Determining Your Contribution Percentage Consider Automatic Boosts

In 2019, the average 401 contribution was 7 percent of pay, according to Vanguard 401 data. Meanwhile, only 21 percent of 401 participants saved more than 10 percent of their salary for retirement.

If you cant afford to contribute that much initially, many employers will allow you to increase your contribution percentage automatically each year , which may be a more comfortable and gradual way to increase your contribution amount.

A 401 can be one of your best tools for creating a secure retirement. But you may want to also consider some retirement investing alternatives.

Recommended Reading: What Happens To My 401k When I Leave My Job

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

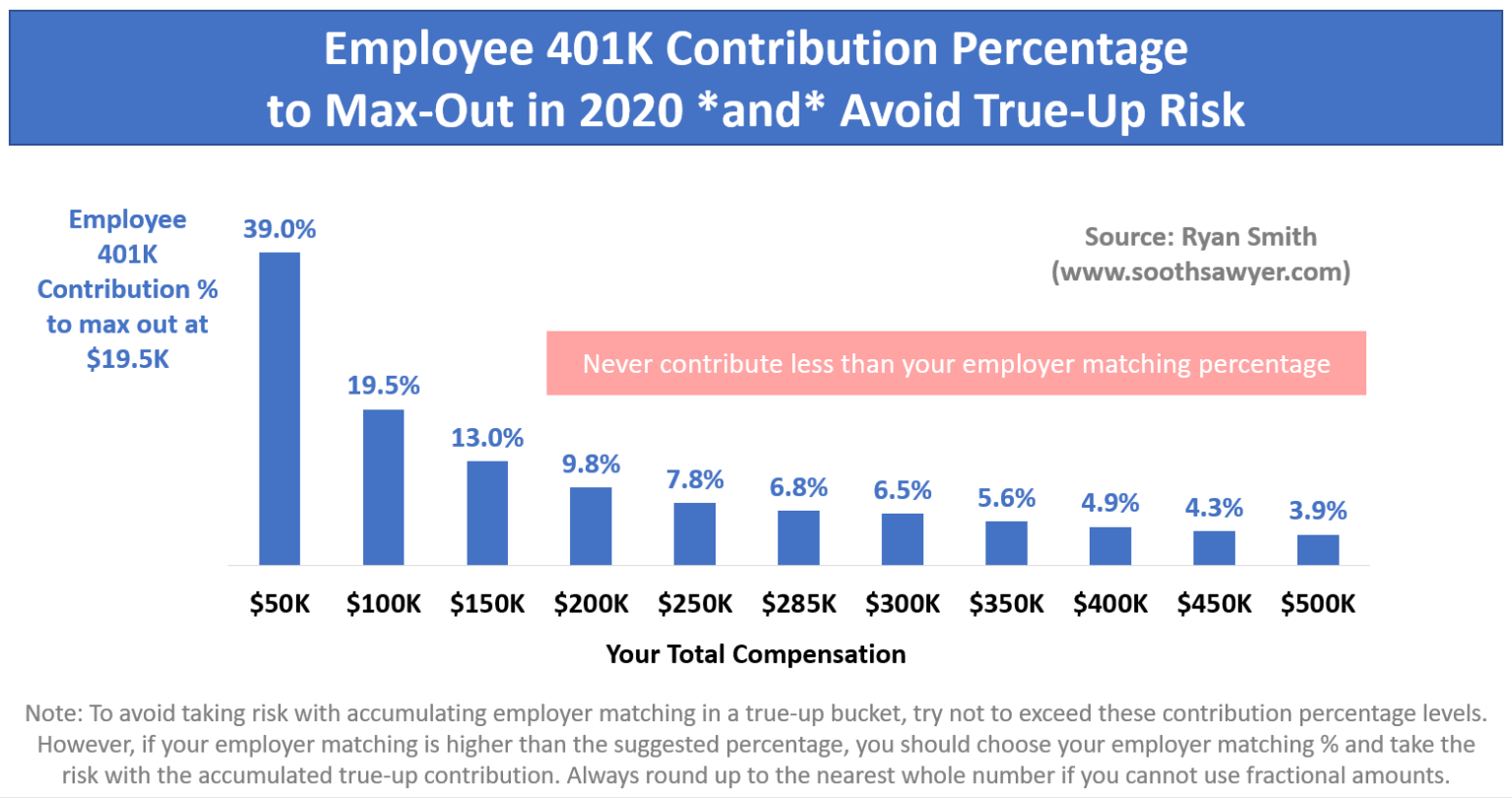

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

You May Like: What Is The Tax Rate On 401k Withdrawals

Figure Out The Ratio Youre The Most Comfortable Withbut Keep Upping Your Savings

There are lots of ratios out there recommending how to divide up your income. Some are as simple as spend 50%, save 50%. Although an admirable goal, most people will have a hard time with this. Especially in your twenties. I like 75/20/5.

- Spend 75%

- Save 20%

- Give 5%

But figure out the ratio youre comfortable with. You may want to defer charitable giving until youre debt-free. If you need most of your income to eat, it might be spend 90, save 10 or even 95/5. Thats okay. But you should reevaluate this as your financial situation changes and aim to get to at least 80/20.

In this example , if you earn $40,000, you would spend $30,000 or $2,500 a month, save $8,000 a year, or $667 a month, andif you wantset aside $2,000 a year for your chosen causes. Note that were working off of before-tax income, so that $2,500 a month for spending might be more like $2,000 after taxes).

Working backwards from this, lets say your employer will match up to half of a 6% contribution to your 401. So 6% of your pre-tax income is $3,000. Your employer throws in $1,500. You put that in, and you have $3,500 left in your savings budget.

If you dont have a fully funded emergency fund, this comes next. Open a simple online savings accounttheyre boring, but safeand load it with cash.

How Much Should I Put In My 401k Dave Ramsey

4.3/5you shouldanswer here

For 2018, you can invest up to $18,500 a year in your 401k. If you are over 50, you can contribute up to $6,000 more for a maximum of $24,500 per year. If you’re going to invest in a 401k, you want to get the most out of it. The default contribution is 3%, but you should be saving at least 10% for retirement.

Beside above, can my financial advisor manage my 401k? The simple answer is yes, even if it isn’t the traditional way of managing an account. You can meet with your advisor, go through you investment options in you 401k and ask for their input on how to allocate your 401k. Some advisors charge by the hour, some by the dollar amount of assets that they manage.

In respect to this, is just a 401k enough for retirement?

Since a 401 may not be sufficient for your retirement, it is important to build in other provisions, such as making separate, regular contributions to a traditional or Roth IRA. I always recommend, if possible, having a taxable account, Roth IRA, and IRA .

Can I retire with 500 000 in savings?

Typically, experts recommend withdrawing 4% of your retirement assets or less each year to ensure the money lasts. Assuming you have $500,000 in retirement, you could realistically withdraw $20,000 your first year of retirement.

Also Check: How Do Companies Match 401k

Could You Increase Your 401 Contribution

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road.

Cutting or reducing non-essentials could allow you to bump up the money youre putting into your 401 or 403. Like the gym membership you havent used in 6 months, for example. Or buying a certified used car instead of a new one. How about those merit increases or a bonus?

A little could go a long way in the future. Consider this example1 for a $35,000 annual income:

| Additional contribution | Reduction in bi-weekly take-home pay | Estimated additional monthly retirement income | Total employee contributions over 30 years |

|---|---|---|---|

| 5% | |||

| $18,068 |

Imagine if you could increase it to 10% of your pay?

If youre wondering how to save more toward retirement, read 5 smart money tips from super savers.

Tip: Dont forget inflations impact on retirement savings. You may feel like youre saving enough to maintain your current lifestyle. Even though your income may increase over the years, so will your cost of living . If you spend $50,000 a year to live in todays dollars, for example, how much more will it take 30 years from now?

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 for 2021 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Recommended Reading: Is It Good To Invest In 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

When Should You Change Your 401 Contribution Amount

Once you’ve decided how much to contribute to your 401, revisit the amount you contribute to the plan from time to time. It’s good to be aware of how your income changes and how the plan limits change.

Most importantly: Don’t stop contributing to the plan. And don’t use it for purposes other than retirement. Taking out 401 loans or making early withdrawals for other expenses robs you of investment gains that you’ll need later in life.

Read Also: How Does Retirement Work With 401k

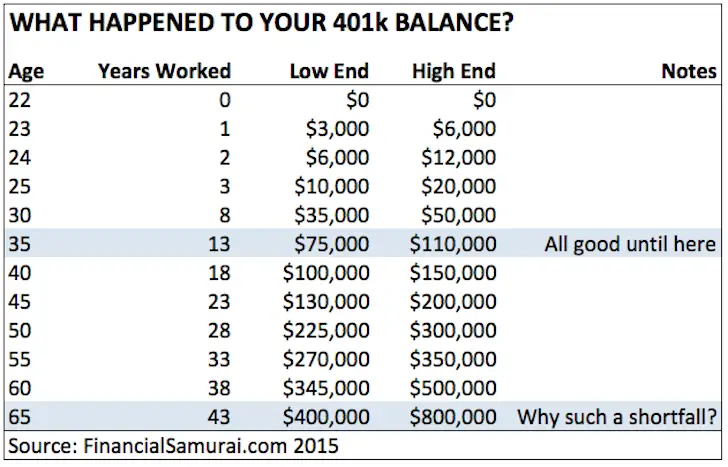

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Recommended Reading: How Much Can You Contribute To 401k

How Much Of Your Salary Should You Put Away For Retirement

getty

If youre like most employees, one of the most important decisions that will impact your financial future has already been made for you.

In 2006, Congress passed the Pension Protection Act. Despite the laws name, it represented a watershed event for retirement savers using a 401 plan. It allowed employers to change how employees enroll in their retirement plan.

In the past, you had to opt-in. Now, for the most part, companies will automatically enroll employees into the 401 plan. The employee still has the opportunity to opt-out, but most dont.

As a bonus, not only are you automatically enrolled, but you dont even have to decide where to invest. The plan will do that for you.

Heres the thing, though. That automatic savings rate is usually much lower than what you need. It may not even be enough to take full advantage of the company match.

So, what is the appropriate amount to save? What percentage of your salary should you defer into your retirement plan?

Theres a pretty strong consensus among retirement advisors regarding that number .

Broadly speaking, targeting a salary deferral percentage of at least 15% of gross income will allow a saver to be better positioned to meet their retirement goals once Social Security and working to a normal retirement age is factored in, says Rob Comfort, President of CUNA Brokerage Services Inc. in Madison, Wisconsin. The ideal percentage, however, will vary depending on many different factors.

Also Check: How To Search For Unclaimed 401k

The Effect Of A Few Percentage Points Over Time

When determining what to contribute, dont set your sights too low: A couple of percentage points can make a big difference.

Even if you start small, its important to start saving as early as you can and let time do the work of accumulating interest for you. Make a goal to increase your contribution each year and stick to it.

For example, this graph shows how much someone earning $60,000 annually would save after 30 years, investing at different levels. In this example, a couple of percentage points can be worth more than $150,000 in the end.

Potential value after 30 years

$ thousands

Example is for illustration purposes only. Assumes $60,000 salary, bi-weekly contributions, 3% annual pay increase, and a 7% rate of return. Investments will fluctuate and when redeemed, may be worth more or less than originally invested. Balances shown are pre-tax and are subject to income taxes upon distribution. Values do not account for fees and expenses.

This information is a general discussion of the relevant federal tax laws provided to promote ideas that may benefit a taxpayer. It is not intended for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties. Taxpayers should seek the advice of their own advisors regarding any tax and legal issues specific to their situation.

Like what youre reading?

Get articles like this delivered directly to your inbox.

Your 401 Savings And Your Desired Retirement Lifestyle

How you want to live out your golden years is another huge factor in what your 401 savings will need to look like. Thats because retirement has evolved over time to become a more active time of life. Its now viewed as a new beginning to our lives rather than a beginning of our end. That shift in mindset has driven the need for additional sources of retirement income.

The Employee Benefit Research Institute study on the Expenditure Patterns of Older Americans shows that as we age our expenses decline. Using age 65 as a benchmark, the study found that household expenses drop by 19% by age of 75 and 34% by age 85. The study also found that people over the age of 50 spend 40-45% of their budget on their home and home-related items. The bottom line is that by the time we retire our expenses are down between 20% and 40%. This is why expert opinions differ on how much of our pre-retirement income we need. Guidelines generally vary from 60% to 80%.

If you have a household income of $100,000 when you retire and you use the 80% income benchmark as your goal, you will need $80,000 a year to maintain your lifestyle. Assuming your 401 savings grow at 8%, you should expect to have up to $80,000 a year in interest income so you can avoid having to touch your principal as much as possible.

Don’t Miss: When Can I Rollover 401k To Ira