Why And When You Should Roll Over Your 401 To An Ira

Many companies offer the employees the option of investing in an employer-sponsored 401 plan. However, if you leave the said employer, you must decide what to do with your 401 plan fortunately, you have several options. You can determine if you want to cash it out, leave it in the account, transfer it to your new employers 401 account, or roll it over into an IRA. For most people, rolling over the 401 into an IRA is the best route to take. IRAs arent linked to employment and can be opened with any brokerage firm or financial institution. They also have a wider variety of investment selections with more hands-on management. To shed some more light on the subject, we will dive into four main reasons you should roll your 401 over to an IRA.

Why Roll Over

When you roll over a retirement plan distribution, you generally dont pay tax on it until you withdraw it from the new plan. By rolling over, youre saving for your future and your money continues to grow tax-deferred.

If you dont roll over your payment, it will be taxable and you may also be subject to additional tax unless youre eligible for one of the exceptions to the 10% additional tax on early distributions.

What Is An In

Unlike the traditional rollover, an in-service rollover is probably something youve never heard of and for good reason. First, not all company retirement plans allow for it, and second, even for those that do, the details can be confusing to employees. The bottom line: An in-service rollover allows an employee to be able to roll their 401k to an IRA while still employed with the company. The employee is also still able to contribute to the plan, even after the rollover is complete. Most plans allow this type of rollover once per year, but depending on the plan, you could potentially complete the rollover more often for different contribution types.

Also Check: What To Invest My 401k In

Using Retirement Savings To Fund An Annuity

Say youre interested in using your retirement funds to buy an annuity. Should you withdraw the funds from your retirement account, pay the taxes and then buy the annuity? Or can you just roll over the funds directly into the annuity, continuing to avoid taxes until you receive the income stream payments?

In most cases, the Internal Revenue Service allows qualified funds to be transferred into, or out of, qualified annuities.

Direct rollovers occur when qualified funds move from one trustee to another trustee without touching the owner. Under these circumstances, direct transfers are tax-free. Direct transfers are commonly done by mailing or wiring funds directly to the new plan provider, but on some occasions the old plan provider may mail the check directly to you, payable to the new plan provider. This still counts as a tax-free direct transfer.

Indirect rollovers, however, are more complicated and have significant tax consequences if not executed correctly. Indirect rollovers occur when the participant takes constructive receipt of the funds. In order to remain tax-free, the funds must be rolled over within 60 days of distribution. Otherwise, the distribution is income taxable and may also be subject to the penalty for withdrawing funds prior to age 59½.

The advice here is simple: whenever possible use direct transfers.

You May Be Charged Lower Fees

In 2016, a comprehensive study of annual fees by Employee Fiduciary found that the average 401 participant paid 2.2% of their balance as administrative and fund fees. While some plans had combined fund and administrative fees as low as 0.2%, others charged as much as 5%.

Check with your old 401 provider to see what fees you may owe them annually. By comparing fees, you can figure out if you would save money with an IRA rollover.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

Read Also: Should I Transfer 401k To New Employer

If I Roll Over From A 401 To An Ira Can I Then Roll Over From An Ira To A 401

Properly completed rollovers aren’t taxable, but must still be reported on your taxes.

The Internal Revenue Service allows you to move money between your different retirement accounts through rollovers. If you’ve moved money from your 401 plan to a traditional IRA, the IRS won’t stand in your way if you want to put it back in a 401. However, if you converted it from a 401 plan to a Roth IRA, you can’t roll it over into another 401 plan, even a Roth 401.

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Don’t Miss: Can You Transfer An Ira Into A 401k

How To Roll Over A Pension Into An Ira

Private sector employers that once offered workers traditional pensions, typically defined benefit plans, have been encouraging people to roll over their pensions into tax-advantaged plans like individual retirement accounts and 401s. If youre considering such a move, its important to understand your options, the pros and cons of each option and the tax-related rules about such a move. Before you do anything, though, consider working with a financial advisor who can help you make the best choices.

During the 1980s, 60% of private-sector companies offered their workers traditional pension plans, which were usually defined benefit plans. As the years have passed and employees stopped staying with the same company for life, the defined benefit plan is going the way of the dinosaur. Today, only 4% of private companies offer defined benefit plans.

As private-sector companies have discontinued their traditional pension plans, they have encouraged workers to launch a pension rollover to an IRA. Some have replaced the defined benefit plan with a 401, a defined contribution plan. They have encouraged their workers to either roll over their pension money to the new 401 or initiate a pension rollover to an IRA.

How Long Does An Indirect 401 Rollover Take

401 plan administrators may force an indirect rollover if you have less than $1000 in your account. You may also choose an indirect rollover if you want to use the funds as short-term credit, and deposit the funds into the IRA account before the 60-day deadline expires. When you request the funds, the 401 plan administrator will liquidate any non-cash assets in your account, and send you a check.

The 60-day rule applies to indirect rollovers, and it requires you to deposit the funds into an IRA within 60 days of funds transfer from the 401 plan. Funds deposited within the 60 days do not attract income tax or early withdrawal penalty. However, if you miss the deadline, the IRS treats the money as an early withdrawal and subjects it to income taxes at your tax bracket rate and a 10% early withdrawal penalty.

For example, if the 401 plan administrator sent you a check for $40,000, you must deposit the funds within 60 days. Assuming that you deposit the funds on the 61st day since the date of receipt, you will be required to include the distribution in your annual taxable income for the year, and pay taxes on the distribution. IRS will also charge you a 10% penalty, equivalent to $4,000 if you are below age 59 ½.

Read Also: What Is Ira And 401k

Reasons Why You Might Want To Do A Partial 401 To Ira Rollover

One common reason for rolling funds out of a 401 is to streamline your accounts into fewer ones. Each time you change jobs you have to enroll in the new employers plan. Once you change jobs a few times, you could have several accounts to juggle.

Another reason is to avoid paying the extra fees assessed by some 401 plans. Additionally, the investment choices afforded by some 401 plans leave something to be desired, prompting people to move money out as soon as possible.

So why would you want to do a partial rollover in the first place? Why leave part of your retirement funds in the 401 account?

There are a few reasons why people choose this approach.

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

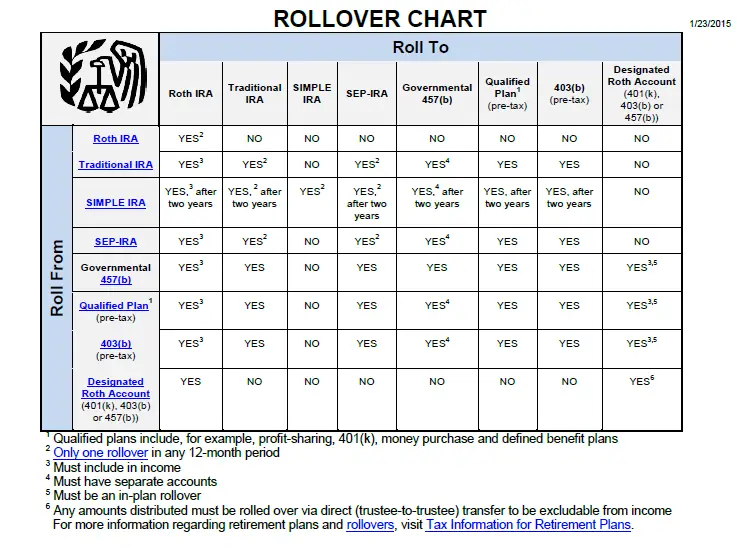

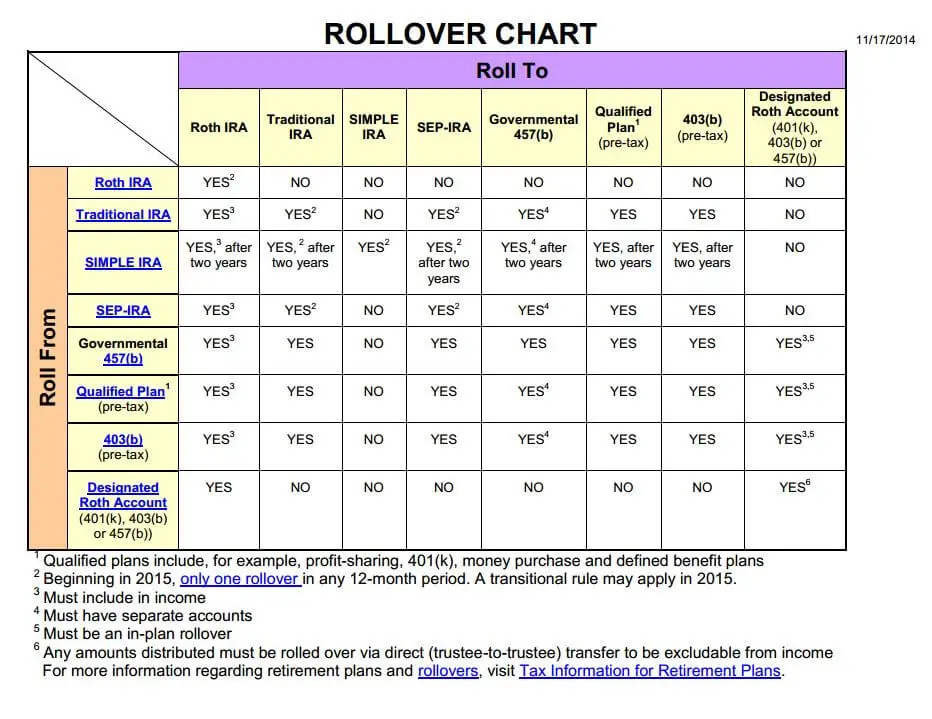

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Recommended Reading: How Do You Know If You Have An Old 401k

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

How To Complete An Ira To 401 Rollover

The first step is checking whether your employers 401 plan accepts IRA rollovers. Not all plans will allow you to roll over IRA assets. If they do, youll want to request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

If a direct transfer isnt an option, your IRA provider will send you a check for 80% of your accounts value and withhold the remaining 20% for taxes. You must deposit 100% of the value of your IRA into your 401 within 60 days or the transaction will be treated as an early distribution, triggering the 10% penalty and income taxes. The 20% that your IRA provider withheld will serve as a tax credit when you file your tax return.

Don’t Miss: Where To Check 401k Balance

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

You Get More Investment Options

In a 401 plan, your mutual fund investment options can be limited, points out Dominique Henderson, CFP, founder of DJH Capital Management.

Often you have between six and 24 fund choices in a 401, Henderson says. With an IRA, you can choose individual stocks as well as fundsand even use alternative investments. Alternative investments can include everything from real estate to bitcoin.

If you move your retirement funds into an IRA, you get a very broad menu of investment choices and more control over how your money is invested.

Read Also: How Much Should I Put In My 401k

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

Recommended Reading: How To Rollover Vanguard 401k

Can I Roll Over A Portion Of My 401

There a few limited circumstances where a partial 401 rollover makes sense.

There are a few different investment options for retirement that most of you are using, such as traditional IRAs, Roth IRAs, and employer-sponsored 401 retirement plans.

These retirement plans allow you to squirrel away pre-tax money. When you take it out after you retire, the money is taxed at your current tax bracket rate, which will be presumably lower than your tax bracket while working .

Not all your retirement savings have to be in the same place and there are certainly tax benefits to mixing your retirement accounts across a mix of pre-tax and post-tax options.

Lots of people ask what they should do with an old 401 when they change jobs. Some people leave the 401 with the previous employer while others choose to move the old 401 to the new employer.

But what if you only want to rollover a portion of the money? Can you do that? Lets find out.

Discover The Benefits Of A Cryptocurrency Ira Today

With a Cryptocurrency IRA, you can diversify your retirement fund beyond just cash or equities and take advantage of the full potential of this exciting new asset class. Coin IRA provides an easy method of investing in real, non-derivative cryptocurrencies through the safety of a Cryptocurrency IRA. To learn more about the benefits of starting a Cryptocurrency IRA, contact Coin IRA today.

Recommended Reading: How To Check How Much Is In Your 401k

What Spouses Should Know

If you are the spouse of someone who plans to roll over their 401 balance to an IRA, be aware that you’d lose the right to be the sole heir of that money. With the workplace plan, the beneficiary must be you, the spouse, unless you sign a waiver.

Once the money lands in the rollover IRA, the account owner can name any beneficiary they want without their spouse’s consent.

Here’s another potential misstep: Making a withdrawal from your 401 to give to your ex-spouse as dictated in a divorce agreement. That won’t work the money will be considered a distribution to you, subject to taxation, as well as potentially a penalty if you’re under age 59½.

In a divorce, retirement assets that are awarded to the ex-spouse can only be distributed penalty-free via a qualified domestic relations order, or QDRO. That document is separate from the divorce decree and must be approved by a judge.

How To Roll Over A 401 While Still Working

Some 401 plans allow you to roll them over while still employed with your company.

Anyone can roll over a 401 to an IRA or to a new employers 401 plan when leaving a job. Depending on your plans policies, you might be able to make the rollover while youre still with the company. Unlike a post-job rollover, your plan doesnt have to allow in-service rollovers, but many companies do. However, there are usually significant restrictions.

You May Like: How To Use Your 401k

Also Check: How Do You Max Out Your 401k