Do Employers Have To Match 401

Related

A 401 match is a good deal for you and your employer. You get extra money fattening your retirement account, and your employer can claim the contributions as a tax write-off. Zenefits points out it also gives you an incentive to stick with the firm. If your employer doesn’t provide a match, weigh the unmatched 401 against the retirement investment alternatives.

Tip

Employers have no obligation to match your 401 contributions. If they match, it’s up to them how much. However, if they contribute to executive accounts, they must make comparable contributions to lower-ranked workers.

What Is Facebooks 401k Match

Facebook Inc. allows employees to participate in their 401 Retirement Plan offer through Fidelity. Facebook instituted a 50% match on participant contributions up to 7% of total eligible compensation. For Facebook, compensation includes base compensation, overtime pay, commissions and performance bonuses.

How Much Do Companies Typically Match On 401 In 2020

Dylan Telerski / 4 Aug 2020 / Business

Getting insight into how much companies are matching on 401s in 2020 will help you know how well your employer stacks up and whether youre in the right ballpark with your contributions.

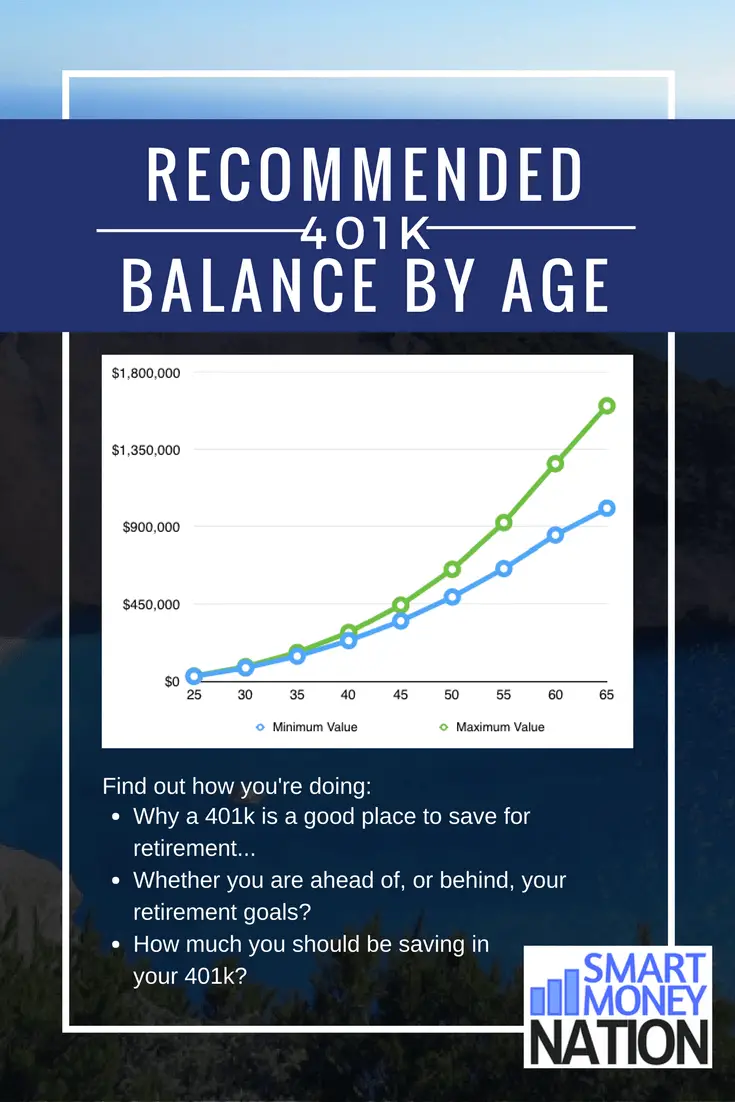

Long gone are the days where a full pension or government stipend will guarantee you a secure future. These sources of income typically comprise less than half of what you would need to live comfortably in retirement. A 401 investment account is one of the best strategies to bridge the gap and save enough money for your post-retirement years.

In addition to the contribution deducted from your paycheck, about 51% of employers offering a 401 agree to match a certain amount of employee contributions. This generous bonus is literally FREE MONEY that employers add to your retirement savings that will gain interest and compound over time to help you reach your goals faster. There is, however, one caveat to the employer match in most cases , how much you receive depends on how much you put in.

Read Also: How To Find Out How Much In My 401k

Why Should You Take Advantage Of 401 Matching

Taking advantage of employer matching puts free money toward your retirement income. Let’s say that your employer offers a dollar-for-dollar match on up to 3% of your salary. You make $1,500 per week and contribute 3% to your retirement plan, which is $45. Because your employer offers a full match up to 3%, your employer will contribute another $45 to your retirement account. Youre essentially doubling your contributions. If you do this for a number of years, you can significantly you have in your account when you retire.

Your employers contributions to your 401 are also beneficial because they don’t count against the IRS’ annual contribution limits. There are limits on how much you can put into your retirement account each year. In 2020 and 2021, those limits were $19,500 per employee, and in 2022, it will increase to $20,500. This is the that you can put into your 401 each year.

However, your employer match doesnt count toward this dollar amount. So, let’s say that you max out your contributions in 2022. Through your matching program, your employer contributes another $4,500. Instead of putting $20,500 into your account, you end up putting $25,000 into your account. Your employer match allows you to circumvent the total contributions limit set by the IRS.

Q: What Is A 401k Matching Example

A: Suppose an employee earns $50,000 annually and decides to contribute 10% of his pay to his 401k account, or $5,000 per year. Now suppose his employer matches 100% of employee contributions up to 6% of salary. The employer would make a matching contribution of $3,000. If the employer made a 50% match, the match amount would be $2,500.

Recommended Reading: Can I Rollover My Ira To My 401k

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

Is 401 Employer Matching Mandatory

401 matching is not a mandatory benefit for 401 plans. Some employers may offer 401 matching as a way of attracting new hires and retaining top talents, while other employers may decide not to offer 401 matching to lower its costs.

If an employer offers 401 matching, the IRS requires such employers to offer the benefit to all employees, regardless of their income levels. Hence, employers must conduct nondiscrimination tests to ensure the 401 match does not favor highly compensated employees to the disadvantage of other employees.

Read Also: Can I Rollover My 401k To An Annuity

A 401 Employer Match Is Free Money Heres How It Works

When applying for a new job, youll often see the terms 401 matching in the description of benefits offered at a job.

But not all 401 benefits are the same. For instance, some companies provide the above mentioned 401 employer match, while others dont.

Not all 401 employer match programs are not all created equal. So how can you tell what career opportunities and companies provide you with the best benefits?

Lets explore how 401 employer matches work so that you can be more informed about your financial future and retirement planning when youre making your next career decision.

Make The Most Of The 401 Employer Match

As an employee, you can make the most of a 401 employer matching program when you maximize your contributions.

But you can also improve your financial future by finding your focus, purpose, and confidence to develop your career.

to start working with a coach so that you can unlock your personal and professional growth.

You May Like: How To Use Your 401k To Buy A Business

What Is Employer 401 Matching

Employer 401 matching is a contribution your employer makes to your 401 retirement account. The contribution matches what you have taken out of your paycheck, usually up to a defined amount. A 401 is an employee-sponsored retirement account that employers offer to help their employees save and invest for retirement in a tax-advantaged way.

The match is the money the employer contributes to the 401 account when the employee is also actively contributing, says Kelly ODonnell, executive vice president and head of workplace at Edelman Financial Engines, a financial planning firm. So in order to get the employer match, you need to contribute, too.

How Does Employer Match Count Toward 401 Limits

Some employers offer a 401 employer matching plan, which means they match the amount of pay an employee contributes toward their 401. The amount an employer matches can vary, depending on the company and IRS limits. Some employers match a portion of the employees contribution, while others match the full amount.

You can make the same contribution for all employees, or it can vary according to much each employee makes and change annually based on their earnings. For example, if an employee receives a raise at the end of the year, their employer may also increase their match amount. The most popular matching plan employers use is matching up to 6% of their employees annual income.

Read Also: When Can You Roll Over 401k To Ira

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

How To Maximize A 401 Match

An employee who doesnât contribute to their 401âand misses a matching opportunityâcould be leaving money on the table. So it pays for employees to maximize an employerâs match.

Begin Contributing Early

Itâs never too early to start saving for retirement. The sooner someone makes 401 contributions and takes advantage of an employerâs 401 match, the more the invested money can grow. Thatâs especially true when the employee makes the maximum contribution allowed.

Contribute Enough to Get an Employerâs Full Match

Itâs critical to understand how a 401 plan works, including how much an employerâs matching contribution is. With this knowledge, employees can contribute the most money possible to capitalize on the employerâs full match.

To continue maximizing an employerâs match, an employee might consider bumping up their contribution amount after receiving a raise.

Set Up Automatic 401 Withholding

To make the most of a 401, employees can consider opting for automatic withholding of their contribution for every paycheck. This way, adding money to the account becomes routine. Some employers automatically enroll employees in the 401 unless an employee decides to opt out.

Donât Tap Into a 401 Unless Absolutely Necessary

Don’t Miss: What Happens To 401k When You Quit

Ial 401 Matches In 2022

In a partial match plan, the employer matches a smaller percentage of what employees contribute. A common partial match is 50 cents for every dollar of employee contribution, up to 6% of the employees salary. Even if employees opt to put in a greater amount say 8% the employer is still only responsible for putting in up to 6% in that case. So, for instance, a person earning $100,000 a year might contribute $6,000 and receive another $3,000 in partially matched funds.

How 401 Plan Contribution Limits Work

The 401 plan is a long-term savings plan designed to help people build their retirement savings. The IRS labels a 401 as a qualified retirement plan, which means it has certain tax benefits for the employee, the employer, or both.

The tax advantage for employees is that their contributions are deducted from gross income, not net income. That means less take-home pay, which lowers the employees taxes, and the money goes into an investment account on an ongoing basis.

For some 401 plans, employers can match some percentage of their employees contributions, but its strictly voluntary. The average 401 match ranges from 3% to 7% of the employees gross salary.

Recommended Reading: When Should I Start My 401k

Traditional 401 Vs Roth 401

A Roth 401 is an employer-sponsored investment account thats similar to a traditional 401 plan, except the contributions to the account are taxed up front rather than at the time of withdrawal. It is well suited to people who expect to be in a high tax bracket when they retire and thus want to avoid paying taxes on their investment returns.

A traditional 401 is also an employer-sponsored retirement savings and investment account. Employers and employees both make contributions to a 401 on an elective basis. Employers may choose to match an employees contributions, up to a certain point. The money is then invested in various securities and mutual funds to grow until it is withdrawn after retirement.

Traditional 401 contributions are made with pretax dollars. This means that more money goes in right at the start, giving you a bigger amount to invest. The contributions are also tax-deductible at the time they are made, so they might move you to a lower tax bracket. That is something to consider, especially if you are on the cusp. When the funds are withdrawn, however, you pay taxes on both your initial investment and your investment returns that have accumulated over the years.

Why Do Employers Match 401

401 employer matches are one of the best job benefits available for employees. But these matches are entirely optional for companies. Even if they offer a 401 program, they have no obligation to contribute any amount whatsoever to their employees accounts.

So why do employers match 401 contributions for their employees?

For one, a 401 matching program is a powerful way to incentivize employees to come work at an organization.

Competitive 401 employer matches can also drive employee retention. And employee retention can help employers build a more resilient organization.

Thats because those organizations can rely on the talent they have. They can also safely invest in developing employees into leaders since the people they develop are more likely to stay.

Read Also: Should I Roll My Old 401k Into My New 401k

Simple 401 Limits In 2022

Employers offering a SIMPLE 401 allow employees to save up to $14,500 in 2022, which is up by $1,000 from 2021. Those age 50 and older may contribute another $3,000 for a total of $17,000.

Employers can contribute dollar-for-dollar up to 3% of a workers pay or contribute a flat 2% of compensation regardless of the employees own contributions. Employer 401 contributions are subject to an employee compensation cap of $305,000 for 2022.

Why Should You Offer A 401 Employer Match

Offering a 401 employer match as part of your small business 401 plan has three primary benefits for your company:

- Better recruiting: Not all companies offer a 401 employer match, so doing so can help your business stand out to top job candidates. Providing better benefits correlates with hiring better employees.

- Stronger employee morale and retention: Just as offering 401 contribution matching can draw better recruits to your business, this benefit can also improve morale among existing team members and increase employee retention at your company.

- Employer tax benefits: There are tax savings that businesses can take advantage of by offering 401 employer matching. Tax laws allow employers to claim their matching contributions as tax deductions.

Tip: Retirement savings plans are often considered a key part of a great employee benefits package. Whether they are a taxable fringe benefit depends on whether the plan is tax-deferred.

Also Check: How Much Goes Into 401k

How Does Roth 401 Matching Work

Quick Answer

Your employer can match contributions to a Roth 401 the same way they would with a traditional 401. The primary difference: Matching contributions go into a traditional 401 account rather than a Roth 410 and arent taxed as additional income.

In this article:

If your employer offers a retirement plan, one of your options might be a Roth 401. A Roth 401 blends some of the best benefits of traditional 401s and Roth IRAsincluding the possibility of an employer match. Roth 401 matching contributions work much the same as traditional 401 matches, but the matching funds are deposited into a separate traditional 401.

Attract And Retain Talent

Since 401 matching is not mandatory, some employers may match contributions as a way of attracting top candidates to the company. When presented with two job offers, the additional benefit may be the deciding factor.

Also, by structuring the 401 match based so that the employer contributions vest gradually over several years, an employer can retain its top talents who may not want to leave the âfree moneyâ behind.

Recommended Reading: How Does A Company 401k Match Work

How Does 401 Vesting Relate To Your 401 Matching Program

As an employer, you can take ownership of part or all of your employer match contributions through a practice known as vesting. The legal definition of vesting is the right to ownership over a future payment, benefit or asset. When applied to retirement accounts, vesting describes the process of employees earning greater rights to access their employer contributions as time passes. Thats why the vesting schedule you set for your 401 employer match is a crucial component of your program.

Tip: If youre considering borrowing from your 401, keep in mind you can only borrow against the vested amount of your employer match, not the gross total that includes the non-vested matching funds.

Your vesting schedule can incentivize employees to stay with your company longer because the longer your employees stay with you, the more their nonforfeitable rights to your employer contributions grow. After a set number of years, your employee can leave your company while taking all of your employer matching contributions with them, but employees who leave too soon may forfeit some or all of your employer matching contributions.

Alternatively, offering immediate vesting is an appealing benefit for employees too. Theyll have the comfort and security of knowing that should they leave your company for any reason at any time, their 401 funds are going with them regardless of how long theyve been employed with you. This option is likely to make your business more attractive to new hires.

What Is The Best Possible 401 Employer Match

Employers rarely match 100% of employee contributions. Even if they do, there is a limit mandated by the IRS. For 2020, employees can contribute up to $19,500 to their 401 accounts. Employers can contribute up to $37,500 to reach a combined employee/employer total of $57,000. Employees over 50 can add $6,500 in catch-up contributions as well. So that would represent the best possible match an extra $37,500 put toward your retirement.

Recommended Reading: When Can I Get Money From 401k

What Is A 401 Employer Match

A 401 plan is a retirement account sponsored by employers, while a 401 employer match is a type of added employee benefit.

Employees can contribute part of their salary towards a 401 retirement account. This is typically done via a percentage amount, but can also be done by an employee choosing a dollar amount. But when employers match 401 contributions, they also contribute to their employees accounts.

So, if an employee contributes to their 401, employers will match this contribution up to a certain amount. Put simply, a 401 match program is essentially free money for employees.

The average employer 401 match is at an all-time high at 4.7%. This means that, on average, companies will match 4.7% of an employees salary toward their retirement.

Employee contributions to 401 plans vary greatly. But on average, employees contribute 8.8% yearly. This percentage, combined with a 4.7% match from an employer, means an employee could save 13.5% of their total salary in their 401 plan.

So, if you make $45,000 per year, you can expect to save an average of $6,075 per year in your 401 savings account.

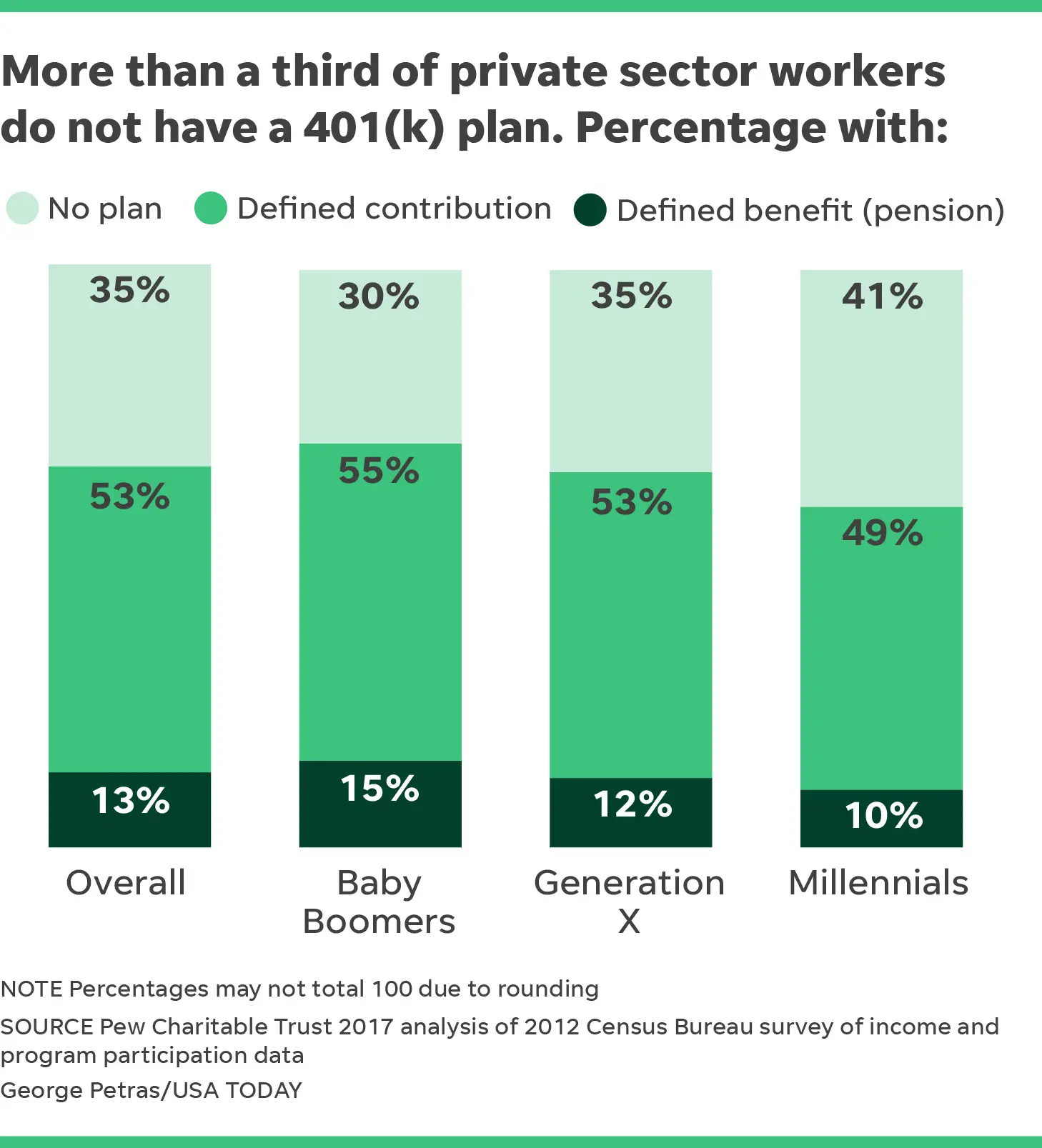

Its important to note that not everyone has a savings account. About 54% of millennials dont have a retirement account.