Considering A Loan From Your 401 Plan

Your 401 plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your 401.

If you dont repay the loan, including interest, according to the loans terms, any unpaid amounts become a plan distribution to you. Your plan may even require you to repay the loan in full if you leave your job.

Generally, you have to include any previously untaxed amount of the distribution in your gross income in the year in which the distribution occurs. You may also have to pay an additional 10% tax on the amount of the taxable distribution, unless you:

- are at least age 59 ½, or

- qualify for another exception.

What Is A Plan Offset Amount And Can It Be Rolled Over

A plan may provide that if a loan is not repaid, your account balance is reduced, or offset, by the unpaid portion of the loan. The unpaid balance of the loan that reduces your account balance is the plan loan offset amount. Unlike a deemed distribution discussed in , above, a plan loan offset amount is treated as an actual distribution for rollover purposes and may be eligible for rollover. If eligible, the offset amount can be rolled over to an eligible retirement plan. Effective January 1, 2018, if the plan loan offset is due to plan termination or severance from employment, instead of the usual 60-day rollover period, you have until the due date, including extensions, for filing the Federal income tax return for the taxable year in which the offset occurs.

How Are 401 Loan Interest Rates Calculated

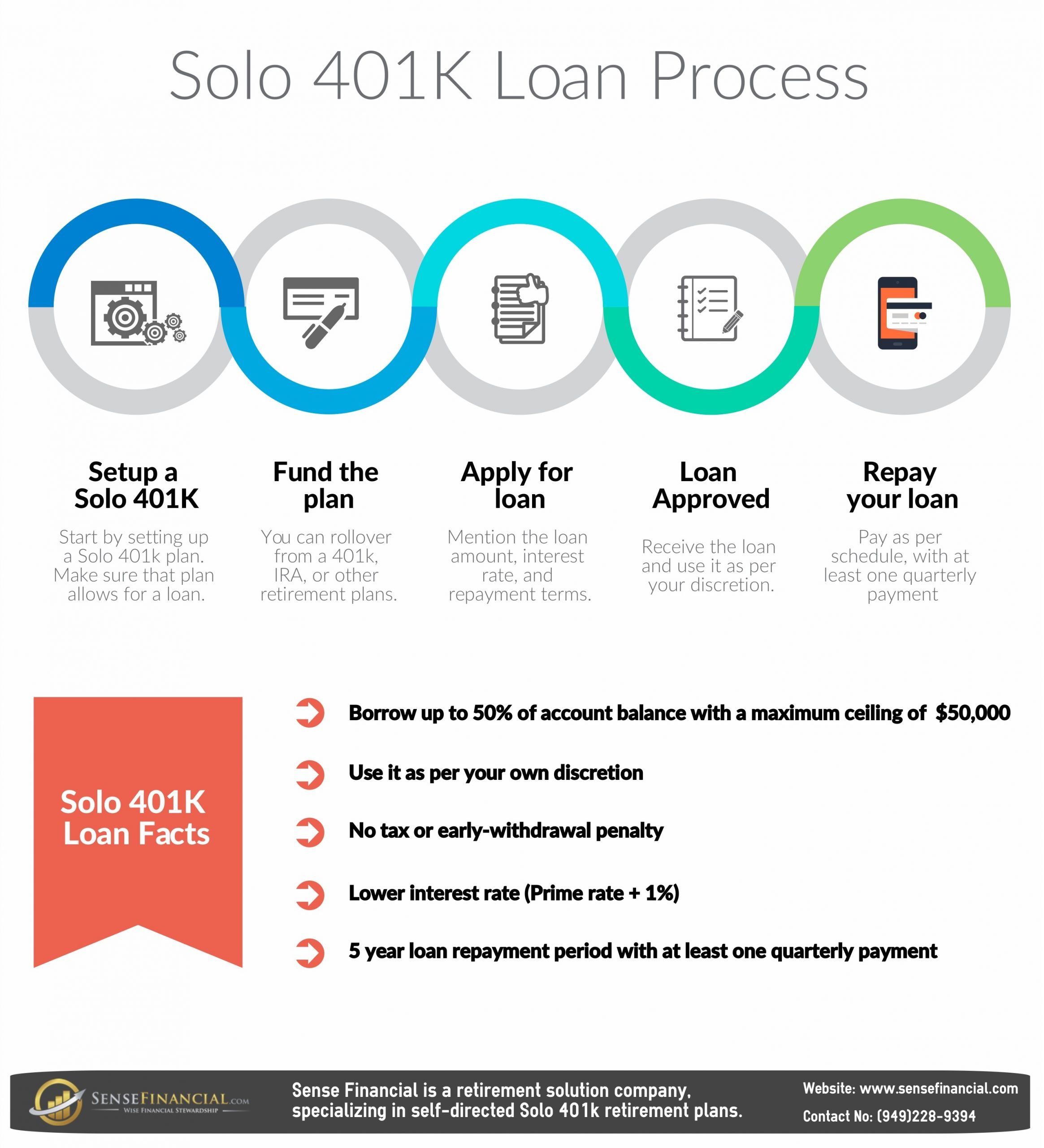

Although your 401 administrator is facilitating your 401 loan and not a bank, there is a method in deciding what interest rate youâll pay on your loan. While the interest you pay on your 401 goes back into your 401 account, your planâs administrator will set your rate for you.

Typically, the interest rate on a 401 loan is between one and two percent higher than the prime interest rate. The prime interest rate is set by the Wall Street Journal and calculated daily based on a survey of 30 banksâ lending rates.

The interest rate on your 401 loan will depend on the prime interest for the day your loan application is submitted.

Read Also: Can I Get My 401k Early

Is 401k Considered Interest Income

Tax-deferred interest with 401s When you put money into a bank savings account, you pay taxes on any interest it earns every year. But, with a tax-deferred 401, you save taxes on the earnings of your contributions.

How often does interest accrue on 401k?

Yearly vs. For instance, if you have $1,000 invested at 6 percent and it compounds yearly, youll have $1,060 after one year and $1,123.60 after two. If it compounds monthly, you get . 5 percent interest each month.

How is interest calculated on 401k?

Typically, according to most sources, a 401 loan will carry an interest rate based on the Prime Rate plus 1 or 2 percentage points. The prime rate is published every day by the Wall Street Journal, based on surveys of 30 banks lending rates.

How much should I have in my 401K at 50?

Stocks And Stock Funds

Interest rates also play a key role in the price and performance of equity markets. Lower interest rates promote economic growth, while the increased borrowing costs associated with higher rates tend to slow it. Because corporate profits are correlated with economic growth, lower rates provide a tailwind for stocks, while higher ones can slow profit growth and hold down earnings multiples.

Note, though, that interest rates don’t rise and fall in a vacuum: what’s prompting rates to move tends to matter more to stock market investors than the move itself. Interest rates declining because the economy is falling into a recession may not provide enough lift to stocks to offset downward pressure from the contraction in economic activity.

Rising interest rates increase the equity risk premium, which is based on the risk-free rate of return, typically the yield of the 10-year Treasury note. As fixed-income investments such as bonds and CDs with higher rates present more competition to stocks for the investment dollar, the rising equity risk premium becomes a headwind for share prices.

Also Check: Does Employer Match Count Towards 401k Limit

How Higher Interest Rates Impact Your 401

Interest rates are a key variable for the economy and the stock and bond markets in particular. In the U.S., the Federal Reserve is the central bank that sets the federal funds rate, which influences other interest rates, to meet its mandate of promoting stable prices and maximum employment. The Federal Reserve holds regular meetings to discussand announceany changes in interest rate policy.

Interest rates can also affect your 401 plan. Knowing how this critical economic factor can affect the performance of your retirement plan can help you bolster your investment returns, and to avoid potential losses that could result from changes in interest rates.

Why A 401 Loan Should Still Be For Need Not Investing

Ultimately, the key point is simply to recognize that paying yourself interest through a 401 loan is not a way to supplement your 401 investment returns. In fact, it eliminates returns altogether by taking the 401 funds out of their investment allocation, which even at low yields is better than generating no return at all. And using a 401 loan to get the loan interest into the 401 plan is far less tax efficient than just contributing to the account in the first place.

Of course, if someone really does need to borrow money in the first place as a loan, there is something to be said for borrowing it from yourself, rather than paying loan interest to a bank. The bad news is that the funds wont be invested during the interim, but foregone growth may still be cheaper than alternative borrowing costs .

In fact, given that the true cost of a 401 loan is the foregone growth on the account and not the 401 loan interest rate, which is really just a transfer into the account of money the borrower already had, and not a cost of the loan the best way to evaluate a potential 401 loan is to compare not the 401 loan interest rate to available alternatives, but the 401 accounts growth rate to available borrowing alternatives.

You May Like: Do You Pay Taxes On 401k Rollover To Roth Ira

Understand The Limits On How Much You Can Borrow

Just because you have a large balance in your 401 and your plan allows loans doesnt mean you can borrow the whole amount. Loans from a 401 are limited to one-half the vested value of your account or a maximum of $50,000whichever is less. If the vested amount is $10,000 or less, you can borrow up to the vested amount.

For the record, youre always 100 percent vested in the contributions you make to your 401 as well as any earnings on your contributions. Thats your money. For a company match, that may not be the case. Even if your company puts the matching amount in your account each year, that money may vest over time, meaning that it may not be completely yours until youve worked for the company for a certain number of years.

Example: Lets say youve worked for a company for four years and contributed $10,000 a year to your 401. Each year, your company has matched 5% of your contribution for an additional $500 per year. Your 401 balance would be $42,000. However, the companys vesting schedule states that after four years of service, youre only 60% vested. So your vested balance would be $41,200 . This means you could borrow up to 50% of that balance, or $20,600.

Now lets say that after ten years of service, youre fully vested and your balance has grown to $120,000. The maximum you could borrow is $50,000.

The government sets these loan limits, but plans can set stricter limitations, and some may have lower loan maximums. Again, be sure to check your plan policy.

You End Up Paying Taxes On Your Loan Repaymentstwice

Normally, contributing to your 401 comes with some great tax benefits. If you have a traditional 401, for example, your contributions are tax-deferredwhich means youll pay less in taxes now . A Roth 401 is the opposite: You pay taxes on the money you put in now so you can enjoy tax-free growth and withdrawals later.

Your 401 loan repayments, on the other hand, get no special tax treatment. In fact, youll be taxed not once, but twice on those payments. First, the loan repayments are made with after-tax dollars . And then youll pay taxes on that money again when you make withdrawals in retirement.

Whats worse than getting taxed by Uncle Sam? Getting taxed twice by Uncle Sam.

Recommended Reading: How To Move Your 401k To An Ira

When A 401 Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401 plan probably is one of the first places you should look. Let’s define short-term as being roughly a year or less. Let’s define “serious liquidity need” as a serious one-time demand for funds or a lump-sum cash payment.

Kathryn B. Hauer, MBA, CFP®, a financial planner with Wilson David Investment Advisors and author of Financial Advice for Blue Collar America put it this way: “Lets face it, in the real world, sometimes people need money. Borrowing from your 401 can be financially smarter than taking out a cripplingly high-interest title loan, pawn, or payday loanor even a more reasonable personal loan. It will cost you less in the long run.”

Why is your 401 an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your .

Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress. In fact, in some cases, it can even have a positive impact. Let’s dig a little deeper to explain why.

Can A Loan Be Taken From An Ira

Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans that satisfy the requirements of 401, from annuity plans that satisfy the requirements of 403 or 403, and from governmental plans. Reg. Section 1.72-1, Q& A-2)

You May Like: How To Find My 401k Balance

What 401 Investments Can Help With Inflation

Inflation can harm the value of certain investments, and so having some holdings in assets that are considered to be inflation hedges might be smart when inflation ticks up. Commodities such as gold have been touted as a hedge against inflation, as has real estate. Treasury inflation-protected securities, or TIPS, are also indexed to inflation.

Withdrawals Are An Alternative To 401 Loans

A 401 loan is generally preferable to a 401 withdrawal if you must use the funds in your retirement accounts to meet your immediate needs. A loan is a better alternative because:

- You avoid the 10% early withdrawal penalty that applies if you take money out of your 401 before age 59 1/2.

- You’ll repay the money to your 401 so it will not permanently lose out on all of the investment gains it could have earned between the time of the withdrawal and the time you retire.

Before considering a 401 withdrawal and incurring both the penalties and losing gains for the remainder of the time until retirement, you should seriously think about taking out a loan instead if your plan allows it.

You May Like: How To Grow Your 401k Faster

If You Need Cash Borrowing From Your 401 Can Be A Low

Provided your 401 plan permits loans, borrowing from your 401 may help you pay bills, fund a big purchase or make a down payment on a home.

But youll need to pay interest if you want to tap your retirement account. There are also rules you need to follow so that you arent taxed on the amount you borrow. And there are possible drawbacks like missing out on potential investment growth to consider before deciding to take out a 401 loan.

Why Do I Have To Pay Interest On My 401k Loan

Borrowing money has a cost, in the form of loan interest, which is paid to the lender for the right and opportunity to use the borrowed funds.

As a result, the whole point of saving and investing is to avoid the need to borrow, and instead actually have the money thats needed to fund future goals..

Recommended Reading: What Happens When You Roll Over 401k To Ira

Don’t Miss: Can I Trade Stocks In My 401k

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Zirp Danger: Zero Interest Rate Policy Impact On Whats Ahead

Last week, 401 Specialist published Institutional Investors Both Optimistic, Pessimistic Post-Pandemic. I believe that paranoia is more appropriate than schizophrenia at this time, and that optimistic statements are gaslighting, tricking investors into ignoring current realities.

As stock markets continue their meteoric rise, optimism currently prevails, driven in large part by investor biases. But investors should consider what might spoil the party. The most likely spoiler is the termination of Zero Interest Rate Policy since rising interest rates decimate stock and bond values. The reduction in bond values is straightforward because bond prices fall when yields rise.

The impact on stock prices is more nuanced. Investment analysts estimate a fair stock value by projecting earnings and then discounting those back to today.

So, if interest rates rise, the discounted present value of future earnings declines, making a stock worth less. In fact, current low-interest rates are the common justification for high stock prices, implying that stock prices would be lower if interest rates were higher.

Also Check: Can Anyone Open A 401k

Read Also: How Do I Get A Loan On My 401k

The Dangers Of Default

While we’ve touched briefly on the dangers of default, the subject deserves some closer attention. Defaulting on a 401 loan is a complicated business, and while it doesn’t impact your personal credit score it can lead to some significant financial pitfalls. First of all, as long as you remain employed at the company that controls your 401 you can’t slip into default. Regular payroll deductions will see to that. However, if you quit, or are fired, you will only have 60 days to repay the outstanding balance of your loan. If you fail to do so, your former employer will have to report to the IRS that you were unable to repay the loan. It will then be treated as a hardship distribution, and you will be required to pay taxes on the unpaid balance plus a 10% early withdrawal fee.

Another point to consider is the size of your unpaid loan. Remember, if you go into default the unpaid balance will be treated as taxable income, and depending on the amount owed it may push you into a higher tax bracket, effectively eliminating any expected deductions or credits, and leaving you with an unexpected financial liability.

Think About What Would Happen If You Lost Your Job

This is really important. If you lose your job, or change jobs, you cant take your 401 loan with you. In most cases you have to pay back the loan at termination or within sixty days of leaving your job. This is a big consideration. If you need the loan in the first place, how will you have the money to pay it back on short notice? And if you fail to pay back the loan within the specified time period, the outstanding balance will likely be considered a distribution, again subject to income taxes and penalties, as I discussed above. So while you may feel secure in your job right now, youd be wise to at least factor this possibility into your decision to borrow.

Smart Move: To lessen the odds of having to take a 401 loan, try to keep cash available to cover three to six months of essential living expenses in case of an emergency.

Recommended Reading: Where Can I Rollover My 401k To An Ira

How To Create An Esignature For The Prudential 401k Loan Form On Android

In order to add an electronic signature to a prudential 401k loan rules, follow the step-by-step instructions below:

If you need to share the prudential retirement loan with other parties, you can easily send it by electronic mail. With signNow, you are able to eSign as many files in a day as you need at an affordable price. Begin automating your eSignature workflows today.