Current Lower Tax Rates Set To Expire At The End Of 2025

One such factor aiding the math for many is that today’s lower marginal income tax rates under the Tax Cut and Jobs Act are set to expire in 2026. At expiration, marginal tax rates are set to revert to the previous higher levels. The difference in personal marginal income tax rates and income thresholds is substantial and can be seen from the charts below:

Many individuals stand to benefit from a strategy of converting IRA assets in 2021, 2022, 2023, 2024, and 2025, realizing income up to some specified marginal bracket and paying taxes each year. By converting some amount of IRA assets and realizing some amount of income each year, the individual can pay income taxes based on the current lower income tax rates and avoid realizing the income after 2025 at higher income tax rates.

Do You Plan On Moving Soon

If you have plans to move to a state where future distributions from a traditional IRA or employer-sponsored retirement plan will be taxed at a higher rate, such as California, it could be advantageous to do the Roth conversion before you relocate. “On the flip side,” says Joel Friedlander, a partner at Ernst & Young, “maybe you’re moving from California to Texas the tax cost of converting to a Roth may not be worth it because those future distributions would not be taxable in your resident state of Texas.”

Roth Iras Have No Required Minimum Distributions

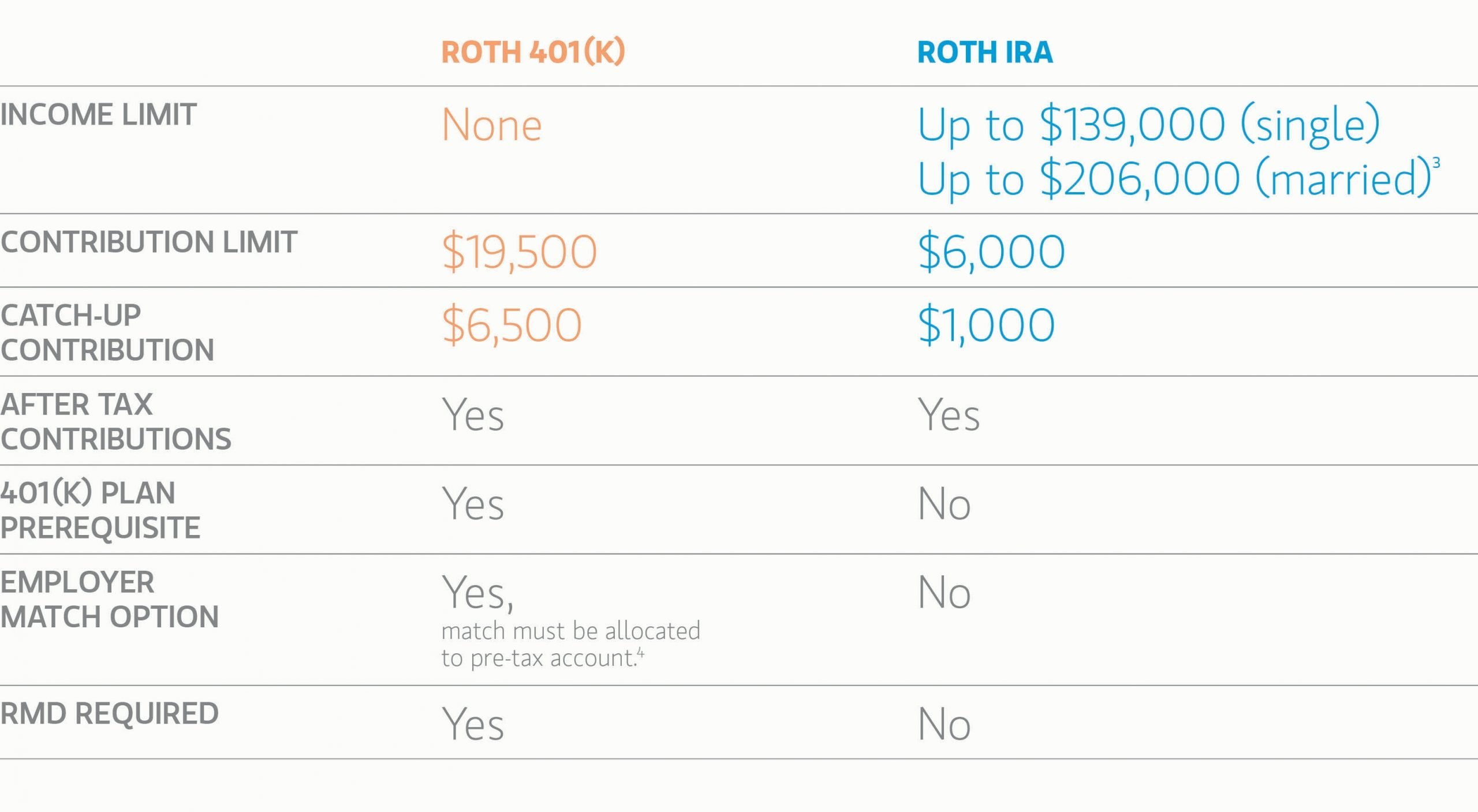

One significant advantage of a Roth IRA is that these accounts do not have required minimum distributions. That means you are not forced take out a certain amount each year so these funds can remain in the Roth IRA, earning tax-free. Other types of retirement accounts, including traditional IRAs and most 401s, do have RMDs.

Don’t Miss: When Can I Borrow From My 401k

Do I Have To Pay Taxes On My 401k After Age 65

Taxes on a 401k Withdrawal After 65 Varies Whatever you withdraw from your 401k account is taxable income, just like a regular paycheck when you contributed to the 401k, your contributions were pre-tax and therefore you will be taxed on withdrawals.

Do I pay taxes on 401k withdrawal after age 66?

You can withdraw funds from your 401 with no penalty once you are 59-1 / 2 years old. Withdrawals are subject to ordinary income tax based on your tax bracket.

Can I cash out my 401k at age 65?

Typically, once you reach 59½, you can withdraw funds from your 401 without paying a 10% early withdrawal penalty tax. However, if you decide to retire at 55, you can make a distribution without facing the penalty.

Know The Rules For Roth 401 Rollovers

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

If you have moved jobs while holding a traditional 401, you are probably familiar with the rollover options for these ubiquitous retirement accounts. You may be less sure, though, of your options when you leave an employer with whom you hold a Roth 401, the newer and less prevalent cousin of the traditional 401.

The main difference between the traditional 401 and the Roth 401 is that the former is funded with pretax dollars while Roth contributions are in post-tax dollars so there is no tax hit from a qualified withdrawal made in the future.

If your job is at stake, or you are considering a career move, here are your options regarding your Roth 401 account when changing employers.

Read Also: How Does A 401k Loan Work

One: Roll Over Your 401 To A Traditional Ira

Contributions to your 401 plan were pre-tax. This means your employer deducted them from your taxable salary when reporting your income to the IRS. Same goes for any employer matches. So you have yet to pay taxes on any contributions and on any accrued earnings.

Traditional individual retirement accounts are also tax-advantaged. The difference, of course, is that individuals rather than employers send their contributions to their financial institutions and claim the deduction when filing their taxes. So like 401 balances, the money in an IRA is tax-deferred. You wont owe taxes on it until you retire and start taking distributions.

This is why rolling over your 401 to a traditional IRA is fairly straightforward. Its an apples-to-apples transaction.

When You Should Consider Converting A 401 To A Roth Ira

If you anticipate your tax bracket being higher in retirement due to required minimum distributions or other sources of income, then it may make sense to pay income tax now while you are in a lower tax bracket.

Another reason to convert to a Roth is when you have a sizable pool of tax-free Roth assets relative to your tax-deferred retirement accounts. The tax benefits of a Roth IRA are most significant in this case. If your Roth IRA savings are only 5% or 10% of your entire retirement savings, it may not be enough to justify the loss of tax deferral.

Keep this in mind as an isolated conversion of relatively small dollar value may not make a material impact on your overall wealth. A financial plan can help you weigh whether maintaining tax-deferred growth is a better strategy to maximize your wealth.

Read Also: Can You Pull Out Your 401k To Buy A House

Bbb To End The Abuse Of Roth Retirement Accounts

A high-profile part of the Build Back Better legislation would stop the uber-wealthy from taking advantage of Roth IRAs, which were authorized in the late 1990s to help middle class Americans save for retirement.

Contributions made to Roth IRAs are made after youve paid income taxes on the money. In other words, the money you save is taxed up front, enabling the biggest Roth IRA benefit: Withdrawals down the road are free of federal income tax, no matter how much your investments have gained.

I think the American people are taxed too much. So I strongly support and have advocated for many years reducing the taxes on the working people of America, said Senator William Roth in 1998, whose work passing legislation enabling Roth IRAs and later Roth 401s got the accounts named after him.

Apologies to Senator Roth, but backdoor Roth IRA workarounds have turned his boon for working people into a tax-free piggy bank for the uber-wealth. Various workarounds and loopholes have been abused by the rich to shelter money from income taxes in Roth IRA accounts.

If You Will Pay For Higher Education Fee Costs

Tax-free early withdrawals from an IRA used to pay for eligible higher education costs such as textbooks, tuition, or education supplies on your behalf or on behalf of your spouse, as well as on behalf of your children or grandchildren, are exempt from the 10 percent early withdrawal penalty.

For all the other exceptions, you can refer to the IRA early withdrawal penalty exceptions guide.

Read Also: How To Find A Deceased Person’s 401k

Taxes On Earnings From After

After-tax contributions to a 401 or other workplace retirement plan get a different tax treatment than their earnings. Since you’ve already paid taxes on the contributions, those withdrawals are tax-free in retirement. But the IRS considers the earnings to be pre-taxso they would be treated as pre-tax and you would owe income tax when you withdraw the earnings from the plan.

Earnings in Roth IRAs, however, aren’t subject to income tax as long as all withdrawals from the account are qualified withdrawals. So rolling after-tax money from a workplace plan to a Roth IRA means you can avoid taxes on any future earnings.

What You Can Do

- Roll over a traditional 401 into a traditional IRA, tax-free.

- Roll over a Roth 401 into a Roth IRA, tax-free.

- Roll over a traditional 401 into a Roth IRAthis would be considered a “Roth conversion,” so you’d owe taxes. Note: A Roth conversion that happens at the same time as your rollover may not be eligible for all plans. We can usually complete the Roth conversion once your pre-tax assets arrive into your Vanguard IRA account, though.

Also Check: Can You Transfer 403b To 401k

Should I Convert My Current 401 Into A Roth 401

If you already have a traditional 401 at your current job and the company just introduced a Roth 401 option, converting that 401 into a Roth might sound like a good idea. But is a conversion your best option? It depends on your situation.

The main drawback of converting a traditional 401 into a Roth 401 is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money because it hasnt been taxed yet.

Lets say you have $100,000 in your traditional, pretax 401 and you want to convert the account into a Roth, after-tax 401. If youre in the 22% tax bracket, that means youd be paying $22,000 in taxes. Thats a lot of cash!

If you convert your 401 into a Roth 401, you need to have the cash on hand to cover the tax billno exceptions. Do not use money from the investment itself to pay the taxes. If you do, youll lose a lot more than $22,000. Youll also miss out on years of compound interest, which is typically about 10%. So after 30 years, a $100,000 account could grow to be $436,000 more than an account with a $78,000 starting point because of compound interest.

There are also alternatives to a 401 conversion to consider. For example, you can leave your traditional 401 alone and start putting money from your paycheck into a new Roth 401 instead. That way, you dont have to worry about taking a hit paying taxes now and still take advantage of the Roths tax-free growth later.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: How To Close Vanguard 401k Account

How To Reduce The Tax Hit

Now, if you contributed more than the maximum deductible amount to your 401, you’ve got some post-tax money in there. You may be able to avoid some immediate taxes by allocating the after-tax funds in your retirement plan to a Roth IRA and the pre-tax funds to a traditional IRA.

Alternatively, you can choose to split up your retirement money into two accounts, one a traditional IRA and the other a Roth IRA. That will reduce the immediate tax impact.

This is going to take some numbers-crunching. You should see a competent tax accountant or tax attorney to determine exactly how the alternatives will affect your tax bill for the year.

However, consider the long-term benefit: When you retire and withdraw the money from the Roth IRA, you will not owe taxes. There is another reason to think long term, which is the five-year rule explained later.

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Recommended Reading: How To Take Money From 401k Without Penalty

At What Age Is 401k Withdrawal Tax

The 401 Withdrawal Policy for People Over 59½ If you put pre-tax cash in your 401 , you can grow it tax-free until you take it out. There is no limit to the number of withdrawals you can make. From the age of 59 ½ you can withdraw your money without a prepayment penalty.

How do I avoid taxes on my 401k withdrawal? To minimize 401 and IRA withholding taxes on retirement:

- Avoid the early repayment penalty.

- Transfer your 401 with no tax withholding.

- Think about the minimum distributions required.

- Avoid making two distributions in the same year.

- Start withdrawing before you have to.

- Donate your IRA distribution to charity.

Traditional 401s Vs Roth 401s

Employer-sponsored 401 plans are an easy, automatic tool for building toward a secure retirement. Many employers now offer two types of 401s: the traditional, tax-deferred version and the newer Roth 401.

Of all the retirement accounts available to most investors, such as 401 and 403 plans, traditional IRAs, and Roth IRAs, the traditional 401 allows you to contribute the most money and get the biggest tax break right away. For 2021, the contribution limits are $19,500 if youre under age 50. If you’re 50 or older, you can add an extra $6,500 catch-up contribution, for a total of $26,000.

Plus, many employers will match some or all of the money you contribute.

A Roth 401 offers the same convenience as a traditional 401, along with many of the benefits of a Roth IRA. And unlike a Roth IRA, there are no income limits for participating in a Roth 401. So if your income is too high for a Roth IRA, you may still be able to have the 401 version. The contribution limits on a Roth 401 are the same as those for a traditional 401: $19,500 or $26,000, depending on your age.

The biggest difference between a traditional 401 and a Roth 401 involves when you get a tax break. With a traditional 401, you can deduct your contributions, which lowers your taxable income for that year. With a Roth 401, you dont get an upfront tax break, but your withdrawals will be tax-free. Once you put money into a Roth, youre done paying taxes on it.

Also Check: How To Figure Out Your 401k Contribution

Important Additional Information & Disclosures

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product , or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level, be suitable for your portfolio or individual situation, or prove successful.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from MFT.

Please Note: MFT does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to MFTs web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Mft Receives Prestigious National Award

This press release to national media hits some highlights but we will have more to say about this in our January newsletter. For now, know that we are very proud to have received the2019 TRAILBLAZER IMPACT AWARD in recognition of over 20 years of efforts to improve the quality of advice, raise the bar for ethics standards, and advance the financial planning profession. The award is presented at the national conference of Schwab Advisor Services.

Congratulations to Mike Salmon, CFP® for his election to the Board of Directors of the Central Florida chapter of the Financial Planning Association. Mike is the fourth of our shareholders to serve on this board.

You May Like: How To Grow Your 401k Faster

Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

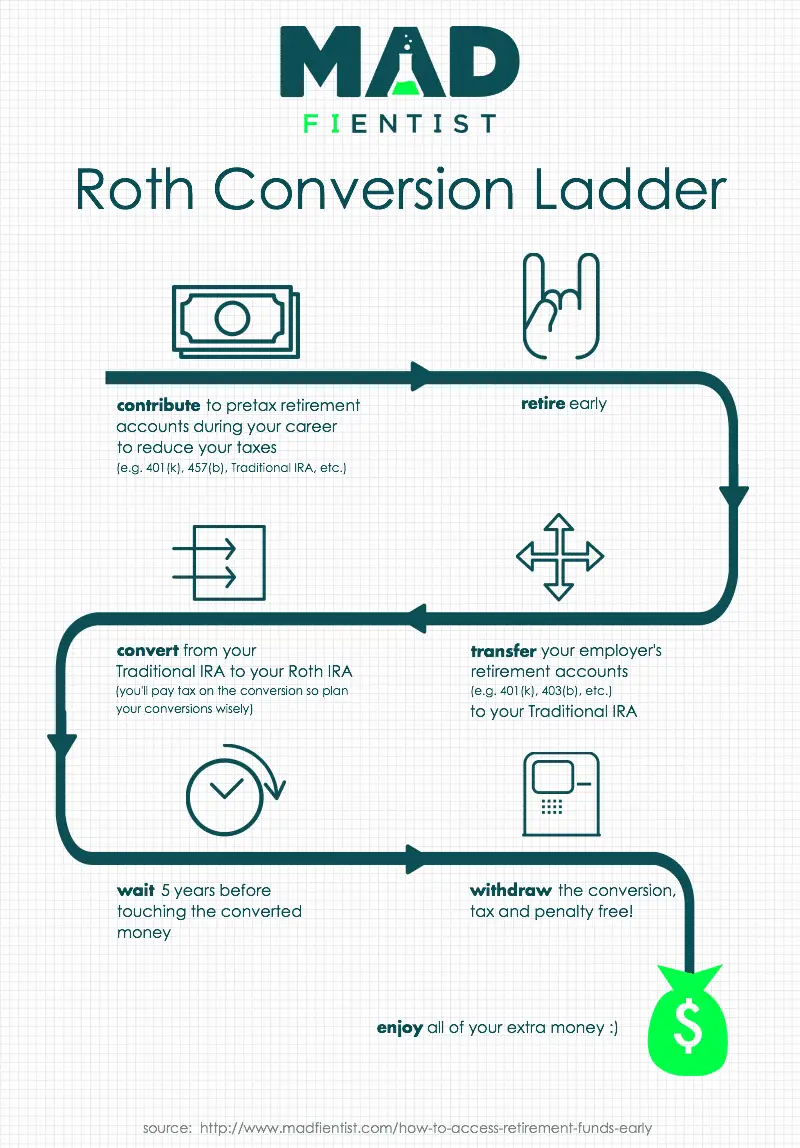

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.